When you are thinking about applying for a business loan, there are different ways of evaluating them. Finding the best interest rate or the lowest monthly payments should not be the only thing you examine. By checking the annual percentage rate (APR), you can more easily compare the total cost of your loan. But what is APR, exactly?

It is the amount you will pay each year in interest on your business loan, credit card, or mortgage. The APR will include additional fees charged as part of the business loan to measure your true total costs of borrowing money.

Fees may include items such as:

- Loan origination fees

- Lender processing or services fees

- Application fees

- Underwriting fees

- Document preparation fees

APR gives you a standard way to compare business loan rates from lenders. While you may find a lower interest rate from one lender, the additional fees charged will make the loan more expensive than another lender that’s charging a higher interest rate with no additional fees.

If you want to see which business loan will cost you the least in the long run, look for the loan with the best APR.

APR vs. Interest Rate: What’s the Difference?

When you take out a loan, there are more factors to take into consideration than just the interest rate. Considering other fees are added to the loan which can increase the cost of borrowing money, you will see a difference between the interest rate and the loan APR.

For example, if you are taking out a business loan for $10,000 with a 5-year term and a fixed interest rate of 9%, you would expect to pay $2,455.01 in interest. However, if the lender charges a 3% origination fee to initiate the loan ($300), the interest rate remains at 9% but the loan APR rate is at 10.31%.

Unless there are no added fees, the APR rate will always be higher than the interest rates charged. If there are no additional fees, the interest rate and APR will be the same.

How Is APR Calculated?

When you apply for a business loan, lenders will use different factors to assess your creditworthiness. They generally pull a credit report and check your business credit score to look at how you have used credit in the past, your credit utilization ratio and whether you’ve made timely payments.

The APR a lender quotes you will also be dependent on the loan amount, term and the lender’s cost for borrowing money and processing payments.

APR Calculation Formula

To calculate the APR, you will need to know:

- Loan amount

- The term

- Any fees associated with the loan

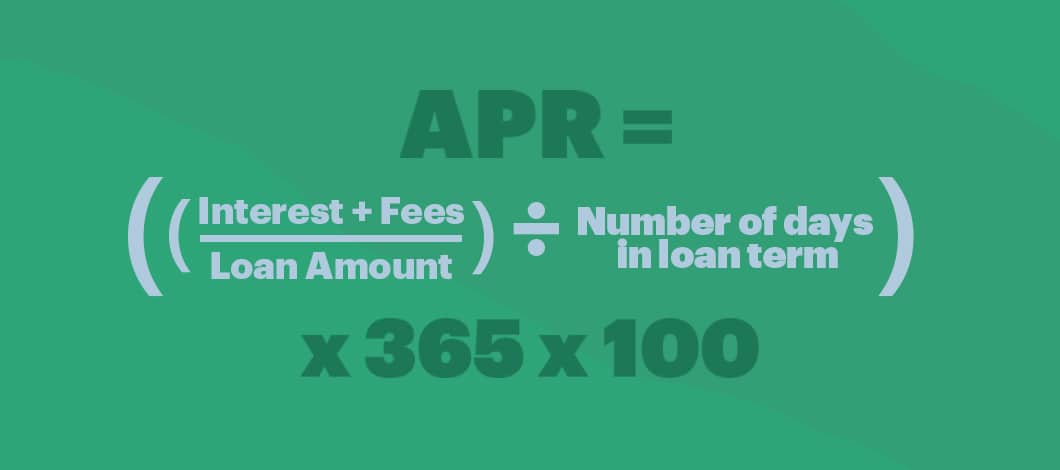

The APR equation looks somewhat complex.

APR = ((Interest + Fees / Loan amount) / Number of days in loan term)) x 365 x 100

So, let’s break it down step-by-step:

- Fees + Interest over the term of the loan

- Divide the above by the amount of the loan

- Then, divide by the number of days in the loan

- Multiply by 365

- Multiply by 100

This provides you with the APR. Here’s a simple example of the APR equation in action. Let’s say you are taking out a microloan for $2,000 with a 2-year term with a 5% interest rate and $200 in closing fees. Over the term of the loan, you would pay $200 in interest.

