Asset based lending is a form of business financing in which the loan’s value and security are derived from the collateral you pledge — not your financial track record. As a result, it’s a useful form of financing if your business is young or you have less than stellar credit.

We’ll explore the ins and outs of asset based lending so you can determine if this type of financing is the right fit for your business’s needs.

Asset Based Lending: A Definition

Sometimes abbreviated as ABL, this lending is a form of business financing in which the loan is “secured” by your business’s assets. Lenders determine the borrowing base — the amount they’re willing to finance — based on the valuation of the pledged collateral. Such items include inventory, equipment and accounts receivables.

Asset lending can be in the form of a credit line or loan. Either way, though, if a borrower defaults on a loan, the lender can seize and liquidate pledged assets to recoup losses.

Why Consider an Asset Backed Loan?

When considering asset based lending vs. a line of credit from a bank or a conventional loan, remember asset based loans are based on the value of available collateral you can offer as opposed to cash flow. As such, it’s often used by companies with ebbs in cash flow, such as service companies, distributors and manufacturers. Businesses don’t necessarily need to be established or boast a healthy credit score either, which are common requirements with conventional business loans and lines of credit.

If your business needs a quick infusion of capital, an asset based loan could be a good option to get through a short-term lull or maintain your growth momentum.

What Types of Assets Do Lenders Prefer?

The list of assets you can offer as collateral can be long and varied. In general, lenders prefer liquid securities — assets that can be readily converted to cash with little to no loss in value.

These are the items found at the top of your balance sheet: things such as marketable securities (stocks and bonds) and accounts receivables (outstanding payments from your customers or clients).

A lender might grant up to 90% of the face value of such assets. While inventory, equipment and real estate can be pledged as collateral, expect to receive about 50% of their valuation because lenders consider these assets less liquid.

As an example, let’s say the Miller & Miller Law Firm seeks a loan to expand its operations. The company decides to pledge its accounts receivable balance as collateral.

Because of the high liquidity of accounts receivable balances, the lender agrees to advance 85% of the face value of these assets. On the balance sheet, the total of accounts receivables equals $105,000. This means the lender will loan $89,250 to the firm.

