Many small business owners turn to inventory financing when their current working capital doesn’t cover product purchases outright. Here’s what you should know about the types of inventory-based loans, how they can benefit your business and how to apply for inventory funding.

What Is Inventory Financing?

Inventory financing is any type of loan, line of credit or other funding solution that small businesses use to purchase products and stock. This type of lending is helpful for product-based businesses, such as retailers and wholesalers.

Inventory business loans can help you buy stock in bulk, take advantage of a discount from a vendor or make inventory purchases during seasonal cash flow shortages.

How Inventory Financing Loans Work

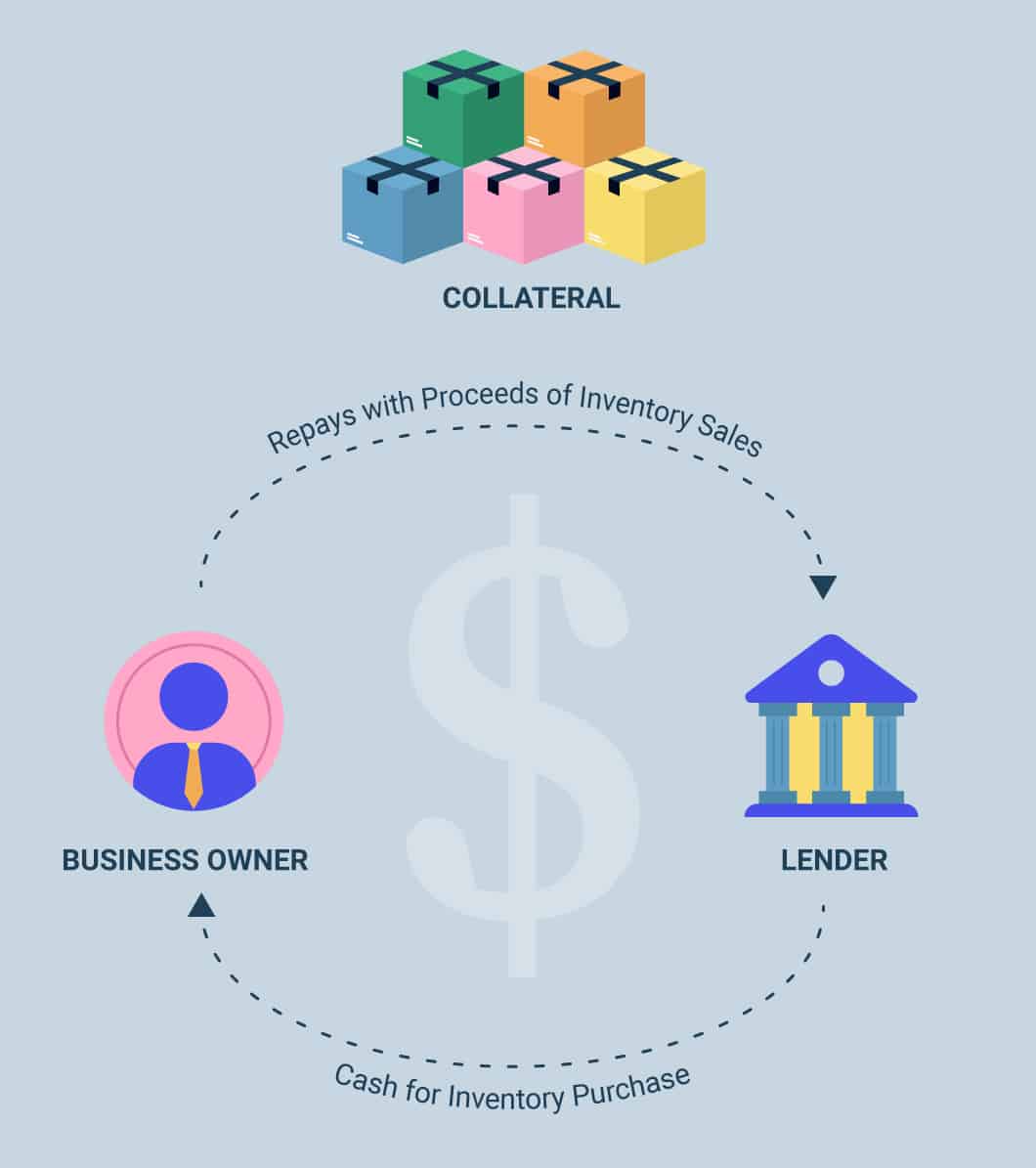

The products a business buys with inventory funding act as collateral to secure the financing. Similar to equipment financing, inventory financing loans open opportunities for small businesses that might not have assets to secure other types of funding.

During your repayment period, the inventory is yours to sell. The revenue you generate repays your loan. Consequently, lenders assume the risk when products don’t sell. If a borrower misses payments or defaults on the loan, the lender can repossess and liquidate the products to recoup the money.

