Beyond Capital Blog

Expert advice for your small business.

Business Expansion

View all

FEATURED

7 Methods to Help Build Your Small Business to Scale

Scaling a business is a challenge. Learn how to scale your company just like the most profitable small businesses in the country using these 7 proven methods.

Grow your business with the perfect loan

get approved

Business Financing

View all

FEATURED

11 Frequently Asked Questions We Hear From Borrowers

Find out some of the most common questions applicants for business financing ask and get the answers from Fast Capital 360’s senior business advisor.

Business Credit

View all

FEATURED

Soft vs. Hard Credit Checks: What Are the Differences? And Why They Matter

Business credit checks allow lenders and business owners to access a company’s credit report. Learn all about soft vs. hard credit checks.

Business Management

View all

FEATURED

10 Business Success Stories (and the Entrepreneurs Behind Them)

Here are 10 of the best business success stories (and the entrepreneurs behind them). See how these small ventures rose to become titans.

Sales and Marketing

View all

FEATURED

10 Cheap Marketing Ideas for Small Business Owners

You can’t make sales without marketing, but promotion efforts can get expensive. Here are 10 cheap marketing ideas to cut your costs.

Grow your business with the perfect loan

get approved

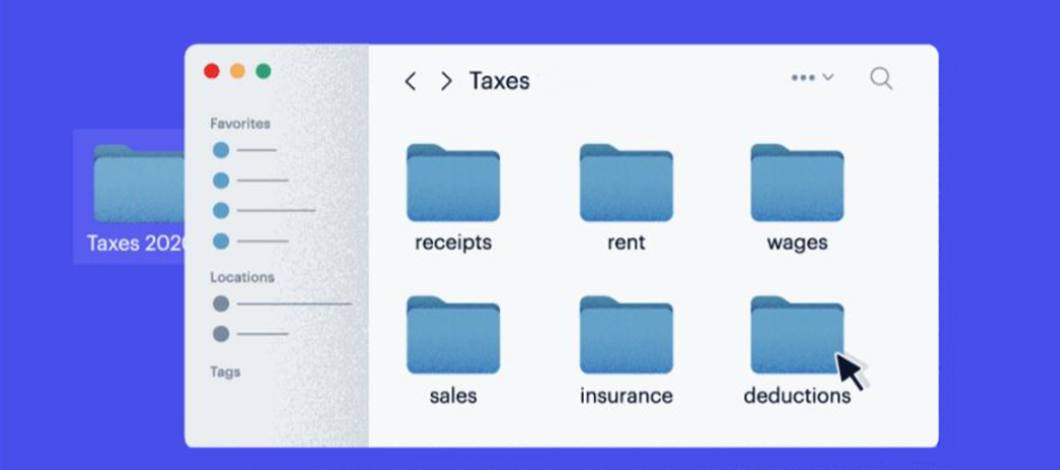

Accounting

View all

FEATURED

Best Help for Tax Filing for Small Businesses

Small business tax filing is a tedious but necessary task. We’ll show you how using software or an advisor can make it easier.

Leadership

View all

FEATURED

10 Inspiring Female Entrepreneurs and Their Advice to Other Women

Here are 10 inspirational female entrepreneurs and the businesses they run. See what sets them apart and the advice they share with aspiring women business owners.

Business Insurance

View all

FEATURED

Top 9 Types of Business Insurance

Don't panic; there are many resources available if you're looking for the best insurance for small business owners.

Retail

View all

FEATURED

8 Retail Technology Trends to Watch This Year

Here are 8 retail technology trends taking center stage in 2023. Discover the shopping experiences consumers want in ecommerce and brick and mortar.

Get your business loan options in minutes

get started

Human Resources

View all

FEATURED

11 Tips for Hiring Top Talent

Hiring quality employees takes time, money and extensive planning. This post provides you with effective tips to streamline the process.

Grow your business with the perfect loan

get approved

Real Estate

View all

FEATURED

How to Value a Commercial Property for Sale or Purchase

Here’s what you need to know when you’re wondering how to value a commercial property, whether you’re buying or selling.

Business Law

View all

FEATURED

Fast Capital 360 Is Letting You In on the Most Common Business Lawsuits (and How to Avoid Them)

Fast Capital 360 is letting you in on 6 of the most common business lawsuits and how to avoid them. Find out how to protect your company from litigation today.

Business Technology

View all

FEATURED

Digitally Done Right: 6 Ecommerce Success Stories (And How They Did It)

Starting a successful ecommerce business is tough but these 6 ecommerce success stories are sure to inspire you. Learn from the best.

What Should You Pay for a Business Loan?

Estimate My Terms

Estimate My Terms

Get industry-leading advice to help you make confident decisions.