The best credit union for your small business will be one that gives you a secure place to keep and increase your cash.

Some small business owners might be unaware of the advantages of opening an account with a credit union rather than a typical bank.

Here’s what makes credit unions different from banks, what they can offer and how they can match the needs of your small business.

What Is a Credit Union?

A credit union is a financial cooperative owned by its members. When you apply to join a credit union, you essentially become a member-owner. Credit unions are set up as nonprofits. Members appoint a board who appoints managers to run the daily operations. In contrast, banks are held by owners with stock available to public investors.

The 5 Best Credit Unions for Small Business Banking

If you want to make the most of your small business banking, credit unions may be the way to go. The best credit unions for business accounts are those that anyone can join, have great account options and offer affordable loan products.

Here are the 5 best:

- Consumers Credit Union

- Navy Federal Credit Union

- America First Credit Union

- Self-Help Credit Union

- First Tech Federal Credit Union

Let’s look at each of these business credit unions in more detail.

1. Consumers Credit Union

-

At a Glance:

- Multiple checking and savings account options

- Visa Platinum credit card with no annual fee

- 24/7 cardholder and fraud-monitoring service

- Online / mobile checking and bill pay

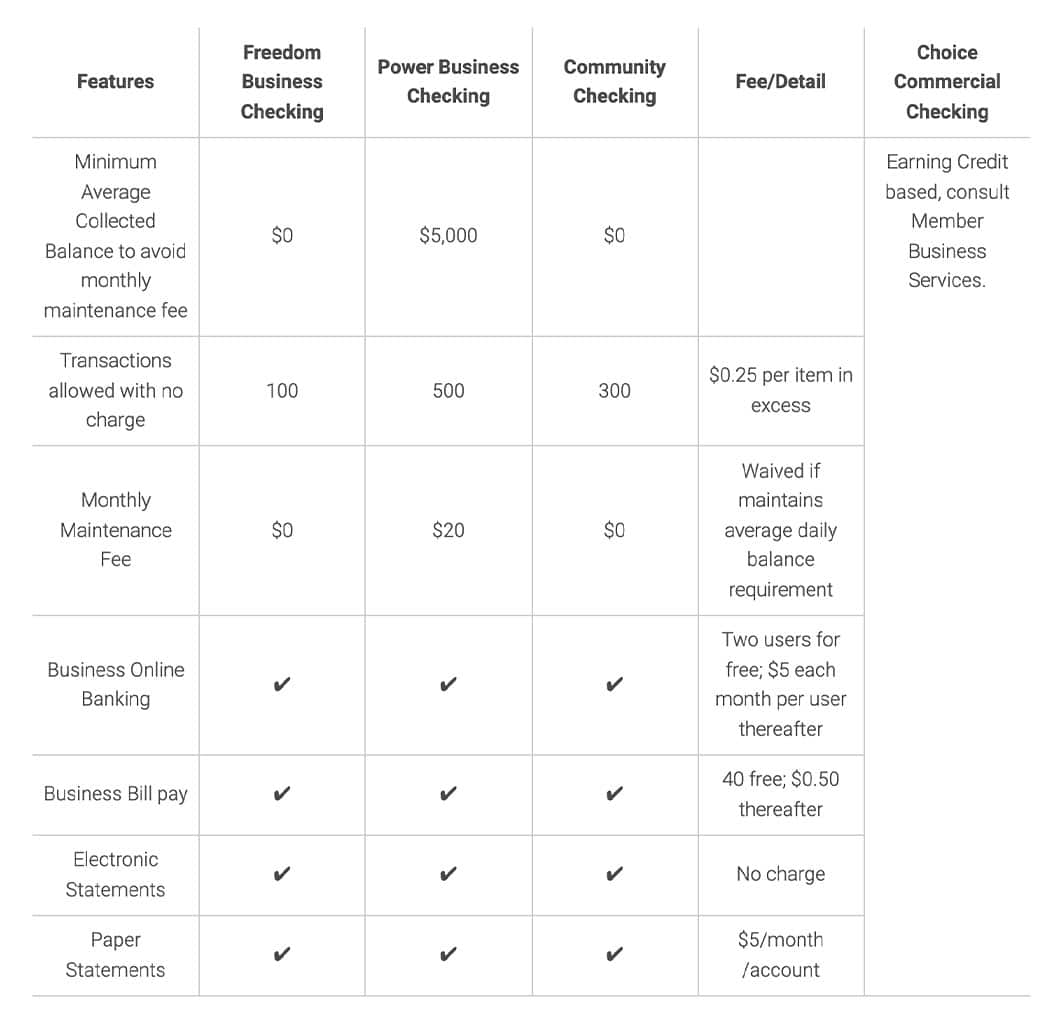

- Power Business Checking and Business Membership Savings accounts pay dividends of 0.05% and have an annual percentage yield (APY) of 0.05%

- Business Money Market accounts with a minimum collected balance of at least $500 are eligible for dividends and APY of 0.25%

- Business High Yield Money Market accounts with a minimum collected balance of $100,000 or more qualify for 0.75% dividends and APY

Consumers Credit Union stands out to us as one of the best online credit unions.

