Alternative lending offers another option for financing your business. But when should you use it instead of conventional lending?

Learn what alternative lending is, what types of alternative lending are available and how its pros and cons stack up against conventional borrowing. Also, find out how to qualify and apply for alternative financing.

What Is Alternative Lending?

Alternative lending refers to consumer and business financing offered by nontraditional loan providers (not banks or credit unions).

These types of nonbank lenders emerged in the early 2000s when private individuals and groups began using the Internet to lend directly to consumer borrowers, a practice known as peer-to-peer (P2P) lending. The 2008 recession was another factor that caused alternative lending to become more commonplace.

Today, the term refers primarily to digital technology to connect both consumer and business borrowers with lenders, known as marketplace lending.

While alternative lending today includes crowdfunding, this guide will focus primarily on marketplace lending.

Who Uses Alternative Lending?

Alternative lenders frequently work with consumers and business owners underserved by conventional lending institutions, such as borrowers with low credit scores who don’t qualify for conventional loans. Indeed, according to the Federal Reserve Banks’ Small Business Credit Survey, 35% of firms with lower credit scores turned to online lenders for financing, while 23% applied with nonbank finance companies.

That said, alternative lending providers may work with borrowers who use both conventional and nonconventional channels. However, some borrowers who could qualify for conventional financing still turn to alternative lending because they find it faster or more convenient.

Related: High-Risk Business Loans: Know Your Options and Get Low Rates

How Does the Alternative Lending Process Work?

Alternative lending typically occurs through online platforms that connect borrowers with investors. Online lending platforms use digital technology to support and expedite the loan application process.

Typically, when prospective borrowers seek alternative credit, they fill out an online discovery form to determine if they prequalify for a loan or other form of financing. The form collects basic information about the applicant’s financial situation to make a preliminary assessment of creditworthiness. Data entered into the form gets reviewed automatically by a software program, often within minutes. However, some applications may get passed on for follow-up manual review by a live person.

If applicants pass the initial prequalifying process, they receive an invitation to continue the application process. This usually involves working with a designated loan officer and submitting qualifying paperwork. If the application gets approved, funds are typically transferred via electronic deposit within days or hours.

What Are the Different Types of Alternative Lending Models?

Today’s alternative lending market includes several types of lenders:

- Marketplace lenders

- Direct private lenders

- Crowdfunding platforms

In the alternative lending space, marketplace lending platforms use technology to process loan applications, screen applicants and connect qualified applicants with potential lenders. Marketplace lenders package loans from lenders and deliver them electronically to borrowers instead of using deposited money to provide funds the way a bank would. The marketplace lender collects a commission and fees for this service.

Direct private lenders finance loans with their own money instead of using bank depositors or investors. This gives these noninstitutional lenders broad discretion over loan qualifications and terms. For example, a direct private lender might be willing to lend a smaller amount of money than a conventional lender.

Both marketplace lending and direct private lending as described above are often referred to as P2P lending. However, technically, P2P lending involves lending from an individual to a borrower, while marketplace lending can allow financial institutions and individuals to lend money and more often involves institutions.

Crowdfunding takes place on a digital platform where borrowers can raise money by asking large numbers of investors to contribute small amounts.

What Types of Financing Do Alternative Lenders Offer Businesses?

Marketplace alternative lenders can offer a wide range of financial products to businesses. Depending on the lender, business financing options may include:

- Term loans: Funds must be repaid over a specific period (the term of the loan) at a fixed or variable interest rate on a predetermined repayment schedule

- Short-term loans: Term loans with a short window for repayment, often less than a year

- Microloans: Term loans for low amounts, such as $50,000 or less, often with short-term repayment schedules

- Bridge loans: Short-term loans used to cover cash-flow needs while longer-term financing is being arranged

- Commercial loans: Longer-term business loans typically used to pay for significant capital expenditures, such as real estate or equipment investments, or to cover operational costs

- Working capital loans: Short-term loans used to finance daily business operations rather than purchases of long-term assets or investments

- Small Business Administration (SBA) loans: Term loans backed by the SBA, reducing the risk to the lender and enabling lower interest rates for borrowers

- Accounts receivable financing: Cash advance based on receivables owed to borrowers by their customers

- Merchant cash advances: Cash advance lent on the strength of sales projections, to be repaid from a percentage of future sales

- Equipment financing: Loan used to purchase or lease equipment, with the equipment serving as collateral

- Business lines of credit: Similar to a credit card but differing in that it can be used to write checks; may be borrowed against up to a set limit, with funds typically becoming available for spending again after they’re repaid (known as a revolving line of credit)

Some lenders will offer all of these products. Others may specialize in certain products, including others not listed here.