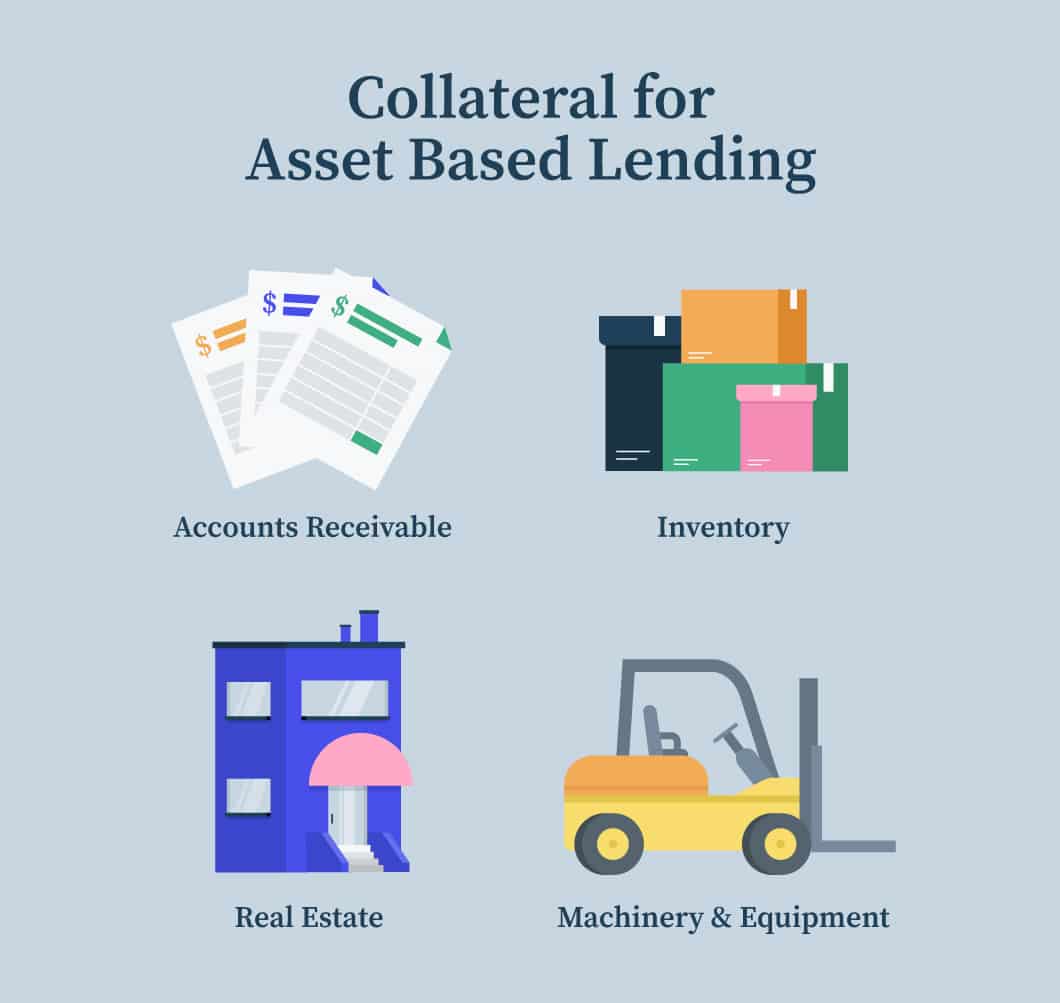

Most Common Collateral Pledged for Asset Loans

Here are 4 of the most common types of collateral used in asset based lending:

- Accounts Receivable: Typically, receivables due within 60-90 days may be pledged as collateral in an asset based loan. In this case, the size of the loan is proportionate to the outstanding receivables balance. The amount a lender will advance depends on many factors, including the collection period and the diversification of a business’s accounts. In most cases, advance rates on accounts receivables are set at 70%-90%.

- Inventory: If you’re a wholesaler, manufacturer or retailer, chances are you have a good amount of inventory on hand. That inventory can serve as collateral in an asset based loan. When assigning value, lenders will consider the nature of the commodity, margins and how quickly the inventory can be converted into profits.

- Machinery and Equipment: Any machinery or equipment your business owns can be pledged as collateral. As these assets are not as easily converted to cash, they require special consideration. The borrowing base, therefore, widely varies. A lender will consider an asset’s useful life to determine value depreciation over time.

- Real Estate: Any real estate a business owns can be used to secure asset backed lending funds. For this type of property based loan, an independent appraiser will need to determine the property’s market value and any appreciation. If you’re still paying a mortgage on the property, you’ll need to have paid off a significant portion to pledge the property as collateral.

What Are Some Asset Based Lending Companies?

Many banks today offer asset backed lending funds, with some banks even having special divisions specifically for ABL business loans. Examples of asset lending banks include U.S. Bank, Bank of America and Fifth Third Bank.

Other asset based loan companies include certain online alternative lenders, which may offer equipment loans or accounts receivable financing.

Regardless of the lender, your asset based loan terms will depend on the type of collateral your business offers as well as the value of the assets. Additionally, interest rates will vary depending on factors such as credit history, cash flow and time in business.

Asset Based Financing Basics

The application and approval process for an asset backed loan can be an extensive undertaking for both parties. In general, an ABL — more than other loan types — requires more paperwork and an involved due-diligence process, including an onsite audit. Before you apply, get a firm handle on the ABL finance consideration process to set your business up for success.

Gather Required Financial Documents

Asset backed lenders may request to see the following financial documentation:

- Balance Sheet: Your balance sheet offers a direct look into your assets, making it the single most important indicator of your business’s eligibility for asset based lending.

- Sales Forecast: Asset based lenders are more concerned with the future success of your business, rather than its history. If you have a well-researched sales forecast that tracks a growth trajectory, it might tip the scales in your favor.

- Banking Statements: Lenders will request to see at least 4 months’ worth of banking statements in your quest for an asset loan.

Before you apply, check each document for completeness and accuracy.

Prove the Value of Your Collateral

Depending on what you pledge as collateral, you’ll need to prepare the following statements to identify assets and their value when you apply for ABL financing.

- Accounts Receivable Aging Statement: If you plan to offer up your outstanding accounts receivables as collateral, you’ll need to prepare an aging statement that shows open invoices, their terms and the number of days these invoices have been open.

- Inventory List: If you seek to secure an asset loan backed by your inventory, a lender will request a detailed itemization, noting the location and resale value of each asset.

- Machinery and Equipment List: If you’re offering your equipment as collateral, you’ll need to detail each item’s purchase price, whether it was purchased new or used, its age, its location and its condition. You’ll also need to account for the depreciation of the equipment to estimate its current value. This may require an independent valuation from an appraiser.

Prepare for a Field Audit

As part of the asset based lending process, a lender will most likely conduct an onsite audit of your business. They’ll visit your space, audit your financials and examine any physical assets that will serve as collateral for the loan. If you’re approved, be aware that your lender may perform periodic audits of your collateral to continuously assess value.

Asset Based Financing Pros and Cons

Before you decide if ABL is right for you, consider the risks and benefits of asset based lending.

Pros

- Asset backed loans are more accessible than their cash flow counterparts

- A business that has assets on the balance sheet can put these investments to good use and secure additional funding for growth

Cons

- Not all assets qualify as collateral; for an optimal loan-to-value ratio, lenders look for high liquidity and low depreciation rates.

- Due to the thorough due-diligence process, obtaining an ABL takes time, so it’s not the best option if you need immediate access to capital.

- There is the risk of losing your assets in the event of default.