One of the biggest challenges for small business owners is finding funds to launch, run and grow businesses.

While borrowing from banks might be the first option that comes to mind, you should also consider applying for small business grants.

We’ll discuss the types of small business grants, as well as the differences between each one. We’ll also share how to get a small business grant, including how to find active business grant opportunities and what you’ll need to do to apply for them.

What Are Small Business Grants?

Small business grants are offered by specific entities such as a government agency, a nonprofit or a for-profit organization. Grant recipients must fulfill a set of standards created by the providing entity.

Unlike business loans, business grants are issued without the expectation of repayment.

Grants for small business owners also aren’t available year-round — and when applying for one, your competition can be fierce.

If it’s within the realm of possibility for your company to qualify and be selected for a grant, you want to apply for it. Even if you ultimately don’t currently qualify for a grant, you’ll at least have an idea of how your business can grow moving forward. You’ll also gain experience working on small business grant applications.

The grants you’re going to want to look for typically fall into one of the following categories:

- Federal government grants for small business

- State and regional grants

- Private/corporate small business grants

- Specialized grants, including small business grants for women and minorities and businesses impacted by COVID-19

-

In need of funds? Quickly compare loan offers from multiple lenders. Applying is free and won’t impact your credit.

Federal Government Small Business Grants

Federal government small business grants are funds awarded to qualified businesses throughout the United States.

Typically, federal grants are offered to companies that fit a set of very stringent standards.

Organization Type

The requirements for a government grant for small business are strict. Federal government small business grants are usually offered to organizations that benefit and promote the welfare of our national community in some way. For example, grants are often provided to companies in the following sectors:

- Environmental conservation

- Childcare and education

- Scientific and technological research

Specific federal government grants are typically offered in-line with governmental initiatives. The grants are provided to organizations that could help the government fulfill its own goals, so several federal grants target welfare-focused institutions.

This doesn’t mean your business has to be a nonprofit to be eligible. However, if your organization’s efforts aren’t directly focused on improving your community, you likely won’t be qualified for such grants based on other factors.

Business Status

Federal government grants for small businesses are also more tailored to organizations operating successfully for a sustained period. While startups aren’t excluded based on the age of their organization, companies just getting off the ground probably won’t meet the criteria for the grant.

The organizations that are chosen for federal grant funding have clear and specific goals for their business and their overall mission. These organizations also have a clear plan regarding reaching these goals — and a solid blueprint for how they’ll use the grant money to do so.

Intended Use of Grant Funds

As for how the money is used — it all goes into research and development. In other words, organizations can’t use federal cash to fund their operational expenses — and they must be able to cover these costs as they increase their R&D initiatives moving forward.

While there is fierce competition (and criteria) to earn a federal government small business grant, the reward for being chosen is almost certainly worth the effort. Many federal government grants provide a minimum of a few hundred thousand dollars — and can sometimes reach into the tens of millions.

How to Find Active Federal Grant Opportunities

Several sites can help connect you with federal grants you might be eligible for, including:

- Grants.gov: Government website that allows you to browse federal grants by category, agency and eligibility

- Challenge.gov: Government website presenting grants in the form of contests, in which applicants are challenged to provide a viable solution to a particular problem or issue

- Grantwatch: A non-government website that acts as a database for grants for nonprofit organizations