How Do Alternative Business Loan Lenders Differ from Conventional Lending?

Alternative lending companies tend to differ from conventional lenders in many respects:

- Operate primarily online, whereas conventional lenders are normally based at physical locations

- Can process applications quicker by using digital technology, while conventional lenders use manual review processes, which are more complex and can take longer

- Often willing to extend credit to higher-risk borrowers in return for higher interest rates and other less favorable terms, while conventional lenders have stricter qualifying criteria

- May require less documentation than conventional lenders, simplifying the application process

- May expedite transfer of approved funds within days or hours using electronic deposits, while conventional lenders can take weeks or months before the application process is completed and funds become available

Mike Dell, client success manager at Wall Street Funding, a merchant cash advance provider, says, “A traditional lender, whatever their process is, is certainly going to be much longer than ours.”

Dell notes often merchants don’t have the time to go through a lengthy process with conventional lenders, which typically requires extensive paperwork and the need for collateral. This amount of due diligence common with conventional lenders leads many merchants to suffer what Dell refers to as “time erosion.”

While funds received through a conventional lender can be less costly and come with a lower interest rate, time is money when all is said and done. Many small business owners don’t have the time to wait for approval, which could take weeks or months.

In contrast, to help business owners get funded quickly and avoid time erosion, alternative lenders ask for much less to approve an applicant. However, they assume more significant risk, which they balance with shorter repayment terms and higher rates.

When it comes to alternative lending, Dell says, “We’re a beautiful means to an end, and I think we fill a very necessary void if a merchant understands what we do. What we’re not is a loan over a long period of time. We’re a bridge of sorts – a merchant is able to come to us [and] in a very timely fashion, we’re able to review the very few necessary documents, determine an amount of funding that they qualify for and get them funded. It doesn’t even matter the size of the deal…it could be funded in 2 days or even less in some cases.”

What Are the Advantages of Alternative Lenders?

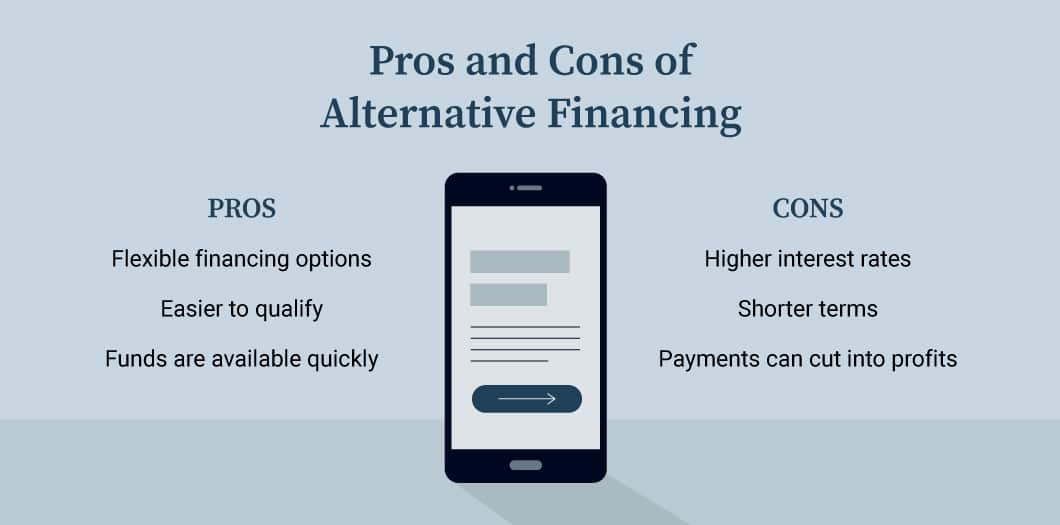

Alternative lenders offer several benefits that can make them appealing to business borrowers:

- Digital application process, reduced paperwork and expedited processing can make alternative loans more convenient than conventional loans

- May offer a more flexible range of financing products to meet the needs of a broader range of borrowers

- Alternative loans can be easier to qualify for

- Funds can be made available more quickly

Dell notes the importance for business owners to have an “understanding that you can deploy this money to your benefit, quickly, to take advantage of a situation where other monies might not be available – forever or not yet.”

“Merchants should be using us to take advantage of opportunities that exist. Maybe they can buy merchandise in bulk, and whatever the cost of our money is, they’re still deriving a benefit. They’re able to buy X, increase their profits, where even with the cost of our capital they’re coming out ahead.”

“We’re an easy, fast way to come up with that capital,” says Dell, and a way to avoid the time erosion often encountered with a conventional lender.

These advantages can make alternative lending attractive to business owners who have difficulty qualifying for conventional loans or who need access to financing quickly.

