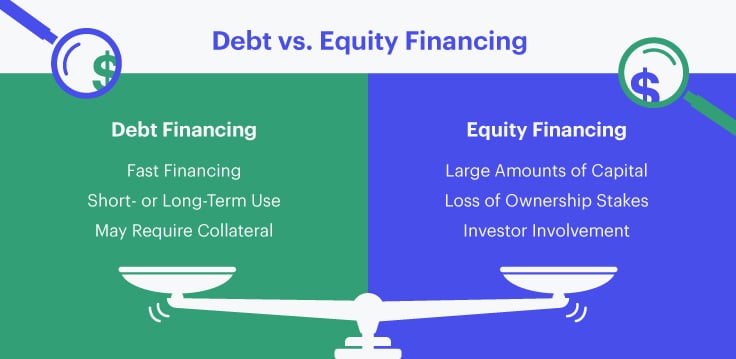

There are 2 types of outside financing small business owners can consider when they need capital.

Debt financing involves borrowing a sum from a lender that has to be paid back with interest. Equity financing involves selling stakes of your company to an investor in exchange for capital.

Deciding between debt or equity financing will depend on your business needs. And, in many cases, businesses use both.

What Is Debt Financing?

If you’ve ever taken out a loan, you’ve used debt financing. This is when you borrow a set amount of money and pay it back with interest over a set period of time. Debt financing encompasses a broad category of loan types, including the following.

Bank Loans

Business bank loans are a type of debt financing that often require collateral. While approved borrowers can find competitive interest rates and repayment terms, including long-term loans, the process to apply and get funding can be tedious and time-consuming. Additionally, a high credit score is often needed to qualify.

Small Business Administration Loans

There are many types of Small Business Administration (SBA) loans, and they can be used for many purposes in most cases. For the popular 7(a) loans, for instance, borrowers can use funds for working capital or debt refinancing. Funds also can be used for inventory, real estate, equipment or franchise purchases.

Although specific collateral is often required, these loans afford approved borrowers competitive rates and terms and are less risky for lenders because they’re guaranteed by the federal agency.

Business Lines of Credit

Business lines of credit are arguably the most flexible form of financing. Once you’re approved for a credit line, it’s there when you need it. Many business lines of credit are unsecured, meaning no specific collateral is required. That said, unsecured credit lines typically have higher interest rates and lower approval amounts.

Business Credit Cards

Business credit cards are another option and similar to personal credit cards. These are commonly offered by banks and credit unions and may be secured or unsecured. They may come with rewards, such as cash back or travel credits. Additionally, these cards may offer perks such as extended warranties or special offers (e.g., 0% limited-time annual percentage rates).

Short-Term Loans

A short-term loan is another example of debt financing and it’s a common offering among alternative nonbank lenders. Many business owners qualify for this type of financing, which is meant to cover temporary expenses. As such, short-term loans often have more frequent payment installments.

Higher interest rates when compared with long-term loans are common. That said, a cost comparison with a long-term loan may show shorter term financing with a higher interest rate could actually save you money because of the condensed term.

Need financing fast?

Debt Financing Examples

Example 1: When Company XYZ needs funding to expand, it decides to apply for a secured business loan, which means it will need to offer specific collateral. It’s approved for $25,000 with a 5-year repayment period. The interest rate is 7%. Company XYZ will pay about $500 a month until the loan term expires, at which point it would have paid back its debt plus interest.

Example 2: Company XYZ decides to apply for an unsecured revolving business line of credit. In this debt financing example, a lender offers Company XYZ a $50,000 line of credit at an 8% interest rate.

The company doesn’t have to use this available limit right away. Instead, it could draw against the line as needed and pay down the debt once it’s borrowed funds. As the funds are paid down, the credit is restored incrementally, up to the original credit line.

-

U.S. Business Debt Statistics

According to Statista, outstanding debt held by small and medium U.S. companies in 2020 was as follows:

- Less than $25,000: 11%

- $25,000-$50,000: 10%

- $50,000-$100,000: 14%

- $100,000-$250,000: 20%

- $250,000-$1 million: 16%

- More than $1 million: 8%

- No outstanding debt: 21%

Pros and Cons of Debt Financing

Debt financing doesn’t require owners to give up any shares or control, but the loan application process can prove challenging. The necessary requirements and documentation will vary by lender.

Advantages of Debt Financing

Benefits include:

- Available to businesses of any size

- Fast turnaround

- Flexible use of funds

- Wide range of funding amounts

- Set repayment terms

- Liability limited to loan term

- Tax-deductible interest payments

- Could build business credit

- Retain ownership

- Lender can’t request shares of future profits

- Lender doesn’t have control of business management

- No investor reports or shareholder meetings required

Disadvantages of Debt Financing

Drawbacks include:

- Some borrowers may not meet credit score requirements

- Financial standing may impact borrowing limit, rates and fees

- Collateral may be required

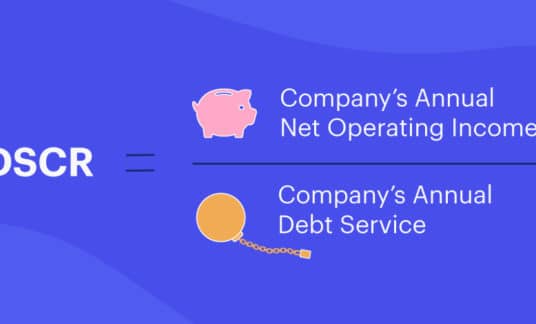

- Debt service payments cut into business revenue

- Repayment, including principal and interest, is required regardless of business success

- Failure to repay the loan could lead to business or asset liquidation

- Taking on too much debt could hurt business valuation and hamper future financing

What Is Equity Financing?

