An online business loan offers an accessible and fast option for business owners who either don’t qualify or can’t afford to wait to get funding through conventional lenders, such as banks and credit unions.

Many business owners, however, might be unaware of how internet loans work and how lending marketplaces can be the resource they need to secure online funding for their small business.

In this guide, we’ll take a look at the different types of financing options available, the best online business lenders and how to get a small business loan online.

What Is an Online Business Loan?

This term is shorthand for myriad types of financing — from term loans to business lines of credit and merchant cash advances and more — that are processed entirely over the internet through online business lenders. These lenders, in general, have less stringent lending requirements for applicants, making online business funding more accessible for small companies that don’t qualify for conventional financing.

Best Small Business Loans Online: At a Glance

You’ll find plenty of options when you’re looking for online funding for a small business. Here’s an overview of some of the best online business loans and financing options you can apply for:

| Loan Type | Description |

|---|---|

| Term Loans | The best option for business owners with an established credit score. |

| Short-Term Loans | Ideal for covering a temporary one-time expense. |

| SBA Loans | Good for profitable businesses that have been operating for at least 2 years. |

| Business Lines of Credit (LoCs) | Suitable for business owners with revolving capital needs. |

| Invoice Financing | Helpful for businesses with cash tied up in unpaid invoices. |

| Equipment Financing | Ideal for entrepreneurs needing capital to purchase equipment, costly tools, work vehicles or machinery. |

| Merchant Cash Advances | A reliable solution for business owners with a poor credit history who need fast access to capital. |

Why Choose Online Business Lenders Over Banks?

Internet loans are a relatively recent financing option for businesses that previously couldn’t secure traditional bank financing.

After the financial crisis of the late 2000s, small businesses’ access to bank loans was severely constrained. Banks were reluctant to approve funding for businesses without high annual revenue, strong credit scores and even a preexisting relationship with the bank. Smaller businesses that made less money or that hadn’t been in business long enough to build a healthy credit history couldn’t obtain financing.

Online business lenders came on the scene to offer an alternative. With less-stringent requirements and an emphasis on speed and ease of use, alternative lenders are opening doors to small business financing. While these loan providers do set minimum credit score requirements for some lending options, they also consider other aspects of a small business’s financial picture, including annual revenue and credit card sales, when deciding whether to approve funding.

According to the Federal Reserve Banks’ State of Small Business Credit Survey, in 2020, 20% of firms surveyed applied for financing with online lenders. Additionally, the survey found that 35% of firms with lower credit scores turned to alternative online lenders.

Get a Small Business Loan Online

How Is an Online Business Loan Different from Traditional Loans?

