According to the Congressional Research Service, in 2021 the Small Business Administration (SBA) approved more than 51,800 of one loan type alone, totaling nearly $36.8 billion in funding. This statistic clearly demonstrates a financial need among small business owners.

Sometimes, however, the financial need is greater than what one loan will cover. That’s when some business owners consider loan stacking.

What Is Loan Stacking?

When one business loan doesn’t suffice, some borrowers consider applying for additional financing to try to meet their needs. Loan stacking, by definition, means taking out multiple business loans or alternative financing with different lenders at once. Financing could take the form of a loan, line of credit or merchant cash advance.

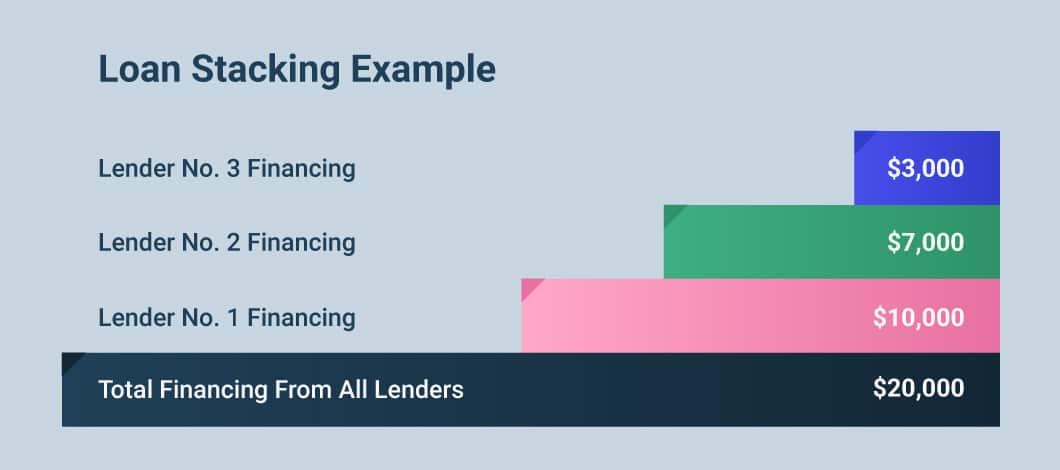

Suppose you want to complete a business renovation but don’t have the funds to do so. You’ve estimated the total amount of money you’ll need to complete the project: $20,000. You find a lender and apply for the full amount, but you’re only approved for half. So you decide to apply for financing with other lenders in an attempt to get the full financing you need.

A second lender approves you for several thousand dollars, and a third lender loans you enough that you’ve now got your full financing. You’ve just partaken in loan stacker financing.

What Are ‘Second-Position’ Business Loans?

When you accept business financing, a lender can place a consensual lien against your property. The lien is security for your loan in case you default.

When you only owe money to one financing company, that lender is in a first-lien position: They are first in line to seize your assets and recoup their losses in the event you can’t repay your debt.

Subsequent lender liens are numbered in succession. For instance, a lender offering a second loan to a borrower would be in a second-lien position. Being in the second position means your ability to recover any collateral can only be completed after the first lender has taken theirs. But at that point, there may be no assets left to liquidate. As such, second-position loans are riskier for lenders.

While liens can be a matter of public record, recording of the lien can take time. Similar to the delay in the posting of credit inquiries, potential lenders in a loan-stacking scenario might have difficulty finding a recent lien filing.

Is Loan Stacking Illegal?

No, loan stacking isn’t illegal. However, some lenders have policies against offering financing to a borrower who has an existing loan. This is because being a second or third lender to a borrower is risky for finance providers.

That said, some unscrupulous borrowers may attempt to commit loan stacking fraud. Some individuals who apply for multiple loans at one time may have no intention of repaying the debt. They take advantage that it could take 30 days for an existing loan or credit inquiry to be reflected on their credit report. In these cases, potential lenders would have no knowledge that there are existing loans in the borrower’s name.

What Are the Risks of Loan Stacking?

At first glance, it might seem helpful to take out an additional loan to help sustain your business during a cash flow shortage. However, when 2 turns to 3, 3 to 4 and so on, your risk (and a lender’s risk) increases. Why?

Ever played the video game Tetris? Think of loan stacking like a Tetris puzzle: You start off with a base of blocks. The goal isn’t to stack blocks, but to eliminate them. At a certain point, though, the pace increases. The game becomes more challenging, and it’s difficult to keep the blocks from piling up. The stacks grow at an exponential pace and you struggle to keep up. If you can’t clear your stacks, you lose.

As a borrower, loan stacking could affect you in the following ways:

Credit Score

If you’re thinking about debt stacking, consider that multiple outstanding loans could have a negative impact on your business credit score as well as your personal credit score. Once your personal credit is affected, it isn’t just about your business anymore.

Affordability

Having several loan payments due at once can make it challenging to stay current on all of your accounts, which could cause you to go into more debt. Also, because you already have outstanding debt, terms on a new loan might not be as favorable. This could cost you more money in the end.

Cash Flow

For your business to be successful, you need positive cash flow. Depending on the lender and financing terms, though, you may be required to make daily or weekly payments on a loan. If you’re indebted to multiple lenders, this could put a strain on your business’s revenue and working capital.

