Small business tax deductions can help reduce your tax liability, but which expenses qualify?

We’ve compiled a list of the best tax deductions for small businesses to help you save the most this filing season.

We’ll review what a tax write-off for small business is all about, 27 of the best tax deductions and how to write off business expenses when it’s time to file.

What Are Small Business Tax Deductions?

A tax deduction lowers your overall tax liability by decreasing your taxable income. This is different from a tax credit, which directly reduces the taxes you owe, not your taxable income.

An expense must be categorized as both ordinary and necessary to be included in business tax write-offs. As defined by the Internal Revenue Service (IRS), ordinary expenses are “common and accepted” costs in your industry or business. A necessary expense is a cost that is considered “helpful and appropriate” for your industry or business, but it’s not essential.

Some “ordinary and necessary” business expense deductions can include:

- Employee compensation

- Retirement plans

- Rental expenses

- Local, state and/or federal taxes

- Interest

- Insurance

Small Business Tax Deductions Checklist

Here is our small business tax deductions list of the top expenses your business could write off. (Note that hundreds, if not thousands, of business tax deductions are relevant to small business owners.)

1. Qualified Business Income Deduction

Business structures with pass-through income (sole proprietors, S corporations and partnerships) may be eligible for an up to 20% deduction on their total income, also known as Qualified Business Income (QBI), and a 20% deduction on any real estate investment trust dividends (REIT) and qualified publicly traded partnership (PTP). QBI can be filed through Worksheet 12-A.

QBI is your business’s income for the fiscal year, minus any of the following:

- Capital gains or losses

- Dividends or interest

- Annuity payments

- Foreign currency gains or losses

Owner compensation and guaranteed payments to business partners for services rendered can also be included in this list. However, such write-offs are more complex. Any amount paid to business owners must be deemed reasonable by the IRS.

QBI is subject to maximum income thresholds. For the 2022 tax year, the maximum earnings for married filing jointly status is $340,100, while all other filing statuses have a threshold of $170,050.

Confer with an accountant regarding how to handle these potential business tax write-offs best.

2. Startup Costs

If your business is a startup established during the last tax year, you can elect to deduct up to $5,000 in startup costs and $5,000 in organizational expenses — if your total costs are $50,000 or less.

These small business tax write-offs allow you to write off expenses required to prepare your business for its first year in operation. Example costs include advertisements, salary and wages for employees and instructors involved in training, costs associated with market analysis and travel expenses incurred while securing customers, suppliers or distributors.

In addition, the claim for organizational costs allows you to deduct legal fees, state fees and travel fees for organizational meetings from your taxable income.

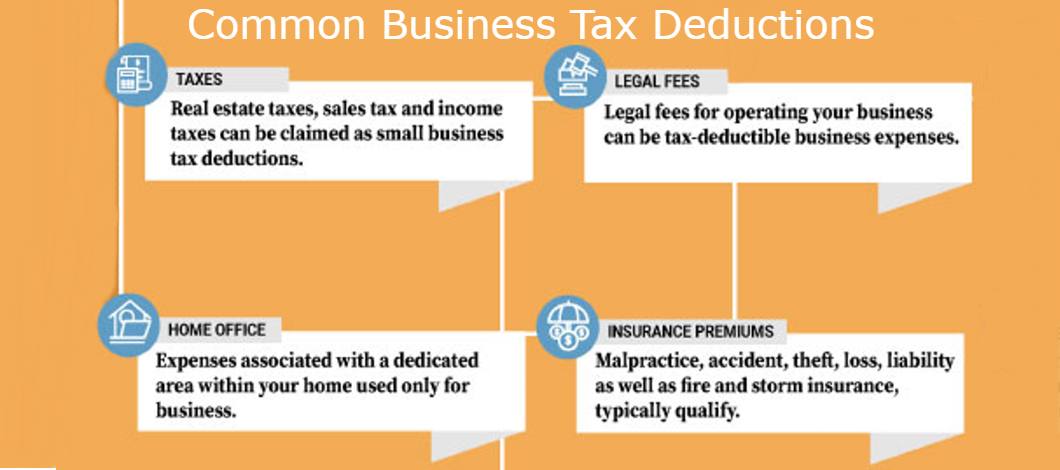

3. Home Office

Another item to make our list of tax deductions for small business is the home office write-off. Indeed, you may be eligible for home office small business tax deductions if there is a dedicated area within your home used only for business and it is your primary place of business.

The area’s size dictates the overall deduction. If you use the simplified option, multiply the square footage of the home office by $5, up to a maximum of 300 square feet (or $1,500 maximum deduction).

However, if you use the regular method for your business tax write-offs, calculate and record your actual expenses for the percentage of office space.

