Business finance is funding that companies use to launch, maintain or expand their operations.

If you’re a small business owner, you know that turning a profit doesn’t come easily between everyday costs that can cut into your earnings and unforeseen business emergencies that can disrupt your operations.

This can be problematic because you have to maintain a steady cash flow if you want to succeed.

Fortunately, business financing can help small companies push through financial hardships and expand their operations. Let’s get business finance explained and examine how to finance a business.

Business Finance: a Definition

The business finance definition is the credit and capital available to qualified companies to make investments, buy assets or goods or otherwise fund operations.

Business financing also refers to the way a company manages its money. It can be used to make costly purchases, refinance debt and cover everyday expenses.

Types of Business Finance

There are two main methods of financing a business — debt financing and equity financing. Many companies use both of these funding types as a means of getting capital for their businesses. Let’s take a look at how each type impacts the way a business is financed.

Debt Financing

Debt financing is funding you obtain through a lender, which you must repay. This financing, such as a small business loan, can be used for a business purchase. This type of business finance typically accrues interest until borrowed funds are repaid in full.

With debt financing, you’ll likely secure your debt with assets, such as real estate, or offer a personal guarantee to repay the funds.

Equity Financing

Equity financing is capital you receive in exchange for partial ownership in your company that you sell through shares to investors. Unlike debt financing, equity financing doesn’t have to be repaid.

How Can Small Business Owners Use Business Financing?

Business financing is flexible, and in most cases, you can spend your funds however you see fit.

Use the funds as a means of:

- Working capital financing to help maintain a healthy amount of cash

- Inventory financing to purchase an abundant supply of products during a busy season

- Business equipment funding for financing a business purchase of technology, machinery or supplies needed for production

- Funding to hire more personnel

- Financing to expand or open another location

That’s the beauty of business financing and business finance loans: You’re in control of how you use the funding. You’re able to stand back and assess your company’s needs and decide what areas of your business need the most improvement, and will reap the most benefits.

However, it’s important to note that no two types of business finance are the same.

The way a business is financed might work best for a large manufacturing company, but it might not be ideal for a small grocery store.

That’s why it’s crucial to do your research on understanding business finances before pursuing equity financing or debt financing through business finance loans.

Now that you understand the definition of business finance, explore the myriad of business financing options available to you, such as SBA loans, conventional bank loans and online loans.

Sources of Business Finance

Who can finance my business? You might be surprised to learn how many funding options are available to small business owners looking to start or expand a venture.

Banks and Credit Unions

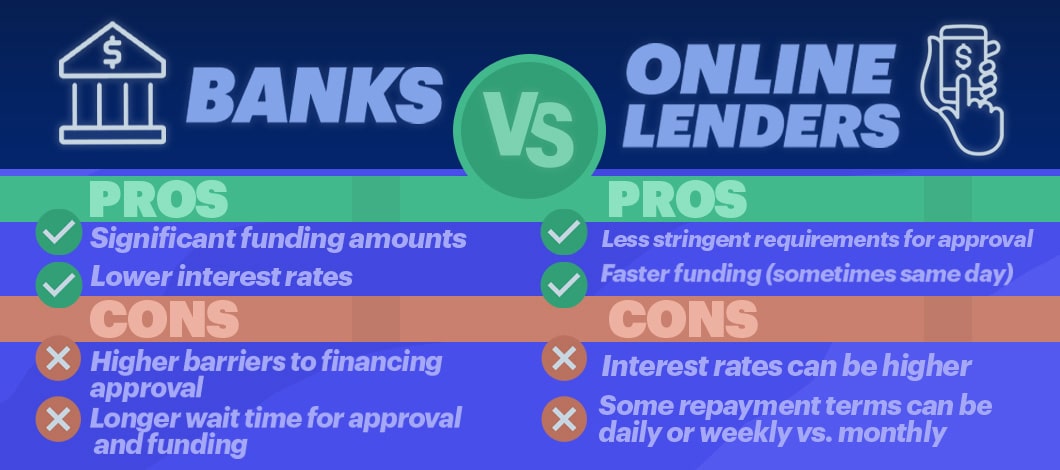

Banks and credit unions can provide various types of business financing that offer longer term lengths and more significant funding amounts. However, these lenders can also require applicants to have very good credit scores (starting at 700), several years in business and even a pre-existing relationship with that bank or credit union before approving a business finance amount.

Online Lenders

An online or alternate lender can provide an easier path to funding than some banks or credit unions. Your business could still qualify for financing even if you’ve been in operation for only a year or 2 and have a fair to good credit score (around 600). You can also be approved for some financing by using a piece of equipment as collateral or putting up a personal guarantee.

You could also qualify for a Small Business Administration (SBA) loan through some banks, credit unions and online lenders. The SBA will guarantee a portion of the loan, removing some risk for lenders approving your financing.

Angel Investors

An angel investor is an individual who funnels their own funds to an early-stage business enterprise — usually via equity financing. Because angel investors work with startups, you’ll want to explore other sources of business finance if you’re sustaining or expanding an existing company.

Venture Capitalists

Venture capital (VC) firms and investors raise money through partners to provide equity financing for your business.

In addition to traditional and alternative lenders and investors, you can access other methods of financing a business.

Grant Programs

In contrast to other sources of business finance, grant funding doesn’t have to be repaid or exchanged for equity in your company. You can apply for grants from several sources, including non-profit and even some for-profit organizations as well as state and federal government agencies. Some grants are available specifically to female entrepreneurs or minority-owned businesses or military veteran business owners.

While you can receive thousands of dollars in grant awards, you’ll also sometimes face fierce competition from other businesses trying to obtain the same funding.

Crowdfunding

Crowdfunding sites, including Indiegogo and Kickstarter, help entrepreneurs solicit money from VCs and angel investors as well as the general public to help fund their businesses. The sites have flourished in popularity as a business finance resource throughout the last several years. Some businesses will provide equity in exchange for funding, while others will offer products for certain donation amounts.

Financing Your Small Business

Choosing a business funder is a serious decision and shouldn’t be taken lightly. Conduct your due diligence and research the business financing options available to you before making a decision.

Be sure to determine how much funding you need beforehand. And make sure you’re choosing the small business financing option that works best for your company, whether you’re considering business finance loans or investor funding.