Business Line of Credit Calculator - How Much Can You Afford?

If you need working capital, incur emergency expenses or have fluid project costs, a business line of credit can provide the capital you need to help maintain the status quo.

With this small business line of credit calculator, see how affordable a credit line can be.

What Is a Business Line of Credit?

A business line of credit provides approved companies access to funds to spend as they need them. You withdraw the funds your business requires while only paying interest against the capital you’ve used. Additionally, you’re never obligated to draw the entire credit line.

Understanding Your Repayment Structure Using a Business Revolving Line of Credit Calculator

Before securing any business line of credit, use a small business line of credit payment calculator to understand what your business will be expected to pay.

Before making any decision, be aware of the following cost factors.

Terms

When you come to terms on a loan product, you’re given your funds all at once, along with an accompanying repayment schedule.

A business line of credit, on the other hand, only requires payment once you’ve withdrawn from your credit line. As you find with a term loan, a business line of credit will provide repayment parameters once a withdrawal is made.

Depending on the lender you’re working with, your repayment period can extend from 12 months to 10 years, though a term of 24 months is common. That said, terms are subject to your unique qualifications as well as your lender’s policies and preferences.

Interest Rates

As noted, interest is only applied to the funds you withdraw, not the total line of credit. This is where using a business line of credit loan calculator can be helpful.

Aside from your own qualifications, where you secure your business line of credit will also impact your interest rate. Lines of credit from banks historically carry the lowest rates, while alternative lenders typically have less competitive rates due to the increased risk they face.

It’s important to remember that even though a bank rate may be lower at face value, the total interest over the course of the line of credit through an alternative lender could be lower. This is due to the fact that alternative lenders use a condensed term (12-24 months) when compared with conventional lenders.

Fees Excluded From a Business Line of Credit Interest Rate Calculator

The most common fees attached to a business line of credit are application fees, origination fees and draw fees.

While application and origination fees are one-time costs, draw fees are common when you borrow money from your credit line. Some lenders may charge 1%-3% of the amount you borrow.

In contrast, if you don’t borrow any money from your line of credit, some lenders may charge a small monthly maintenance fee for non-use, which could be $20, for example.

You could also be charged a fee for missed or late payments.

Because such fees aren’t folded into your interest rates, it’s important to include them when determining your overall costs. By adding your estimated fees, you’ll come away with a much clearer picture of how much your business will pay.