If you’re expensing your home office costs as itemized deductions, use Schedule C (Form 1040). You’ll also need to fill out Form 8829 if you’re using the simplified method, which according to Revenue Procedure 2013-13 from the IRS, is “an easier way to determine the number of expenses you can deduct for a qualified business use of a home.”

4. Office Supplies

Any supplies you need in your office to conduct business (pens, paper, etc.) can be included in your business expense deductions. Claim these items on Line 18 of Schedule C (Form 1040).

5. Tools and Supplies

Beyond office supplies, any tools or materials required to run your business can be deducted.

For example, a business computer’s full cost can be added to your list of deductible business expenses the year you purchased it. You can also deduct it with depreciating value over 5-7 years, depending on the item. These items are also listed on Schedule C (Form 1040).

6. Repairs and Maintenance Costs

Excluding items that have been replaced, what you’ve spent to repair and maintain your place of business can be claimed as a small business tax deduction. For example, reconditioning the floors in your place of business, repairing signage, painting and electrical repair are examples of costs that can be written off on line 21 of Schedule C (Form 1040) or line 9 (or Form 1120 for corporations).

7. Utilities

As long as they are not for personal use, utilities — such as heating, electricity, water, sewage and phone services — are tax-deductible business expenses. Itemize these small business tax deductions on line 25 of Schedule C (Form 1040).

8. Internet Services

Internet services are vital to conducting business and are therefore tax-deductible business expenses. Internet-related services include any domain registration fees and any webmaster consulting costs.

9. Software

Similar to tools and supplies, if your business requires a specific piece of software to function — like a point of sale system for a food truck or an appointment scheduling system for a doctor’s office — the costs are among small business tax deductions you can claim.

10. Business Vehicles

Vehicle expenses for business-related driving are another common tax deduction from which small business owners can benefit. Deductions can be claimed using either standard mileage or actual costs, such as repairs, gas, oil changes, etc. This deduction does not, however, apply to luxury, equipment or for-hire vehicles.

As of July 1, 2022, the standard small business mileage deduction rate is 62.5 cents, an increase of 4 cents from the start of 2022. Even if your actual mileage costs are less than the current rate, you can still apply the standard mileage deduction. Any mileage costs claimed must be associated with business activity.

Proper documentation of these costs must also be kept on hand for 7 years after you’ve filed. For further detail on car and truck expenses and how to report them, refer to Publication 463.

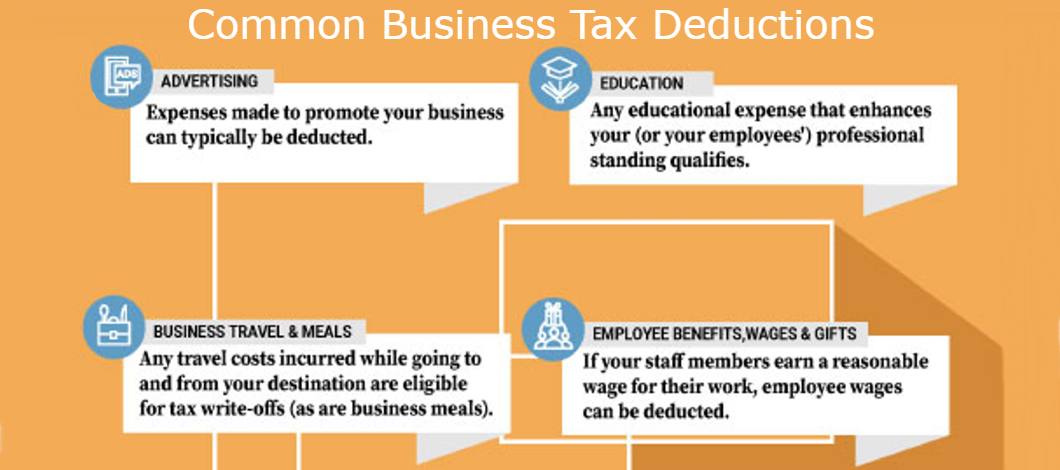

11. Business Travel

There are quite a few small business tax breaks when it comes to business travel. For example, if you’re on the road for business, any travel costs incurred while going to and from your destination are eligible for business tax write-offs.

In addition, lodging, dry cleaning, phone charges or any other item purchased to conduct business are considered tax-deductible business travel expenses. Just as you would with any vehicle claims, be sure to keep travel expenses on file for 7 years.

For further information on which travel and non-entertainment related expenses can be deducted and how to report them, refer to Publication 463.

12. Business Meals

For 2022, reasonable business meal expenses from restaurants are 100% deductible. In other instances, business meals are typically deductible at 50% of the cost.

To claim this as one of your small business tax breaks, you must have a record of the date and location of the meal, an itemized cost breakout of each expense and the business relationship(s) of the person(s) you ate with. One of the best ways to keep track of these expenses is to write down the purpose of the meal and what you discussed on the back of the receipt.

