When securing a Small Business Administration loan, you must pay an SBA guarantee fee (also spelled “guaranty fee”).

We’ll explain:

- What SBA guarantee fees are

- How much an SBA guarantee fee costs

- What other SBA fees you may encounter

- How SBA fees are paid

What Is an SBA Guarantee Fee?

When a lender approved by the Small Business Administration (SBA) extends a loan to you, the federal agency agrees to back a portion of the loan if you default. This guarantees your lender will be repaid part of what you borrowed if you stop paying back your loan. By making this guarantee, the SBA puts itself at risk of having to pay money to your lender.

To offset this risk, the SBA charges your lender a fee based on a percentage of your loan amount. Typically, lenders pass this fee on to borrowers . In effect, you’re paying the SBA an “insurance” fee for the risk the agency is taking guaranteeing your loan.

How Do SBA Guarantee Fees Work?

SBA guarantee fees vary with the size of your loan as well as the term. In general, as your loan amount and term increase, so does your guarantee fee. Keep in mind, the guarantee fee is a percentage of the guaranteed portion of your loan, which varies depending on the loan type.

For 7(a) loans, the SBA uses a tiered system to scale loan size to guarantee fee percentages. After your loan size increases beyond a set threshold, you enter the next tier and your guarantee rate goes up. Additionally, loans with terms of 12 months or less have lower fees than those with longer terms.

While SBA guarantee fees may be financed with the proceeds of the loan, they are due within 90 days of the loan approval date.

Maximum Percentage of Loan Guaranteed by the SBA

- Standard 7(a): 85% up to $150,000, 75% for loans exceeding this amount

- Export Express: 90% for loans up to $350,000, 75% for loans exceeding this amount

- Export Working Capital: 90%

- Express: 50%

SBA 7(a) Guarantee Fee Rates

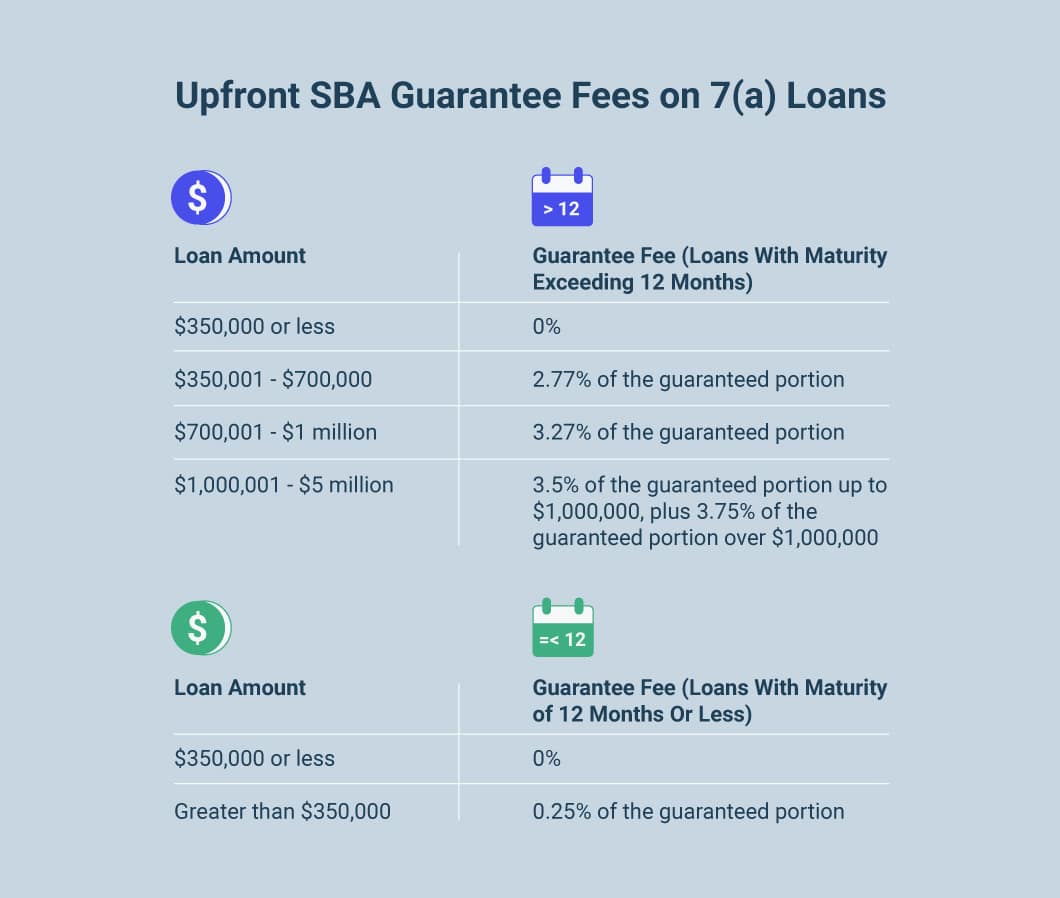

The upfront SBA guarantee fee on most 7(a) loans will depend on the loan amount and the maturity of the loan. SBA 7(a) programs consist of various loans, including Standard, Express and CAPlines.

