Funding for Your Today (and Your Tomorrow)

Whether you’re seeking to invest in a business opportunity or enduring a challenging season, a small business loan can help. Get the financial flexibility to keep business running smoothly and moving forward.

At Fast Capital 360, we’re committed to helping entrepreneurs succeed. We do this by partnering with reputable lenders throughout the country. Through this trusted network, we can deliver multiple financing offers without delay.

Find out how to compare options and choose the best offer for your business today!

Contents

SECTION 1

Types of Small Business Loans

There’s no one-size-fits-all business financing solution. Fortunately, you can fund your day-to-day operations and company growth initiatives through business loans and financing products.

At Fast Capital 360, we offer the following online business loans and financing options.

Term Loans

With a business term loan, you’re given a lump sum of capital upon approval. You pay back the funds with interest in equal installments over a set period.

At Fast Capital 360, we offer:

- Short-term loans: 3 to 18 months

- Medium-term loans: 1 year-5 years

Compared with longer term loans, shorter term loans require more frequent payments, often weekly or daily instead of monthly. However, same-day funding can be available.

Who Qualifies?

| Short-Term Loan | Medium-Term Loan | |

| Time in Business | 1+ year | 1+ year |

| Annual Revenue | $75,000+ | $200,000+ |

| Credit Score | 540+ | 600+ |

Loan Specifics

| Short-Term Loan | Medium-Term Loan | |

| Funding Amount | Up to $500,000 | Up to $250,000 |

| Interest Rate | Starting at 10% | Starting at 7% |

| Repayment Term | 3-18 months | 1 year-5 years |

| Speed of Funds | Same day | 1 day |

Lines of Credit

If you want flexible contingency financing, consider a line of credit. Once approved, you can draw from your credit line for emergencies, unexpected bills, operating expenses and more. Though you may be charged a nominal fee per withdrawal (e.g., 1%-3% of the borrowed funds), interest only accumulates on the amount you use.

Most credit lines are revolving – as you pay down your balance, your credit line is restored, so you can keep borrowing up to your limit.

Who Qualifies?

- Time in Business: 1+ year

- Annual Revenue: $200,000+

- Credit Score: 560+

Loan Specifics

- Funding Amount: Up to $250,000

- Interest Rate: Starting at 8%

- Repayment Terms: 1 year-5 years

- Speed of Funds: 1 day

Equipment Financing

Equipment financing is a type of asset-based financing specifically for equipment loans or leases. With this type of small business funding, the item you intend to purchase or lease serves as collateral for the loan. Depending on the condition of the equipment and your qualifications, you can finance up to 100% of the asset’s value.

Who Qualifies?

- Time in Business: 2+ years

- Annual Revenue: $160,000+

- Credit Score: 620+

Loan Specifics

- Funding Amount: Up to 100% of equipment value

- Interest Rate: Starting at 8%

- Repayment Term: 1 year-5 years

- Speed of Funds: As fast as 2 days

SBA Loans

Small Business Administration (SBA) loans are serviced by participating banks, credit unions and alternative lenders and are partially guaranteed by the SBA. Because of this guarantee, the risk for the lender is reduced, encouraging lending to small business owners. Additionally, interest rates on SBA loans are capped, making them one of the most affordable small business loans available on the market.

Who Qualifies?

- Time in Business: 2+ years

- Annual Revenue: $50,000+

- Credit Score: 650+

Loan Specifics

- Funding Amount: Up to $350,000

- Interest Rate: Starting at 7%

- Repayment Term: 5-10 years

- Speed of Funds: As fast as 7 days

Merchant Cash Advances

Through a merchant cash advance, a business borrows against its future profits. Merchant cash advances are short-term alternative financing meant to be repaid quickly, often with automatic daily payments. They can be serviced rapidly and are an option for borrowers who do not qualify for other types of funding due to limited time in business or poor credit.

Who Qualifies?

- Time in Business: 4+ months

- Annual Revenue: $100,000+

- Credit Score: 500+

Loan Specifics

- Funding Amount: Up to $500,000

- Factor Rate: Starting at 1.10

- Repayment Term: 3-24 months

- Speed of Funds: As fast as same day

Invoice Factoring

In an invoice factoring agreement, a business sells its accounts receivable balance to a financing provider. The funder then issues an advance of the invoice’s face value (e.g., 80%). When the customer pays the invoice, the provider releases the remaining invoice balance to the borrower, minus a fee. How much you incur in fees is tied to how long it takes your customers to pay their invoices.

