Few industries are as reliant on updated equipment as the medical field. State-of-the-art equipment provides patient comfort and accurate diagnostic readings. It also attracts new clients while keeping established patients satisfied.

That said, many small business owners in the medical field may not have the working capital to buy new tools and machines. A medical equipment loan offers a solution to this problem.

Let’s go over how medical equipment financing works, how much it can cost and how to apply.

Related: Where to Find Working Capital Loans Options for Small Business Needs

What Is a Medical Equipment Loan?

Medical equipment loans provide financing for medical professionals, such as doctors, surgeons, dentists and specialists, when they can’t buy equipment for their practice outright.

Several types of financing — from term loans to equipment financing and government-backed loans — can help you purchase medical equipment for your business.

How Does Medical Equipment Financing Work?

With medical device financing, a medical equipment finance company or lender gives you money to acquire equipment. You then pay back the loan plus interest with regular installments.

It’s important to note that equipment financing is secured, meaning when you buy medical equipment, the product serves as loan collateral. Depending on the type and condition of the equipment, you could receive up to 100% of the value in funding. So it’s possible to get a medical equipment loan with little or no down payment.

Do You Need a Medical Equipment Loan for Your Small Business?

What Type of Medical Equipment Can I Finance?

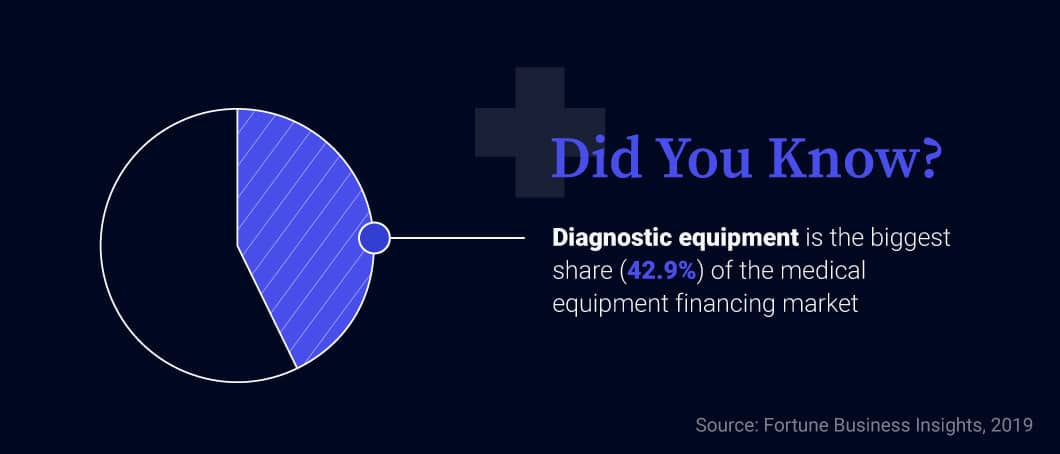

You may wonder if the type of tools or machinery you need can be purchased with medical equipment financing. Good news: Most common medical devices are eligible.

A medical equipment loan can be used to acquire:

- X-ray and other imaging equipment

- Diagnostic equipment

- Dental instruments

- Hospital beds and examination tables

- Optometry equipment

- Dermatology equipment

- Chiropractic equipment

- Surgical equipment

Can I Get a Loan to Buy Used Medical Equipment?

Many lenders provide loans for medical professionals looking to buy used medical equipment. (After all, medical machines and devices are expensive.)

Qualifying for funds to buy used medical equipment can be trickier than with other forms of financing. That’s because the equipment’s type, age and condition will dictate the down payment, interest rate and repayment terms.

Let’s say you want to purchase a piece of imaging equipment that’s 7 years old and will become outdated once it hits 10 years of age. Your down payment may be higher than a brand-new piece of equipment, which would take the full 10 years to become outdated. Similarly, your repayment term may be shorter than if the machine were 3 years old vs. 7 years old, for example.

Why is that the case? The medical equipment finance company needs to ensure it can make money off the collateral if you ever default on your loan.

Keep in mind, the useful life of medical equipment is 7-10 years, so lenders must consider when machines and devices will lose their value. After all, if the equipment becomes outdated, the lender can’t make any money if the equipment needs to be repossessed and sold.

Can I Get a Medical Equipment Leasing Loan?

A couple of options available if you’re interested in medical equipment leasing.

Your first option is to lease the equipment outright. Doing so involves essentially renting it for a specified period. At this time, the healthcare equipment leasing company (usually the manufacturer or a bank they partner with) retains ownership and sells the used equipment to another business.

This is a good option for medical professionals who regularly update their equipment, but it might not work for those with smaller budgets.

The other option for medical equipment leasing is lease-to-own agreements. These pacts are like regular leases but give you the chance to buy the equipment before the lease is over.

Leasing to own can work if you’re unsure whether you want to commit long-term. This type of medical equipment finance option could also be beneficial if you need to lower payments until you begin to make more money.

Types of Medical Equipment Loans

There are a few different types of medical equipment loans for doctors and other healthcare professionals. Available options will be determined by your personal and business credit score, the equipment you’re buying and other factors.

Equipment Financing

Equipment financing is the default choice for many medical companies and practices needing healthcare tools and devices. However, some medical equipment finance companies specialize in these loans exclusively.

Equipment financing rates will vary by lender. Repayment terms from medical equipment financing companies or other lenders can fall between 1-5 years. Longer terms give you lower monthly payments but can raise the default risk for lenders.

Your terms will be based on your credit history and the useful life of the equipment you’re buying.

Term Loans

Alternatives to loans from medical equipment finance companies are conventional term loans.

