Wondering how to get a business line of credit? It’s easier than you might think.

Follow our step-by-step process on how to apply for a business line of credit. Discover the differences between line of credit types, and see what you need to get started.

Secured vs. Unsecured Lines of Credit

There are no “standard” types of lines of credit: There are long-term, short-term, secured and unsecured business lines of credit with high or low interest rates.

Secured business lines of credit require borrowers to collateralize the financing. Applicants pledge high-value assets, called collateral, to secure the loan against the risk of default.

An unsecured line of credit hasn’t been collateralized. To offset the risk of unsecured lending, creditors often reduce credit limits and charge higher interest rates.

The benefit of unsecured lending is that the approval process tends to be much shorter than that of a secured loan and typically requires only a fraction of the necessary paperwork.

Decide which small business line of credit works best for you before you apply.

How to Qualify for a Business Line of Credit

Whether you qualify to get a new business line of credit hinges on several factors. Some lenders will want your business to have been in operation for at least a year and be earning at least $200,000 in annual revenue. When it comes to your credit, aim to have a score of at least 560 when applying for a business line of credit as this is another common business line of credit requirement. Ensure you do online research into several lenders’ requirements before submitting your applications.

If you want a secured business line of credit, you’ll need assets for collateral, which can include the following:

- Personal or business property

- Personal or company vehicle

- Business inventory or equipment

- Accounts receivable

Related: Business Loan Requirements

How to Apply for a Business Line of Credit

When you’re ready to apply for a line of credit, you’ll need to follow a few steps. Here are ways to increase the odds when you’re wondering how to get approved for a business line of credit:

1. Check Your Credit Score

Your credit score is a crucial business line of credit qualification and is one of the few aspects of your application that can make or break your chances of success. One of the best ways to get the best business line of credit rates and terms is to have a strong credit score.

Ideally, you’ll apply for a low-interest line of credit with a fair credit score or better (although some lenders will consider applicants with bad credit). According to Experian, FICO credit scores are used by many lenders and correspond to the following categories:

- 300-579: Very Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Exceptional

As a rule, you should expect a higher annual percentage rate (APR) on your loan or credit line if you have a FICO score of 600 or less. Online lenders may be the best way of getting a small business line of credit with bad credit or getting a business line of credit for a new business that may have just a few months in operation.

2. Gather Your Documents

Once you’re ready to apply, you’ll need to collect various documents and pieces of identification the lender will ask for on the business line of credit application.

While online lender applications are relatively streamlined compared with conventional lenders, such as banks and credit unions, there are crucial pieces of information many creditors seek when you’re getting a line of credit for your business, including:

- Tax returns

- Bank statements

- Cash-flow statements (i.e., balance sheet and profit-and-loss statements)

- Articles of incorporation (if applicable)

- One form of a government-issued identification

Although not all of these documents may be required by the lender you choose, it’s a good idea to collect these documents during the pre-application phase.

3. File the Application

At this point, you’ve settled on a lender and gathered all the documents you need to get started on your business line of credit application form. All that’s left to do is go to your lender’s website and follow the application process.

If you’ve decided to apply for your business line of credit through a bank or credit union, you might need to schedule an appointment with an in-house loan officer.

If you’re applying online, the process could take just a few minutes. Once the application is complete, you’ll be notified when the lender has received your file and that it’s under review. From there, an algorithm will vet your application, check your business line of credit qualifications and send your file through an underwriting process.

With many nonbank lenders, you may receive a funding decision within a day. If you’re applying through a bank or filing for a secured loan, the turnaround time will likely be longer.

Get Your Business Loan Faster

Why Open Up a Business Line of Credit?

Establishing a business line of credit is appealing to entrepreneurs and business owners in unpredictable, fast-paced environments.

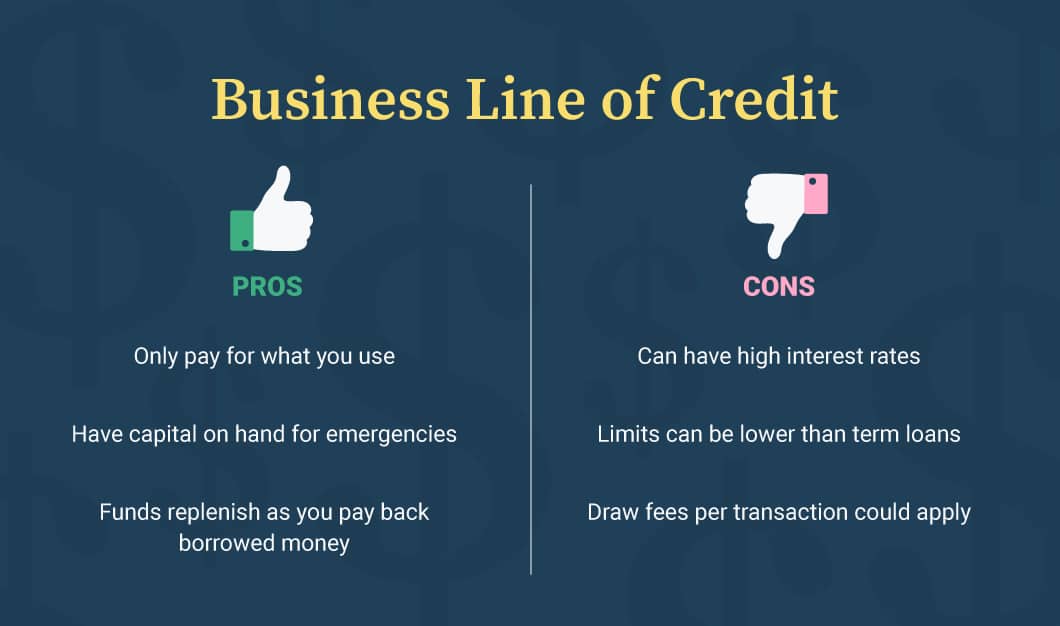

Choosing a credit line over a loan or an advance has its benefits:

