For small business owners wondering, “How much is a business loan?” the answer is the true cost of a loan depends on various factors, including the type of financing, the use of funds, the interest rate and other associated costs.

While there’s not a one-size-fits-all answer, it’s crucial to know the loan fees involved and the total cost over the life of the financing.

Here’s what you need to know about average loan costs, what factors determine interest rates and more.

Understanding Small Business Loan Costs

To start, annual percentage rate (APR), interest rate and fees are factors to consider when you’re determining the true cost of a loan. Here’s an overview of each.

Annual Percentage Rate

When evaluating the cost of financing, one place to start is to look at the annual percentage rate.

The APR represents the annual cost of financing, including interest and other typical loan fees, such as business loan processing fees and origination fees.

The APR, therefore, provides a more complete picture of the total cost of financing.

Here’s something to keep in mind, though: While annualizing the loan is a great way to assess and compare the rate on long-term loans, it isn’t the best way to evaluate short-term financing. Simply put, determining the APR of a 6-month loan isn’t an effective metric.

Interest Rate

Interest rates can vary widely depending on the lender, type of financing, borrower’s credit history and, in cases of secured loans, a down payment or collateral.

Conventional lenders, such as banks and credit unions, can offer qualified applicants competitive rates, but the requirements to be approved can be challenging for many entrepreneurs, often including the need for collateral and a high credit score.

SBA loans have interest rate caps and competitive rates, but additional loan fees can add up and collateral is typically required as well.

With less stringent requirements than conventional bank loans, alternative business loans are typically higher risk and, as a result, carry higher interest rates.

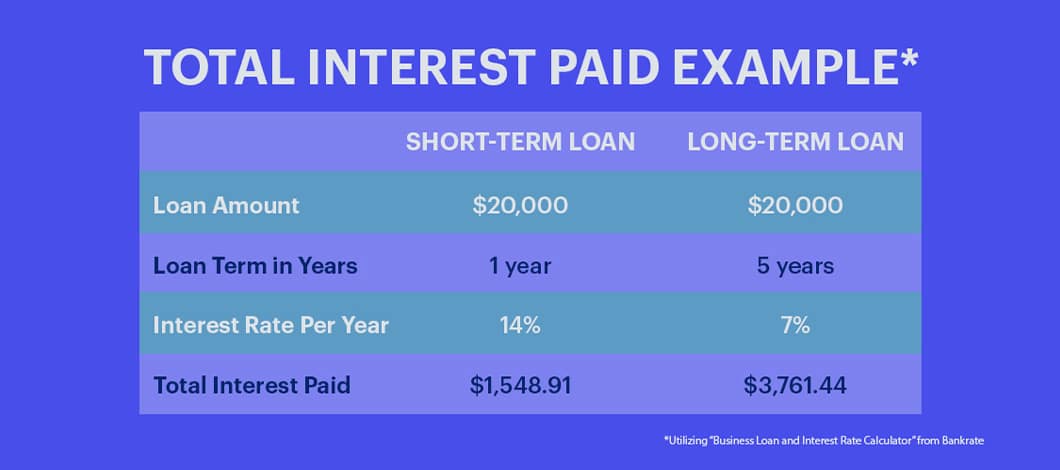

As an example, short-term loans, commonly offered by many alternative lenders, can have double-digit interest rates, while long-term loans such as you’d find at a bank could have rates in the single digits.

Keep in mind, however, even with a lower interest rate, you could wind up paying more in total interest costs over the life of a long-term loan, as you can see below.

Fixed vs. Variable Interest Rates

When reviewing the rate of a loan, it’s important to know the difference between fixed and variable interest rates.

A fixed interest rate is one that remains the same throughout the term of your loan. As such, your payments won’t change.

As for variable interest rates, the rate can change over the term of the loan. As the market interest rates change, such as the prime rate, a variable loan interest rate fluctuates as well.

Clearly, a variable rate comes with risk. What might have seemed a very affordable loan could turn out to be costlier than you had anticipated.

Conversely, your payment could go down if there’s a drop in market interest rates. Keep in mind your lender may have limits as to how low your interest rate can fall.

Refer to your loan terms to determine how often you’re subject to variable interest rate changes.

Loan Fees

Be mindful of additional fees that could be tacked onto your loan. Also, note that some loan fees may not be included in the APR. Additional loan fees, which can vary by lender and loan type, may include the following.

Origination Fee

This is a percentage-based fee charged by a lender to secure and service your loan. This could be between 0.5% and 1%, but may go up to 6%-8% in some cases, depending on the loan term and a borrower’s credit score.