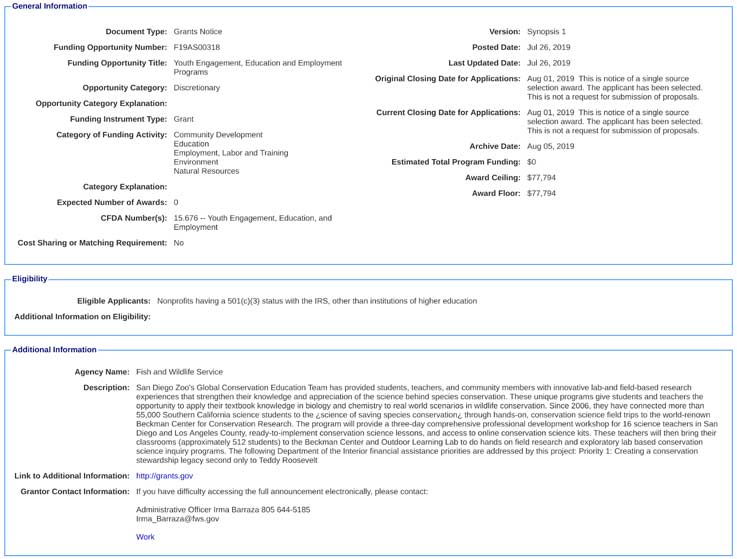

Here’s an example of a grant opportunity on Grants.gov that offers small businesses funding to support research into potential commercial products that can reduce the stigma surrounding substance use disorders.

Some of these postings’ “related documents” tab contains further information on the specific grant. This supplemental documentation allows your team to dig into the “nitty-gritty” of a particular grant application before you reach out to the provider for more information.

State and Regional Grants for Small Business

The federal government provides individual states and even smaller jurisdictions funding to be dispersed through grants as the local government sees fit.

Like federal grants, a state or regional government grant for small business will typically be awarded to an organization with a project or overall mission that benefits the local community. If your local government can attain its goals by enabling your business to thrive, it’s a win-win scenario.

State and Regional Grant Criteria

Local grants tend to target companies that benefit the local economy. In contrast, federal grants are more about national welfare — though the economic benefits are certainly a byproduct.

It’s common to see local grants offered to businesses that:

- Pledge to bring jobs to the area

- Provide products and services to other businesses in the local area

- Provide location-specific products or services (e.g., farming equipment in rural areas, etc.)

Fewer companies are eligible to apply for a small business grant from a specific state or region, compared to the national pool of applicants for federal small business grants. However, there will still be high-caliber applicants for a state or regional government grant for small business, making the award process competitive in quality, if not quantity.

Additionally, because state and local governments have much smaller budgets than the federal government, localized grants are typically much smaller in funding size. This isn’t to say they aren’t substantial and wouldn’t positively impact your business. However, you’re less likely to see local small business grants reach the same level of funding that federal grant winners receive.

Matching Grants

Another caveat to consider when applying for local business grants is that they often work on a matching policy. Essentially, this means that grants are awarded to selected organizations after said organization has raised a predetermined amount of funding on its own.

Match grants usually work on a 1:1 or 2:1 ratio. When applying for 1:1 grants, a company will need to raise an amount equal to the grant amount before earning funding.

Providers of 2:1 match grant funding agree to pay 2 times the amount raised by an organization (as long as the said organization can raise the predetermined amount).