- Fees + Interest: $200 + $200 = $400

- Divide by the amount of the loan: $400 / $2,000 = 0.2

- Divide by the number of days in the loan: 0.2 / 730 = 0.000274

- Multiply by 365: 0.000274 x 365 = 0.10

- Multiply by 100: 0.10 x 100 = 10

So, even though your interest rate is 5%, your APR in this case would be 10%.

Fortunately, you don’t have to do the math by hand. Lenders are required to disclose the APR as part of the Truth in Lending (TIL) disclosure statement.

You also can skip the APR equation and figure your loan costs using our business loan calculators.

What Are the Different Types of APRs?

Doing the calculation yourself can be tricky because there are different types of loans that impact the APR. For example, business loans may offer:

- Fixed rates

- Variable rates

- Introductory rates

- Penalty rates

While a fixed rate business loan will have the same interest rate for the duration of the borrowing period, a variable rate business loan may have different interest rates over time. With a variable rate business loan, interest rates are tied to benchmarks, such as the prime rate. If the benchmark rates rise, the interest charged will rise. This also raises the APR.

Some lenders will offer introductory rates. For example, lenders may offer a reduced interest rate for the first year as an enticement. This also impacts the APR. Lenders also may assess additional fees or penalties if you fail to live up to the terms of your agreement. Besides late fees, lenders may impose a penalty and raise your interest rate.

It’s Critical to Know the Terms

It’s crucial to understand the terms of any business loan you take out. While lenders are required by law to disclose the APR, as you can see, the APR can vary depending on other factors depending on the type of loan and the conditions.

If you are using your business credit card rather than taking out a business loan, you may have different APRs depending on how you use your card. For example, taking out a cash advance from your credit card will typically have a higher APR and no grace period.

Effective Interest Rate vs. APR

Another term you may encounter is the effective interest (EIR). The EIR is sometimes called the effective APR, effective annual rate (EAR), or annual equivalent rate (AER), but they all mean the same thing.

While the APR doesn’t take into account the compounding of interest over the term of the loan, the EIR does. Compounding happens when interest is charged on top of the interest you already owe.

An easy way to think about this is to think about your business credit card. If you have an outstanding balance of $1,000 and a 10% interest rate. Add the $100 in interest and you owe a total of $1,100. If you did not make any monthly payment, the next month, the 10% would be applied against the entire balance of $1,100 which would add another $110 in interest for a total of $1,210 (not including any late fees).

Compounding works great when you are saving money, but can significantly increase the amount you owe. When you are applying for a business loan, pay careful attention to how the interest rate is applied.

With a fixed-rate loan, if you make your monthly payments on time, compounding isn’t generally a concern. That isn’t the case with a business credit card. Most card issuers compound interest on either the daily balance or the average balance during the month. Rather than assess a monthly rate on the balance at the end of the month, credit card companies will apply the daily interest rate against the daily balance or against the average balance.

The Limitations of APR

If the amounts and lengths of the loans are the same, APR gives you an easy way to compare the total cost of the loan, but it doesn’t tell the whole story.

For example, if you are comparing a $100,000 loan with a 5- and a 10-year term, they both may have the same APR. Remember, APR is the average interest rate for a year. You will pay more interest on the 10-year loan because you are paying off the loan more slowly.

The amount of the loan also impacts your total costs. A $200,000 loan with a 10% APR and a 10-year term will cost more than $100,000 loan with the same APR and term. 10% of $20,000 is more than 10% of $100,000.

When you are shopping for a business loan, lenders will often show a range of APRs. However, you likely won’t know the actual APR until after your loan application has been processed because the final rates offered will depend on your credit history and other factors.