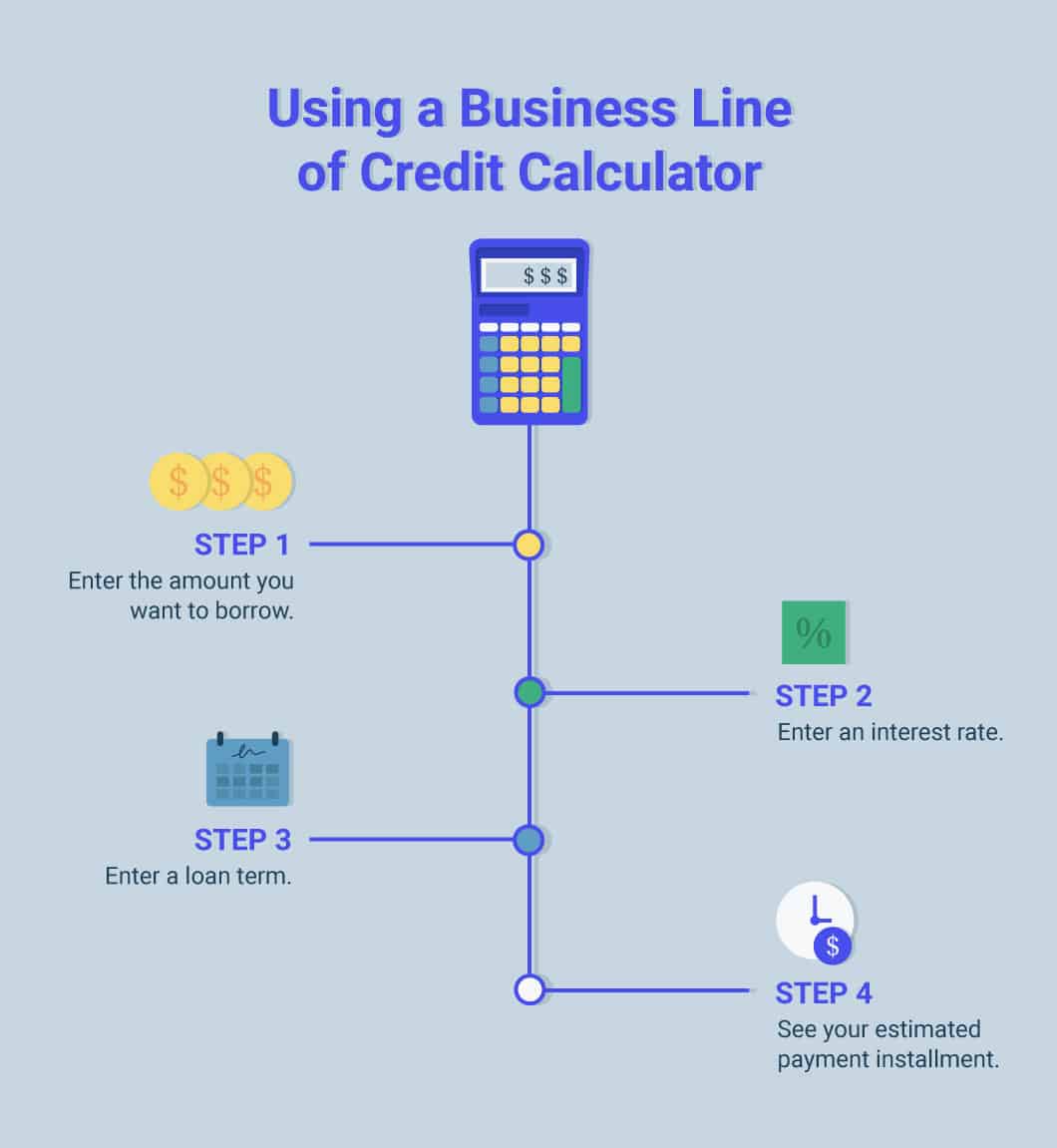

How Small Business Line of Credit Calculators Work

The business line of credit calculator works by estimating your monthly payment if you were to draw the entire credit line.

Let’s review factors a business line of credit calculator uses to make its estimations:

- Loan amount

- Interest rate

- Loan terms

Example Using the Commercial Line of Credit Calculator

Let’s say you were approved for a $50,000 line of credit at an 8% interest rate with a term of 24 months.

You opt to access the total amount in a single draw. In this case, the business line of credit monthly payment calculator would show you’re responsible for $2,261. You’d pay this amount each month over the course of 2 years.

With a revolving credit line, as you were to pay down your debt, you could draw from your available credit line when needed again, subject to a draw fee.

Understanding Your Business Line of Credit Calculator Results

Using Fast Capital 360’s business line of credit loan calculator, you’ll have a clearer sense of what your monthly payment might be.

Plug figures into the calculator at the start of this page to evaluate how different credit line amounts impact your overall costs.

The Final Calculation on Small Business Line of Credit Calculators

As you begin identifying the best business line of credit, use a payment calculator to estimate your costs. If you’ve received several offers, see how each one’s interest rate, repayment term and fees compare.

Alternatively, if you’re starting your search, business line of credit payment calculators are fantastic tools to check your potential costs. Based on the information a business line of credit calculator provides, you’ll have a better idea of just how much your business can secure and pay off.

Whether you’re looking for a credit line or are simply curious about what a revolving business line of credit calculator could tell you, Fast Capital 360 has the information and detail you’ve been seeking. If you still have questions about your line of credit payment calculator results, our team of expert Business Advisors will be happy to guide you.