An Automated Clearing House (ACH) loan can help your small business quickly obtain funding without meeting the strict credit and financial requirements of conventional bank loans.

ACH business loans are repaid to lenders through automatic withdrawals from your business’s bank account.

ACH loans — sometimes referred to as ACH advances, ACH cash loans, ACH lines of credit or ACH cash-flow loans — are accessible to small business owners with bad credit because automated payments reduce the risk for lenders. Another benefit is that applying for an ACH loan requires minimal documentation.

While ACH loans offer faster and more attainable small business funding than conventional bank financing, the main drawback is typically higher fees.

-

What Is the Automated Clearing House?

The Automated Clearing House Network is a digital system that makes it possible to transfer money electronically from one bank account to another. Each year, the ACH network transfers trillions of dollars and handles billions of transactions between more than 10,000 financial institutions. The Automated Clearing House is run by Nacha, formerly known as the National Automated Clearing House Association.

What Is an ACH Loan?

ACH loans refer to types of business financing that are repaid in a certain way — specifically, through automatic withdrawals.

An ACH debit transfer takes place when a borrower allows a third-party lender, merchant or vendor direct access to a business checking account. (Most electronic payments in the U.S. are made through an ACH finance network, including online bill payments, payroll deposits, government transactions, business-to-business payments and consumer transactions.)

To be clear, ACH loans aren’t actually loans by definition. Rather, they’re advances. When you apply for an ACH business loan, lenders will review the average daily balance of your business checking account.

When you enter into an ACH agreement, you’re pledging a portion of your future revenue in exchange for a lump sum of cash. After a business is funded, a borrower remits payment to the lender through ACH withdrawals from their business bank account at set intervals — monthly, weekly or even daily.

Keep in mind, ACH financing is best for short-term financing, and loan amounts are typically smaller than other funding options.

-

ACH vs. MCA

ACH loans are a variation of merchant cash advances (MCAs).

With a conventional MCA, a lender will deduct a percentage of your credit or debit card sales on a set interval (usually daily or weekly). This means your payment shifts based on the pace of your business income, helping you avoid cash-flow disruptions during sales slumps.

ACH loans are based on the total projected revenue of your business rather than just credit- and debit-card transactions. This is why lenders review the health of your business checking account. As a result, your ACH loan payment is fixed over a set term — regardless of your sales volume.

