You’ve decided to apply for a business loan, but what do you need to get started?

Understanding a lender’s business loan requirements before you apply can help fast-track your application and the underwriting process.

This guide will explain standard commercial loan requirements and what you’ll need to do when qualifying for a business loan.

Business Loan Application Requirements

There are several factors involved in qualifying for a small business loan. These loan requirements impact the funding amount, interest rate and repayment term the lender will grant.

Although specific requirements vary by institution and type of financing, in general, lenders ask for the following information and documents to evaluate your application:

- Personal information

- Business information

- Time in business

- Annual revenue

- Cash flow

- Credit score and debt load

- Industry

- Collateral

- Business documentation

- Desired loan amount

- Intended loan use

1. Personal Information

One of the first small business loan application requirements is your personal information. Lenders want to know about you and other co-owners of your small business; some of this information includes the following:

- Full name

- Social Security number

- Address

- Marital status

2. Business Information

Another one of the commercial loan requirements is basic information about your business. Lenders can ask for the following:

Full Business Name

Lenders need your business’s full name (including a DBA, “doing business as” name, if applicable) so they can search public records for details about your company. This includes Uniform Commercial Code (UCC) liens filed through the Secretary of State office. An active lien indicates there are claims other lenders have against your assets.

Employer Identification Number

If you aren’t exempt from needing one, an IRS-provided employer identification number (EIN) acts as a Social Security number for your business. A lender will use it to perform a background check to verify the information you provide about your company.

Ownership or Partnership Information

If you aren’t the sole owner, you’ll need to provide information on your business partners. This allows a lender to get a full view of how your company runs, what responsibilities each owner has and how their credit scores and assets impact terms.

3. Time in Business

A big factor in business loan requirements is operating for a certain length of time.

For example, bank and Small Business Administration (SBA) loan requirements usually mandate companies to have been in business for at least 2 years. Lenders like to see a history of success, and established businesses are considered less likely to falter and default on a loan.

However, newer businesses aren’t out of luck. Some financing options, such as merchant cash advances, can be obtained by businesses that have been open for less than a year.

4. Annual Revenue

Lenders want to see your annual revenue totals and examine the details, such as any year-over-year differences and seasonal cash flow disparities. Annual revenue requirements vary by loan type and lender. A lender might require a minimum of $50,000 annually for an SBA loan, while you could need $200,000 or more in revenue to qualify for a business term loan.

Some lenders will list specific revenue requirements on their website’s respective loan product page. Bank of America, for example, requires a minimum of $250,000 in annual revenue for a secured business line of credit, secured term loan and commercial real estate loan. In contrast, its unsecured loans are available to businesses with at least $100,000 in yearly revenue. Fast Capital 360 notes that its lending partners require $200,000 in annual revenue to qualify for a business line of credit.

5. Cash Flow

In addition to revenue, lenders will look at your cash flow, which indicates your ability to repay the loan you’re requesting.

If you have high revenue but also y high expenses, your cash flow may be insufficient to afford a loan. The higher your revenue and cash flow, the better your chances are of qualifying for a business loan.

Related: Cash Flow Loans for Small Business

6. Credit Score and Debt Load

Credit score, which considers your credit history and debt load, is another factor lenders consider when evaluating you for loan approval: The higher your credit scores and the lower your debt load, the better. Note that even though business and personal credit scores are separate entities, lenders can still weigh both in their small business loan requirements.

Personal Credit Score

Although you’re borrowing money for your business, your personal credit score can impact your fundability.

Banks might require a personal credit score of at least 700, while SBA lenders may accept a score of 650 and alternative lenders may consider applicants with scores in the 500s.

Your personal credit history will be used to vet you as an owner, with lenders assessing your money management skills outside of your business. A personal history of delinquencies or bankruptcies will worry a lender, even if your business’s financials are strong.

Business Credit Score

Your business credit score is another factor lenders take into consideration. Depending on your preferred business financing, small business loan credit score requirements will vary. However, a score of more than 80 on a scale of 0-100 is considered very good.

Having an excellent credit score will help get you approved with banks and SBA lenders for term loans with high amounts and low rates. SBA loans are popular for businesses with good credit, as they offer competitive terms and are partially guaranteed by the federal government.

If you don’t have a good credit score, don’t worry. With the emergence of online lenders, finding bad credit small business loans isn’t as difficult as it used to be.

Small Business Tip

The best way to secure better rates and terms on your small business loan is by improving your creditworthiness. Being on time with payments and practicing better money management skills can repair your credit score and get you approved for affordable funding.

Related: What Credit Score Do I Need to Qualify for a Business Loan?

Debt Service Coverage Ratio

A large part of assessing your risk includes looking at current debts.

To do this, lenders calculate your debt service coverage ratio (DSCR) based on what you owe compared to your business’s revenue.

