A Quick Capital Solution

If you face a sudden cash-flow emergency or an opportunity presents itself and you have to act swiftly, a short-term business loan may be the solution. It’s fast funding you don’t need to jump through hoops to acquire. And the best part is, you’ll pay it off quickly, so you’re not on the hook repaying a temporary expense for years.

At Fast Capital 360, we partner with various lenders that offer business loans over a short term as well as other provisional financing options when you need capital in a hurry.

Contents

SECTION 1

What Is a Short-Term Business Loan?

A short-term business loan is a type of financing that offers approved borrowers a one-time disbursement of funds, which the borrower repays over an abbreviated term. Businesses can use the funds for any company need. For instance, short-term small business loans can finance renovations, pay for inventory purchases, cover operating costs or help a business prepare for the busy season.

How Does a Short-Term Business Loan Work?

A short-term small business loan provides borrowers with quick working capital, which they repay in daily, weekly or monthly installments, depending on the lender and loan terms. The borrower makes regular payments to pay off the loan plus interest over an abbreviated term, often between 3 and 18 months.

SECTION 2

When Does a Short-Term Business Loan Make Sense?

A short-term loan might make sense if your business will benefit from an immediate infusion of capital and you’re confident you can repay the debt fully and on time. Here are a few reasons to consider this type of financing.

Fast Funding

With a short-term small business loan, you can be approved within hours and see the funds in your account as soon as the same day. Conversely, acquiring a business loan from a conventional lender can take weeks to several months.

Provisional Expenses

Business loans with a short term are best used to fill temporary capital needs. They’re not well-suited for high-cost, long-term projects that could take years before you see a return on your investment. As such, you might consider taking out a short-term loan during times of fluctuating cash flow, growth periods or to act on immediate business opportunities.

Low Credit Score

Unsecured short-term loans, such as those offered through Fast Capital 360, are easier to attain than secured bank loans, which require collateral, high credit scores and revenue. With more accessible qualifications, your business could obtain the funds you need to grow. Annual revenue of $75,000, a credit score of 540 and a business history of at least 1 year are enough to qualify.

Quick Payoff

With short-term business funding, loan amounts are generally smaller, and the repayment terms are shorter. It’s not uncommon for a short-term loan to feature a payoff period as abbreviated as 3 months, quickly freeing your business from debt.

SECTION 3

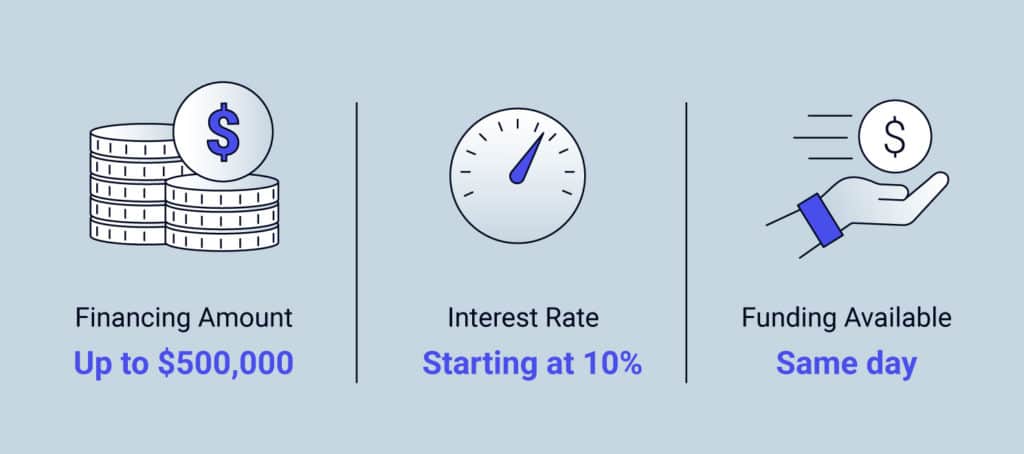

What Does a Short-Term Business Loan Cost?