Business Loan Processing Fee

Also known as an underwriting fee, this may or may not be included in the origination fee. This covers the cost of assessing the risk of your loan and your creditworthiness. This can be a flat fee or a percentage of the loan.

Loan Application Fee

This is an upfront fee charged by some lenders to process your loan application and might be up to $500.

Referral Fee

Online lending marketplaces may charge this one-time fee for referring you to one of their lending partners. SmartBiz, for example, notes a referral fee up to 2% of the financing for SBA loans and up to 3% for non-SBA loans.

Loan Packaging Fee

Online lending marketplaces may also charge a packaging fee for preparing your loan application for lender review.

Closing Costs

If you’re taking out a commercial real estate loan, you’ll have closing costs, which include attorney, recording and appraisal fees. According to Quicken Loans, closing costs average 3%-6% of the purchase price.

Appraisal Fee

If you’re using loan funds to purchase property or equipment, you may be responsible for paying an appraisal fee, usually $300-$500. However, this may be included in the closing costs.

SBA Guarantee Fees

With SBA loans, you may be responsible for a fee of up to 3.75% of the loan, depending on the total funding amount and type of loan.

Late Payment Fees

This is a flat fee, often $25-$50, charged when a loan payment is made past its due date.

Invoice Factoring Fees

Fees you might see specifically with invoice factoring providers include:

- Documentation fees: Commonly applied on top of invoice factoring.

- Setup fee: One-time fee upon initial account opening, usually 3%

- Lockbox fee: If you need to deposit checks into a lockbox, you could be charged $50-$500 for this service

Prepayment Penalties

Typically a percentage of the loan amount, this fee is charged if a borrower attempts to pay off their loan before the end of the preset term. Commercial real estate loans and SBA loans typically have prepayment penalties.

Administrative Fees

Some lenders may charge a monthly administrative fee and/or an annual fee. Be wary of lenders who charge these.

Conditions That Affect Small Business Loan Costs

There are conditions and factors that influence the cost of a business loan.

Credit Score

Your credit score demonstrates your reliability as a borrower. The lower the score, the less competitive rates and terms you’ll be given.

For competitive bank loans, you’ll likely need a credit score of 700 or higher, and with SBA loans, a score of 620 or greater.

Alternative financing products often have less strict qualifications for approval, with credit scores of 500 qualifying for financing in some cases. However, alternative financing rates are significantly higher than those of conventional loans.

Revenue

Revenue provides lenders with insight into your business’s earnings and how much debt you can afford to take on. Lenders will review your revenue when determining the loan amount, type of loan, interest rate and repayment terms to offer you. All of these factors affect what the loan will cost you.

Collateral

Many conventional loans require a borrower to offer some type of collateral to secure the loan. Collateral can be real estate, equipment, invoices and more.

Securing your loan with collateral means you’ll often be able to get a lower interest rate as well as higher borrowing limits. This is because the lender has recourse to seize your collateral if you default on your loan, which makes lending less of a risk.

Time

While lenders will consider your time in business when reviewing you for a business loan, there are a couple of other aspects of time that can impact your business loan costs: the application process and the loan repayment period.

Note that conventional bank and SBA loan applications, which offer the most competitive interest rates and repayment terms, take some time, perhaps even a few months. If you aren’t in a rush for funds and you meet minimum lender qualifications, taking the time to apply could get you a lower rate and — lower payments.

Additionally, your repayment term will impact your loan costs. For instance, typically short-term loans have higher interest rates as well as more frequent installment payments than long-term loans.

Keep in mind, though, that long-term financing can sometimes lead to higher interest costs in the long run compared with short-term loans, which are designed to be paid off quickly.

Loan Amount

Whether you’re searching for small business bank loans or SBA loans, your loan amount is another factor that could impact your cost of financing. Think of it this way: The more you borrow, the more risk lenders generally take on. This is where collateral can help.

Reason for Borrowing

The reason you’re borrowing money or the way you’ll be using your funds can play into your business loan.

For example, if you’re seeking startup business loans, this type of financing is viewed as a riskier proposition for most lenders, and will undoubtedly have an impact on the cost of your loan. In contrast, with equipment financing, the equipment serves as collateral for the loan, making it less risky for lenders to loan you funds.

Compare Small Business Loan Costs Before Deciding

A small business loan is never free of charge. To understand just how much a small business loan could truly cost you, use a business loan repayment calculator.