To claim business meal expenses, use Form 1040, Schedule C.

13. Employee Benefits

Health plans, sick and vacation pay, accident coverage, welfare benefit funds, life insurance coverage, meal programs and dependent care assistance are all benefits that are eligible for business tax deductions.

For more information, see the IRS’s business expense deductions publication.

14. Employee Wages and Bonuses

If your staff members earn a reasonable wage for their work, employee wages can be deducted. In addition, certain bonuses and awards can be deducted. You can also deduct fees you pay for contractor workers or freelancers to whom you pay $600 or more in the year. However, you will need to send them a 1099-NEC.

15. Employee Gifts

You can deduct up to $25 in business gifts per person each tax year. However, the IRS notes, “Any item that could be considered either a gift or as entertainment is generally considered entertainment and cannot be deducted.”

16. Medical Care

If you’re self-employed, in addition to deducting your health insurance, you can deduct doctor’s fees, home care and the cost of prescription drugs. Note that personal medical care deductions are claimed as personal expenses rather than business expenses.

In addition, if you’re the policyholder on your family’s plan (spouse and/or dependents), their premiums could also qualify as a deduction (unless you’re eligible to be covered for health insurance through your spouse’s employer). To claim medical care costs, use Schedule A (Form 1040).

17. Education

Any educational expense that enhances your (or your employees’) professional standing in your current industry qualifies as a tax deduction.

Use Form 1040, Schedule C to report the costs of any classes, workshops or conferences you’ve attended and document each as professional development. Trade publication subscriptions and industry-related books are also deductible.

18. Retirement Plans

Contributions made to your employees’ retirement plans are business tax write-offs. Alternatively, if you are self-employed and contribute to an eligible retirement plan, you may claim a deduction for that.

19. Insurance Premiums

Malpractice, accident, theft, loss, liability as well as fire and storm insurance typically qualify as small business tax deductions. Health insurance can also be deducted for self-employed business owners. Additionally, any business insurance policy costs, including your homeowner’s insurance if you work out of a home office, are also business tax deductions.

20. Taxes

Real estate taxes, sales tax and income taxes can also be small business tax deductions. Any of these deductions need to be filed via Schedule A (Form 1040). If you employ workers, you can also deduct the amount you contributed to FICA (Social Security and Medicare tax) as well as federal and state unemployment tax.

21. Legal Fees

Legal fees tied to operating your business can be tax-deductible business expenses. This includes business licenses, tax preparation and franchise or trademark fees. Use Schedule C (Form 1040) or Schedule C-EZ (Form 1040) to write off these expenses.

22. Interest

You may also qualify for a small business tax break on certain interest you’ve paid or accrued during the fiscal year. (If you’re only liable for a portion of a debt, you may deduct only the interest you’re responsible for paying.) Examples of items with allowable interest deductions include eligible business loans, business credit cards and mortgages.

23. Advertising Expenses

Expenses made in relation to promoting your business can typically be deducted. Sole proprietorships and single-member LLCs should file this expense on Form 1040, Schedule C, while partnerships and multi-member LLCs need to use Form 1065. For corporations, advertising expenses are recorded on Form 1120.

24. Research and Experimental Costs

In some cases, the costs of developing or improving an existing product could be deducted as a current business expense in certain cases. To learn more about how your organization should expense these costs, see Publication 535, Chapter 7.

25. Credit Card Fees

Processing fees that are applied to every credit card swiped in your business are tax-deductible business expenses. In addition, a portion of your business credit card usage — including the interest paid and any annual or late fees — can be written off through a few different deductions.

26. Charitable Contributions

Contributions your business has made to a charitable organization registered as a 501(c)(3) can be tax-deductible.

Corporations deduct these costs on their corporate tax returns, while sole proprietorships, partners and single-member LLCs will record these tax deductions on their personal returns, using Schedule A (Form 1040).

27. Depreciation

Depreciation enables you to reduce the cost of a high-ticket business expense throughout its lifetime instead of one large deduction. For example, suppose your business has a machine that crafts its primary product. To calculate attributable depreciation, you must estimate its asset life and scrap value (the machine’s components’ worth after it’s no longer useful).

If your machine costs $250,000 and is expected to have a value of $75,000 in 5 years, the machine’s depreciation expense is $35,000 per year. The depreciation is calculated by subtracting $75,000 (the salvage value) from $250,000 (the asset cost) and dividing by 5 (the useful life), equaling $35,000. This calculation is just one way to determine depreciation for small business tax deductions, referred to as straight-line depreciation.

We recommend speaking with a certified public accountant (CPA) or another tax advisor to find the best calculation method for your own business. To learn more about depreciation, see Form 4562.