At some point or another, your small business likely will need financing to reach its goals.

The Small Business Administration (SBA) offers multiple initiatives to help business owners access capital, including the 504 loan program. Whether you’re seeking an SBA 504 loan for startup funding or need capital to run and grow your business, this program can be a great option for you.

About SBA 504 Loans

For many company owners, small business loans can be difficult to obtain. Banks have strict criteria to meet and other lenders tend to offer higher rates and fees that can make financing cost-prohibitive. Fortunately, the SBA wants to make it easier for you to get the funds you need to advance your business.

As with most SBA loans, the 504 program is focused on building up America’s small business infrastructure. The SBA accomplishes this by helping owners finance their business in exchange for stimulating local economies and creating jobs. The SBA 504 loan program has reportedly created more than 2 million jobs.

It’s considered a win for everyone involved: Owners get the funding they need, more jobs are available for workers and the economy grows. Note the benefits of SBA 504 loans for veterans, minorities, women and business owners in general are numerous.

That said, there are specific requirements you need to meet, and the structure of these loans can be difficult to understand. But we’ll explain what you need to know to evaluate and apply for an SBA 504 loan.

How SBA 504 Loans Work

With 504 loans, the SBA entices conventional lenders to accept your loan by guaranteeing a chunk of the loan amount, that is offered through partner Certified Development Companies (CDCs), which is referred to as a debenture.

Certified Development Companies

A CDC is a nonprofit corporation that’s regulated and certified by the SBA. CDCs work with lenders to facilitate 504 loans under the structure the SBA provides. There are about 270 CDCs nationwide. Each CDC services a specific territory, where its agents work with businesses seeking funding in that area.

Find assistance applying for an SBA 504 loan in your area with SBA’s CDC search tool.

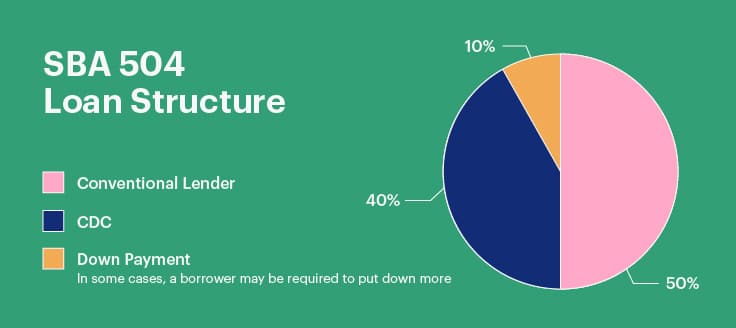

SBA 504 Loan Structure

The structure of 504 loans is unique. The funding is serviced by 2 parties. If approved, you’ll essentially be getting 2 separate loans: 1 from a conventional lender (e.g., bank, credit union) or other participating private-sector lender, and 1 from the CDC, which is a nonprofit SBA 504 lender backed by the government agency. Together, with a modest down payment, the 2 loans make up the total financing you need to get your project started.

The funding breakdown is as follows:

- Conventional lender: 50%

- CDC: 40%

- Down payment: 10% (in some cases, a borrower may be required to put down up to 20%)

There are some exceptions, however. CDCs are only allowed to contribute up to $5 million in funding for SBA loans (or $5.5 million for some small manufacturers and businesses qualifying for specific energy projects).

SBA restrictions don’t bind conventional lenders, however. They can provide 2-3 times that amount, which would throw off the previously noted percentages.

Also, CDC loan percentages could go down in certain instances, with a higher down payment percentage required by borrowers. This would only apply in certain cases.

Specifically, your SBA 504 loan down payment could be raised to 15% if your business is a startup or the real estate you’re financing is considered special-use property (e.g., amusement park, car wash, theater, winery, etc.). If both factors apply, your down payment requirement would be at least 20%.

Projects 504 Loans Are Used For

Unlike some 7(a) loans, the 504 program is more specific in terms of what you can (and cannot) use the funding for. In general, the money must be allocated toward expanding or modernizing your business. Expansion means more jobs, which is the heart of what the 504 program is all about.

Examples of qualifying uses include fixed assets, such as owner-occupied commercial real estate, land, some fixtures and furniture for your business, as well as necessary remodeling and upgrades that will help your business grow. SBA equipment loans are also possible under the 504 program. And if you’re in search of an SBA construction loan, you’re in luck – funds from the 504 program can be used for construction of new facilities.

