Lenders assume financial risk whenever they hand money over to a business. To mitigate that risk, many creditors require business collateral. Collateral is an asset that a borrower provides a lender to secure a loan. Assets can be tangible, which can be seen and touched, such as buildings or vehicles, or intangible, such as accounts receivables.

Indeed, an impressive credit history, positive cash flows and other attractive attributes aren’t enough to bypass this requirement in many cases.

You’ll likely need to set aside a sum of cash or other assets to get approved for a business loan with a conventional lender, such as a bank or credit union.

Related: How to Get Small Business Funding

Does Collateral Mean a Small Business Loan Is Secured or Unsecured?

Small business loans can be secured or unsecured. When a lender requires you to offer specific collateral to approve your loan application, you’re applying for a secured loan.

In contrast, an unsecured loan doesn’t require specific collateral to be pledged. Unsecured loans are issued based on a borrower’s creditworthiness and ability to repay the loan.

Unsecured loans often require a personal guarantee or a general or blanket lien. In the lending world, this is a legal right granted by the borrower to the lender in case of default, allowing the lender to seize any of the borrower’s personal or business assets to recoup their loss.

Borrowers considering taking out a loan backed by a blanket lien should be aware that most banks won’t consider this option unless they’re in a first-lien position. In other words, creditors want to be the first lender to file a blanket lien on your assets. Otherwise, they will have the second or third claim on your assets if you default, which means they may end up empty-handed.

Examples of unsecured financing include certain short-term loans, merchant cash advances and many business lines of credit.

In contrast, because they’re backed by collateral, secured loans are often considered less risky to lenders than unsecured ones. As such, secured loans can come with higher approval amounts, more competitive repayment terms and better interest rates.

Examples of secured loans include mortgages, construction loans and equipment loans.

Can You Use Personal Assets as Small Business Loan Collateral?

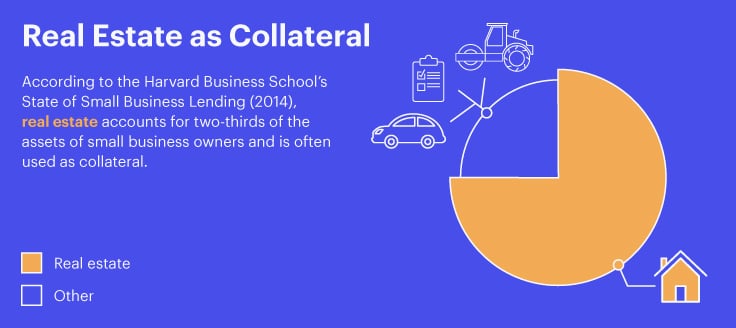

Indeed, collateral can consist of business assets as well as personal assets. If an asset has a title of ownership, you can offer it as collateral. A bank will typically accept this because, in the event of default, the bank can access the title, sell the property and recoup its losses. As such, personal collateral often takes the form of an owner-occupied home, vehicles, personal savings or other financial accounts.

Which Small Business Loans Come With Collateral Requirements?

In some cases, you’ll need to offer collateral for a business loan. In other cases, you can get a small business loan without collateral, though stipulations will apply. Whether you can get a loan with or without collateral will depend on factors such as the loan type and your credit history.

Conventional Bank Loans

Many conventional business loans offered through banks are secured and require borrowers to pledge collateral. For real estate loans, the real estate being mortgaged typically serves as collateral. With equipment loans, the equipment you’ll be purchasing serves as collateral. Other examples of collateral you could offer to conventional lenders include cash and vehicles.

Some banks also offer unsecured business loans, typically for lower funding amounts. For these options, a personal guarantee will likely be required for approval. Indeed, according to business media company Inc., more banks are expecting small business owners to offer a guarantee.

SBA Loans

Loans secured by the Small Business Administration (SBA) often require collateral to minimize the associated risk. Examples of assets that can be provided as SBA loan collateral include equipment, buildings, accounts receivable and inventory.

Additionally, according to the SBA, business owners looking to borrow funds that require collateral should assume that all assets financed with their loan will be used to secure that loan, though additional assets may be needed.

- For standard SBA 7(a) loans greater than $350,000, lenders must obtain as much collateral as possible, up to the loan amount.

- For SBA 7(a) small loans from $25,000 to $350,000, lenders follow the collateral policies they’ve established for non-SBA commercial loans. At the least, the lender must take a lien on a borrower’s fixed assets, including real estate, as well as take a first lien on assets financed with loan proceeds.

- SBA 7(a) loans of up to $25,000 don’t require collateral.

SBA loans also require an unlimited personal guarantee from anyone owning 20% or more of the business.

Alternative Lender Loans

Loans and financing offered through alternative online lenders typically aren’t collateralized and don’t require a borrower to pledge specific assets. That said, a personal guarantee or blanket lien is usually required.

Because the value of specific collateral doesn’t need to be assessed with alternative loans, the application process is streamlined and it’s often easier for borrowers to qualify for financing.

How Much Collateral Do You Need for a Small Business Loan?

How much collateral you need for a business loan can vary.

If your business meets the criteria for a conventional bank loan, chances are you’ll have to secure that financing with some form of collateral, typically equal to or greater than the value of the loan.