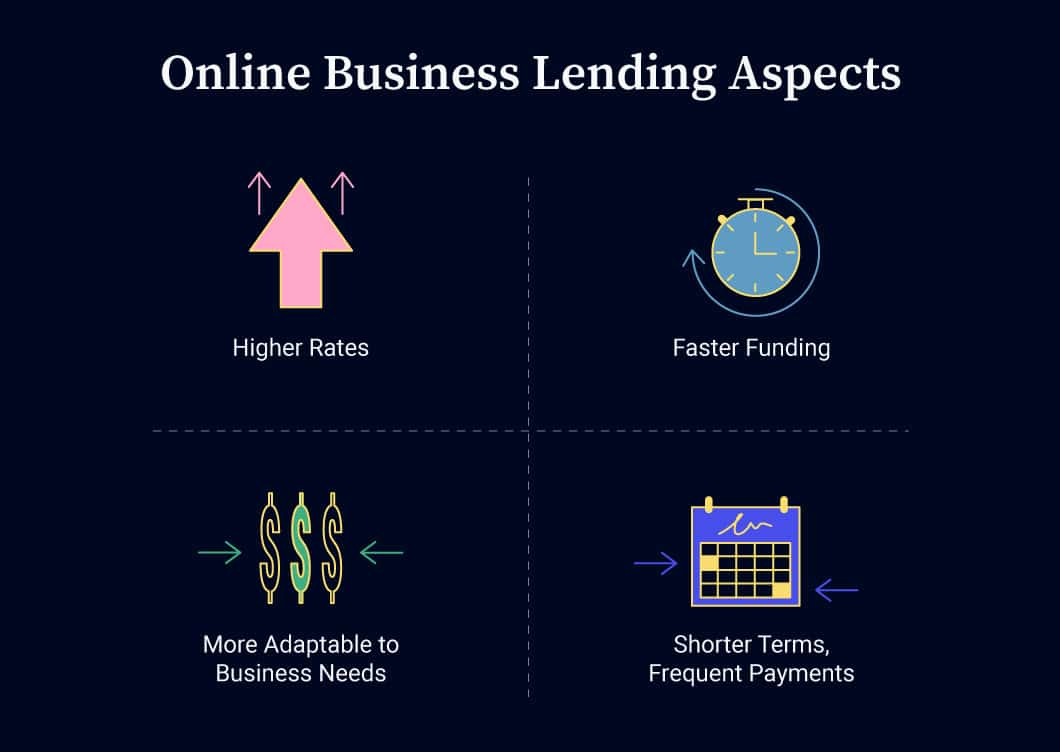

The speed, term lengths and adaptable nature of these loans can help you decide whether an online business loan is a right choice for your venture.

Higher Rates

Online business lenders work with a broad array of business owners — some have been in business for years, while others might be relatively new and have a scant credit history. A lack of credit history or a low credit score can make a potential borrower riskier to lenders, so higher interest rates and annual percentage rates (APRs) will be attached to online small business loans.

When you take out an online business loan, you’ll also pay a small premium for the convenience and flexibility the loan provides. Online loans typically have APRs above 10%. In comparison, Small Business Administration (SBA) loans can be approved with interest rates as low as 6% or 7%. The added risk that online business lenders are willing to assume and the convenience they provide make it necessary for them to include these higher rates.

More Adaptable to Your Needs

Internet loans offer a degree of flexibility. Only need to borrow a small amount? Loans as low as $10,000 are common among online lenders. Want a short repayment term? Online lenders often grant small business loans with terms as short as 3 months.

Shorter Terms, More Frequent Payments

Online business lenders often work with borrowers who might not have a lengthy or strong credit history, which can make lending riskier. Shortening the term to as little as 3 months and requiring weekly or even daily payments minimizes that risk and helps ensure that online business lenders have the ability to recoup their investment.

Faster Funding

When you apply for a business loan at a bank, the application process can take several weeks or more than a month before approval, and it usually involves a lot of paperwork. However, when you apply for a commercial loan online, the process is digitized and it can be completed in minutes. Online lenders run your information through proprietary algorithms that dive deeper into the data so they can evaluate their risk and make decisions faster.

When you get fast business loans online, you can quickly access the cash you need. Altogether, the process from application to funding could take just a couple of days. Instead of waiting weeks or months for a bank to get back to you, internet loans provide an exceptionally fast turnaround for businesses that need funding now.

Related: Bad Credit Business Loans? These Are Your 5 Best Options

Online Business Funding Options

Once you know the requirements for getting a commercial business loan approved, it’s time to find an online business loan that fits your needs, whether you’re seeking an online small business loan for bad credit or a long-term business loan. Below, we’ll go over some of the best online small business loans and financing options.

Term Loan

If you have a long-term project that needs capital financing, a term loan is a good option.

Fast Capital 360’s online business loan providers can offer a term loan with the following conditions:

- 1-5 year term lengths

- Interests rates from 7%

- Principal amounts up to $250,000

- Approval as fast as 1 day

Business Lines of Credit

If your business could benefit from having revolving capital, we recommend considering a business line of credit (LoC). With a business LoC, you can borrow only as much as you need until you reach a predetermined credit limit. This helps you avoid borrowing too much or too little, particularly if you’re financing an ongoing project — such as a renovation.

With this type of financing, you have to pay interest on only the amount you withdraw as opposed to interest from a lump-sum term loan, potentially saving you money.

We recommend choosing an online business line of credit if you’re a small business owner who needs an undetermined supply of cash. In other words, if you know you need $5,000 upfront and potentially a little more (or a lot more) later down the road, then applying for an online business line of credit might be your best bet.

Fast Capital 360’s online business lenders have terms such as the following:

- 6-month to 3-year term lengths

- Interest rates from 8%

- Credit limits up to $250,000

- Approval as fast as 1 day

Merchant Cash Advance

Merchant cash advances are recommended for business owners that need an expedient, easy solution for a short-term cash crunch. Known for their lightning-fast approvals and low credit score requirements, merchant cash advances provide a quick fix if you need cash in a hurry or don’t meet the credit score requirements of other online business funding options.