What Are the Disadvantages of Alternative Lenders?

While alternative lending offers several advantages over conventional options, there are some tradeoffs:

- Often have higher interest rates or other less favorable terms (though this is not always the case, as with alternative lenders who handle SBA loans, which are generally similar regardless of lender)

- May have shorter terms than seen with conventional lenders

- Alternative lending products that rely on accounts receivable or future sales for collateral can cut into profits and cash flow while advances are being repaid

Dell advises that business owners should not be taking out alternative funding for the sake of it. It should be advantageous. They should ask themselves what they’ll use the money for and what their end goal is.

For example:

- Do you need to cover payroll while waiting for accounts receivable to come in?

- Do you need X amount of capital on hand to win a project?

- Are you experiencing a short-term operational hiccup?

- Is there an auction or fire sale that would allow you to buy equipment at a deep discount?

Whatever the case, consider the pros and cons of alternative lending before deciding which type of financing is right for you.

When Should I Try an Alternative Lender Instead of a Conventional Lender?

There are several scenarios where an alternative financing product might suit your small business needs:

- You’re having difficulty qualifying for conventional loan products because of factors such as a short amount of time in business, a low credit score or insufficient revenue

- You need access to financing immediately and don’t have time to wait for the turnaround on a conventional loan

- Your business model and sales projections would make it easy for you to repay a short-term loan or advance

- You need immediate financing for an equipment purchase

On the other hand, if you qualify for a bank loan or can afford to wait for financing, exploring conventional options might make sense.

Alternatively, Dell says, “Maybe you have a situation where you do qualify for traditional lending but you can’t wait it out…You can take care of whatever your needs are with our capital. You could in turn pay us off with that other traditional funding when you receive it. There’s nothing that prevents you from doing that.”

At the end of the day, the question business owners should be asking when they’re contemplating whether they should fund with an alternative lender is this: “Are you able to take advantage of an opportunity from a price perspective that will otherwise evaporate?”

How Do I Qualify for Alternative Business Lending?

Different alternative nonbank lenders may consider varying factors when evaluating your application for approval. In general, lenders typically consider the following:

- Personal or business credit score

- Monthly or annual revenue

- Time in business

- Cash flow

Certain criteria are specific to different types of lending products. For instance, with accounts receivable financing, lenders want documentation of your outstanding invoices. For merchant cash advances, lenders may want documentation of recent revenue levels supporting your sales projections.

In addition to a business owner’s personal credit, Dell notes his company will “review the last few months of bank statements to see how they’re doing from a revenue perspective, to see if they have any bounced payments, late payments.”

Additionally, Dell says, “We’re going to pull a background just to look for any judgments, liens or criminal history.”

There may be other requirements for loans of larger amounts. For example, of alternative financing, Dell notes, “If it’s a large deal, we’ll ask for some very basic financials – a balance sheet, P & L, A/R report.”

With conventional lenders, qualifying criteria also may be stricter for loans in larger amounts or those with lower interest rates. As with conventional lenders, you can often secure higher amounts and more favorable terms if you have a strong credit rating and revenue history.

You may wish to check your credit score and take steps to build your business credit before approaching conventional and nonbank lenders for business loans.

How Do I Apply for Alternative Lending?

Applying for alternative lending normally involves a few steps:

- Filling out an online form with prequalifying information, such as revenue and years in business

- If you pass prequalifying criteria, you may be given one or more loan options and asked to provide qualifying documentation, such as financial statements or tax returns

- If your application is approved, the funder will send you documents to sign to finalize your lending agreement

- Following finalization of your agreement, you’ll receive your funds, typically through electronic transfer

These steps may vary somewhat by lender and loan product. Some application processes may be more streamlined than others.

How Do I Find Alternative Lenders for Small Business Financing?

There are many lenders offering alternative financing for small businesses. In fact, Fast Capital 360 provides reviews of some of today’s most popular alternative lending providers.

See how lenders compare on popular review sites too, such as:

Keep in mind, we have partnerships with many industry funders, so you can quickly compare multiple financing offers on our secure platform.

Find Out Whether You Qualify for Alternative Business Lending

Alternative lending can be an option for your business if you don’t qualify for a conventional bank loan or you need to secure financing quickly. If this applies to you, you might benefit from a nonbank lender’s business loans.

Fast Capital 360 works with lenders throughout the country to help small businesses find financing fast, including SBA loans and other funding options, such as business lines of credit, accounts receivable financing, merchant cash advances and more.

Take a few minutes to fill out our no-obligation online application and find out which forms of alternative lending you may qualify for. Our software compares your prequalifying criteria with our wide network of lenders to find the provider that’s right for you.