DSCR is an important business loan requirement because it allows lenders to judge what you’re capable of paying.

If you have multiple loans and other payments that cut too far into your revenue, you’ll be unable to take on another loan payment.

If you have a current debt that will soon be paid off, it might be best to wait before applying for a small business loan.

Refinancing can be a good way to lower your DSCR. If you borrowed financing as a startup or have raised your credit score since you took out a loan, you might consider refinancing for better terms.

7. Industry

In some cases, companies in a certain industry may have a more difficult time qualifying for a business loan.

For instance, businesses involved in any of the following are ineligible for SBA loans:

- Gambling

- Loan packaging

- Speculation

- Investments

- Lending

- Leasing

- Insurance

- Pyramid sales plans

- Religious organizations

- Rare coin and stamp dealers

Other industries, like commercial trucking and used car dealerships, have higher failure rates and are a bigger risk to lenders.

Also, it’s important to note that lenders have different assessments for sole proprietorships, partnerships, LLCs and corporations. Your business structure will determine what additional information you’ll need to include with your loan application.

8. Collateral

If you’re applying for a secured bank loan or loan backed by the SBA, you’ll likely need to offer collateral to secure the loan.

Collateral could be in the form of money, inventory, real estate, equipment or accounts receivables. A collateral-backed loan is less risky for lenders, so a secured loan can net lower interest rates.

If you’re applying for unsecured business loans, which don’t require collateral, you’ll usually need to provide a personal guarantee. In some cases, collateral-backed loans also might require a personal guarantee. This means you’re personally liable to pay the lender back if your company defaults on its loan.

9. Business Documentation

Commercial loan requirements include sharing certain documents to demonstrate your business’s current state and offer a picture of its future. Lenders could request several months to up to 2 years of financial documentation, along with the following information:

- Business plan

- Balance sheets

- Commercial property lease or deed

- Business licenses and permits

- Personal and business tax returns

- Profit-and-loss statements

- Accounts receivable and accounts payable statements

- Corporate documents (e.g., articles of incorporation, bylaws)

10. Loan Amount

One of the first questions a lender asks is, “How much do you need to borrow?”

The loan amount you need can help determine what type of financing you’ll apply for and what kind of lender you’ll work with. For example, larger banks don’t typically offer microloans; instead, focusing on business loans for more than $50,000. Online lenders can finance small loan amounts, they won’t exceed set maximums (which can be 5 or 6 figures).

Note that some business loans require a down payment (sometimes up to 20%). However, some financing options, such as a business line of credit and accounts receivable financing, don’t need a down payment.

11. Loan Use

It’s essential to explain precisely how you’ll use the funding to grow your business.

If you’re buying a tangible asset, such as commercial real estate, you’ll need to provide basic information about it. This can be an address, square footage and pictures for an office space. Or, if you’re buying equipment, such as a commercial truck, you’ll often need to provide mileage, repair history and dealership information.

Applying for a working capital loan to invest in multiple aspects of your business? You’ll have to tell the lender the specific uses for that funding.

Lenders use this information to determine if returns are likely and how that will impact your ability to repay the loan.

Small Business Loan Requirements by Financing Type

When you’re researching the loan application process and what’s required for a small business loan, it’s important to understand that loan requirements differ by lender and financing type.

Here’s what you can expect from some lenders, including the funding partners with Fast Capital 360.

SBA Loan Requirements

SBA-backed loans are designed for small business owners who don’t meet bank loan requirements but still have strong creditworthiness.

To qualify for an SBA loan through Fast Capital 360, you’ll need:

Do you qualify?

-

Credit score above 650+

-

Time in Business 2 years +

-

Annual Revenue $50,000+

Business Lines of Credit Requirements

A business line of credit offers revolving funding that you can use only when you need it and then pay it back in installments, similar to a business credit card. Business lines of credit don’t have as high requirements as term loans, making them a great option for younger businesses with ongoing working capital needs.

To qualify through Fast Capital 360, you’ll need the following:

Do you qualify?

-

Time in Business 1+ year

-

Annual Revenue $200,000+

-

Credit Score 560+

Equipment Financing Requirements

Equipment loans are secured by the equipment you’re financing, which can make them easier to qualify for.

With Fast Capital 360, you’ll need to meet the following business loan requirements:

Do you qualify?

-

Time in Business 2+ years

-

Annual Revenue $160,000+

-

Credit Score 620+

Accounts Receivable Financing Qualifications

Accounts receivable financing, also referred to as invoice financing, is an advance on your future receivables. This is where your accounts receivable aging statements come in handy, showing the lenders how quickly they can expect to receive repayment from your customers.

Since your invoices secure the advance, minimum requirements are comparatively low.

To qualify through Fast Capital 360, you’ll need the following:

Do you qualify?