Banks often provide loans with longer terms for fixed assets that hold their value (e.g., real estate). Such agreements can extend to 25 years. However, medical equipment financing through term loans is considerably shorter. Many equipment term loans reach maturity in 10 years or fewer.

If you can secure a longer-term loan, your medical equipment loan interest rates might be lower than other options.

Short-Term Loans

A short-term loan may be an option for businesses that want to buy used medical equipment or low-value items, like small dental instruments.

Repayment terms for these loans are generally less than 2 years. Depending on the type of financing you pursue, terms could be as short as 3 months.

Short-term loans are also an option for businesses with credit scores that disqualify them for long-term financing.

SBA Loans

Guaranteed in part by the Small Business Administration (SBA), certain SBA loans can be used as medical equipment financing solutions.

The maximum maturity for SBA loans used to finance equipment is 10 years. Additionally, interest rates are subject to SBA maximums, making this financing one of the most affordable options for small business owners. The application and underwriting process is lengthy, however, sometimes taking several months.

If you need to buy your medical equipment immediately, you might have to look into alternative small business funding options.

Business Line of Credit

When you secure a business line of credit, you’re given a funding limit based on your creditworthiness. Once you withdraw money, you pay regular installments until paid in full. Typically, as you pay down what you borrowed against your credit line, you can withdraw funding again as needed.

If you frequently upgrade equipment, this is a great alternative to a medical equipment loan.

Merchant Cash Advance

Another medical equipment financing option is a merchant cash advance (MCA).

An MCA works a bit differently than a loan for medical equipment. Instead of paying the cash back with monthly installments plus interest, MCAs use factor rates to determine the total cost of funding, which remains the same even if you pay off your financing early.

Payments, often daily or weekly, are taken from a percentage of your credit card transactions. Alternatively, ACH payments are withdrawn directly from your business bank account.

MCAs are an alternative to loans for medical professionals with bad credit or those who need money fast. Many alternative lenders, including Fast Capital 360’s partners, can issue a funding decision within hours and deposit capital into your business bank account within 24 hours of approval.

-

Credit Score Requirements for Medical Equipment Finance

At Fast Capital 360, a borrower needs the following minimum credit scores to be considered for each type of medical equipment finance option listed.

Financing Type Minimum Credit Score Equipment Financing 620 Term Loan 600 Short-Term Loan 540 SBA Loan 650 Business Line of Credit 560 Merchant Cash Advance 500

Medical Equipment Loan Interest Rates

Your medical equipment loan’s interest rate will vary based on many factors.

Loan Type

The first factor determining your interest rate is the type of loan you apply for. Remember, a business owner might not qualify for certain loans because of the following:

- Low credit score

- Low revenue

- Insufficient time in operation

Creditworthiness

Low credit scores not only disqualify small business owners from certain lenders and financing types, but they will raise your interest rate as well.

While you can still get medical equipment loans with bad credit, your interest rate might exceed 10% or more than 20%.

How Much Can My Business Qualify For?

Time in Business

How long your business has been in operation also affects your interest rate. The younger your company is, the riskier it is to lenders.

Seeking funding as a startup could mean steep interest rates or disqualification from specific programs altogether. Most healthcare equipment financing companies require your business to be at least 2 years old.

If you haven’t met that requirement yet, consider alternative funding options, such as MCAs, which require companies to be in business for just 4 months.

Revenue

Your annual revenue impacts financing eligibility.

To qualify for equipment financing through Fast Capital 360’s lender network, an applicant must generate a minimum of $160,000 in annual revenue.

However, the revenue thresholds set for other financing programs are far lower. For instance, to qualify for an MCA, a business must generate $100,000 in annual revenue.

-

Medical Equipment Financing Costs

Want to estimate what hospital or other medical equipment financing will cost you? Check out our equipment financing calculator to learn more and estimate your cost of borrowing.

Here are business financing interest rates offered through Fast Capital 360’s lending partners:

Financing Type Interest Rates Starting at … Equipment Financing 8% Term Loan 7% Short-Term Loan 10% SBA Loan 7% Business Line of Credit 8% Merchant Cash Advance 1.10 (factor rate)

Applying for Medical Equipment Financing

The process of applying for medical equipment financing is similar to the application process for most small business funding options.

1. Compile Necessary Information

Before you complete your application, make sure you have the following financial documents and other relevant information on hand:

- 4-6 months of the most recent bank statements

- Tax returns

- Balance sheets

- Profit-and-loss statements

- Personal information and details of partners or co-owners of the business

- Personal and business credit scores

- Doing-business-as (DBA) name, if applicable

- Articles of organization or incorporation

- Investment information, if applicable

Small Business Tip: Some medical equipment finance companies may ask to see more financial information to assess your application. Always have up-to-date financial reports on hand to ensure your application can be quickly processed.

2. Complete the Application

You’ll use your personal and business information to fill out your application. You’ll also need to attach copies of any relevant documents (e.g., bank statements).

If you’re applying for a medical equipment finance loan with a conventional lender, such as a bank or credit union, check with a representative about how they’ll receive your paperwork. You might be asked to share documents online or submit them in person.

If you work with an alternative lending provider, such as Fast Capital 360, the entire application and data upload process takes place entirely online and takes only minutes.

3. Vetting and Approval Process

Once your financial data is verified, the medical equipment finance company or lender will decide whether to approve your application.

Depending on the type of financing and lender you choose, the time it takes to secure funding can vary. Conventional lenders can take several weeks to more than a month to review your application before granting approval. This process can include virtual or in-person meetings and potentially an on-site visit to your business.

In contrast, alternative lenders’ streamlined applications help them process funding requests much more quickly, and you could receive an approval within days. Some financing options can even be funded the same day you’re approved.