Whether you run a sandwich shop or a law practice, there’s a common element all business owners share: expenses.

Business expenses are the daily costs of operating your company, from conventional utilities, such as electricity and water, to employee wages to federal and local taxes. They are a part of your income statement and deducted from revenue to determine your net income.

So, let’s review these expenses and their categorization, how the IRS defines them and what’s eligible for deductions. Here are the most common small business expenses and how to stay on top of your costs so you can run your organization.

What Are Business Expenses When It Comes to Filing Taxes?

Although business expenses can eat into an organization’s working capital, many of them can be written off as tax deductions if they are considered “ordinary and necessary,” according to the IRS.

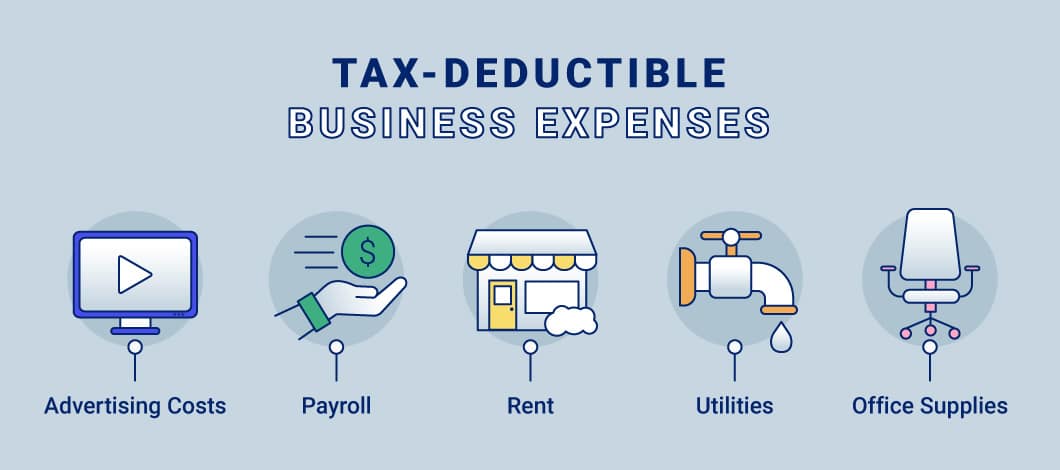

Ordinary expenses are common and widely accepted in your industry or business, while necessary expenses are costs viewed as helpful and appropriate for your trade or business. Such business expense examples include employee benefits, rental fees, business loan interest and insurance. Local, state and federal taxes also make the list. These expenses are often referred to as “the cost of doing business” and are tax-deductible in most cases.

Business meals and home office costs are other examples of tax-deductible business expenses.

That said, even though a typical business expense may be ordinary and necessary, it may not be tax-deductible. You’ll need to determine if it’s a usual business expense vs. an expense used to figure costs of goods sold (COGS), a personal expense (e.g., housing, vacation) or a capital expense.

What Is a Capital Expense?

Capital expenses are the costs a business incurs for specific assets that will provide benefits beyond the tax year in which they’re purchased. For instance, if you own a manufacturing company and buy a business vehicle, this purchase should be recorded as a capital expense and, therefore, can’t be deducted as a business expense.

Even though you can’t deduct capital expenses, you can recoup the money you’ve spent through depreciation, amortization or depletion. These methods enable you to subtract a portion of each capital expenditure each year, allowing you to recover your costs over time.

Remember that many of your capital and personal expenses can be intertwined. To determine which can be business tax deductions and which should be divided, refer to IRS Publication 535.

Most Common Business Expenses: List of Deductible Items

While specific expenses can vary by industry — for example, a restaurateur versus a barber — some financial obligations overlap for all business owners, including building, promotional and material costs. With that in mind, here are the most common types of business expenses that are fully or partially deductible:

Facility Costs

Building Costs

- Mortgage

- Lease

- Home business location (dedicated space inside the home)

Utilities

- Electricity

- Gas

- Water

- Sewer

- Trash hauling

Materials, Equipment and Supplies

Operating Expenses

- Software

- Cell phones

- Landline telephones

- Internet services

- Postage

- Necessary office equipment

Office Supplies

- Computers

- Printers

- Fax machines

- Paper

- Ink

- Pens

- Furniture

Personnel

Employee Expenses

- Wages

- Salaries

- Payroll taxes

- Benefits

Marketing and Advertising

Conventional

- Print ads

- Billboards

- Television

- Radio

- Coupons

Digital

- Search engine marketing (Google AdWords, Bing, Yahoo)

