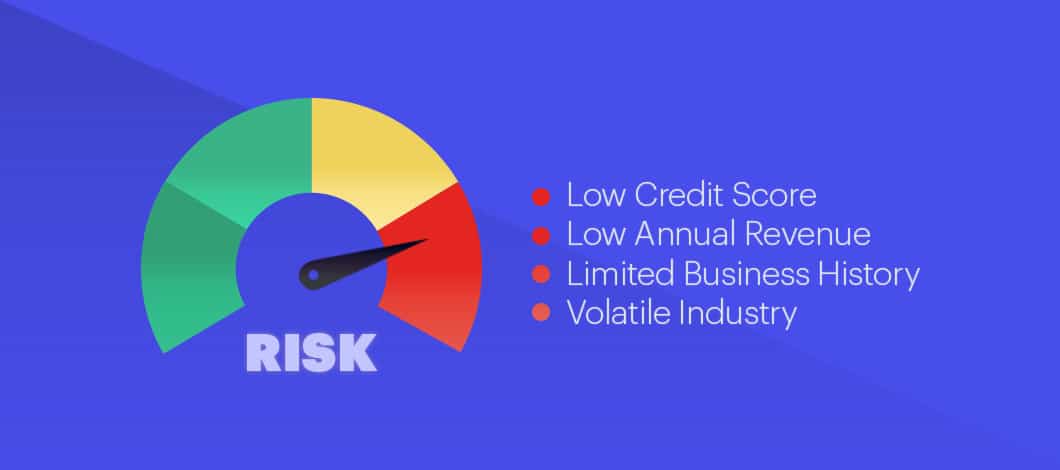

There are many reasons why business lenders might classify your financing application as a potentially high risk business loan. The most obvious of which is a bad credit score, but there are other considerations, too.

Whatever the reason, a “high risk” label can prove problematic when trying to obtain a business loan. But that doesn’t mean you’re unfundable. In today’s marketplace, alternative high risk commercial lenders consider a broader set of data points and have redefined what “fundable” looks like.

Let’s explore what qualifies as high risk business loans as well as the best loans and financing options available for high risk clients.

What Are High Risk Loans?

High risk business loans are loans that lenders extend to applicants with subpar qualifications, such as poor credit, no collateral and low revenue. In these cases, the lender assumes more risk working with this individual or entity.

Let’s take a look at each element that can contribute to a high risk business loan’s label.

Low Personal Credit Score

When assessing applications, lenders will review the business owners’ personal finances, including their credit scores. If you have an insufficient credit history or bad credit—which is a FICO score of 580 or less—your business loan application can be flagged as “high risk” by lenders.

Low Annual Revenue

A business’s annual revenue is a reliable indicator of creditworthiness. If your business generates consistent income, you’re more likely to meet debt obligations. As such, many lenders set strict minimum annual revenue requirements. If your business falls below these thresholds, you could be considered a high risk applicant.

Limited Business History

If your business has been operating for fewer than 2 years, you’ll lack the track record to prove profitability; thus, many lenders could consider it too risky to invest in your business.

Unstable Industry

If your overall industry can be unpredictable, such as the retail and restaurant sectors, you could be in the “high risk business loans” category. If a company stands a risk of defaulting due to factors outside of its control, it poses a liability to lenders.

How Do High Risk Commercial Lenders Offset Risk?

Alternative high risk commercial lenders offset risk by using additional data points and advanced algorithms to evaluate a company’s creditworthiness further.

For high risk loans, lenders consider additional factors such as bank account activity, earnings, deposits and payment histories, among other criteria.

Armed with this information, alternative lenders make data-driven decisions about applicants. As such, many high risk business owners now have viable capital options that weren’t available in previous years.

However, note that high risk business loans can incur higher interest rates, smaller loan amounts, and shorter—and more frequent—repayment terms. High risk lenders take these measures to reduce the chance of default and protect their investments.

High Risk Business Loans: Your Top 4 Options

While financing offerings differ among high risk loan lenders, there are a few go-to options suitable for business owners working to improve their credit or build a history.

Here are 4 types of high risk business loans and financing.

| Financing Type | Details |

| High Risk Merchant Cash Advances | Lenders advance funding in exchange for a percentage of future sales |

| Short-Term High Risk Business Loans | Borrowers receive funding to be repaid over an 18-month maximum term |

| Accounts Receivable Financing | Lenders advance businesses a percentage of their outstanding invoices. Client’s creditworthiness is key for this financing |

| High Risk Equipment Financing | Lenders can finance a portion or all of an equipment purchase; the equipment serves as collateral and reduces lender risk. |

1. High Risk Merchant Cash Advances

A popular option for high risk borrowers is a merchant cash advance (MCA), which isn’t a loan but an advance. With an MCA, high risk lenders advance you a sum of cash in exchange for a percentage of your future sales.