Once you’re approved for a merchant cash advance, you’ll receive a one-time cash infusion that you’ll repay based on a percentage of your sales revenue, determined by the lender. Merchant cash advances can seem costly to first-time borrowers since payments are taken daily or weekly and are calculated using factor rates. On the bright side, merchant cash advances can be beneficial to many small businesses.

Here’s a shortlist of some of the main features of online merchant cash advances offered from our network of online business lenders:

- Repayment periods from 3-24 months

- Factor rates starting at 1.10

- Advance amounts up to $500,000

- Same-day approvals

Related: Merchant Cash Advance vs. Business Loan: Which Is Best for You?

Accounts Receivable Financing

If you own an invoice-issuing company (e.g., in the professional services or business-to-business industry) that wants to apply for a commercial loan online, you’re well-suited for accounts receivable financing..

Accounts receivable financing allows borrowers to collateralize outstanding invoices for a cash advance. The best part of invoice financing is that it’s not debt. A cash advance is issued for a fraction of what the invoice is worth — typically, 80% to 90% of its value, less a processing fee.

Accounts receivable financing, although not the most affordable method of funding a small business, can be useful in getting out of a cash crunch.

Note that factor fees between 1.0 and 2.0 are often charged weekly until the invoices are paid in full.

Here are some invoice financing terms from our network of online business lenders:

- Repaid when invoices are paid by the customer

- Cash advances up to 80% of receivables

- Same-day approvals

Equipment Financing

Equipment financing is funding specially purposed for the acquisition of equipment, such as X-ray machines and heavy construction tools. Most internet equipment loans have repayment terms between 1 and 5 years, and the equipment isn’t considered owned by the borrower until the loan is paid in full.

In addition to machinery and tools, you can also use online equipment financing to lease technology for your business. For example, those in the construction, dental or medical industries often rely on equipment financing to gain an edge over competitors with the latest technology.

Equipment financing terms, although diverse, typically conform to the following when working with online lenders in the Fast Capital 360 marketplace:

- 1-5 year term lengths

- Interest rates from 8%

- Financing up to 100% of the equipment value

- Approvals as fast as 2 days

SBA Loan

The Small Business Association (SBA) does not serve as a lender. Instead, they act as a guarantor that reduces the risk lenders undertake to extend capital to small business owners.

Guaranteeing up to 90% of the loan in some cases, the SBA makes it possible for lenders to provide better interest rates and higher amounts of funding to businesses they otherwise would not approve. SBA loans are essential for entrepreneurs and other small businesses that have trouble qualifying for conventional funding.

They can be slower to acquire than other online business loans.

Our SBA partner lenders are able to offer the following terms:

- 5-25 year term lengths

- Interest rates from 6.25%

- Principal amounts from $5,000-$5 million

- Approvals as fast as 30 days

Short-Term Loan

A short-term loan can benefit small business owners who need to cover immediate expenses or tide themselves over until the end of a cash crunch.

Short-term loans typically have repayment terms between 3 and 18 months. Interest rates are generally higher — usually 10% or more.

This type of online business loan is among the easiest to access because borrowers could be approved in as little as a day and lenders usually have lenient requirements for approval.

Short-term online loans offered through our network of lenders have these features:

- 3-18 month term lengths

- Interest rates from 10%

- Principal amounts from $3,000-$500,000

- As fast as same-day approvals and funding

How to Get a Small Business Loan Online

The criteria some of the best online business lenders use to determine whether to approve financing include:

Time in Business

Online small business loan applicants will be asked to provide a few pieces of information about their business before getting approved. One of the most important aspects of your application is your total time in business. If your business only launched a month ago, your chances of securing a term loan or line of credit will be slim.

It’s a good idea to first establish your company and gain a foothold in the market before applying for financing. After 4 months in business, your company will meet the minimum requirement for some online funding for small businesses. After 2 years, you’ll be eligible for approval from a wide variety of online business lenders.

Business’s Annual Revenue

Annual revenue is an important part of securing an online business loan. Unless your business has demonstrated that it can generate revenues and potentially become profitable, both online and conventional lenders will likely consider your application too risky to touch. In many cases, minimum annual revenues of $75,000 are required to qualify.

Credit Score

Typically, conventional lenders look for credit scores of 650 or above. However, some online business lenders will consider applicants with scores as low as 500. In fact, they often have alternatives for borrowers seeking online small business loans for bad credit. The lower the credit score, however, the higher the interest rate, the shorter the term and more frequent the repayment schedule.