For the 2022 fiscal year, SBA guarantee fees for 7(a) loans are as follow:

Loans of 12 months or less

- For loans greater than $350,000 with a maturity of 12 months or less, the SBA assesses an upfront guarantee fee of 0.25%.

- There is currently no fee for loans of $350,000 or less.

- Loans greater than 12 months

- For loans up to $350,000, there is currently no upfront guarantee fee.

- For loans from $350,001-$700,000, the SBA requires 2.77% of the guaranteed portion.

- For loans of $700,001-$1 million, the charge is 3.27% of the guaranteed portion.

- For loans of $1,000,001-$5 million, the SBA requires 3.5% of the guaranteed portion up to $1 million, plus 3.75% of the guaranteed portion over $1 million.

For the 7(a) program, the SBA Express guarantee fee for veteran-owned small businesses is waived.

Of note, if an applicant is approved for 2 or more SBA-guaranteed loans within 90 days of each other, the guarantee percentage and fee are determined based on the aggregate amount of the loans.

Additionally, if an applicant is approved for a 7(a) loan increase, an additional SBA guarantee fee is due. This additional fee will be the difference of what the guarantee fee would have been if the increase was part of the original loan amount and the original fee.

-

SBA Loan Guarantee Fee Example

Let’s say you take out a standard 7(a) loan in the amount of $400,000 for a term that extends past a year. The guarantee fee would be 2.77% of the guaranteed portion of the loan.

Now, you might be wondering, how much does the SBA guarantee fee cost in dollars? In this case, because the SBA guarantees 75% of standard 7(a) loans greater than $150,000, the 2.77% fee would apply to $300,000, which is 75% of the total loan amount.

This would translate to a total cost of $8,310 (i.e., $300,000 x 2.77% = $8,310).

SBA Export Working Capital Program Loan Guarantee Fee Rates

Though part of the 7(a) program, the SBA’s Export Working Capital Loan program has different upfront guarantee fees, which are based on a maximum guarantee of 90% of the loan.

Thanks to an SBA guarantee fee waiver, for loans of $350,000 or less, the upfront fee is 0%.

- For loans greater than $350,000:

- If maturity is 12 months or less, the fee is 0.25% of the guaranteed portion.

- If maturity is between 13 and 24 months, the upfront guarantee fee is 0.525% of the guaranteed portion.

- If maturity is between 25 and 36 months, the upfront guarantee fee is 0.80% of the guaranteed portion.

Additionally, if a loan of $350,000 that is set to mature within 24 months is extended, the SBA requires an additional guarantee fee. In such cases, the lender must pay the difference in the SBA guarantee fee originally paid and what it would have been if the loan had been initially approved at the extended maturity.

SBA 504 Guarantee Fee Rates

For the 2022 fiscal year, the SBA’s 504 loan program has the following upfront guarantee requirements:

The upfront guarantee fee on SBA 504 loans, excluding debt refinance with expansion loans, will be 0.50% (the annual service fee will be 0.2475% of the outstanding balance).

-

SBA Guarantee Fee Calculator

You can generate an SBA guarantee fee calculation for 7(a) loan programs by heading to the government website, which offers a guarantee rate calculator.

Other SBA Loan Fees

SBA guarantee fees are but one fee you might be required to pay when securing an SBA loan. Here are some other fees you might encounter, though not all of them will apply to every SBA loan.

Appraisal Fees

If you’re using property as collateral on an SBA loan, you may need to pay a fee to get the property appraised.

Phase I Environmental Fees

If you’re using commercial property as collateral for your loan or if you plan to use your loan to purchase commercial real estate, your lender may charge you for a Phase I environmental site assessment (ESA).

A Phase I assessment is a preliminary step in the process of doing due diligence on real-estate properties for existing or potential environmental contamination. If a site is determined to be contaminated, a more detailed Phase II investigation begins.

Business Valuation Fees

If you plan to use your SBA loan to acquire another company, you’ll need to pay a fee to get the value of that business assessed.

Loan Packaging Fees

Lenders often charge a packaging fee for the service of processing your loan and submitting it to the SBA. According to the SBA, packaging fees “must be reasonable and customary for the services actually performed and must be consistent with those fees charged on the lender’s similarly-sized non-SBA guaranteed commercial loans.”

Title Fees

If you’re using your loan to purchase real estate, you will need to pay for a title search to make sure the property is free of any other claims.

Attorney Review Fees

You typically will need to pay an attorney to review all your loan documents before closing.

Related: Common Loan Fees

How SBA Fees Are Paid

While guarantee fees are usually rolled into your payments, other SBA fees get paid at different points in the loan process.

During the application process, the following fees may be paid as deposits:

- Appraisal fees (can also be paid at closing)

- Phase I environmental fees

- Business valuation fees

At closing, you may pay:

- Loan packaging fees

- Title fees

- Attorney review fees

While SBA fees might seem costly out of context, the bigger picture is that they help secure funding to finance your business. Your loan provides you with capital many times the amount you pay in fees, and this goes into funding your business and generating profit. From this perspective, SBA fees represent an investment in your business.