Funds also can be used to pay professional fees essential to the project (e.g., surveys, titles searches, title insurance). Additionally, loan proceeds can be used to cover short-term costs associated with the main project.

However, SBA 504 loans can’t be used for working capital or inventory. Additionally, if you’re looking for an SBA loan for rental property, the 504 program is not for you, as funds cannot be used for that purpose.

Additionally, SBA 504 refinance loans are available, but there are restrictions. To qualify, a business must have been in operation for at least 2 years and the debt to be refinanced must be a commercial loan that meets these requirements:

- Incurred for the benefit of the small business not less than 6 months before application for 504 refinancing, a new SBA 504 guideline set forth in 2021 (previously, it was 2 years before application)

- Proceeds were used to acquire 504-eligible fixed assets, such as real estate, land, equipment, etc.

- Secured by 504-eligible fixed assets

- On-time payments for the last 12 months

SBA 504 Loan Requirements and Eligibility

There are certain requirements that are generally needed to acquire any SBA loan, as well as some specific to CDC 504 loan program eligibility. These requirements are for the loan provided by the CDC only. The conventional lender working with the CDC to fund your project may have additional criteria, including credit score and annual revenue minimums.

General Business Prerequisites

First, your business must be conducted for-profit within the U.S. and fall under the SBA’s size standards guidelines to qualify.

As an owner, you must have shown that you require funding and have exhausted alternative financing options, including investing your own time and money into the business. Certain types of businesses aren’t able to apply for an SBA 504 loan, including companies that are engaged in lending practices or promote gambling or illegal activities.

Specific SBA 504 Loan Qualifications

You must also meet specific SBA 504 loan qualifications. Start by having a sound plan in place that proves the funding is a smart investment for both you and the SBA. You must demonstrate that a loan will help you grow and create jobs.

If approved, your business must create or retain 1 job for every $75,000 that is guaranteed by the SBA debenture on the CDC loan within 2 years of project completion (this number jumps to $120,000 for qualifying small manufacturers). Seventy-five percent of these jobs must be kept within your community, meaning you can’t outsource these jobs and must promote local economic growth.

You may get around the job-creation requirements if the funding will help your business meet other community development, public policy or energy reduction goals, including but not limited to the following:

- Diversifies, improves or stabilizes the local economy

- Promotes the development of other local businesses

- Expands opportunities for women, minorities and veterans

- Upgrades or remodels facilities to meet health, safety and environmental regulations

You must provide the lender and the CDC with a strong proposal on how you’ll reach these goals to be considered for the SBA 504 loan program. Failure to show a plan that will result in a win-win for the SBA and your business will likely result in the rejection of your SBA 504 loan application.

Terms, Rates and Fees for SBA 504 Loans

The purpose of all SBA loan programs is to provide businesses like yours access to funding under reasonable terms. To accomplish this, they extend financing with longer payment lengths and competitive rates, keeping money in your pocket and stimulating the economy.

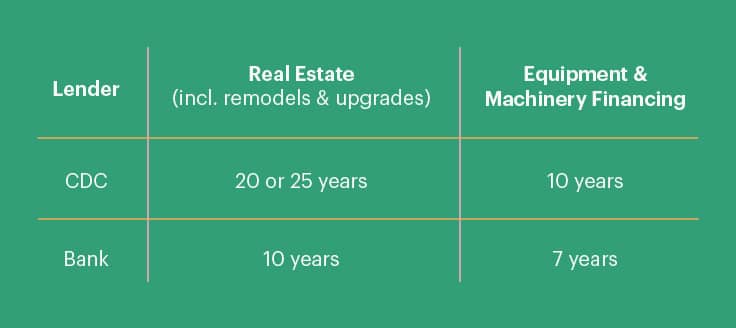

SBA 504 Term Lengths

Depending on your use of funds, the repayment length will vary between the bank and CDC portion of your 504 loan.

By having longer term lengths, SBA 504 loans allow you to spread out and lower payments, making them a desirable option for larger and more expensive projects.

Interest Rates and Fees

As with the repayment lengths, interest rates and fees are different within the 2 individual parts of your loan. Banks can set variable or fixed rates for the borrower and will impose their standard fees, though the SBA sets caps that lenders can’t exceed.