- Extremely flexible financing

- Can be repaid and borrowed from again and again

- Valuable buffer to cover emergency expenses or a business opportunity

- Can help manage seasonal and industry-specific cash flow fluctuations

- May have lower interest rates than credit cards

- Offers a good middle ground between term loans and credit cards

Opening a small business credit line is often the preferred choice among entrepreneurs who want a flexible, streamlined, no-nonsense borrowing solution.

According to the Federal Reserve Banks’ State of Small Business Credit report, 71% of surveyed companies that applied for a business line of credit were approved.

Cash-Flow Management

Superior cash-flow management is one of the main selling points of business credit lines.

Small business lines of credit can be used to cover costs or make important purchases when cash is low. A line of credit, for example, can help you purchase inventory when you need it most. Compare that to buying inventory far in advance and having to wait until business picks up again to purchase more.

Line of Credit Interest Rates and Tax Benefits

Although lines of credit won’t offer you the perks and marketing incentives that some credit cards do, they often come with lower APRs. Some of the best small business lines of credit may have starting rates that hover just above the prime rate.

Credit lines tend to have high credit limits and can come in handy if you’re looking to finance 5- or 6-figure expenses.

Potential applicants also should note interest paid on a business line of credit used for legitimate business expenses may be tax-deductible. Being able to write off interest can save you money every year on your tax returns. Consult with your accountant or tax adviser for additional details when you’re looking into how to get a business line of credit.

Should I Get a Business Loan or Line of Credit?

Indeed, lines of credit and loans are the most common forms of financing sought by companies, according to the Federal Reserve Banks’ Survey of Small Business Credit. Specifically, 89% of those surveyed indicated such. However, which option is best for your business?

Business Lines of Credit

For short-term needs, credit lines are a sensible solution. Unlike term loans, revolving credit lines can be withdrawn from and repaid on an as-needed basis.

Think of getting a business line of credit as a replenishing pool of capital that can be drawn from up to a predetermined limit. Revolving credit lines operate similarly to credit cards in that they can be tapped from when necessary, paid off and then borrowed from again. As with a credit card, you only have to pay interest on the portion that you borrow.

Additionally, credit lines are among the best options for business owners who regularly find themselves having to pay off unexpected expenses. Unlike a term loan, the amount you repay from the credit line is made available to you again for future use.

What’s more, with a credit line, you don’t have to worry about continually reapplying and waiting through the vetting process every year or so.

Business Term Loans

Business term loans offer a lump-sum payment, the entirety of which a borrower repays with interest in regular installments. In certain agreements, you must pay a prepayment penalty if you pay off a loan in full before its amortization period.

A term loan can cover the cost of a fixed, one-time purchase. Term loans make the most sense in scenarios where you need to use the entire borrowed amount right away.

After you’ve taken out a loan and repaid it, you need to apply again for additional funds.

Where to Find the Best Online Business Lines of Credit

Conventional Lenders

If you’re an established business with a fair-to-excellent credit score, you’ll likely see the most competitive interest rates and repayment terms with banks and credit unions. While the process to apply and get funded can take time, if you aren’t in a rush for funds and meet bank minimum requirements, you could save money and benefit from lower interest rates, higher line of credit limits and extended payment terms.

One of the best banks for business lines of credit includes PNC Bank, which offers up to $100,000 in unsecured funding and up to a $3 million secured credit line. This bank has an A+ rating with the Better Business Bureau and a 3.9-star Bankrate rating.

Online Lending Marketplaces

If you’re seeking quick access to funds, have a credit score in the 500s to low 600s and are looking for a hassle-free application, consider an online lending marketplace. With a single easy-to-complete application, you can be connected to multiple financing providers, making it a good option for how to get a business line of credit.

Applying through a marketplace also reduces the amount of time it takes to find a lender that meets your business’s needs and whose eligibility requirements you can satisfy. On top of that, many lending marketplaces offer resources to help business owners navigate the application process.

-

Fast Capital 360’s Partner Lenders

If you’re in the market for working capital, Fast Capital 360’s nationwide network of lenders can help. Apply online in just a few minutes and get the financing you need as fast as the same day.

Direct Alternative Lenders

You could also apply directly with an online lender. Here are a few direct alternative lenders offering business lines of credit.

| Lender | Maximum Credit Line | Repayment Term | Borrower Requirements |

| BlueVine | $250,000 | 12, 18 or 24 months |

|

| OnDeck | $100,000 | 12 months |

|

| Kapitus | $250,000 | Varies |

|

Discover Your Best Business Loan Options

How to Get a Business Line of Credit That’s Best for Your Organization

It’s just as crucial to be flexible as it is to be strategic. This is where small business lines of credit lend a hand. When you need to borrow capital to cover unforeseen costs, get through a cash crunch or jump at an opportunity, getting a line of credit for your business can be beneficial.

If you’re asking yourself, “Should I get a business loan or line of credit?” keep in mind that business lines of credit are a flexible, accessible source of financing for newer businesses and burgeoning enterprises alike.

If you’re strapped for time and can’t wait around while banks and credit unions process your application, consider applying for an online business line of credit.