Compare Online Business Lenders

Now that you have an understanding of what lenders look for in borrowers, it’s time to find the best online business lenders. Every company is different, so looking into each lender will help you determine which financing option, terms and borrower requirements* are the best fit for you and your business’s needs.

The Business Backer

This lender offers online small business loans and financing that include the purchase of receivables and a business line of credit. The Business Backer contacts potential customers the same day they submit their applications, and financing can be approved in a matter of hours.

Lender requirements for borrowers are the following:

- At least 1 year in business for an online business loan or purchase of receivables; at least 6 months for a business line of credit

- Minimum $100,000 in annual revenue for online business loans and purchase of receivables; $50,000 for a business line of credit

- 550+ credit score for a business loan or purchase of receivables; 560+ for a business line of credit

The Business Backer’s financing options offer the following terms:

- Maximum funding amounts are $200,000 for small business loans and purchase of receivables; a business line of credit can be approved for $100,000 maximum

- Factor rates start at 1.2 for the purchase of receivables; interest rates start at 1.7% for a business loan and monthly rates start at 3.3% for a business line of credit (other fees can be applied to these financing options)

- Maximum repayment terms can range from 18 to 24 months, depending on the type of financing

Credibly

This lender provides internet term loans and other financing options to help existing businesses. If you want to apply to Credibly, you’ll go through a prequalification process and can receive approval and funding in 24 hours.

Requirements vary according to financing type, but If you want to apply for a commercial loan online or other funding through Credibly, the following are some general standards:

- At least 6 months in business

- 500+ credit score

- $15,000 in monthly bank deposits or $50,000 in annual revenue (requirements depend on funding type)

Credibly’s online long-term business loans have the following terms:

- Financing up to $250,000

- Up to 2-year terms

- Interest rates starting at 9.99%

Smartbiz Loans

This online business lender offers commercial term loans and other business financing and facilitates the SBA loan application process. Smartbiz term loans can be used for various business expenses, including working capital and equipment purchases, and their alternative financing options include invoice financing, business credit cards and lines of credit. After you submit your online application, approval and funding can take up to a week.

Eligibility requirements vary from loan to loan, but in general, SmartBiz Loans looks for the following from its potential borrowers:

- At least 2 years in business

- Be a U.S. citizen

- Minimum credit score of 640 (for SBA-backed loans) or 660 (for term loans)

- No bankruptcies or foreclosures in the last 3 years

The online business loans have the following terms:

- Interest rates start at 4.75% for SBA loans and 6.99% for term loans and other financing options

- Funding amounts up to $500,000 for term loans and other financing options; $5 million for SBA loans

- Terms from 2-5 years for term loans; 24-60 months for other financing options; 10-25 years for SBA loans

OnDeck

OnDeck is another source for fast business loans online. It takes only 3 steps from small business owners filling out an application for a short-term loan or business line of credit to learning whether their request was approved.

General eligibility requirements for online funding for small businesses include the following:

- In business for at least 1 year

- $100,000 in annual revenue

- 600+ FICO score

Some of the lending terms are the following:

- Terms up to 24 months for short-term loans; 12-month terms for business lines of credit (that are reset)

- Funding amounts up to $250,000 for term loans; $100,000 maximum for business line of credit

- Daily or weekly repayments

Everest Business Funding

The online business lender provides merchant cash advances to various industries, from retail to healthcare to contractors and food service to seasonal businesses and more.

Potential borrowers can submit basic personal and business information to get pre-approved for financing. Everest Business Financing boasts a 95% approval rate for applications.

This lender has the following requirements for customers:

- U.S. business

- Minimum $4,000 monthly revenue

Businesses can be approved for merchant cash advances ranging from $5,000 to $1 million and can receive funding within 24 hours.

*Loan conditions accurate as of December 2021.

How to Apply for a Business Loan Online

Once you’ve decided which financing type fits your business’s needs and which lenders you want to work with, you’re ready to apply for a commercial loan or other financing online.

Business documents and information you’ll need can include the following:

- Personal information about you and any other business owners or partners

- Your business’s incorporation documents

- Your doing-business-as name, if applicable

- At least 6 months’ worth of bank statements

- Tax returns

- Investment information, if applicable

You’ll also need to share bank account routing information, but some lenders might have you directly connect your account for funding purposes.

Once you have all of the required information, you can apply by simply visiting the website of a trusted online business lender and applying through their web portal. The entire application process is completed online, usually within minutes. The average online business loan provider takes a few days, or sometimes a few hours, to review and approve an application. Some lenders also provide same-day funding.