How to Find State and Regional Grant Opportunities

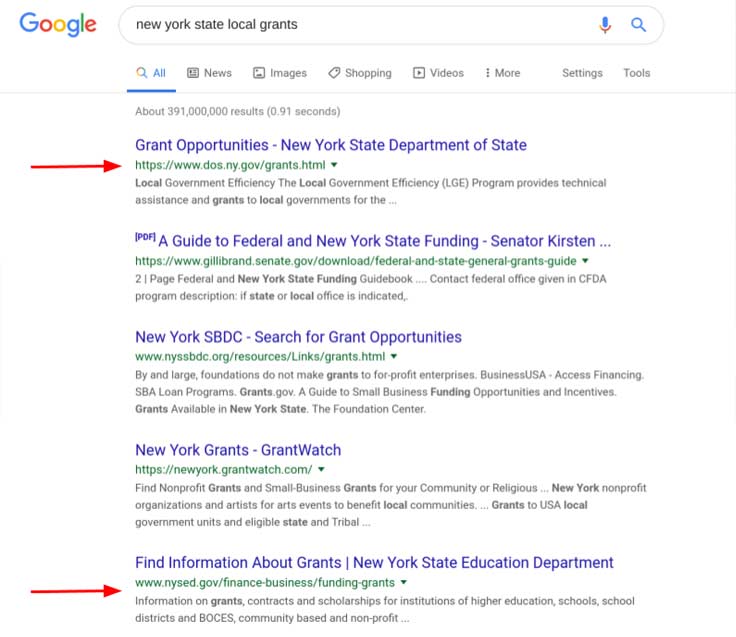

To find active grants for small business owners in your local area, your best bet is to head to Google and use search queries such as “(State name) state grants,” “(State name) local grants” or “(City name) grants.” This will point you toward the section of a government website that deals explicitly with government-issued grants.

From there, you can dig deeper into grant opportunities by your respective state.

(Source)

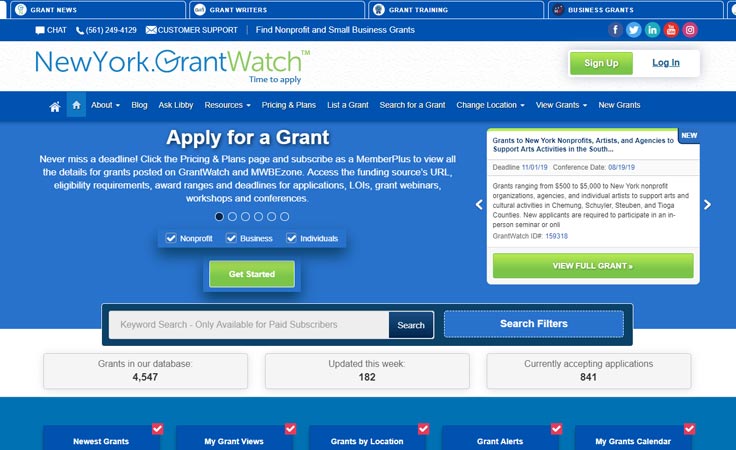

You can also use GrantWatch mentioned above and similar commercial databases to find business grants in your area:

(Source)

Like federal grants, the reward for earning more localized small business grants is more than just monetary. Because these grants are used to improve the area for the local population, having a chance to be a part of such an initiative will help you forge an image as a pillar of your community. In turn, this could help drive business from local patrons.

Private/Corporate Small Business Grants

Commercial organizations and companies offer private small business grants. Like government grants, corporate and private small business grants are offered to organizations with a mission aligned with the providing entity. Corporate or private business grants are often targeted at organizations that provide ancillary services to an industry or specific company. The goal is to create a situation in which everybody involved in the process wins in some way.

In contrast to governmental grants — which typically follow a similar format regarding how they’re offered, what they offer and how to apply — the providing company determines corporate business grants’ makeup

Private grant offerings can be presented in “contest” format, in which a select group of winners is chosen on a predetermined date. The rules and processes of said contests will vary depending on several factors, such as the providing company’s industry and the type of grantee targeted. Small business grant applications are submitted on an annual or semi-annual basis — which adds to the “contest” feel when applying.

Corporate or private grants for small business owners can also be quite substantial in terms of the dollar amount. Also, many companies offer runner-up small business grants to applicants who showed clear promise in their initiatives. What’s more, the added publicity winning organizations receive will only add to the value they glean from the grant.

Let’s take a look at a couple of examples:

NASE Grant

The National Association for the Self-Employed (NASE) offers Growth Grants to its members. Applications for these small business grants are reviewed quarterly, and awards can be up to $4,000. Funding can be used to expand your business’s facilities, hire employees, pay for advertising or marketing or other business initiatives.

To apply for a NASE small business grant, you must meet the following criteria:

- Be a non-student NASE member in good standing

- Demonstrate a business need for the grant and how you’d use the funding

- Demonstrate how the grant money could contribute to further success

- Include documents such as a resume and business plan

FedEx Small Business Grant

FedEx’s Small Business Grant Contest is an annual event that awards “grants, prizes and insights from FedEx experts to help them grow their business…(and allow them to join) a community of small businesses that offer peer insights.”