The advance is then repaid through daily or weekly debits from your business’s bank account. These remittances are fixed over a set term, usually ranging from 3 to 24 months.

High risk cash advance fees are calculated using a factor rate. Factor rates are expressed as decimal figures rather than percentages and typically range from 1.10 to 1.50. The factor rate is used to calculate the MCA fee, a percentage of the original advance amount, not a fee based on depreciating principal. For this reason, the cost of MCA financing remains the same, whether you pay off an advance in 3 months or 6.

Before approving a high risk cash advance, a lender will review your small business’s deposit and cash-flow statements to determine how much money you’re eligible to receive. Because your credit score, history and time in business are less of deciding factors, MCAs are a good fit for many high risk business owners.

Do you qualify? Fast Capital 360’s minimum MCA requirements:

- Time in Business: 4+ months

- Annual Revenue: $100,000+

- Credit Score: 500+

2. Short-Term High Risk Business Loans

Short-term high risk business loans function as a condensed version of a term loan. Your business will receive a lump sum of cash that it will pay off, plus interest, over a set term. And herein lies the difference: you pay off short-term loans more quickly than term loans.

In general, short-term high risk business loans reach maturity in 18 months or fewer. This shortened payoff structure reduces the risk of default and thus results in lower lender requirements.

Do you qualify? Fast Capital 360’s minimum short-term loan requirements:

- Time in Business: 1 year or more

- Annual Revenue: $75,000+

- Credit Score: 540+

3. Accounts Receivable Financing

Accounts receivable financing—also known as invoice factoring or financing —converts outstanding invoices into immediate cash for your small business. High risk commercial lenders’ terms vary, but an invoice financing company will generally advance businesses up to 80%-90% of the invoices’ value, deducting an overall processing fee and a weekly factor from the reserved portion until the invoice is paid in full. The remaining balance is then remitted to the borrower in the form of a rebate.

While the creditworthiness of your business is less of an approval factor, your customers’ creditworthiness is. For this reason, accounts receivable financing might be a good option for your high risk business, as long as you operate in the business-to-business space and have outstanding receivables on the books.

Do you qualify? Fast Capital 360’s minimum invoice financing requirements:

- Time in Business: 1 year or more

- Annual Revenue: $150,000+

- Credit Score: 600+

4. High Risk Equipment Financing

If you need to purchase a vehicle or key piece of machinery for your business and some lenders have deemed you a high risk borrower, equipment financing is a solid alternative to achieve your goals. With equipment financing, a lender will finance up to 100% of the equipment you’re buying, and the equipment itself serves as collateral to secure your funding. This reduces the risk for the lender because they can recoup the equipment in case of loan default.

Do you qualify? Fast Capital 360’s minimum equipment financing requirements:

- 2 years or more in business

- $160,000 or more in annual revenue

- 620 or higher credit score

Other Loans and Financing for High Risk Clients

You can investigate the following alternatives in addition to the primary 4 high risk loan options.

Personal Loan: If your personal credit score is higher than your business credit score, a personal loan could be preferable to applying for high risk business loans for poor credit. If you’re just starting your business venture, a personal loan could also be an alternative to high risk small business startup loans. However, these funding amounts are usually lower than business financing; 6-figure loans are usually approved for people with excellent personal credit scores and high income.

Co-signer: Lenders are more likely to approve your application if someone with a higher credit score and stronger credit history can co-sign with you. This removes some of the default risk. Note that your repayments impact your co-signer’s credit score, so ensure you can meet the terms of your agreement and won’t strain any professional or personal relationships.

Applying for High Risk Small Business Loans Through Fast Capital 360

Few business owners hit the ground running. Companies often go through trials and tribulations before finding the right formula for success. Unfortunately, it isn’t uncommon for your credit score to take a hit in the process.

But if other financial indicators point to a brighter future, there are funding options out there. We and other legitimate high risk lenders are here to help you uncover them. You can apply for high risk small business funding in 3 simple steps:

Step 1: Apply in Minutes

Our online application is quick, easy and only asks for basic business information. Most users complete an application in a few minutes.

Step 2: Qualify in Hours

After you submit your application, one of our experienced business advisors will reach out to you in as little as an hour to discuss the financing options your business qualifies for.

Step 3: Next-Day Funding

Once you select your funding program, your funds could be wired to your company bank account the next business day.

If conventional lenders are giving your company a hard time with high risk small business loans, it isn’t the end of the road. Apply now for unsecured business funding with Fast Capital 360 and you could have the capital your business needs to grow.