Who Qualifies?

- Time in Business: 1+ year

- Annual Revenue: $150,000+

- Credit Score: 600+

Loan Specifics

- Funding Amount: Up to 80% of receivables

- Factor Rate: Starting at 1.02

- Repayment Term: Until receivables are paid

- Speed of Funds: As fast as same day

SECTION 2

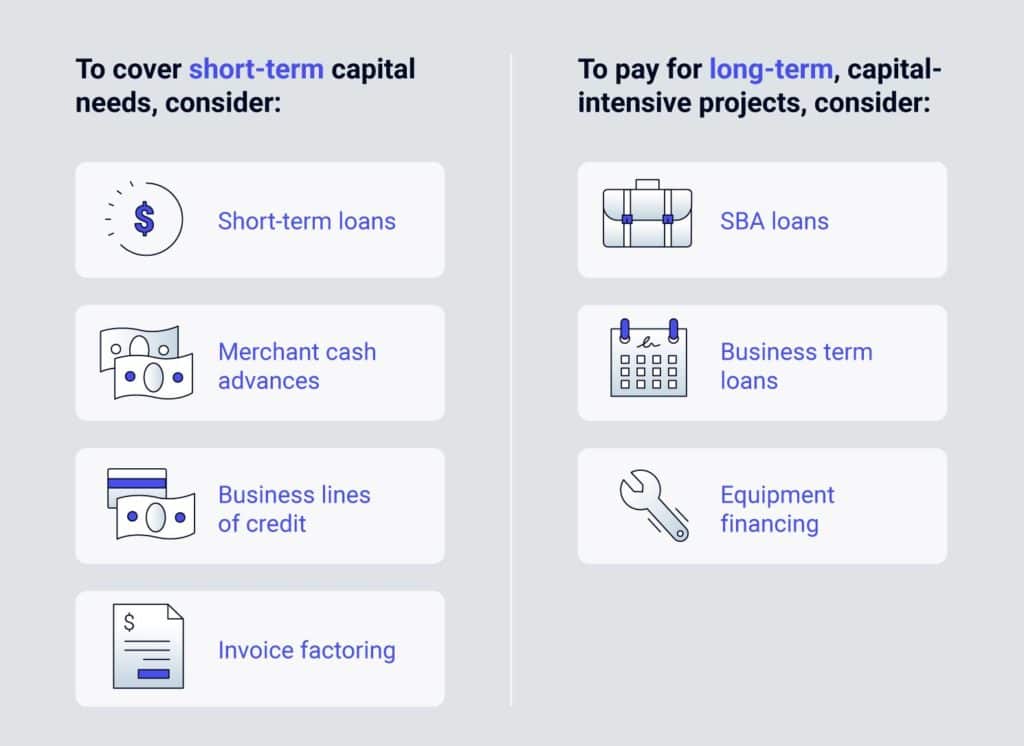

What Type of Financing Makes Sense For My Business?

To determine the best types of business loans for you, examine what you need, why you need it and by when. Consider your business profile and industry too.

Funding Need

Does your business have gaps from the time you complete a service to the time you get paid? Is your industry seasonal? Are you looking to improve your credit? Are your needs short or long term? These are some of the questions you should be asking when you’re researching small business loan options.

As a general rule of thumb, debt shouldn’t outlast the life of an investment, so it’s important to consider why you’re seeking a loan. If your objective is to purchase seasonal inventory you intend to turn in 90 days, for example, it’s not the best decision to take out a 10-year loan. In contrast, long-term loans are the better choice for capital-intensive projects, where you may not see an immediate return on your investment.

Business Credit History

Your business creditworthiness is a factor you need to consider when applying for financing. It’s important to look at your credit history and be realistic about the funding options available to you.

For example, if you’re a business owner just starting out or have fair to poor credit, a short-term loan, merchant cash advance or accounts receivable financing may be the best fit. On the other hand, if you have a stronger credit profile, you may consider a line of credit, term loan or SBA loan.

Timing Requirements

Are you looking for a fast business loan above all else? If timing is your greatest concern when you’re in the market for financing, consider that application and funding times are notoriously long with conventional lenders, such as banks and credit unions.

