Current small business loan rates can start around 3% for the most qualified applicants at conventional banks to about 7% with online lenders.

Ultimately, the interest rate on a business loan will be determined by loan type, lender, credit score and other factors. Finding the best small business loan rates will help you finance your company’s growth and make worthwhile investments.

Average Business Loan Interest Rate

According to the most recent Small Business Lending Survey data from the Federal Reserve Bank of Kansas City, the weighted average interest rates for small business financing range from 3.02%-6.85%.

The lowest interest rate was seen with outstanding fixed-rate term loans (including Paycheck Protection Program loans). The highest was evident with outstanding variable-rate lines of credit. Additionally, new term loan interest rates were higher than new line of credit rates.

Interestingly, in the third quarter of 2021, the weighted average interest rate for most small business loan products increased or remained stable, with the largest increase reportedly for fixed-rate term loans.

Commercial Business Loan Rates Today at a Glance

Of course, average business loan interest rates today vary depending on the loan type and lender, among other factors. For instance, current business loan rates and line of credit rates that are variable and offered through conventional banks are typically tied to the prime rate (7% as of Nov. 2, 2022), plus an additional percentage. Additionally, secured business loans often have lower interest rates than unsecured ones.

That said, here are interest rates and factor rates for popular business funding models from our partner lenders, from short-term loan interest rates to Small Business Administration (SBA) loan rates.

- SBA loans: Starting at 6% interest rate

- Medium-term loans: Starting at 7% interest rate

- Business line of credit: Starting at 8% interest rate

- Equipment financing: Starting at 8% interest rate

- Short-term loans: Starting at 10% interest rate

- Invoice financing: Starting at 1.02 factor rate

- Merchant cash advances: Starting at 1.10 factor rate

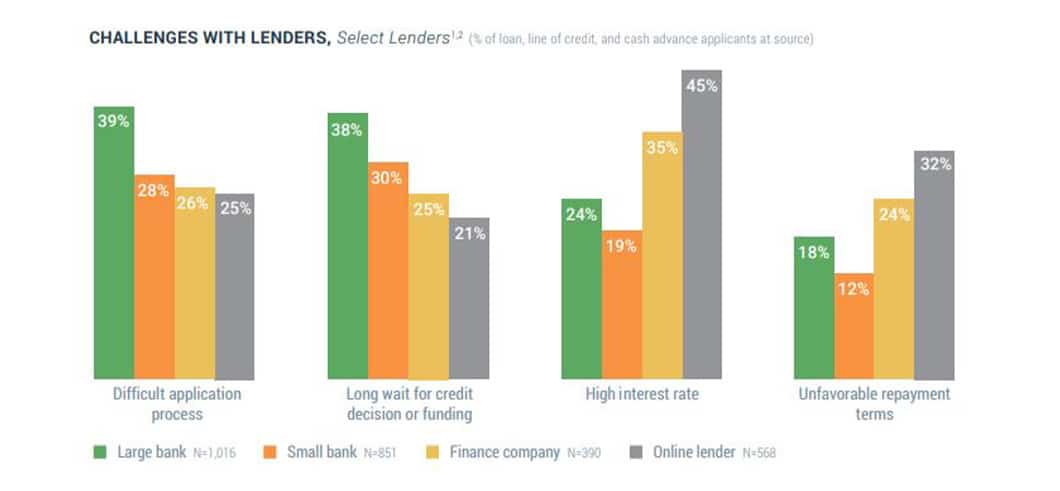

Keep in mind, conventional business loan rates will likely be more competitive than rates offered through online lenders. Indeed, according to the Federal Reserve Banks’ 2022 Small Business Credit Survey, when it comes to avoiding high interest rates, small banks are the go-to lender, followed by large banks. However, while these lenders are known for low-rate business loans, they also have the most difficult application processes and the longest waits for credit decisions and funding.

Image Source: Federal Reserve Banks’ 2022 Small Business Credit Survey

Related: What Are the Current SBA Loan Rates?

What Goes Into Business Loan Terms and Rates?

Loan interest rates aren’t going to be one size fits all. As a rule of thumb, though, business loans with low interest rates are often reserved for those with the strongest financial standing.

After applying for a small business loan, a lender will review several factors before finalizing the loan and rate. Here are common considerations that could influence your loan interest rate:

- Credit score

- Industry

- Monthly revenue

- Cash flow

- Time in business

- Collateral

It’s important to note that some lenders will review your personal and business credit score to determine your business loan rate.

Additionally, the amount of time you’ve been in business as well as your monthly revenue can give lenders an idea of your ability to make payments and your commitment. Having substantial collateral, such as home equity or equipment, can also help you secure a loan.

Common Hidden Fees for Small Business Loans

Small business loan interest rates aren’t the only fees you may be paying when you accept a financing offer. In some cases, you might end up with additional fees, such as the following:

- Application fees

- Processing fees

- Prepayment fees

- Service fees

- Late payment fees

- Closing fees

- Guarantee fees

- Origination fees

Being aware of these added fees will help you better compare business loan rates and make the best decision for your business.

Certain fees, such as late payment fees or prepayment fees, are punitive. Other fees, like processing, application and origination fees, serve as a way to compensate lenders for the time and effort put into assessing your application and approving your loan. Sometimes an origination fee may be taken off the principal sum you receive on your loan.

Although many lenders will have at least one of these fees, the added cost can vary widely. For example, an application fee might be a couple hundred dollars or less, whereas an origination fee could amount to 1% or 2% of your loan, which is removed from your principal at closing.

Needless to say, be sure to consider additional fees as well as your business loan interest rate offer to gather a full picture of what you’ll be responsible for.

Finding the Best Business Loan Interest Rates

When it comes to small business loan interest rates, a little bit of research and a willingness to shop around for the right lender and loan will go a long way. After all, securing working capital is a necessity for many small businesses. By staying informed, you can track down the best business loan rates to build your company.