If you need financing to grow your small business, upgrade equipment or get through a down time, consider an unsecured business line of credit.

This type of funding is similar to a personal line of credit, without the plastic, and it can be helpful when you need funds in a pinch. Find out how to get an unsecured business line of credit — and see if it’s right for your company.

What Is an Unsecured Business Line of Credit?

An unsecured business line of credit is a type of credit in which you don’t provide collateral to borrow funds, though you might need to provide a personal guarantee. Because collateral isn’t required, it’s considered a riskier type of financing for lenders.

Secured vs. Unsecured Line of Credit

As you might have guessed, a secured line of credit is backed by collateral, such as:

- Investments

- Real estate

- Vehicles

- Equipment

- Invoices

- Inventory

Secured loans are less risky to lenders compared with unsecured loans. Because lenders have less skin in the game, secured loans typically have higher credit limits and lower interest rates.

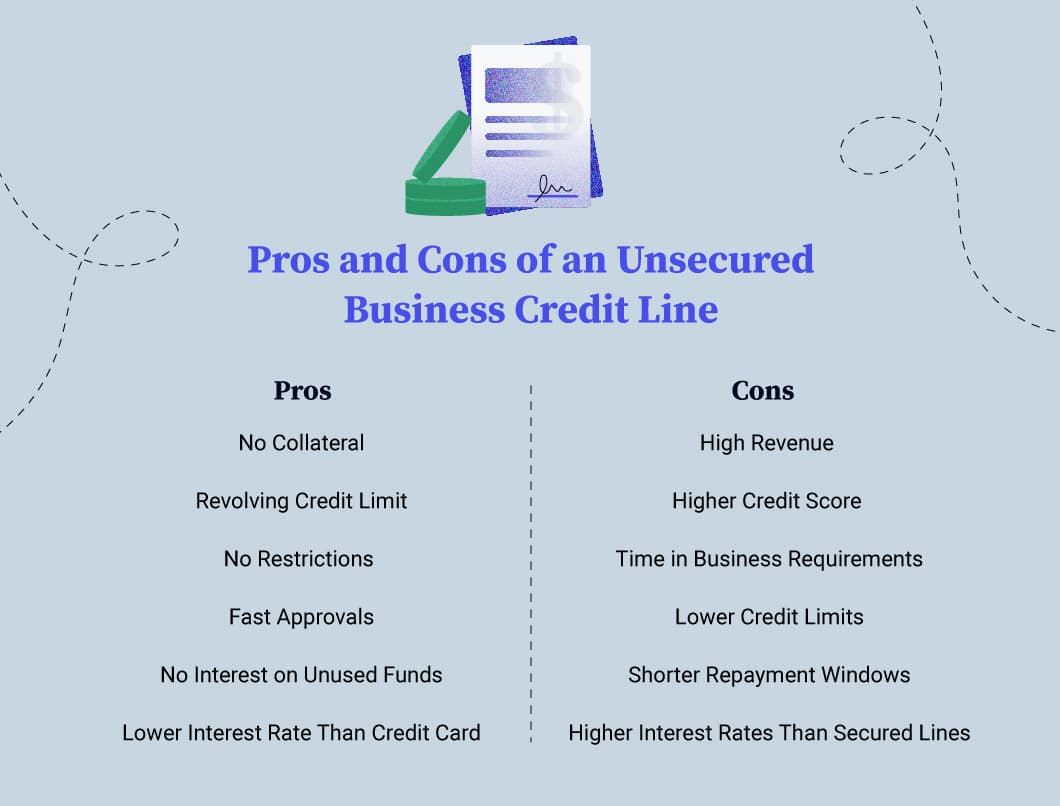

Pros of an Unsecured Business Line of Credit

There are several benefits of this type of unsecured business finance product:

No Need for Collateral

An advantage of unsecured financing, including unsecured business loans and lines of credit, is that you don’t need to have collateral. Though no-collateral financing may be preferred by borrowers, it’s often considered riskier for lenders.

Revolving Credit Limit

If you’re approved for a revolving line of credit, you can use what you need when you need it as often as needed. As you use the funding, your limit goes down. As you pay off your balance, your credit line increases, up to your original approval limit.

No Restrictions on Use of Funds

You’re free to use an unsecured commercial line of credit as you see fit. Some lenders even waive fees for cash advances.

You could use your unsecured business line of credit to:

- Buy equipment

- Pay vendors

- Purchase advertising

- Make utility payments

- Make repairs

- Purchase inventory

- Fund real estate investments

Fast Approval Times

While conventional bank loans can take weeks to process, business lines of credit can be approved much quicker. This is especially true with alternative lenders, who can often approve a borrower within days.

