Some business loans and financing products are more difficult to get than others. Equipment loans and merchant cash advances, for instance, are often approved. On the other hand, business term loans and Small Business Administration (SBA) financing can prove more difficult to acquire. Let’s dig deeper into answering the question, “How hard is it to get a business loan?”

Is It Hard to Get a Business Loan?

While it can be harder to get certain business loans compared to others, many borrowers do indeed qualify.

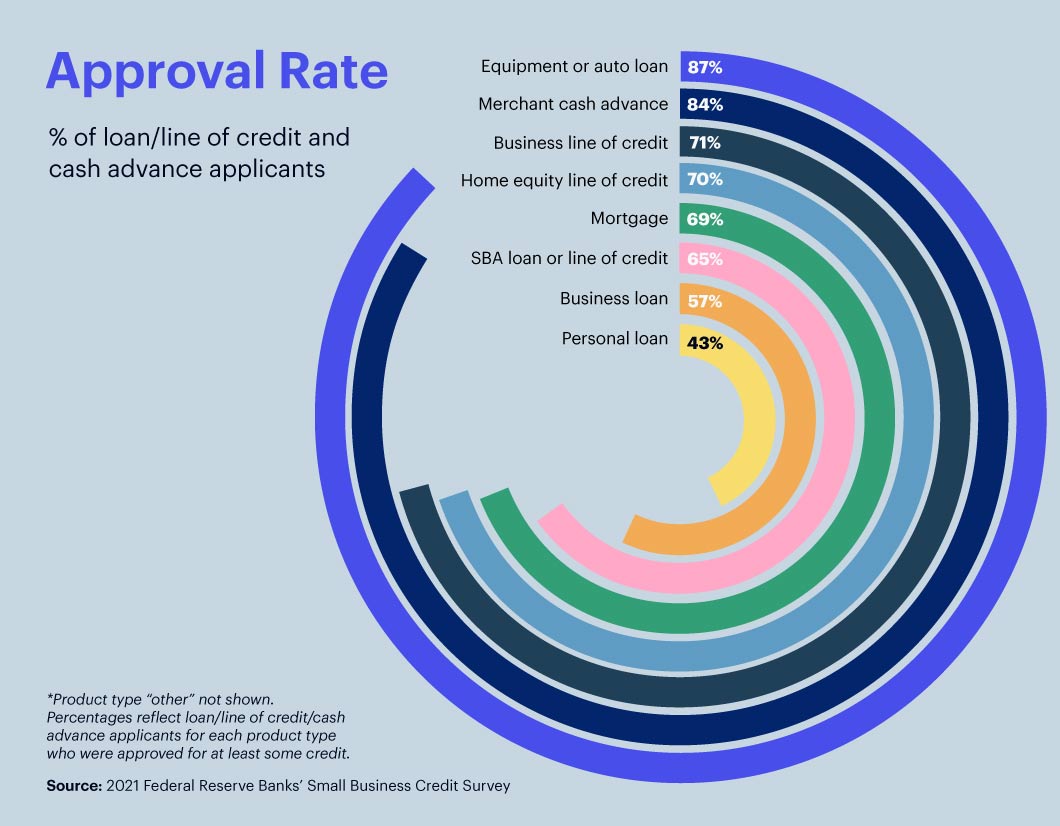

Here’s a breakdown of loan approvals by percentage rate, according to the Federal Reserve Banks’ recent Small Business Credit Survey:

- Equipment or auto loan: 87%

- Merchant cash advance: 84%

- Business line of credit: 71%

- SBA loan or line of credit: 65%

- Business loan 57%

Merchant cash advances, equipment and auto loans and business lines of credit have the top approval rates for at least some financing. Additionally, of loan, line of credit and merchant cash advance applicants most recently surveyed, 44% were fully approved, 26% were partially approved and 30% were denied.

