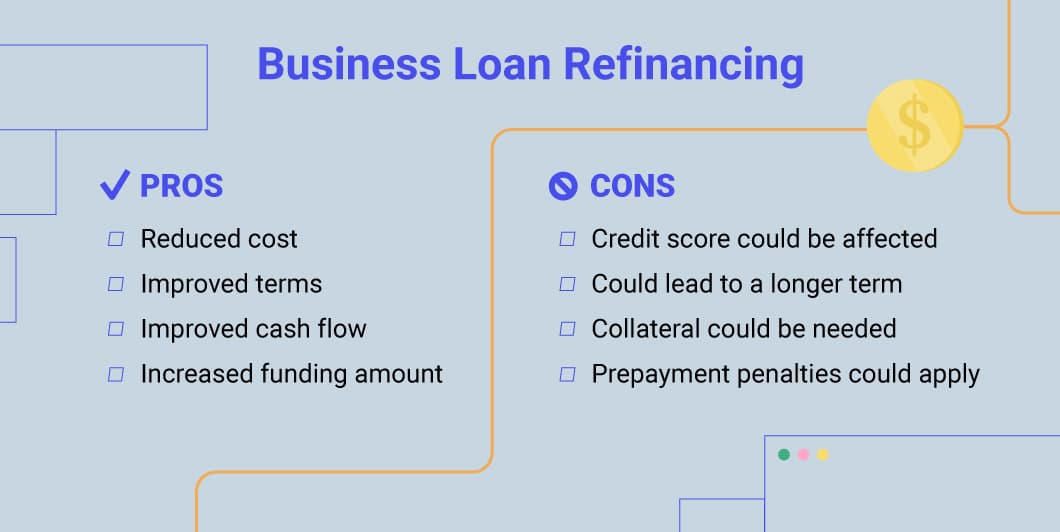

Are you looking to refinance an existing business loan? If you’re on the hunt for a “refi,” it’s likely because you want to reduce the cost of existing debt, which could be cutting into your small business’s cash flow.

Before you refinance a business loan, though, it’s important you’re informed so you make the right choice for the right reason.

What Is Business Loan Refinancing?

When you refinance company debts, you apply for a new loan to pay off the business loans you currently have, whether you’re looking to pay off 1 loan or several. You can refinance with your existing lender or another one.

Refinancing could lower your payment installments or reduce your interest rate (or both). Also, if you have several loans, and consequently several loan payments, refinancing rolls all your installments into 1, which many business owners appreciate.

4 Steps to Refinance a Business Loan

The business loan refinancing process is straightforward, but it’s important to be thorough, given refinancing a small business loan can impact your credit and finances.

Here are the steps to follow.

Step 1: Be Clear on Why You Want to Refinance Your Business Loan

The first thing to do is decide what you want to achieve through business loan refinancing. Businesses refinance their loan debts to save money or extend payments. They’re often looking to do one or more of the following:

- Make payments less frequently

- Lower monthly payment amounts

- Lower interest rates

- Consolidate multiple debts

Consider whether you’re in a position to be approved for a small business refinance loan before moving forward. Also, consider if it’s a sound financial decision. For instance, if you lengthen your debt repayment term, you could, in turn, potentially increase your total cost of financing.

Step 2: Evaluate Your Business’s Finances

You want to take a hard look at your current and future finances before applying to refinance business loans.

Assess Your Existing Debts

If you have one or more loans you want to refinance, list out the following details to get a clear picture of each debt:

- Current balance

- Remaining repayment term

- Payment interval

- Payment amount (multiply to find out how much it costs per month, year, etc.)

- Annual percentage rate (APR)

- Interest rate

Also, review your personal and business credit scores as well as your debt-service-coverage-ratio (DSCR).

Using this information, determine if refinancing could make a meaningful impact. Use a business loan calculator to estimate what a refinance could cost you over the term of the loan and what the payments might look like.

Keep in mind that closing costs and additional loan fees can often add 1%-6% to your loan. Prepayment penalties can also cut into the benefits of refinancing your business loan.

This information will be crucial when comparing any offers from refinancing lenders.

Examine Financial Documents

To obtain a competitive business loan refinance rate, you must meet certain requirements, which you can demonstrate with the following documentation:

- Tax returns

- Profit-and-loss statements

- Bank statements

- Balance sheets

While these are business loan requirements that a lender may want, they also help you assess what kind of refinancing you might qualify for and what you can afford.

If you’re unsure whether or not it’s worth going through the application process, check in with some lenders. See if your business’s qualifications match their minimum requirements.

Step 3: Find the Right Type of Refinancing

When you’re trying to get a small business refinance loan, you might be limited by the types of debt you have and your financial and business background.