Let’s go through the ins and outs of putting up business collateral so you can get the working capital your company needs to sustain or expand operations.

How Is the Value of Business Collateral Determined?

For loans that require business collateral, an appraiser will value the assets you’re pledging to secure the loan. It could be one item or several. The appraiser is licensed and hired by your lender to conduct a certified appraisal.

Based on its policies, the lender will “discount” the appraised value of the asset to account for depreciation, assuming that the asset value will be worth less in the future. The value assigned to an asset is often lower than the fair market value of the item because the lender may need to sell the property quickly to recoup funds in the event of default. Additionally, the asset value can change over time. As a result, it may need to be reassessed down the line, particularly if there are extended loan terms.

It’s important to note that discounts vary depending on the type of collateral. One example is real estate serving as collateral, which is often discounted to 80% of the present value. In contrast, inventory, which can be challenging to sell off, is typically assessed at much lower percentage discounts.

Loan-to-Value Ratio and Business Collateral

Loan-to-value (LTV) ratio refers to the total loan amount and how it compares with the value of the collateral you’ve offered to secure the loan. The LTV ratio provides lenders with a convenient, bite-size assessment of the risk of approving a loan.

Generally, the higher the LTV ratio, the riskier the loan is for the lender. In contrast, the lower the LTV ratio, the less risk for lenders and the lower your interest rate will likely be. Typically, an LTV ratio of 80% is considered standard.

| Loan-to-Value Ratios | |

| Equipment loans | 75%-100% |

| SBA loans | 70%-90% |

| Accounts receivable financing | 75%-90% |

| Commercial real estate loans | 65%-80% |

| Inventory financing | 50%-80% |

Keep in mind, lenders that don’t require business collateral do not consider the LTV ratio. Instead, they look at other factors to make their lending decision, such as cash flow, credit profile and business health.

Examples of Collateral for a Business Loan

Let’s take a closer look at what items you can use as collateral for a business loan. Consider assets that can be liquidated fast because banks and lenders need collateral that can be quickly converted into cash. That’s why cash is often preferred over most other forms of collateral.

Although some business loans have been secured with rather eccentric assets, including wheels of cheese, most banks rely on one of the following types of collateral for small business loans.

Cash

When it comes to taking out a business loan with collateral requirements, cash is king. Although it may seem paradoxical to secure a loan with money, a cash-secured loan is common. This is because cash-secured loans allow lenders to instantly recoup their losses in case you default.

Often, a cash savings account held by the business owner at the same bank will be used to secure the loan. Personal savings and other personal financial accounts are other types of collateral that banks usually accept because their offering reduces the risk for lenders. In the case of default, there’s nothing to sell; the bank simply seizes the bank account funds. As a result, the creditor can immediately liquidate the cash in the applicant’s savings account when necessary.

While cash-secured loans present a very low-risk solution for lenders, allowing a lender to claim your savings can present a high-risk opportunity for you. If you’re forced to default because of outside circumstances, then your personal financial security can be jeopardized.

Property

Although property and physical real estate can be more difficult to convert to cash, they are forms of business collateral widely accepted by creditors and lenders. Buildings, inventory and homes can be used as business collateral after being appraised by an independent party, as can vehicles and equipment, including cars, watercraft and motorcycles.

Be sure to consider the risk involved whenever you back your business loans with property. While real estate is one of the most common forms of collateral for business loans, if you default on your loan, you may lose your home. The same holds true for any other property pledged as collateral.

Inventory

One of the unsung forms of collateral business owners can use is their company’s inventory.

However, conditions apply when using inventory as small business loan collateral. For instance, the value of inventory may depreciate very quickly, so the assets may have to be appraised by an independent third party. Also, since the value of the inventory is subject to volatility, some lenders may be averse to offering inventory-secured loans.

One of the most effective ways to use your company’s inventory as collateral is with inventory financing, in which business owners take out a loan for purchasing stock they will later sell.

Invoices

Invoices, or accounts receivables, offer small business owners who don’t have enough cash on hand a way to secure their loan.

Invoice financing involves lenders accepting outstanding invoices as a form of collateral. For business owners who don’t have the credit score needed to get approved for a loan or need working capital as fast as possible, invoice financing provides a reliable option for locking down borrowed capital.

Investments

Securities are another form of collateral considered by banks and other lenders. The following types of securities can be acceptable forms of business collateral because they can be bought and sold on capital markets:

- Treasury bonds

- Stocks

- Certificates of deposit (CDs)

- Corporate bonds

Pros and Cons of a Collateral Loan

There are several advantages and disadvantages to getting a business loan with collateral requirements. Take the following considerations into account before making your decision.

| Pros | Cons |

| Can help borrowers with poor credit get financing | Application process can be complicated |

| Could help build credit | Must have asset(s) to pledge as collateral |

| Offers lower interest rates than unsecured loans | Can’t access the equity of pledged assets until the loan is paid off |

| Can be a larger loan amount than an unsecured loan | Can lose collateralized property if you can’t make your payments |

To Secure or Not to Secure a Small Business Loan With Collateral

There’s no way around it: You need cash to grow your business. No matter your industry or what type of company you operate, reliable access to funding is crucial.

Research your secured and unsecured loan options and determine if a business loan with collateral requirements is best for your business.