-

Small Business Financial Challenges

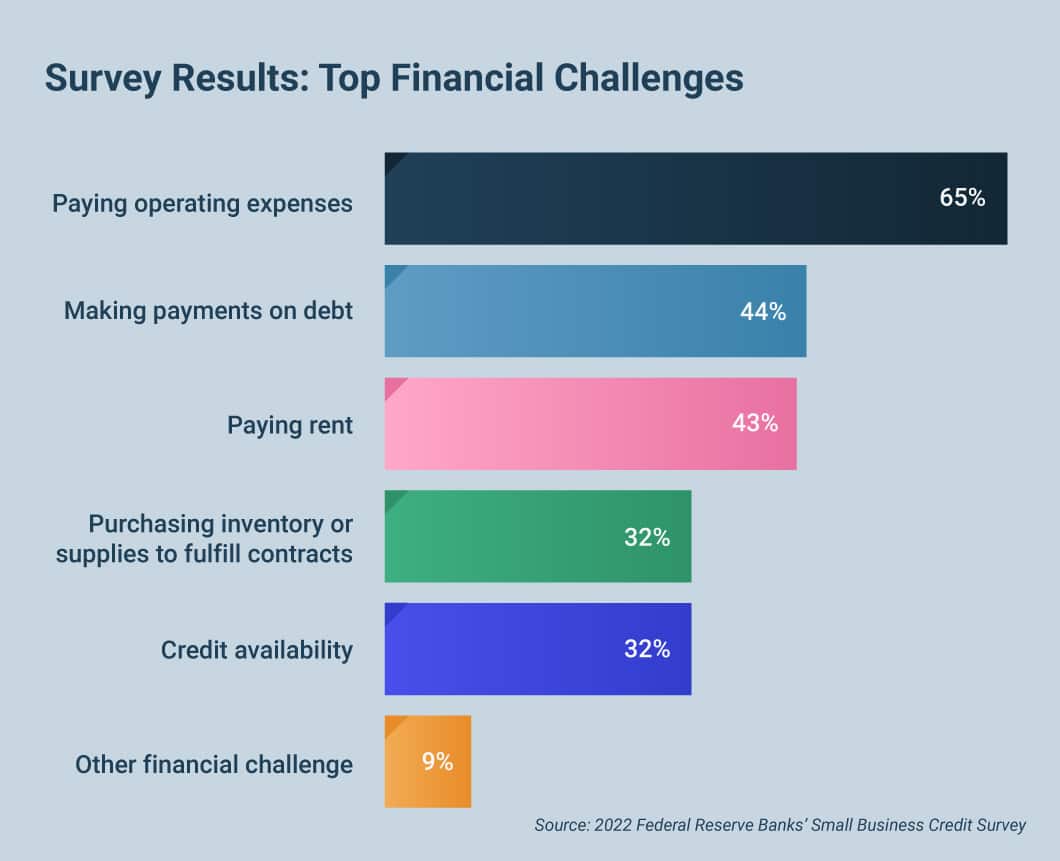

According to the Federal Reserve Banks’ 2022 Small Business Credit Survey, in response to financial challenges, 52% of firms surveyed obtained funds that required repayment, such as loans.

Some of the challenges business owners noted included the following:

Alternatives to Loan Stacking

If you’re seeking additional funds to try to keep your business running smoothly, you can avoid having multiple loans to pay. Let’s review a few options.

Reduce Expenses

If you’re a business owner who’s having difficulty keeping up with bills, consider if there are costs you can eliminate or, at the very least, minimize.

Ask yourself the following:

- Can you cut back on your office or storefront’s utility bills?

- Can you reduce supply ordering or negotiate better terms?

- Do you have equipment maintenance plans or service contracts you can eliminate?

- Can you barter with vendors, offering to provide your services for free as payment for what you need from them?

- Does your business require a physical location? If not, consider working out of your home (and, if applicable, having your employees telecommute).

- Is it possible an alternate location would be as effective but less costly?

Determine your true business needs and see if there are any places where you can save money in the short and long term.

Refinance Your Business Debt

Instead of stacking loans, consider refinancing your current debt. When you refinance a loan, you’re replacing one loan with another with potentially better terms. The new lender pays your previous lender and takes on your existing debt. Refinancing options are available through conventional banks, credit unions and online lenders.

Additionally, with certain SBA loans, the SBA insures a portion of the loans and refinancing options provided by its lending partners. For example, the SBA-backed 7(a) and Express loans may be used for the refinancing of certain outstanding debt. However, the SBA won’t insure the refinancing of existing debt that would cause the lender to sustain a loss.

Related: How to Refinance a Business Loan

Request a Loan Review from Your Existing Lender

Before taking out another loan, consider asking your current lender for better terms. Request they evaluate you for a lower interest rate. Alternatively, you could request an increase in available credit.

If your business is experiencing a short-term hardship, see if your lender will allow a forbearance, an agreement that allows you to suspend payments, in whole or in part, for a time, though interest likely will continue to accrue. Businesses with loans backed by the SBA, for instance, may be eligible to seek a forbearance if they’re in locations designated as federal disaster areas.

As with any major decision, it’s crucial to read and understand the fine print. Analyze what your company truly needs to function and prosper. Then research your options to make an informed decision so you can make sure you’re a small business success story.