Move at the Speed of Business

If a merchant cash advance were in a race with conventional business loans, it would make it to the finish line first every time. That’s how fast you can access business capital with an MCA.

What’s more, you don’t need to let your credit score or time in business hold you back. With Fast Capital 360, get funded with as little as 4 months in business and a credit score of 500.

Even better, merchant cash advance same-day funding is available. Quickly access the funds you need to act on an opportunity or keep operations running smoothly.

Contents

SECTION 1

What Is a Merchant Cash Advance?

A merchant cash advance is a loan alternative that offers borrowers a lump sum of capital based on their business’s future sales. MCAs are short-term and repaid through smaller daily (or weekly) payments until the total cash advance and lender fees are paid in full. They are available to most small business owners.

How Does a Merchant Cash Advance Work?

At Fast Capital 360, our lending partners offer Automated Clearing House merchant cash advances, or ACH MCAs. In this small business cash advance agreement, approval amounts are based on a business’s projected revenue.

Additionally, payments are fixed and occur over a set term. This means your daily or weekly payment will remain the same regardless of your sales volume. Payments are withdrawn automatically from a linked business bank account.

SECTION 2

When Does a Merchant Cash Advance Make Sense?

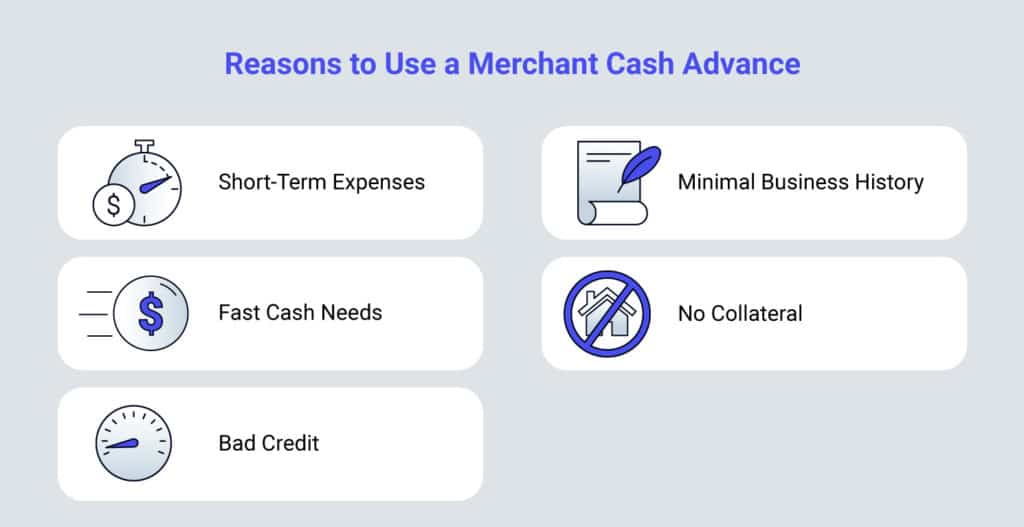

In business, cash shortfalls happen, and expenses and opportunities can arise unexpectedly. But sometimes, traditional financing just isn’t in the cards — whether it’s a matter of timing, credit score or years in business. Here are a few reasons to apply for a merchant cash advance.

Short-Term Expenses

Merchant cash advances are best used for short-term capital needs and quick profit-producing investments. For example, responsible use of an MCA would be to purchase inventory your business can sell quickly at a profit. Companies that have success using an MCA have a clear understanding of the costs associated with this type of financing compared to the potential return on investment.

Fast Cash Needs

Merchant cash advances are one of the fastest forms of financing on the market. Some MCA lenders can release funds the same day an application is approved.

Bad Credit

Cash advance providers often work with business owners whose creditworthiness is deemed lacking by other lenders. That said, consider a merchant cash advance if you have bad credit (i.e., 500+ credit score). If you have the cash flow to support repayment, you’ll likely be eligible for an MCA.

Minimal Business History

With only 4 months in operation needed to qualify, Fast Capital 360’s merchant cash advances are a good option for businesses that are just starting out as well as seasoned ones. Businesses with more time under their belt could qualify for better terms and rates.

No Collateral

Merchant cash advances are a form of unsecured financing, unlike many conventional loans. This means you don’t need to offer specific collateral to qualify. A personal guarantee and a UCC lien may be required.

SECTION 3

How Much Does a Merchant Cash Advance Cost?

You’ll likely be required to pay back 10%-30% or more of the total merchant cash advance amount for which you’re approved. This percentage is known as a factor rate, and it’s most commonly expressed in decimal form. For instance, a factor rate of 10% or 30% would be represented as 1.1 and 1.3, respectively. At Fast Capital 360, our merchant cash advance rates start at 1.10.

Keep in mind that the amount you pay will depend on the funding amount, rate and term. You can use our ACH merchant cash advance calculator to estimate your financing payments.

Factor Rates

Unlike interest that accumulates over time and is calculated based on depreciating principal, factor rates for merchant cash advances are calculated once, at origination. The cost is worked into your scheduled payments.