However, with alternative lenders that offer small business funding online, approvals are much faster. In fact, at Fast Capital 360, you could get the capital you need as soon as the same day of approval in some cases.

SECTION 3

What Factors Do Lenders Review for Approval?

At Fast Capital 360, we don’t require applicants to put up specific collateral to get a loan. We simply consider the following factors.

Credit Score

When you apply for a small business loan, lenders evaluate your credit score to determine eligibility. A credit score of Good, Very Good or Excellent (670-800) will qualify you for some of the best financing rates and terms. That said, there are still programs suitable for business owners with Poor to Fair credit (<580-660). At Fast Capital 360, we have financing available for business owners with credit scores starting in the 500s.

Time in Business

When it comes to loans for small businesses, the length of time you’ve been in operation is another factor considered for approval. While conventional lenders often prefer funding businesses that have been open for a couple of years, at Fast Capital 360, we have financing available if you’ve been in business for at least 4 months.

Cash Flow

When you apply for a business loan, lenders will evaluate your cash flow, including your average monthly sales, expenses and revenue. Funders use this data to determine an appropriate approval amount and terms. At Fast Capital 360, we’ll review your 4 most recent bank statements to evaluate your cash flow.

Debt Load

Lenders also consider your existing debt obligations when evaluating you for approval and deciding what loan amount and terms to offer. After all, they want to make sure you’re in a position to pay them back.

SECTION 4

Why Fast Capital 360?

You know a lot about what it takes to build a successful small business. But if you’re not a finance professional, navigating through different lending products can be overwhelming and time-consuming.

We know you have more important things to do (like run your company). That’s why at Fast Capital 360, we make things easy. We offer expert guidance and help you compare loan offers so you can quickly access the capital you need to grow.

Funding Network

We have established relationships with lending partners across the U.S. to support the financial needs of most entrepreneurs.

Easy Process

With a single, no-cost application, you could receive multiple financing offers. Our online application takes just a few minutes to complete, and you can see what you qualify for without impacting your credit.

Fast Approvals and Funding

At Fast Capital 360, 4 out of 5 applications are approved and funded. In some cases, funds could be deposited in your bank account the same day as approval.

Expert Guidance

A Fast Capital 360 Business Advisor will be in touch to review your offers, guide you through the funding process and answer any questions you have. Our experienced team is dedicated to helping your business succeed.

Trusted by Thousands

Over the years, more than 35,000 small businesses have entrusted us with their financing needs and it shows in our ratings:

- A+ with the Better Business Bureau

- 4.9 stars on Trustpilot

- 4.4 stars on Google

SECTION 5

Business Loan FAQ

You can apply for a business loan on our website in just a few minutes. Simply answer basic questions about your business. Then securely connect your company bank account so that we can review your most recent banking activity, including revenue, debits and cash flow.

Minimum requirements:

- 4 months in business

- $10,000 in monthly revenue

- 500+ FICO score

We offer multiple financing products you might qualify for, depending on what makes the most sense for your business. These can include short-term loans, merchant cash advances, business term loans, equipment loans, invoice financing, business lines of credit or SBA loans.

Depending on the health and qualifications of the business, our rates can start as low as 6% for some financing products. With a business line of credit, your rate could even be as low as 3%-4% if you can pay off borrowed funds in the first few weeks.

How much you can borrow will depend on your credit score, cash flow, revenue and existing debt. That said, we’ll always offer the maximum amount for which you qualify and can afford – our lenders will not extend credit they feel could endanger the financial health of your business.

Typically, you can expect a funding offer that’s 50%-100% of your business’s average monthly revenue. So, for example, if you average $10,000 a month in revenue, you could anticipate a financing offer of $5,000-$10,000.

Find out what you’re approved for within hours, then choose an offer that works for you. Funds could be deposited in your account within a day.

While we currently do not offer early-stage startup loans, we can provide funding to qualifying businesses with at least 4 months in operation.

We can offer business financing to borrowers with credit scores in the 500s who meet time in business and revenue minimums. These products include short-term loans and merchant cash advances. Business lines of credit may also be available to qualifying borrowers with at least a 560 credit score.

One application. Multiple loan offers.

Quickly compare loan offers from multiple lenders without impacting your credit score.

GET APPROVED