Accounting

FEATURED

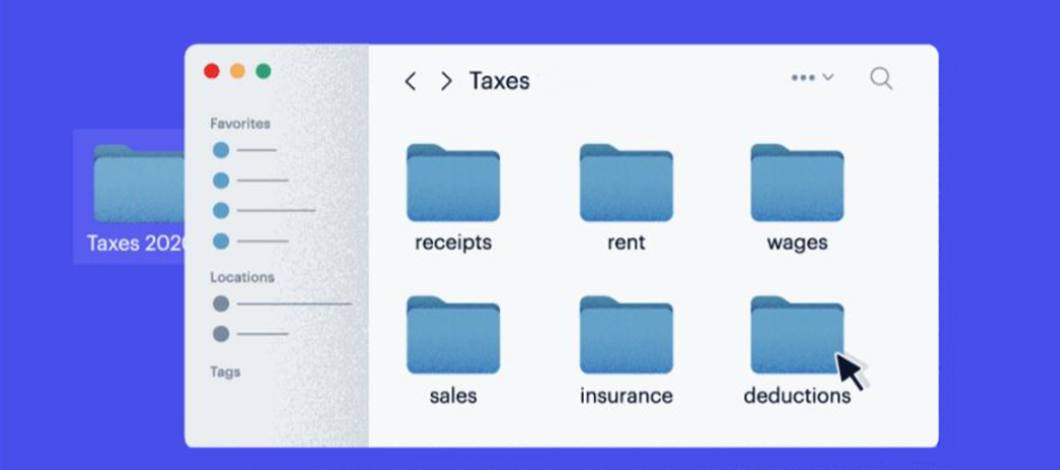

Best Help for Tax Filing for Small Businesses

Small business tax filing is a tedious but necessary task. We’ll show you how using software or an advisor can make it easier.

Get industry-leading advice to help you make confident decisions.