Your factor rate will depend on your industry, average monthly sales, the stability of those sales, the time you’ve been in business and other risk factors.

Merchant Cash Advance Factor Examples

To better understand how factor rates affect your total payback, let’s look at a few merchant cash advance examples based on the following formula:

Advance Amount X Factor Rate = Total Payback Amount

| MCA Amount | Factor Rate | Total Payback |

| $10,000.00 | 1.25 | $12,500.00 |

| $50,000.00 | 1.15 | $57,500.00 |

| $100,000.00 | 1.10 | $110,000.00 |

SECTION 4

Merchant Cash Advance Requirements

Merchant cash advance requirements are fairly lenient. So much so that according to the Federal Reserve Banks’ State of Small Business Credit Survey, 84% of firms that completed a merchant cash advance application were approved.

What Our Lenders Evaluate

Unlike conventional financing, where personal and business credit scores are more heavily weighted, MCA providers consider the consistency of your historical deposits and average daily balances to determine future revenue and approval amount.

Criteria evaluated for underwriting include the following:

- Industry: Different industries present different levels of risk to MCA providers. For example, sectors that routinely experience high and low sales periods are riskier for lenders to work with, resulting in potentially higher factor rates.

- Length of time in business: Just a few months in business is all you need to qualify. Usually, the younger the business, the higher the factor rate.

- Business sales and growth: A merchant cash advance provider will perform a financial assessment of your ability to repay the advance. As MCAs are based on future revenues, showing consistent sales and a proven growth history bodes well for more favorable rates and terms.

- Business credit history: Because an MCA is an advance, your business credit score is less of a deciding factor, but it still comes into play. In general, with MCA financing, the better your credit score, the lower your factor rate.

FC360 Minimum Qualifications

Through Fast Capital 360, you are likely to qualify for a merchant cash advance if you meet the following requirements:

- At least 4 months in business

- Minimum annual revenue of $100k

- Credit score of 500 or better

SECTION 5

Merchant Cash Advance Through Fast Capital 360

What Sets Us Apart

Thousands of small businesses have entrusted us with their financing needs and it shows in our ratings:

- A+ with the Better Business Bureau

- 4.9 stars on Trustpilot

- 4.4 stars on Google

How to Apply for a Merchant Cash Advance

Complete our simple and secure application to get offers from our MCA lending partners.

Applying for a merchant cash advance is fast and easy. Most importantly, it doesn’t need to impact your credit.

- Save Time: Submit your online application in just a few minutes. If approved, you could get your funds the same day.

- Find the Best Offer: If you need cash now, you don’t have time to research different offers and lenders. With Fast Capital 360, just one application lets you compare rates and terms from our nationwide network of lenders.

- Choose Your Financing: Review your merchant cash advance terms and select the best option for your business. Our knowledgeable advisors are here to help you every step of the way.

SECTION 6

Merchant Cash Advance: Frequently Asked Questions

Our merchant cash advance lending partners do not report to the credit bureaus. As such, the amount of funding you receive doesn’t reflect as additional debt on your credit report.

The advantage to this is that you can use the funding from an MCA to pay down existing business debt. For instance, if you’ve maxed out an existing business credit card and your credit score has taken a hit, you can use alternative financing to pay down that debt and rebuild your credit score.

Business owners should be analyzing their cash flow and acting on an as-needed basis. It’s important they use merchant cash advance financing responsibly and avoid overextending themselves. For instance, if you qualify for $50,000 and only need $25,000, only take $25,000. Also, don’t take out a merchant cash advance and just keep it in the bank.

Because the requirements to qualify for a merchant cash advance are less stringent, financing providers take on more risk. To offset this risk, they offer shorter repayment terms than seen with other forms of financing, as well as more frequent payments. This ensures they’re repaid as quickly as possible.

There are no restrictions on how you can use the funds from a merchant cash advance. However, this type of financing is designed to cover short-term business capital needs.

Common uses for cash advances include:

- Purchasing inventory

- Buying equipment

- Bridging cash-flow gaps

- Covering operating expenses

- Acting on an investment opportunity

- Paying for an emergency expense

While both term loans and merchant cash advances offer business owners a lump sum of capital upon approval, a merchant cash advance is designed to be extremely short-term funding. Repayment terms typically start at just a few months and extend up to 18 or 24 months in some cases. Payments are usually daily based on a factor rate instead of an interest rate. Additionally, with commonly offered ACH MCAs, installments are fixed throughout the term and withdrawn automatically through a linked bank account.

In contrast, term loans often have longer repayment periods. For example, at Fast Capital 360, our lending partners offer term loans from 1-5 years. Payments are often weekly or monthly instead of daily. Additionally, term loans are often more affordable than merchant cash advances, with lower interest rates when compared to MCA factor rates.

One application. Multiple loan offers.

Quickly compare loan offers from multiple lenders without impacting your credit score.

GET APPROVED