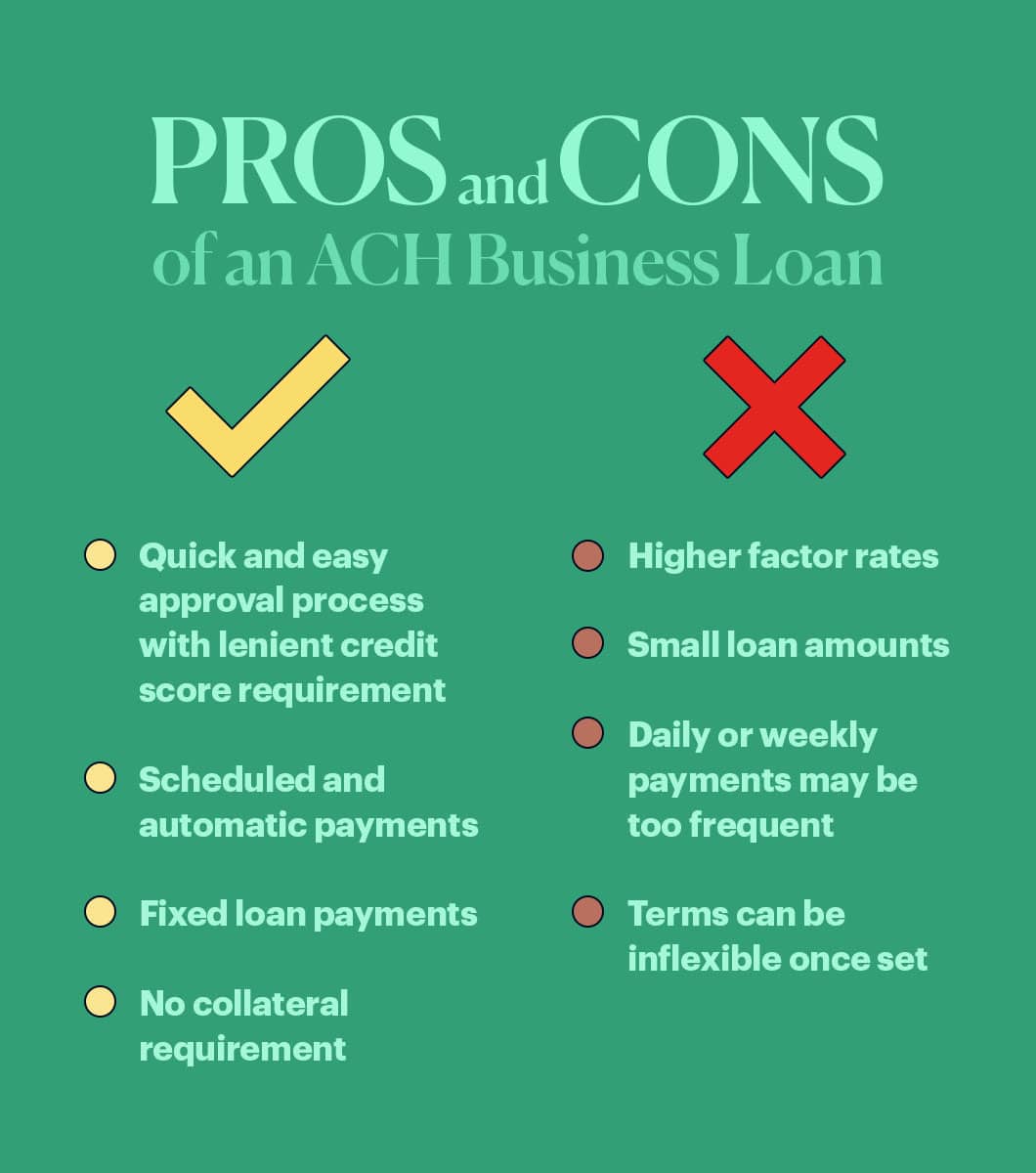

Pros of an ACH Business Loan

ACH business loans for capital benefit both the borrower and the lender and allow for a smoother transaction each and every time a payment is made.

Borrower advantages of an ACH business loan:

- Quick and easy approval process

- Scheduled automatic payments

- Fixed loan payments

- Lenient credit score requirements

- No collateral requirement

Lender benefits of an ACH business loan:

- Business bank account verification

- Quick and easy electronic loan payments

- Lower fees than check and credit-card processing services

- Electronic records of all payments made

- Reduction in the cost of money transfers

Cons of an ACH Business Loan

While there are many positives to ACH loans, there are some disadvantages, including the following:

- Higher factor rates

- Small loan amounts

- Daily or weekly payments may be too frequent

- Terms can be inflexible once set

Tips for ACH Loan Payments

Whether you’re in your first few years of business or a seasoned entrepreneur, an ACH business loan can help you get capital to sustain operations and grow.

What are ACH payment points to keep in mind when you’re considering offers?

- Your ACH loan payment amount will be automatically withdrawn on certain daily, weekly or monthly intervals, depending on the terms and conditions of the loan.

- Maintain a decent cash flow so that you can handle the ACH loan payments. For example, if your income is dependent upon subscriptions that usually renew at the end of the month, you might not want a daily or even weekly ACH loan payment being debited from your account.

- Review all payment terms, such as penalties if you don’t have enough funds in your account to cover your ACH finance repayment.

Whatever route you choose to take in terms of an ACH business loan, make sure you borrow responsibly.

How to Apply for an ACH Business Loan

Applying for an ACH business loan requires several pieces of information including:

- Driver’s license

- Signed application

- Voided check

- Business license

- Bank statements for the last 3-6 months

With ACH loans, credit doesn’t weigh heavily into a lender’s decision. Instead, cash flow has more bearing than a borrower’s credit score and history. Indeed, lenders consider a company’s viability and future cash projections. They also will review deposits and cash-flow statements to assess the average daily balance of the business checking account.

If a lender is confident your business has enough cash on hand to sustain operations while meeting repayment obligations, your application will likely be approved (and fairly quickly). The whole process, from application to funding, could happen as fast as the same day in some instances.

If you’re searching for business financing but have “bad credit,” an ACH loan isn’t your only option. Consider these funding options as well:

- Short-term loans

- Short-term lines of credit

- Invoice financing

- Business credit cards