-

Time in Business 1+ years

-

Annual Revenue $150,000+

-

Credit Score 600+

Merchant Cash Advance Requirements

A merchant cash advance (MCA) is secured by your future revenues. You’ll usually repay your advance on a daily or weekly basis through either a percentage of your credit card sales or ACH payments taken directly from your bank account.

MCAs have the lowest minimum qualifications of any alternative lending product.

To qualify for an MCA through Fast Capital 360, you’ll need to meet these minimum requirements:

Do you qualify?

-

Time in Business 4+ months

-

Annual Revenue $100,000+

-

Credit Score 500+

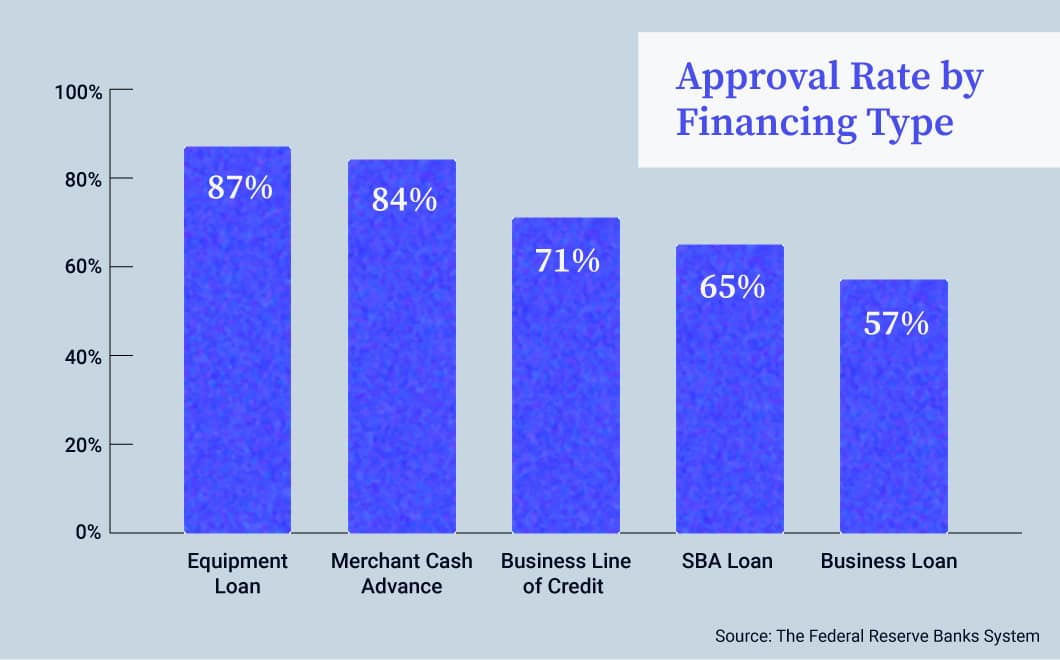

According to the Federal Reserve Banks System, business owners were most likely to be approved for an equipment loan (87%) followed by a merchant cash advance (84%) in 2020.

Requirements for a Startup Business Loan

If you’re ready to start your new business venture but find you have a funding shortfall, your financing options are more limited than if you had a company already in operation. However, there are some funding avenues available. One option is an SBA microloan. The program provides loans up to $50,000 with a maximum term length of 8 years. Microloans are serviced by community-based lenders and are accessible to applicants with new businesses, poor credit or lower revenues.

Loan requirements will vary according to lenders, but the following are the general documents and information you should supply:

- Personal information

- Credit score

- Bank account information

- Business plan

- Business licenses and certifications

If you find you can’t meet startup business loan requirements, you can also open a business credit card, apply for a personal loan or find investors to get your business up and running.

What Do You Need to Get a Business Loan?

Traditional and alternative, or online, lenders have different small business loan application requirements.

Traditional lenders, including banks and credit unions, are stricter regarding whom they approve. Their loan approval requirements usually include the following:

Do you qualify?

-

Time in Business 2 years +

-

Revenues Consistently high

-

Credit Score 700+

Traditional lenders also require more documents and information about your business, and might even require in-person meetings and on-site visits to your business before approving your loan application. Due to the volume of paperwork and the vetting process, the time from application to approval and funding can span several weeks to more than a month.

However, funding products offered by online lenders generally require less documentation. Business owners can complete their loan application on the web and submit it within minutes. Online lenders’ small business loan requirements include the following:

- Personal information

- Business information

- Bank account information (some lenders allow you to connect your business bank account for direct funding or withdrawal)

Specific credit score and revenue requirements depend on the financing type, but alternative lenders have less strict standards compared to banks or credit unions. For example, some borrowers can obtain a merchant cash advance with a credit score of 500 or higher and only $100,000 in annual revenue.

The shorter application process helps speed the review and approval process. Applicants can be approved within days, sometimes hours, and receive same-day funding.