If you’ve ever taken out a business loan, you may see what’s called a UCC filing statement on your business credit report.

You might wonder, “What does a UCC filing mean? How did it get on my report? What does it do and how do I get rid of it?”

We’re letting you in on what UCC loan filings are, different types you might come across and how they can affect your business.

What Is a UCC Filing?

A UCC filing by definition is a legal notice often filed by lenders that shows they have a lien on 1 or more of a borrower’s commercial or personal assets. It’s common in many business loan agreements.

UCC forms are sent to the appropriate Secretary of State office and made publicly available. They allow lenders who file a UCC statement to take action against borrowers who default on their loans. They also allow other lenders to judge a business’s creditworthiness.

The term UCC filing is derived from the set of legal standards the liens are governed under, the Uniform Commercial Code.

-

What Is the Uniform Commercial Code?

The Uniform Commercial Code, published in 1942, has been used to create set standards by which states govern commercial and business laws. The UCC is a broad statutory program that focuses on small business and entrepreneurial transactions.

The program was mainly enacted to combat a couple of growing issues within U.S. businesses:

- Contracts and legal intervention became cluttered and unmanageable during business dealings because of a lack of regulation and competing interests

- Businesses in different states had different laws to abide by, complicating transactions and leading to issues with conflicting rules and regulations

Essentially, there was a need to create a blanket of standards by which, for example, a business in Kentucky could quickly and fairly find funding for new equipment from a lender in Pennsylvania.

The full Uniform Commercial Code is made up of 9 articles. These articles cover business dealings including the sale and lease of goods, funding transfers, letters of credit, investment securities and others.

Let’s focus on Article 9, which deals with secured transactions that can affect your business’s credit score. Article 9 handles the legal interests that lenders and creditors have with debtors and is the reason why you may have seen a UCC filing on your business credit report.

Types of UCC Liens

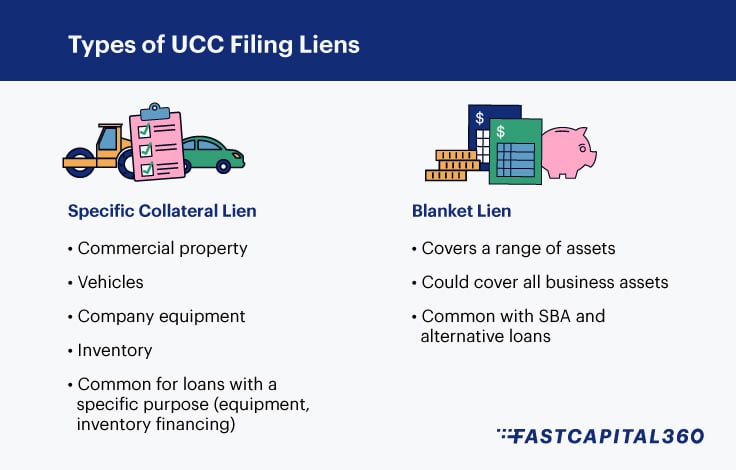

There are 2 types of UCC filing liens that lenders can place on businesses: specific collateral liens and blanket liens.

Collateral Liens

With specific collateral liens, the debtor pledges certain assets that the lender will have a claim to. These liens are common for equipment and inventory loans, with the collateral usually being what the business owner used the funding for. For instance, the collateral for a loan a packaging company takes out to purchase a new forklift may be the forklift itself.

Blanket Liens

A blanket lien takes place when the lender places a claim on most, or all, of a business’s total assets. With a blanket UCC filing, for example, if a debtor is in default on a loan, the lender will then have claim to foreclose on or sell all assets needed to satisfy the debt.

Blanket UCC liens are common with bank loans, Small Business Administration (SBA) loans, commercial real estate loans, online business loans and asset-based financing.

Both types of liens are categorized as a “UCC-1” filing as part of Article 9 in the Uniform Commercial Code.

What Is a UCC-1 Filing Used For?

A UCC filing is used to protect the interests of lenders when working with commercial borrowers. When obtaining funding, a lender will “perfect” a UCC-1 filing as part of the contractual loan agreement to protect its interests. The debtor and lender must agree on the assets that may be seized before the contract is completed, therefore satisfying the Uniform Commercial Code.

In the case of a UCC lien, the lender of a business loan needs to be able to secure collateral to recoup its losses in case the loan agreement is breached, the business files bankruptcy or even if the debtor passes away.

Consider how a mortgage works: When a mortgage loan agreement is made, the bank will place a lien on the house. If the mortgage goes into default, the lien is used to give the bank legal recourse to seize the house.

Who Uses UCC Filings?

Generally, once UCC financing statements are filed with a state’s Secretary of State office, they are considered legally binding. The documents are then placed into public record as a UCC-1 financing statement, which lenders can use for court orders to seize collateral.