You could seek refinancing with your existing lender or look for one of the following types of refinancing options.

- Bank or credit union loan refinance

- Small Business Administration (SBA) loan refinance

- Alternative lender loan refinance

Related: Conventional vs. Alternative Lending

Bank Loan Refinancing

If you’re looking for small business loan debt relief in the form of a commercial refinance, you might consider a bank loan.

| At-a-Glance | Who Should Apply? |

|

|

Small business loans from banks are often considered the gold standard in the industry. These financial institutions can offer competitive refinance business loan rates with long repayment terms available, often with higher principal amounts that you’d find elsewhere.

If you refinance a business loan at a bank, you could get an interest rate between 5% and 10% for a repayment term of 1 year-10 years. That’s according to a 2020 article by LendingTree.

Because of these benefits, however, refinancing a business loan at a bank can be difficult to qualify for. Generally, only established business entities with a strong credit score will be eligible for funding through large national banks. A smaller, regional chain may be slightly more lenient, but they’re still very selective.

To qualify, most require a “very good” to “excellent” personal credit score (think 700+ at the least), 6-figure annual revenue and at least a couple of years in business.

Additionally, depending on the type of loan you’re seeking and your qualifications, the refinancing process could take several months.

Small Business Administration (SBA) Loan Refinancing

You might also consider an SBA loan to consolidate debt your business has undertaken. Here are a few reasons to consider applying as well as some benefits.

| At-a-Glance | Who Should Apply? |

|

|

SBA loans are meant to make affordable financing accessible for small business owners who don’t qualify with banks.

You may be able to apply for funding guaranteed through the SBA to refinance existing debt, such as a standard 7(a) or Express loan.

SBA 7(a) refinance requirements include:

- Purpose of original loan would have been SBA eligible

- Proposed loan payment must be at least 10% less than existing loan

- Written explanation as to why the current loan does not have reasonable terms (e.g., interest rate exceeds SBA maximum, loan is over-collateralized, etc.)

If you’re approved, most SBA 7(a) loans take months to fund. Express loans, however, can be used to refinance certain debts in just weeks, but they max out at $350,000.

The SBA also offers the 504 refinance program. This program works similarly to the regular 504 loan program: A private lender covers 50%, a Certified Development Company (CDC) covers up to 40% and the borrower contributes at least 10%. Borrowers may be able to refinance up to 90% of the current appraised property value plus certain eligible business expenses.

To be eligible to refinance with this SBA loan, the business must have been in operation for at least 2 years and the debt to be refinanced must be a commercial loan that has been current for at least 12 months before application, the loan proceeds were used to acquire an eligible fixed asset (e.g., qualifying real estate, equipment, land) and the loan is secured by the fixed assets. The company should also meet SBA small business size standards.

The CDC portion of the 504 SBA refinance loan has a fixed interest rate with a repayment term of 10, 20 or 25 years. The private lender portion of the loan may be fixed or adjustable rate with varying repayment terms.

Interest rates will be slightly higher than what you can get with a bank, but the SBA places caps on them to help keep them affordable. Often, you can expect rates under 10% on these loans. Refinance business loan rates with the SBA generally range from 4.5%-6.5% with terms of 7-25 years.

If the timing and criteria needed to obtain an SBA loan for refinancing don’t fit your small business, you may need to look into alternative options.

Can You Refinance an SBA Loan With Another SBA Loan?

The answer is, in some cases, yes. If you want to refinance an existing SBA loan, you may be able to if you’re in need of additional financing and you were declined by your current lender or you were refused an SBA loan modification to accommodate your new loan request.

To qualify, you’ll need to have no past due marks on your loan in the 3 years prior to requesting a refinance. Additionally, applicants will need to explain why their current SBA loan’s terms aren’t reasonable. Further, to be considered, the refinance should deliver a payment of at least 10% less than that of the current loan.

Alternative (Online) Loan Refinancing

Refinancing with alternative online lenders is an option for many small businesses. Less stringent credit score and revenue requirements make it possible for many business owners to qualify, in some cases, even if they’re looking to refinance business loans with bad credit.

| At-a-Glance | Who Should Apply? |

|

|

The technology involved in online lending also speeds up the process considerably. Instead of waiting weeks and months for approvals, alternative small business refinancing can often be approved within days.

Online loans and financing products generally have shorter terms than bank and SBA loans. Since online lenders often work with small businesses that are unable to meet the high credit score requirements at banks, they have higher interest rates and require more frequent payments. It’s not uncommon for rates to start around 10% and rise with the type of financing you choose and your qualifications.

Get Your Business Loan Faster

Step 4: Apply to Refinance Your Small Business Loans

When you have your goals aligned and have vetted potential lenders, it’s time to apply.