Because of the risk, inventory financing companies rarely (if ever) finance 100% of the value of the products. Instead, you’re more likely to receive 50%-80% of the liquidation value, which may be less than the initial purchase price.

Related: Secured Business Loans

Types of Inventory Financing

If you think inventory financing is the best option for your business, there are 3 types to consider: an inventory loan, an inventory line of credit or vendor inventory financing.

Inventory Loan

With an inventory loan, your small business will receive funding from a lender to finance your stock supply. Given the typically high turnover rate for retail inventory, getting a short-term inventory loan rather than a longer-term inventory financing loan is more practical.

You can obtain inventory business loans through banks or alternative lenders. Inventory loan rates and terms will depend on the lender, the inventory’s liquidation value and, in part, your creditworthiness and business’s financial picture.

Inventory Line of Credit

An inventory line of credit provides borrowers with a pool of funds from which they can draw. The company’s inventory (on-hand or to be purchased) secures the credit line.

Inventory credit lines are often revolving, meaning the line is replenished as you pay back what you’ve borrowed.

Related: How to Get a Business Line of Credit (Plus Where to Look)

Vendor Inventory Financing

Rather than obtaining inventory financing through a lender and then purchasing your stock, with vendor inventory financing you get lending directly from your vendor.

There are 2 types of vendor inventory financing:

Debt Financing

- Vendor provides a loan for the purchase of inventory

- You repay the loan with interest using your sales revenue

Equity Financing

- Vendor supplies goods in exchange for stock in your company

- While you won’t have to repay them for the cost of the inventory, your vendor will become an equity shareholder in your company — meaning they’ll have a say in future decisions the company makes

Vendor inventory financing is a good option for businesses that either don’t qualify for other funding options or don’t want to incur debt from a lender. This type of inventory financing can also help build a relationship between you and a vendor.

However, interest rates from vendor debt inventory financing can be higher than what you’d get from a lender.

Inventory Financing Rates

Inventory financing rates will vary based on whether you get a loan specifically for buying product stock or use another type of funding solution to purchase your inventory.

Because there’s an increased risk with inventory lending, interest rates will be higher. This is because lenders have to try to get value for your products if they need to sell them, but that can be difficult. Increasing interest rates is a way to mitigate that risk. Therefore, it isn’t uncommon for inventory financing rates to be in the teens or exceed 20%.

Other inventory business loans and lines of credit can have lower rates, but they can require additional collateral to secure the financing. You’ll have to determine your priorities when choosing which funding option you think is right for your small business.

Do you need a loan to buy inventory?

Pros and Cons of Inventory Financing

As with other funding options, inventory financing has advantages and disadvantages. Let’s break them down.

Pros of Inventory Financing

It’s always a good idea to weigh the advantages and disadvantages of any business decision. Here are a few of the positives of using inventory financing.

Helpful for Seasonal Businesses

If you want to buy inventory for a seasonal retail store, you may not have the cash flow upfront to get what you need.

For example, a garden center will make most of its money in the spring and summer months, when people are looking to beautify their outdoor spaces. This means they need to have inventory on hand to meet the demand, but they may not have made enough money during the slow months to purchase sufficient stock.

That’s where inventory business loans come in: You can supplement your own working capital to buy the inventory you need to satisfy customer demand.

Renewable Funding Source

A business line of credit is a versatile funding solution for businesses with ongoing working capital needs. When used as inventory financing, it can be a renewable source of income for a growing retail operation.

Since you can withdraw more funding after paying off what you borrow from inventory financing lenders, it’s an appealing solution for retail businesses that need flexible and continued access to capital.

No Risk to Personal Assets

While it’s possible to get unsecured business loans to buy inventory, many lenders need some type of collateral to approve a loan. This often means a business owner’s personal money, vehicles or house can be at risk in the case of default.

Since inventory business loans use the products themselves as collateral, you won’t have to worry about losing any personal assets as with other options (unless you’ve signed a personal guarantee).

Less Emphasis on Credit Score

Lenders often check personal and business credit scores when reviewing financing applications. However, because products secure inventory business loans, your credit score won’t be as much of a factor to lenders.

Your ability to repay the inventory loan directly correlates to how well you can sell the product, so that’s the main focus. While it isn’t easy to secure a loan with poor credit, you won’t need a high credit score just to be considered (e.g., 700+ credit). In some cases it might even be possible to get inventory financing without a credit check.

Cons of Inventory Financing

Although the advantages are attractive, there are a few reasons why inventory financing isn’t the best option for some businesses.

Higher Rates

Lenders mitigate their risk by increasing interest rates on business inventory loans. These higher rates can make this type of financing more costly. While inventory loan rates can be lower than 10%, rates can also range up to nearly 100%, depending on the lender.

Note: Your product line has a lot to do with the inventory loan rates for which you can qualify. If the inventory won’t hold value or is difficult to liquidate, rates can be steep.