Reasons Business Owners Find It Hard to Get a Business Loan

While financing providers have started easing their lending restrictions, some small business owners are still finding it hard to get a business loan. About 37% of employer firms that applied for credit received all of the financing they requested, down from 51% in 2019.

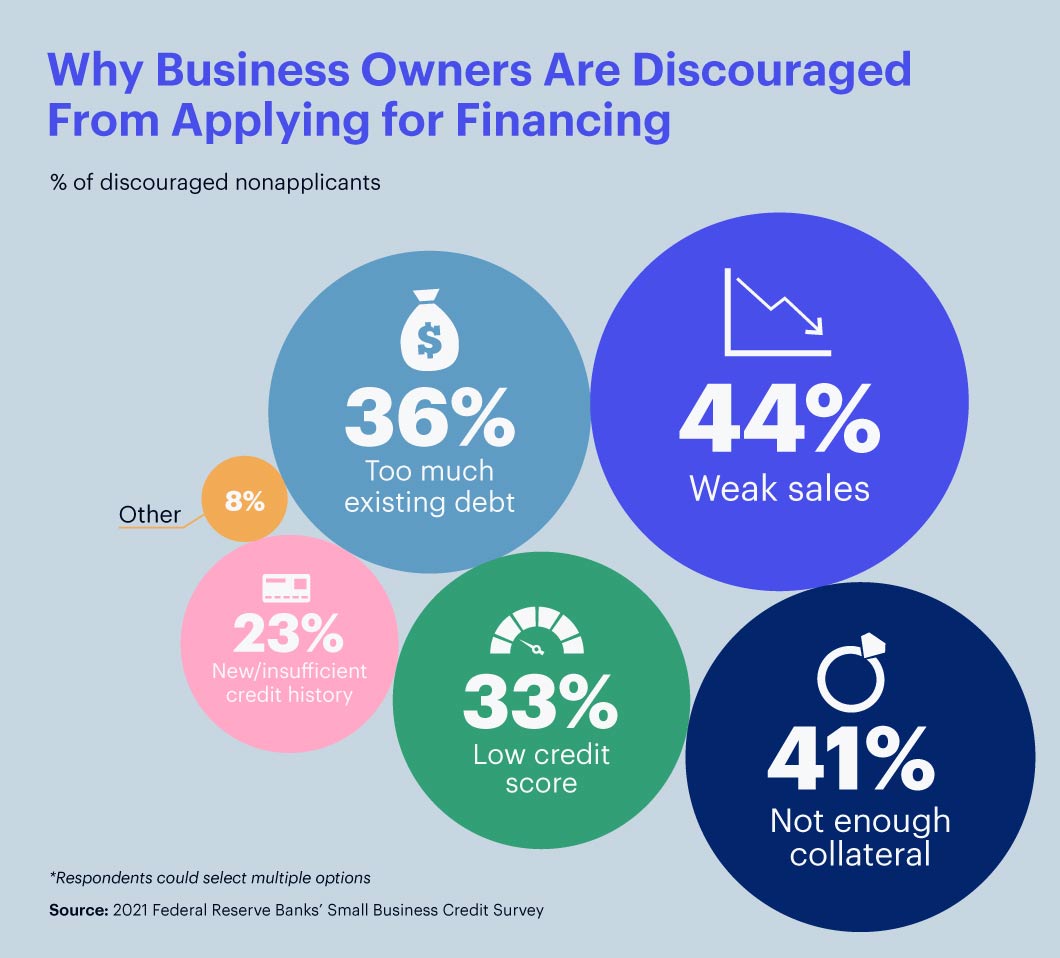

Reasons that kept business owners from applying for financing included the following:

- Weak sales (44%)

- Not enough collateral (41%)

- Too much existing debt (36%)

- Low credit score (33%)

- Too new or insufficient credit history (23%)

- Other (8%)

Factors that Can Make It Hard to Get a Business Loan

Certain factors can impact the difficulty (or ease) of getting a small business loan. Here are a few to consider.