In soliciting applications for its annual small business grants, FedEx aims to attract companies that have a clear mission statement, a plan of attack and a substantial commitment to giving back to their communities in some way. “Community” in this sense could refer to the local area an organization operates in, or it may refer to the community that exists within the organization’s niche.

For example, 2020’s grand prize winner, Access Trax, produces “user-friendly, portable pathways” to help people with disabilities move over uneven terrain in beaches and parks, improving their access to and enjoyment of those outdoor spaces. A bronze winner, Olori, works with African artisans and women-owned businesses to craft and sell handbags and other accessories. The company also “supports girls’ education in under-served African communities.”

The common thread among most winners of FedEx’s grant is in their innovative or unique approach to shipping and logistics — aligning with this the focus of FedEx’s services.

Specialized Grants

These small business grants aim to help specific demographics within the business world. Most often, specialized grants will be created to assist female entrepreneurs, minority-owned companies, and veterans’ businesses. Some businesses, either on their own or in partnership with other organizations, offer grants to support small businesses affected by the COVID-19 pandemic.

Specialized grants are offered by federal and state governments and also by private entities. They can be found by browsing government databases or through a simple Google search.

Examples of small business grants for women, veterans and those in under-served communities include:

- The Amber Grant: A $25,000 grant given annually to a top-performing, female-owned business

- The StreetShares Foundation: A grant-based initiative focused on helping veterans create their own small business

- First Nations Development Institute Grants: The institute offers grants supporting Native American organizations and projects. It’s awarded more than $40 million in grant funding throughout the last nearly 30 years.

It’s worth noting that the application field for specialized grants is likely to be smaller than non-specialized grants because only certain businesses will qualify. Of course, the competition will still be high in quality, much like any other grant application process.

COVID-19 Grant Opportunities

Grant funding and forgivable loans at the federal level weren’t available in late 2020, but state and local governments are making unprecedented moves to help businesses amid the COVID-19 crisis. For instance, Colorado’s Gov. Jared Polis signed a bill in December 2020 providing $57 million in relief funding to small businesses and cultural organizations in the state. Among those funds are grants to help minority-owned businesses in Colorado.

Community organizations and corporations are stepping up too. The Local Initiatives Support Corporation (LISC), a nonprofit community financial development institution (CFDI) has partnered with Lowe’s to offer the Rural Relief Small Business Grants program. Funding, ranging in amounts from $5,000 to $20,000, are awarded to qualifying small businesses in rural communities (defined as having a population of 50,000 or fewer). Applicants are accepted in groups of weeks-long rounds, and are continuing into 2021.

Rebuild the Block’s Small Business Relief Fund awards grants to black-owned businesses throughout the U.S. that have been affected by the COVID-19 pandemic and today’s climate, according to the organization’s website. Up to 15 applicants can receive grants each month.

To find resources that may be available near you, check your governor’s website for up-to-date information. GrantWatch is another useful tool in uncovering grant opportunities for small businesses and nonprofits.

An Alternative Route to Funding

While business grants offer a wide array of funding possibilities for your company, there are a few drawbacks that can arise when applying for them.

First, the right grant for your business might not be available when you need it. A government grant for small businesses is offered in line with specific government initiatives. If your company’s mission doesn’t align with the government’s current focus, you might not be able to find the funding you need. Similarly, private grants are typically offered only at specific points of the year — often annually.

Second, you might not be eligible for a particular grant based on what amounts to a mere technicality. For example, some state-issued grants are offered to out-of-state companies, as long as a certain percentage of their operations are done in-state. If your numbers fail to meet these criteria by the smallest amount, your company will be ineligible.

Finally, because grants are awarded only to one or a handful of organizations, there’s always the possibility that a company could come along and edge your organization out of the running.

If you haven’t obtained a corporate or government grant for your small business, there are other options for securing capital for your business. You could consider applying for an SBA loan, microloan or other small business financing options.

Explore Business Financing Offers