No Interest on Unused Funds

Once you’re approved for a business line of credit, you’ll only pay interest when you tap into your credit line. At that time, a small fee may apply to draw funds, often 1%-3%. However, if you don’t use the funds, you won’t be charged interest. Needless to say, an unsecured business line of credit is a cost-effective way to have funds available in case you need them.

Lower Interest Than Credit Cards

Business lines of credit may have lower interest rates than business credit cards. Business credit cards often charge interest rates in the double digits. For instance, Bank of America offers an unsecured business line of credit with an interest rate as low as 4.50%. However the bank’s small business credit card interest rate is a variable annual percentage rate (APR) of 12.24%-22.24% after a 0% introductory APR.

Cons of an Unsecured Business Line of Credit

Unfortunately, there are some drawbacks to this type of unsecured funding for businesses. A lender’s business line of credit requirements and loan terms can be among them.

High Revenue Needed

A minimum annual revenue of $100,000 is a good starting point when you’re trying to gauge how much you need to qualify for an unsecured business line of credit. That being said, there are some lenders that will consider businesses with less revenue and some that may require more.

Higher Credit Score Required

Unsecured lending guidelines often require borrowers to have a minimum credit score of 600-620, a range that credit-rating company FICO considers “fair.” As a result, getting approved for an unsecured business line of credit with bad credit may be challenging if not impossible. Also, the lower your credit score, the higher your interest rate will be.

Must Meet Minimum Time in Business

Many lenders require applicants to have been operating their businesses for a certain length of time. Some lenders may require 6 months for an unsecured business line of credit, while others may require several years. As a result, unsecured business lines of credit for startups aren’t common.

Lower Credit Limits Than Secured Lines

Since you don’t provide collateral to obtain an unsecured business line of credit, the risk is on the lender. As a result, credit limits are usually lower than you’d see with a secured business line of credit.

However, unsecured business lines of credit may range from a few thousand dollars up to $100,000 or more, depending on the lender. Also, the better your credit and qualifications, the better your odds for approval.

Shorter Repayment Windows

The repayment window for a business line of credit is generally shorter than you’d see with a conventional loan or a secured credit line. Some lenders may require repayment in 3, 6 or 12 months, while others may extend your payment terms for a few years.

Higher Rates Than Secured Lines

Another way lenders of unsecured credit lines hedge their risk is to charge higher interest rates than a borrower would find with a secured line of credit. That’s because secured lines of credit require borrowers to put up collateral that can be seized in the event of default.

Types of Unsecured Business Line of Credit Lenders

With so many options out there, it might be overwhelming to determine where to turn for your small business financing needs. Should you apply with individual banks? What about an online lending marketplace?

Some things to consider when you’re looking for the best unsecured line of credit for your company:

- Are you looking for a streamlined process?

- Do you need a quick answer?

- Do you fall short on some of the common qualification requirements?

If you answered yes to one or all of the above questions, an online lender may be best for you. Let’s look at each type of lender in more detail.

Banks

Keep in mind that banks and credit unions generally have stricter requirements for approval than alternative lenders.

They also likely will require the following information and documentation:

- Personal and business credit score

- Personal and business tax returns

- Bank statements

- Profit-and-loss statements

Lenders seek this information to get a clear picture of your revenue and expenses, cash flow and creditworthiness.

Online Lenders

Many alternative lenders are available online and typically have quicker and easier approval processes. For some, basic details about your business and a connection to your bank account is all that’s needed.

After reviewing your checking account and financials, the lender can provide you with their decision. This streamlined process allows for faster approvals than you’d see with traditional banks.

-

Do Some Due Diligence

Be sure to look for the best unsecured business lines of credit lenders before you apply. The Better Business Bureau, Trustpilot and Google Reviews can be useful resources, providing business details, ratings, reviews and more.

Tips When Applying for a Small Business Unsecured Line of Credit

Once you’ve made up your mind that an unsecured business line of credit is best for your company, put yourself in the best position possible.

- Determine how much funding you need

- Gather the applicable documents your prospective lender will require

- Maintain your credit score — or even better, try to raise it:

- Avoid applying for new credit 6 months before you apply for your credit line

- Keep your existing credit debt as low as possible

- Don’t miss payments

- Start strategizing how you’ll repay the loan

If you’re a small business owner who’s looking for financing that offers purchase flexibility, low risk and easy access to fund replenishment, consider applying for an unsecured business line of credit. Remember, you’re only charged interest on the amount you actually use.