- Social media (Facebook, Twitter, Instagram, YouTube)

- Banner ads

- Podcasting

Transportation

Automobile Expenses

- Monthly business expense for mileage

Travel Expenses

- Flights

- Hotels

- Meals

Entertainment Expenses

- Meals

- Sporting events

- Theater tickets

Taxes

- Income taxes

- Self-employment taxes

- Unemployment taxes

- Workers compensation taxes

- Federal, state and local taxes

Services and Maintenance Expenses

- Facility maintenance (painting, lighting, plumbing)

- Landscaping

- Snow removal

Insurance

- Property/casualty/liability

- Malpractice

- Product liability

Professional Fees

Business Groups

- Memberships

- Associations

Consultants

- Legal

- Marketing

- Information technology

- Strategy

- Human resources

- Accounting

Small Business Expenses List of Non-Deductible Items

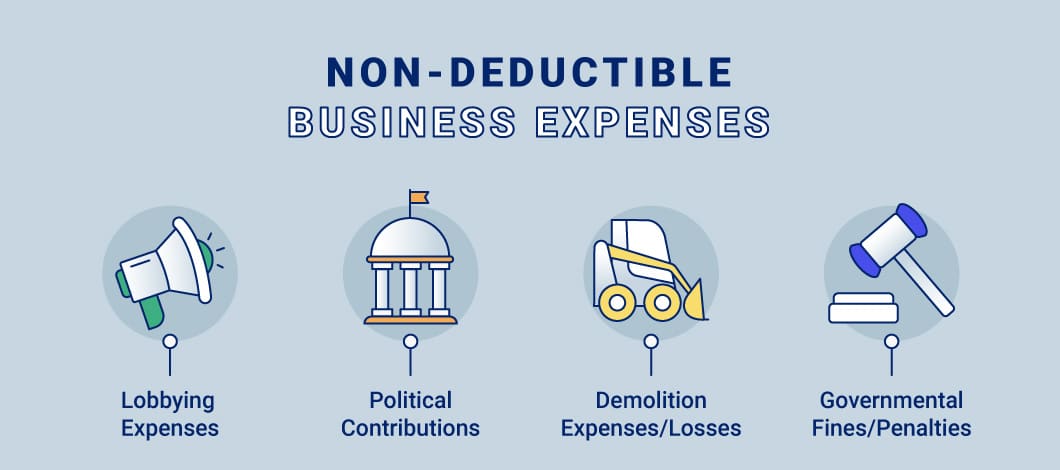

Now that you have a small business expenses list of items you can deduct, find out which types of business expenses are not tax-deductible. Some of these include the following:

- Lobbying expenses

- Political contributions

- Demolition expenses or losses

- Most legal fees incurred to acquire business assets

- Governmental fines and penalties (e.g., tax penalty)

- Education expenses incurred to help you meet minimum requirements for your business

How to Manage Common Expenses in Business

In addition to having a list of business expenses you can deduct from your taxes (and those you can’t), it’s important to know how to manage them. Here are a few tips to follow.

Keep a Paper Trail

As a small business owner, it’s in your best interest to pay as many expenses as possible via a checking account or with credit. This provides an avenue to improve your business credit score and establishes a paper trail for your expenses. In addition, having documentation simplifies recordkeeping and future tax write-offs while providing payment verification.

Indeed, paying for small business expenses with cash is more than acceptable. It simply means the onus is on you to provide an accurate receipt of any payments if you wish to deduct them.

Separate Business and Personal Expenses

Drawing a clear line between personal and business expenses is crucial for keeping your records clean. While sole proprietors can pay bills through a personal checking account, other business organizations don’t have this luxury. Therefore, establishing a business checking account is one of the smartest decisions you can make for your organization, and it provides many benefits, including the ability to accept credit cards for customer payments.

Aside from improving your customer experience, keeping your business and personal expenses separate limits the amount of income tax liability surprises during tax season.

Automate Your Payment Schedules

Staying on top of your payments is the easiest way to maintain good standing with lenders, vendors and creditors. Signing up for automatic payments removes the risk of missing a payment for expenses, allowing you to focus on more pressing business matters. However, monitor your business’s checking account to ensure there are enough funds to cover each installment.

Add Working Capital When Needed

In every business, there will be times when expenses outpace revenue, leaving business owners to decide whether to ride it out and hope for the best or pursue small business financing. When used correctly, small business funding is a beneficial tool. With small business financing, owners can cover their costs during a specific period, handling anything from operating expenses to payroll.