Specifically, third-party lenders can’t charge more than 6% above the prime rate or the maximum interest rate allowed by state, whichever is less. As of Dec. 15, 2022, the prime rate sat at 7.5%. Because these lenders are only responsible for financing a percentage of your project, it may be easier to negotiate a lower interest rate with them than it would normally be.

The CDC always provides fixed rates with a fully amortized structure to help keep your financial commitments consistent. Interest rates for 504 loan programs are tied to current 5- and 10-year U.S. Treasury rates for 10- and 20-year terms, respectively. As of March 8, 2022, the 5-year Treasury rate was 1.80%, while the 10-year rate sat at 1.86%.

There are a few fees to consider when you’re considering a 504 loan.

Fees are about 3.5% of the net debenture loan. There’s also about 1% in yearly servicing and guaranty fees. The CDC charges borrowers directly for some fees, while the SBA charges the CDC for others.

The SBA is allowed to charge CDCs the following for regular 504 loans that aren’t being refinanced:

- Upfront guaranty fee (0.5% of the debenture)

- Monthly service fee, adjusted annually (for fiscal year 2022, this is 0.2475% of unpaid principal balance for regular 504/CDC loans and 0.2590% for 504 refinancing), paid by the borrower

- Annual development company fee (0.125% of debenture’s outstanding principal balance)

- Funding fee (not to exceed 0.25% of debenture)

- Participation fee charged to third-party lenders (0.5% on the lender’s share)

Although the CDC doesn’t necessarily charge borrowers for all of the following fees, they are able to collect:

- Processing or packaging fee: Up to 1.5% of the proceeds from the net debenture, which can be reimbursed from proceeds

- Closing fee: Up to $2,500

- Annual servicing fee: At least 0.625% but not more than 2% per year on the unpaid loan balance, determined every 5 years

- Late fee: The greater of 5% of the late payment or $100 for payments received after the 15th of the month

- Assumption fee: Not to exceed 1% of the outstanding principal for the assumed loan

- Central servicing agent fee: Monthly fee of 0.1% per year of the loan amount

- Underwriting fees: 0.375% for 10-year loans and 0.4% for 20-year loans, paid upfront

Prepayment fees apply during the first half of the term declining a slight percentage each year. Also expect processing, appraisal, legal, underwriting and other fees usually standard in small business loans. Before you apply, check in with your local CDC to find out what the current rates are.

You can also search for SBA 504 loan calculators online to estimate your payments. Some CDCs offer this tool as a resource for interested applicants.

SBA 504 vs. 7a Loans

In comparison with the SBA 504 loan, the 7(a) works a bit differently. When considering the SBA 504 vs. 7(a) loans, understand that SBA 7(a) loans are funded by lenders who partner with the federal agency (there’s no CDC involved).

The SBA guarantees up to 90% of the loan amount, depending on the specific type of 7(a) loan, and loans can go up to $5 million. Repayment terms can range from 5-25 years, depending on use of funds. Additionally, funding use is less restrictive with a 7(a) loan.

You can use a 7(a) loan for renovation and expansion projects, new construction, equipment, fixtures, inventory, working capital and debt refinancing.

Applying for an SBA 504 Loan

Once you’ve reviewed SBA 504 loan guidelines, checked your eligibility and determined that the 504 loan program is the right fit for your business’s needs, it’s time to gather what you need to apply.

You’ll need to put together a plan to prove to the SBA that they should invest in your business. This document should include exactly how you’ll use the funding, why it’s necessary to your business and how it will meet the job-creation or community development goals the 504 program wants to reach.

Once you have your plan in place, gather your financial documentation that will be used to evaluate your loan request:

- Personal and business tax returns

- Personal financial statements (required from each individual owning 20% or more of the company)

- Profit-and-loss statement

- Balance sheet

- Collateral (the equipment or real estate that is financed in the loan is usually enough, but more collateral is sometimes required)

You’ll also want to consider how to cover the minimum 10% down payment required to secure the loan. You could use personal savings, your 401(k) or even a private loan, barring your personal finances are separate and you use a source of income outside of the business to pay it.

When you have everything together, send all of the documentation to your bank and local CDC. They will share it with the SBA and help facilitate your SBA 504 loan application.

If you’re approved, the next step in the SBA 504 loan process is to negotiate the terms of your offer and come to an agreement on both parts of the loan.

If you happen not to get approved, don’t worry. There are alternative business loans available. Be sure to explore all of the options available to get your business what it needs to expand and grow.