How much a business short-term loan costs depends on a variety of factors, including your credit score. At Fast Capital 360, our short-term business loan rates start at 10%. Generally, short-term loans have higher interest rates, as the financing carries a greater risk for the lender.

Short-Term Loan Example

Let’s say you want a short-term loan to purchase inventory and hire staff for your upcoming busy season. A lender approves you a $10,000 short-term loan for your business at 10% for a term of 12 months. If you were to pay installments on a monthly basis, you’d be responsible for $879 each month. In contrast, a weekly rate would run $204 over 52 weeks.

SECTION 4

How to Qualify for a Short-Term Business Loan

Qualifying for a short-term business loan is faster and easier than qualifying for a conventional term loan. Additionally, the longer you’ve been in operation and the better your credit history and score, the better terms you can expect to see.

What Our Lenders Evaluate

Our short-term business lending providers increase approvals by spreading risk across multiple business attributes. Specifically, while your credit rating is taken into account, cash flow and revenue are also considered. This is because significant and consistent cash flow can reduce other financial details that may otherwise prevent a business from acquiring a business loan.

Fast Capital 360 Minimum Qualification

If you’re searching for a short-term business loan for bad credit, Fast Capital 360 works with short-term lending providers that accept credit scores as low as 540.

Other minimum qualifications include:

- 1 year or longer in operation

- $75,000 or more in annual revenue

SECTION 5

Short-Term Business Loans Through Fast Capital 360

What Sets Us Apart

Over the years, thousands of small businesses have trusted us with their financing needs, including our short-term business funding products, and it shows in our ratings:

- A+ with the Better Business Bureau

- 4.9 stars on Trustpilot

- 4.4 stars on Google

How to Apply for a Short-Term Business Loan

Fast Capital 360 brings together some of the best short-term business lending providers through one straightforward application.

Applying for a short-term business loan online is fast, easy — and most importantly — you can get preapproved without impacting your credit.

All it takes is 3 steps:

- Tell us about yourself and your business

- Attach recent bank statements

- Get multiple loan offers

Once you pick the offer that works for you, your short-term business loan could be funded within a day of approval.

SECTION 6

Short-Term Business Loans: Frequently Asked Questions

There are no restrictions on how you can use the short-term business funding offered through a Fast Capital 360 lending partner. However, because this type of loan is meant to be paid off quickly, it should not be used to fund long-term endeavors.

Common uses of business loans for short-term needs include:

- Inventory purchases

- Emergency expenses

- Cash-flow crunches

- Upfront project expenses

Pros

In addition to a wide range of uses, short-term business funding tends to have a quick and streamlined application process with minimal documentation requirements. There’s also less stringent criteria to qualify. Because of this, you could receive funding as fast as a day after approval in some cases.

Also, if your lender reports to the credit bureaus, paying your short-term business loan on time could help improve your credit score.

Cons

Compared to long-term loans, short-term business loan rates are comparatively higher. Additionally, many short-term business loan programs require weekly or daily payments, so cash-flow shortages could occur if your company doesn’t bring in consistent revenue. Also, due to the abbreviated payoff period, short-term lending providers generally offer applicants less money.

By definition, a business loan with a short term is a term loan with an abbreviated payoff period. But the phrase is commonly applied to other forms of financing with short repayment agreements, such as business lines of credit, merchant cash advances and invoice financing. Here’s how these forms of financing differ from a short-term business loan.

- Term loan: Lump-sum loan with a specified repayment period longer than a short-term loan

- Business line of credit: Pool of funds small business owners can draw from up to the credit limit; funds typically replenish as balances are repaid

- Merchant cash advance: Advance of capital based on projected sales

- Invoice financing: Cash advance based on outstanding invoices

One application. Multiple loan offers.

Quickly compare loan offers from multiple lenders without impacting your credit score.

GET APPROVED