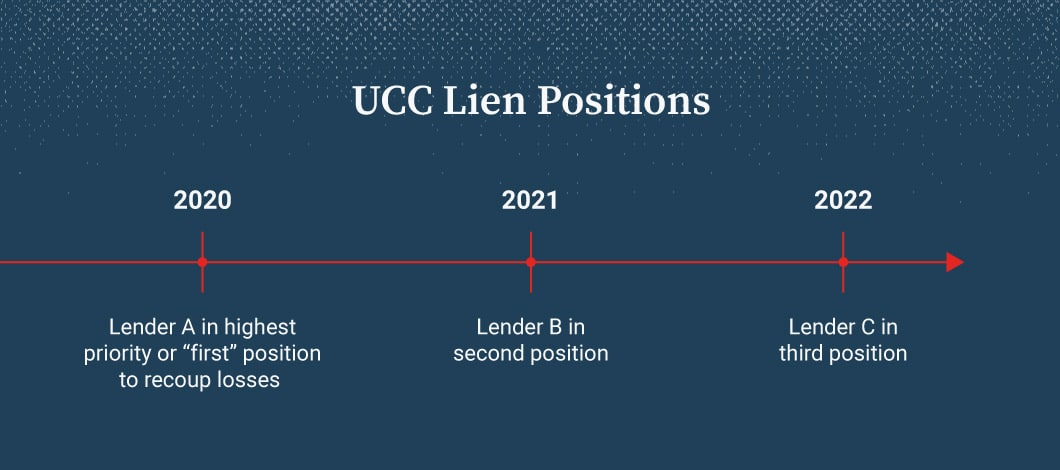

Because these statements are a matter of public record, potential lenders have the ability to see if a business already has UCC liens placed against it. If there are existing UCC liens, lenders will know they won’t be first in line to be paid if a business is unable to pay its debts – instead, existing lienholders will take priority.

UCC liens are also visible on credit reports and helps lenders make funding decisions.

Is a UCC Filing Bad for Your Business Credit Score?

A UCC filing on your credit report isn’t necessarily bad, but it could lead to complications if you don’t make your payments or if you need a secondary loan.

If there is a UCC-1 financing statement on your credit report and you make all payments on the loan it was derived from, there is no cause for concern. The presence of the lien on your company’s credit report is common, with hundreds of thousands filed in each state throughout the U.S. It won’t affect your credit score itself and is only there to let the business owner and any lenders know that a lien is in place.

A loan default, however, can significantly impact your business. When action is taken on a UCC filing, there are a few consequences.

First, the assets agreed upon when perfecting the lien can be seized, leaving a business without the equipment or inventory it needs.

The execution of a UCC lien by seizing your assets will show up on your credit report as a default. The negative impact on your business credit score will cause potential problems if you want to qualify for a future loan.

Can a UCC-1 Filing Affect Your Ability to Acquire a Business Loan?

When applying for a small business loan, UCC-1 filings are one of the factors that a lender considers when determining whether a business owner qualifies for funding. Lenders can be cautious or even deny loans to applicants with active liens, especially if they were in default.

Previous loans in default and derogatory credit items aside, it is possible that filings for loans in good standing can still affect your company’s creditworthiness in the eyes of lenders.

One of the reasons that the Uniform Commercial Code was put into place was so lenders would be aware of dealings a business has with others, including active liens.

Some lenders will be hesitant to work with a debtor that has an active UCC-1 filing in place. That’s because if the debtor goes into default, the lien that was filed first will be given precedence.

After satisfying the oldest lien, which holds the “first position” in the chain or repayment, there may be no additional assets for lower position lienholders to seize. The risk may not be worth it to the potential lender, which could make it difficult to get the funding your business needs.

Related: Second-Lien Loans: What They Are and How They Impact Financing Rates

How Long Is a UCC Filing Good for?

In most cases, a UCC financing statement is valid for 5 years from the date it was filed. At that time, the effectiveness of the statement lapses unless a continuation statement is filed.

If the terms of your loan extend beyond this period, the responsibility is on the lender to file an extension. During that time, it will stay on your business’s credit report and be visible to potential lenders.

If a lender is seeking to continue the lien, the lender must file a continuation statement within 6 months before the 5-year expiration. A continuation statement submitted within the specified time period extends the initial UCC financing statement 5 years from what would have been the expiration date.

After a business has paid the full balance of a loan, their credit report will still show an active lien until the 5 years (or any extension) have expired. In this case, it is important the business owner files what’s called a UCC-3 statement amendment to remove the UCC-1 filing.

The UCC-3 is used to make sure liens are taken out of public record when the terms of a loan are satisfied. You could ask the lender to file a UCC-3, but it’s possible to terminate an expired UCC-1 filing yourself.

Stay on Top of UCC Filings on Your Credit Report

It’s crucial to get ahead of any UCC lien issues before they can negatively affect your business. Find out if your business has any active UCC filings reported against it. Check your business’s credit report or head to the website of your Secretary of State office. You will be able to find active liens and address any issues from there.