Equity financing involves reaching out to external investors for money so you can sell company shares in exchange for capital. The investors can offer shared partnerships, expertise and financial stability.

Equity financing is much less common than debt financing. Specifically, according to the Federal Reserve Banks’ State of Small Business Credit Survey, 6% of firms surveyed sought equity financing.

That said, here are a few examples of equity financing you might consider.

Angel Investors

Angel investors are one example of equity financing. These investors look to get in on the ground floor of a business. They place weight on the founder’s passion and commitment and consider the company’s business plan, product offering and market opportunity.

Angel investors often work with startups during the early stages. They’re private investors with a high net worth who use their own money to invest in a company. Often, they’re family members or friends of the entrepreneur.

Venture Capitalists

Venture capital firms target startups and are often able to invest more funds than angel investors. Venture capitalists typically pool capital from other sources, such as pension funds or corporations, to invest in a business (though funds may come from a single venture capitalist as well). Early-stage small business owners often seek venture capitalists when they’re looking to scale.

Equity Crowdfunding

With this type of financing, an entrepreneur sells company shares in exchange for capital to multiple investors via an online equity crowdfunding platform. In the U.S., private companies can raise up to $5 million in a year’s time through this method.

Examples of equity crowdfunding platforms include EquityNet, SeedInvest and WeFunder (not to be confused with rewards-based crowdfunding platforms, such as Kickstarter, GoFundMe and Indiegogo).

Initial Public Offering

A more established private business might consider offering shares of its company for sale on the stock market, known as “going public.” In this way, a company can raise funds from investors who buy the stock, and the individuals who buy shares are able to own a portion of the company. Because this is a lengthy and costly process, this type of equity financing is often sought only after other forms of equity financing have been raised.

Equity Financing Examples

Example 1: Entrepreneur Smith finds an investor willing to offer $100,000 for a 10% equity stake in his startup, Company XYZ. This means the investor will own 1/10 of Company XYZ and the small business owner will own the remaining 90%, provided no other investors are involved. This also means the company is valued at $1 million ($100,000 X 10).

Example 2: Entrepreneur Smith has invested $500,000 of his own money in his business, Company XYZ, so he owns 100% to date. However, the time comes when Entrepreneur Smith is looking to grow.

Entrepreneur Smith finds an investor willing to offer him $100,000. The company now has total capital of $600,000, made up of his $500,000 initial personal investment and his investor’s capital totaling $100,000.

As a result, Entrepreneur Smith now owns 83.33% of the business [$500,000/($500,000+$100,000)]. The investor owns the remaining 16.67%.

Pros and Cons of Equity Financing

The big trade-off with equity financing is giving up an ownership stake in your business in exchange for capital. Repayment comes in the form of refinancing, a business sale or other means.

Advantages of Equity Financing

Benefits include:

- Larger amounts of capital

- Risk passed on to investors

- Collateral isn’t required

- Revenues aren’t diverted to repayment

- Interest isn’t required on capital

- Immediate returns on investments aren’t expected

- Involved investors can serve as business mentors

- Repayment isn’t required if the business fails

Disadvantages of Equity Financing

Drawbacks include:

- Giving up a portion of company ownership

- Reduced autonomy

- Investors can influence business decisions and culture

- Pitching investors can be time-consuming

- Slow approval process

- Potential investors require a thorough business plan

- Longer turnaround time to receive funding

- Smaller share of ownership can reduce your share of profits

- Investors can force original owners to cash out

Debt Financing vs. Equity Financing: Which Is Right for Your Business?

The difference between debt financing and equity financing comes down to taking on debt or sharing stakes in your business. But there are other factors to consider when weighing debt financing vs. equity financing.

Here are 5 questions to ask:

1. How Fast Do You Need Funding?

Thanks to online lenders, you can receive an influx of cash through debt financing in as little as a day. Equity financing is a more involved process that requires pitching and negotiating with investors.

2. How Much Money Do You Need?

With equity financing, investors will give you large amounts of capital in exchange for a business stake. With debt financing, maximum funding amounts will vary but you can receive a small influx of cash — without giving up equity — to meet your business needs.

3. Do You Have a Short- or Long-Term Need for Capital?

Depending on the type of funding, debt financing can be repaid within months. Equity financing, however, is more about the long game and investors don’t usually expect to see returns for years at a time.

4. Do You Need Other Forms of Business Support?

Debt financing is a transactional relationship between your business and your lender. With equity financing, there is the potential to form close relationships with investors, who can offer advice or help with networking.

5. What Are Your Growth Plans?

If you’re OK giving up control of your business and see your company becoming a major nationwide player, equity financing may be best for you. If you want to keep your business for yourself and find success in a niche market, debt financing may be the better fit.

Is Debt or Equity Financing Right for You?

Ultimately, the advantages and disadvantages of debt and equity financing will impact your business differently based on your needs.

Once you know where you stand, you can choose the path that’s best suited for your business — and secure financing for long-term success.