When you use a business loan calculator, “How much can I borrow?” is a question that is answered in plain terms. For instance, if we were to use a business term loan repayment calculator, we would see that a loan of $225,000 over 36 months at an interest of 9% would cost about $7,155 a month.

Also, look for a “total interest paid” section of a loan repayment calculator, as this tells you how much you paid beyond the principal of the loan. For our example, the borrower would have paid nearly $32,580 in interest.

Before you agree to a loan, compare the calculated total cost of each loan offer to see which is priced the lowest. This is one of the most effective ways to keep your business finance loans affordable. Do your homework to find the best small business loan for you.

Frequently Asked Questions

When it comes to the cost of small business financing, here are a few answers to questions you might be asking.

What Is the Average Interest Rate of Small Business Loans?

The COVID-19 pandemic had a huge impact on small businesses, and according to reported figures from U.S. banks, commercial and industrial (C&I) loan originations increased more than 930% year over year in the second quarter of 2020.

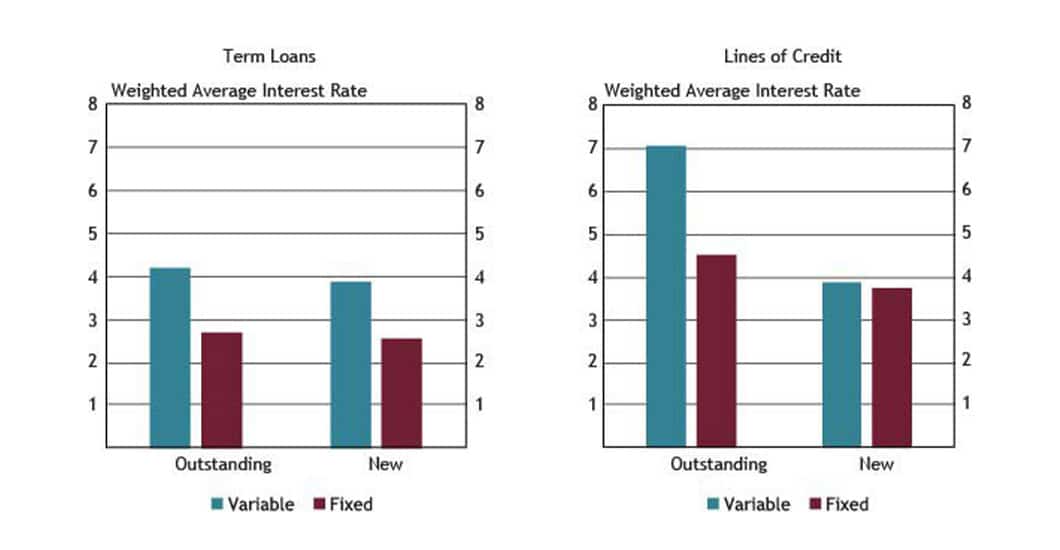

Weighted average fixed and variable interest rates for C&I term loans and lines of credit ranged from 2.54% to 7.02% in the second quarter of 2021. This overall decline in fixed and variable interest rates has been attributed to the Paycheck Protection Program (PPP) rate, which was 1%.

What Is a Good Interest Rate?

According to Forbes, a good business loan interest rate is one that’s less than 10%. That said, you’ll need to take into account the factors that could cause lenders to charge you a higher interest rate. Also, be sure to evaluate the return on investment from the financing you’re approved for to see if it makes sense for your business. After all, if the only financing you’re approved for comes with an interest rate greater than 10% and you need funds to move your business forward, isn’t that a good interest rate for you?

What Is the Most Affordable Type of Financing?

SBA loans and most conventional loans are among the most affordable financing options for small business owners. For example, conventional small business loan interest rates at banks can start at 2%-3% for the most qualified borrowers. For SBA 7(a) loans of $50,000 or more with repayment terms greater than 7 years, interest rates cannot exceed 5.5%.

What Is the Most Costly Type of Financing?

Merchant cash advances are often viewed as the most expensive business financing option. As a type of short-term financing, approved applicants are typically required to authorize daily bank account withdrawals to satisfy their payment installments.

Instead of an interest rate, you’re quoted a factor rate. This rate is calculated once, at the start of the lending period and doesn’t adjust during the life of the loan (as an interest rate might).

Most business owners qualify for a merchant cash advance, even those with poor credit. As a result, it’s a popular financing choice for many entrepreneurs who need a quick infusion of capital, in spite of high costs. Indeed, 84% of firms that applied for this type of financing were approved, according to the Federal Reserve Banks’ State of Small Business Credit report.