Business Revenue and Cash Flow

Your business finances — specifically, your revenue and cash flow — can make it more difficult to obtain funding. Your company’s revenue and cash flow tell lenders if you have the ability to repay a loan and provide insight into how much funding you actually can afford. If these are lacking, it could make it more challenging to be approved for financing.

Time in Business

Along the same lines, demonstrating a solid track record in business is important. Little time in operation can make it hard to qualify for a business loan. For example, if your company’s a startup, you could find it challenging to secure funding.

Time in business requirements will vary by lender and funding type. For instance, a merchant cash advance from an online lender may require 4-6 months in business, while a business term loan from a conventional bank may require 2 years in operation.

Lender Requirements and Timelines

Another factor that can impact how hard it is to get a business loan is a lender’s underwriting criteria. Different lenders have different minimum borrower qualification requirements. What’s more, approval timelines vary by lender.

For example, conventional banks can have more stringent lending requirements than other lenders, including collateral requirements for some loans and high credit score minimums. They also require businesses to submit various financial documents, such as profit-and-loss statements, bank statements, tax returns and more. What’s more, approval and funding could take months.

In contrast, alternative, nonbank lenders are known for their hassle-free processes, with streamlined online applications, often requiring just a few months of bank statements. They’re also known for their speed of funding, with many offering same-day financing.

Credit Score

Your business and personal credit score also can affect your chances of getting a small business loan. The better your score, the higher the chances of getting the loan you want as well as qualifying for competitive interest rates and terms.

Banks, which offer some of the most competitive interest rates and repayment terms, typically prefer to lend to borrowers with credit scores in the 700s, though some may consider a borrower with a score starting in the 620-640 range.

In contrast, alternative lenders are known to offer financing to borrowers with bad credit, though higher repayment fees aren’t uncommon. Not surprisingly, firms with lower credit scores turned to online lenders and nonbank finance companies more often than firms with high credit scores, according to the Federal Reserve Banks’ Small Business Credit Survey.

Credit History

Insufficient credit history can make it hard to get a business loan because lenders are unable to view a pattern of responsible borrowing. Not having clear insight into this poses a risk to financing providers. This is why startups often find it challenging to obtain financing.

Insufficient credit history was the reason why 23% of business owners didn’t think they’d be approved for financing, according to Federal Reserve data.

What Are the Least Difficult Business Financing Types to Get (and Why)?

The type of financing you’re seeking also plays a part in how hard it is to get a business loan approval. Some of the least difficult business loans and financing to apply, qualify and get funded for include the following:

Equipment Financing

With equipment financing, the equipment you intend to purchase serves as collateral for your loan so lenders incur minimal risk in comparison with other business loan types. That’s because if you default on your loan, the lender can seize the equipment, sell it and recoup the loss.

Not surprisingly, equipment and auto loans were the No. 1 most-approved loan, according to Federal Reserve data. In some cases, you could qualify with 2 years in business, a minimum credit score of 600-625 and $100,000-$250,000 in annual revenue, depending on the lender.

Merchant Cash Advances

Merchant cash advances are generally easier to qualify for when compared to conventional business loans. One reason is because merchant cash advances don’t require specific collateral that needs to be evaluated for approval, such as is often needed with a bank loan.

Additionally, even applicants with low credit scores (i.e., 500s) often qualify. This financing type is also among the fastest. Specifically, if approved, you could be funded within a day.

Accounts Receivable Financing

If you operate in the business-to-business space and carry a high receivables balance, this type of short-term financing option could be a quick way to access capital. In some cases, you could get an advance up to 90% of the unpaid balance of your invoices.

This alternative to a conventional business loan is rather easy to get because accounts receivable financing providers place high consideration on how likely your customers are to pay their outstanding balance. That said, they typically prefer newer, smaller invoices, particularly those from larger companies.

Short-Term Loans

Many borrowers find it easier to qualify for short- rather than long-term business financing. In addition to abbreviated repayment periods, short-term loans typically have more frequent payment installments, often daily or weekly. This ensures the lender is repaid fairly quickly.

