Sometimes after you’ve taken out a business loan, you realize you need additional funds.

Whether you didn’t receive the full funding amount you applied for or have unexpected needs arise, you might consider a second-lien loan.

Here’s what you need to know about this type of business financing.

What Is a Second-Lien Loan?

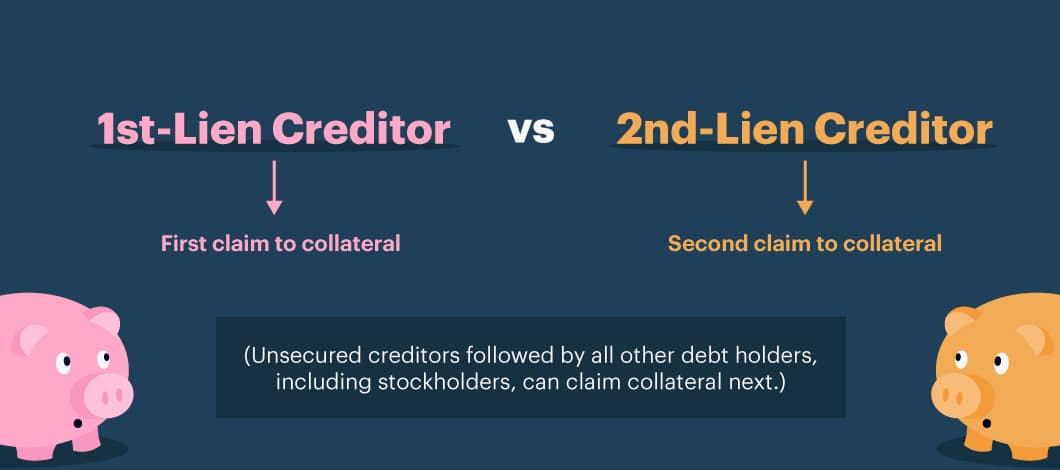

A second-lien loan by definition is financing that is in a secondary position for a lender to recover losses should a borrower be unable to meet the terms of repayment or undergo bankruptcy with asset liquidation. As you might expect, a first-lien loan would be in the first position.

What do we mean by loan positioning?

If you’re a homeowner, think of having a second-lien commercial loan in terms of having a home mortgage and then needing to take out a home equity line of credit. The bank that holds the note on your mortgage is in the first position to recoup outstanding debt if the property needs to be foreclosed on. In this case, the mortgage lender, provider of the first-lien term loan, can use the collateral of your home to satisfy the amount owed to them. The lender with whom you have your line of credit would be in second position to access any remaining collateral value to satisfy its debt.

Keep in mind, liens can be for specific collateral, such as equipment or property. Alternatively, they can be blanket liens, through which a lender can lay claim to most, if not all, of a company’s assets as well as any personal assets you may have pledged as collateral.

How Second-Position Loans Impact Lenders

A lender in the first-lien vs. second-lien position is entitled to recoup up to the full amount of its losses if available. In contrast, the second-lien debt holder stands in line waiting for whatever funds are left over after the first lienholder has been satisfied. That means there’s more risk to secondary lenders, which often translates to higher interest rates and shorter repayment terms.

While alternative lenders are often willing to take second-position loans, some big-name banks and hedge funds might, too. When lenders are evaluating you for a second-position loan, they may take into account which lender you have your first loan with. If it’s through a major financial institution, for example, you may be seen as a less risky applicant.

Reasons You Might Apply for a Second Small Business Loan

There are many reasons why you might look to apply for additional funding for your business, whether a second-lien term loan or other type of supplementary financing. In some cases, you may even consider unconventional financing, such as a merchant cash advance, if you need fast access to funds and are having difficulty meeting bank lending requirements for a secondary loan. Below are just a few reasons small business owners seek second-position loans.

Could you benefit from additional capital?

Bridge Funding Gaps

In some cases, you might take another loan out for short-term working capital. For instance, you may be experiencing a temporary dip in sales and need funds to cover rent, payroll or unexpected expenses.

Fund Growth Opportunities

Sometimes, time-sensitive opportunities come up that could help your company grow. If you’re looking to fund a costly business investment, a second loan could provide the capital you need to jump on a viable venture.

Invest in Real Estate

If you own real estate, sometimes you realize you need more funds after you’ve taken out your initial commercial mortgage. If you have exceeding renovation costs, for example, and need to invest more money in your commercial property, you might seek a second position hard money loan.

Purchase Equipment

Depending on the industry you’re in, equipment costs can add up, whether company vehicles, manufacturing equipment or business technology. If you’re in need of an upgrade or require an entirely new piece of machinery, you may complete a secondary loan application to fund the expense.

-

Does Taking Out Another Business Loan Make Sense?

When you’re searching for a secondary loan, think about what kind of return on investment (ROI) you’ll see from it. Find out how to calculate business loan ROI, and consider the potential profit you could generate from the loan and how that could help you advance your company.

How Lenders Decide on a Second-Position Loan Amount

In performing their due diligence, second-lien lenders typically review the same metrics first-lien lenders do. These include factors such as credit score, revenue, debt-to-income ratio and cash flow. Additionally, when it comes to specific assets collateralized by a loan, lenders will assess the remaining equity above what’s owed to the first-lien lender.

For example, if a business owner has a $250,000 loan on a building that’s worth $500,000, there’s $250,000 in remaining equity. If that business owner wants to take out a second-lien loan using the same property as collateral, the second-lien lender will consider that equity when making a loan offer.

They’ll also weigh other cost factors, such as the chance the building can lose value as well as the cost to liquidate the asset. To hedge against risk of loss and being in the second-lien position, the subordinate lender may offer a loan for half the value of the remaining equity or, in our example, $125,000.

Disadvantages of Second-Position Loans for Borrowers

While taking out a second-position loan could make sense for your business, here are a few things to consider:

Higher Interest Rate

Second-position lenders often charge higher interest rates, though are often less costly than unsecured loans with similar terms.

According to an article by Tyler Mulligan, a faculty member of The University of North Carolina at Chapel Hill’s School of Government, second-lien commercial loans may have interest rates 100-300 basis points higher than first-lien loans, while unsecured loans without liens or collateral may have interest rates 300-400 basis points higher than first-lien loans.

While Mulligan’s article was specifically discussing local governments as lenders, it gives you an idea of the exponential increases in interest rates you could expect from second-lien business loans.

Shorter Payment Term

Lenders of second-lien loans often hedge their risks by requiring shorter repayment terms than a borrower would see with a first-lien loan. According to PNC Bank, repayment terms on second-lien loans are often 12-36 months.

Cash Flow Stress

Taking out multiple loans could strain a business’s cash flow. This is particularly true when stacking business loans, in which second-lien financing is followed by a third or even fourth-lien loan, requiring several regular periodic repayment installments.

Potential Contract Breach

When considering a second-position business loan, make sure taking out additional financing doesn’t violate the loan agreement you have with your first-lien lender.

For instance, some lenders have language in their loan agreements requiring their approval if the borrower wants to take out a secondary loan. Breaching your first loan contract could allow the lender to require immediate payment in full.

Alternatives to Taking Out Multiple Business Loans

A second-lien loan isn’t necessarily your only option when you need financing. Consider approaching your existing lender or another lender about refinancing your current debt. Alternatively, consider applying for small business grants or searching for business investors if you’re in need of capital.

Related: How to Refinance a Business Loan