Applying for a small business loan can be as simple as uploading documents to online lending platforms and filling out some basic information. Or it can involve weeks of exchanges and documentation submissions depending on the lender.

Either way, here’s a general outline of the process:

Step 1: Give the Lender Your Information

How much information and documentation a lender will need will be based on the lender and type of refinancing you’re seeking.

Step 2: Wait for Approval

The lender will evaluate your application and review your time in business, annual revenue, cash flow, credit score and the documentation you’ve provided. Sometimes, you’ll need to submit more financial information so the lender can come to a decision.

Step 3: Get Approved

The lending provider will notify you of its decision. If you’re approved, your loan specialist will share the terms of your financing offer. At this point, weigh whether the rates, fees and term lengths match your refinancing goals.

Step 4: Finalize Refinancing

If you agree and sign a lender’s refinancing contract, your new lender will pay off your existing loan. You’ll then start making payments to your new lender for the loan amount refinanced on your behalf.

When Should One Use Small Business Loans to Refinance Debt

Before you put these steps into action, consider whether refinancing your business loans is right for you. Here are some common examples of when refinancing a loan (or consolidating multiple loans) is the right choice.

The Interest Rate Market Is More Favorable

When market conditions change and interest rates drop across the board, it could be just the time to refinance debt. Consider how obtaining a low fixed interest rate could impact your repayment of long-term debt.

Your Creditworthiness Has Improved

Your loan’s cost was impacted by your business’s age, revenue and credit score at the time of signing. But what you qualified for 2 years ago may not match up with what you can get today.

You can take that high-interest loan you got before and use the success you’ve had since to refinance it into a more affordable option.

You Need a Cash Flow Boost

High monthly payments on small business loans can cut into your available cash flow.

Because refinanced loan payments can be significantly lower, you may have more money to put directly into business growth.

You Have Multiple Short-Term Loans

If you’ve taken out a few short-term loans, it could be a good idea to consolidate them into one.

Long-term business loan refinance rates can lead to lower, more manageable payments.

You Have Multiple Types of Debt

You can refinance more than just loans. Debts accrued on credit cards, business lines of credit and more can be consolidated and refinanced into 1 business loan.

Note, however, that some lenders are less likely to work with businesses that have certain debts, particularly high-interest ones. Also, too much debt could raise concerns about cash flow and make you riskier to lenders. If you have multiple credit card balances or short-term financing (e.g., merchant cash advances), lenders may not be willing to refinance them.

When Is Refinancing a No-Go?

Sometimes it’s not the right time to refinance business loan debt. Here are a few reasons why.

The Savings Isn’t Worth It

You may have a few outstanding loan debts, making the idea of refinancing initially appealing. However, refinancing business loans could offer you little-to-no cost savings or financial benefit in some cases.

Reasons could include the following:

- Revenue hasn’t increased to qualify you for better terms

- Interest rate environment isn’t good

- No credit score improvements

- Prepayment penalties on your existing loan are too high

- Costs to refinance are too high

These reasons and more can make now the wrong time to refinance. If these circumstances change, however, you can revisit refinancing your business loan later.

Costs to Refinance a Business Loan

Remember that closing costs and fees tied to a loan refinance can range from 1%-6% of your loan amount and up to 10% in some cases. Ask your lender about the following:

- Origination fees

- Underwriting fees

- Appraisal fees

- SBA guarantee fees

- Late fees

- Prepayment penalties

When you’re evaluating loan refinancing options, it’s important to understand these fees in addition to the interest rate and payment term. This will give you a clearer picture of all the financing costs involved so you can more accurately compare offers.

You’re Putting Off Debt for the Sake of It

It may be tempting to refinance short-term loans to lower payments and pay them off over a more extended period, but that’s not always the right move.

Stretching out your debt payments could lead to paying more interest over time. Here’s an example. You have a 1-year loan with an interest rate of 15%. You consider the loan to be expensive, so you look into refinancing. However, refinancing to cut the rate with a loan that extends the term to several years could cost you more in the long run.

Look carefully at your business’s financial situation. It may be wiser to stay the course and pay off your current loan instead of refinancing.

You’re Not Eligible

Sometimes you aren’t eligible to refinance your business loans.

Having tax liens, bankruptcies or other red flags on your credit history can disqualify you with many lenders. Your current financial health may do the same if you’ve been experiencing slow sales or high expenses.

Use Your New Knowledge to Refinance a Business Loan

Find out whether refinancing is right for you by taking a good look at your current and potential finances. Reach out to lenders if you need to, and apply when you’re ready.

It could be the difference between saving money in interest and investing more toward parts of your business that will help you reach your goals and grow.