Shorter Terms

Lenders always want to minimize their risk, so you’re likely to receive a short term on your inventory loan. Products will be liquidated in the case of default, so offering term lengths between 6-12 months means lenders are less likely to be stuck with outdated items they can’t sell.

While shorter terms can be a boon for those who don’t want to lock up their capital long term, it also raises payment amounts.

Stricter Approval Standards

Inventory financing lenders are unlikely to offer you funding if they don’t think the product will sell based on your industry, sales or demand. The need for lenders to minimize risk also leads to restrictions on uses for small business inventory loans. Products that will quickly become outdated or difficult to liquidate are unlikely to qualify.

Some examples include computer equipment, perishable products and some seasonal items unlikely to have future value, such as New Year’s Eve decorations with the current year printed on them.

Longer Business History Preferred

Inventory financing companies like to see businesses with a pattern of being able to sell inventory quickly and with a solid profit margin. You’ll usually need at least a year in business to prove that. If you need funding with less than a year in business or if you’re seeking inventory financing for startups, you’ll have to explore other financing options.

How to Get Inventory Financing

When you’re ready to get an inventory loan for your small business, follow these steps:

1. Compile Financial Documents and Business Information

When applying for an inventory financing loan, lenders will want assurances that you have a healthy inventory turnover. Have the following information on hand to give your lender a full view of your small business finances and operations:

- Balance sheets

- Profit-and-loss statements

- Sales forecasts

- Cash flow statement

- Personal and business tax returns

- Bank statements (often the past 4-6 months)

- Inventory lists and management records

- Personal information and information about any co-owners or other business partners

2. Complete and Submit an Application

The inventory financing application process will vary. Conventional lenders, such as banks and credit unions, have a lengthier application process and will ask you to submit a large portion of paperwork and documents. You might also have to meet with the lender before they approve your application.

If you go to an alternative lender, you can fill out an application online and upload required documentation in just a few minutes.

3. Await Final Approval and Make Your Decision

Your total wait time from application to approval depends on the lender. Conventional lenders can take several weeks or even more than a month to vet your application thoroughly.

Alternative lenders, in contrast, can approve applications in days and sometimes grant same-day funding once approved. However, note that using inventory as collateral in your loan means that lenders might perform an audit of your business’s sales and inventory operations.

If you end up being approved for inventory financing, you can then assess the terms of the agreement. Make sure to consider the inventory loan rate before signing.

Related: Why APR Is the Wrong Metric

Inventory Loan Alternatives

Loans secured by inventory aren’t the answer for every small business. The following are some popular alternatives to traditional inventory financing.

Short-Term Loans

As the name suggests, short-term loans are similar to term loans but with shorter repayment lengths. Instead of having years to pay back your loan, these loans can have terms as short as 3 months. Short-term loans can be used for any business need, including for the purchase of inventory.

The shorter repayment terms mean businesses with less-than-excellent credit can find better chances of approval. Many online lenders offer short-term loans, making it a great inventory financing option for small businesses that need money quickly.

Merchant Cash Advance

This alternative to inventory financing isn’t a loan but, as the name notes, funding offered against future sales. Some financing providers, such as Fast Capital 360’s lending partners, could approve up to $500,000 in merchant cash advance financing, which you could use for inventory purchases. You’ll repay the advance through daily or weekly installments, either as a percentage of “holdbacks” of future sales or through Automated Clearing House (ACH) withdrawals.

Accounts Receivable Financing

If you’re in the business-to-business space and experiencing a cash-flow gap while you wait for customers to pay their invoices, you might consider using accounts receivable financing to fund your inventory purchase. With this alternative to inventory financing, lenders will advance a percentage of your accounts receivable — sometimes 80% or 90% of their value — and you’ll receive the remaining amount (minus lender fees) once the balance is paid in full.

SBA CAPLines

If you’re looking to buy inventory for a retail store or other small business that has seasonal sales increases, the Small Business Administration’s Seasonal CAPLine is for you.

This SBA inventory financing option, which is part of the 7(a) loan program, works as a business line of credit, with a maximum credit line of $5 million. These loans can be used to purchase inventory for an upcoming busy season. Maturity lengths can go up to 10 years, making them a great choice if you prefer a long-term commitment.

Business Lines of Credit

If you need inventory financing immediately or don’t have the creditworthiness to be approved by the SBA, you can still receive a business line of credit from alternative lenders.

If you choose to go this route, you can withdraw funding from the line of credit to cover operating costs other than inventory. That versatility could be beneficial for growing small businesses.

The speed and accessibility to funding that online lenders offer makes business lines of credit attractive.

If you go through an online lending marketplace, such as Fast Capital 360, you can have one application sent to multiple lenders. This cuts the time you have to spend filling out multiple applications to several lenders.

Qualification requirements also are much lower than SBA, bank and inventory loan lenders, opening up doors for businesses with lower credit scores.