Also, requirements to qualify, including time in business and credit score, are usually less stringent than you’d find with long-term loans. In addition, unsecured short-term loans don’t require borrowers to pledge specific collateral.

Business Lines of Credit

A business line of credit is another financing option that’s not so hard to get. At Fast Capital 360, for example, you could qualify for a business line of credit if you’ve been in business a year or longer, generate at least $200,000 in annual revenue and have a credit score of 560 or better.

Also, with a revolving credit line, once approved, you could access funds whenever you need them, up to your limit. As you pay down your balance, your credit line remains open and is restored up to your limit throughout the term of your financing offer. This provides maximum flexibility and could reduce the need to take out multiple business loans.

Want to see how easy it could be to qualify?

What Are the Hardest Business Loans to Get?

Some of the most challenging business loans to get, and the ones that typically have the most competitive rates, include the following:

SBA Loans

SBA loans tend not to get approved as fast as other financing types, sometimes taking a few months. (The exception is an SBA Express loan, which could be funded as quickly as 7 days post-approval.)

Additionally, according to Federal Reserve data, while SBA loans were the second-most commonly applied for financing type (after business loans), they were among the bottom 3 loan types actually approved.

To qualify, business owners often need a credit score of 650 or higher, at least $50,000 in revenue and 2 years in business. You’ll also need to offer collateral (for loans more than $25,000).

Additionally, a personal guarantee is needed from every owner with at least 20% ownership stake in the company. You also can’t have any open tax liens, recent bankruptcies or foreclosures on your record.

Conventional Business Loans

Business loans with conventional lenders can be among the most difficult to qualify for. Although large and small banks had approval rates of 58% and 67%, respectively, business loans had the second-lowest approval rates of all financing types, after personal loans. This is in spite of them being the most frequently applied for form of business financing.

It can be hard to get a business loan at a bank unless you have a credit score of at least 700, have consistently high revenues and at least 2 years in business. Specific collateral is also required for secured business loans.

So, Are Business Loans Easy to Get?

Instead of wondering how hard it is to get a small business loan, consider how easy it might be. With so many financing options available to small business owners, getting a business loan doesn’t have to be difficult. Use the information outlined here to understand what lenders take into account when loaning funds and what you need to qualify.

How to Increase Your Chances of Getting a Business Loan

Increasing your chances of getting approved for a small business loan requires you to meet certain standards.

As mentioned, every lender you apply with will look at your time in business, annual revenue and credit score. Lenders will use this information to analyze the health of your business.

While you won’t be able to change things such as your credit score and annual revenue overnight, you can impact a lender’s decision in other ways.

Get Organized

Show lenders your business is in a position to succeed by presenting a well-formulated business plan, a list of references, an active target market and an engaging product. Too often, business owners approach lenders unprepared and unable to explain their reason for applying.

Give Realistic Projections

When presenting your business plan to potential lenders, it’s important to provide well-calculated, realistic cash-flow estimates. Blowing your projections out of proportion won’t make you a more qualified applicant and can make it harder to get a business loan approval.

Make Yourself More Attractive to Lenders

If you don’t have an immediate need for funding, there are other ways to improve your likelihood of approval and make lenders want to say yes to you. Paying off debts, rebuilding your credit and, in some cases, offering collateral, are all ways to reduce the risk for lenders and make it less hard to get a small business loan.

Compare Lenders and Offers

Not all financing providers have the same requirements for approval. Some may offer more lenient underwriting guidelines in exchange for shorter terms, higher rates and more frequent payment installments.

Keep in mind, though, you should compare more than just the annual percentage rates between long- and short-term loans, which may not give an accurate picture of the true cost of financing. Determine the return on investment you could anticipate from the financing offer, too.

When you’re asking yourself, “Is a small business loan hard to get?” consider what different lenders are looking for to determine the best ways you can improve your chances for approval.