It has multiple banking options, including 4 small business checking accounts, 2 of which have no monthly maintenance fee or minimum average collected balances.

There also are 3 business savings account options, including a money market account that can yield higher interest rates.

Consumers Credit Union offers access to a business Visa platinum card with no annual fees in addition to their Visa debit cards.

You also can secure equipment financing, business lines of credit, SBA loans and commercial mortgages with terms as long as 25 years. This term length makes Consumers one of the best credit unions for small business loans.

Additionally, just about anyone can join. All you need to do is pay $5 to become a member of the Consumers Cooperative Association.

2. Navy Federal Credit Union

-

At a Glance:

- Competitive rates on business account options

- Full array of small business loan products

- Visa and MasterCard credit cards

- Exclusive to service members and families

- All business checking accounts earn dividends

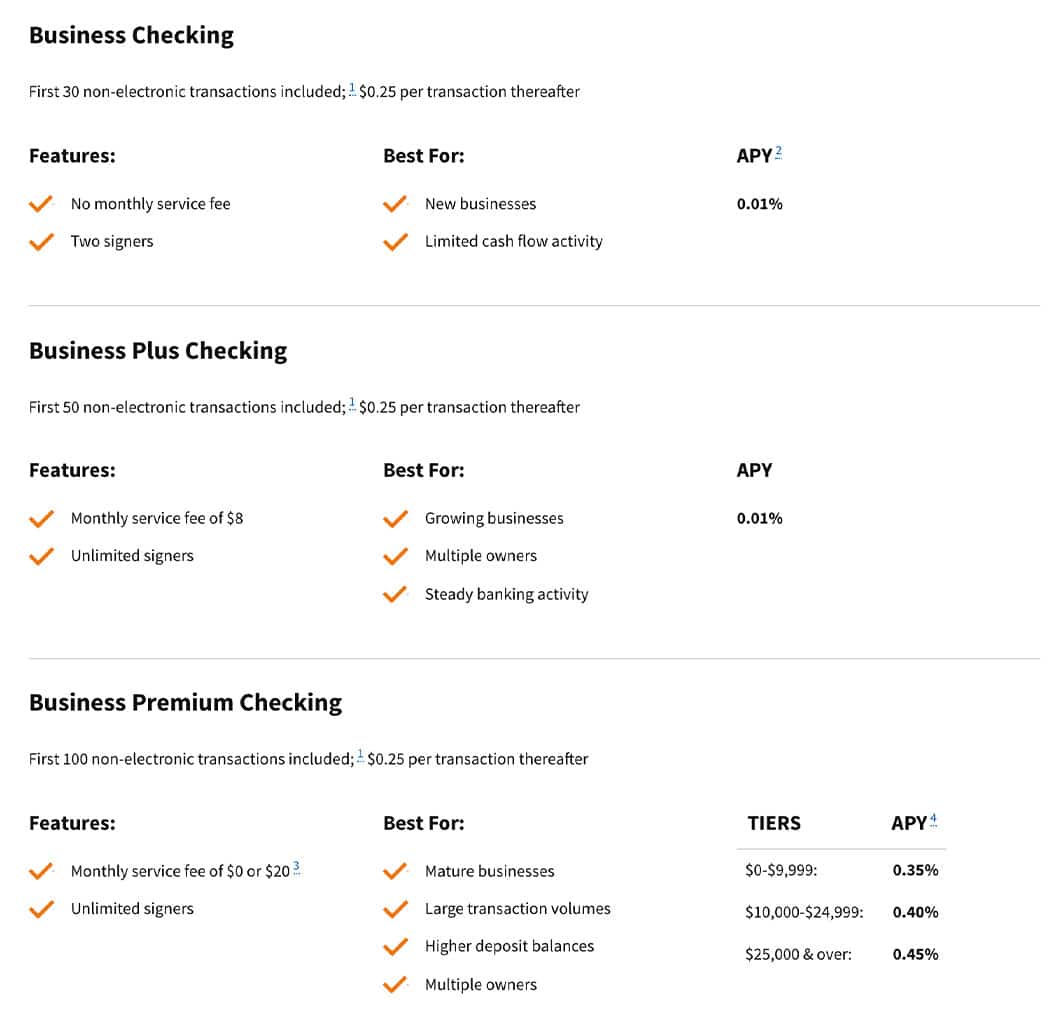

- APY for business checking accounts range from 0.01%-0.45%

With over 10 million members, the Navy Federal Credit Union (NFCU) boasts the largest credit union membership in the country.

In addition to checking and money market savings accounts, NFCU can also compete with the best banks or credit unions for small business loans. You can apply for business lines of credit, commercial mortgages, commercial auto loans and both secured and unsecured term loans.

NFCU’s business credit cards have no annual fees, and the APR starts at the prime rate plus 5.90%.

The biggest drawback to NFCU is the membership requirements. If you aren’t an active-duty or retired military service member, a family member of an active-duty or veteran service member or an employee of the Department of Defense, you won’t be eligible to join this credit union for your small business.

3. America First Credit Union

-

At a Glance:

- Multiple checking and savings account options

- Full array of small business loan products

- Easily accessible on the go

- Exclusive to certain regions

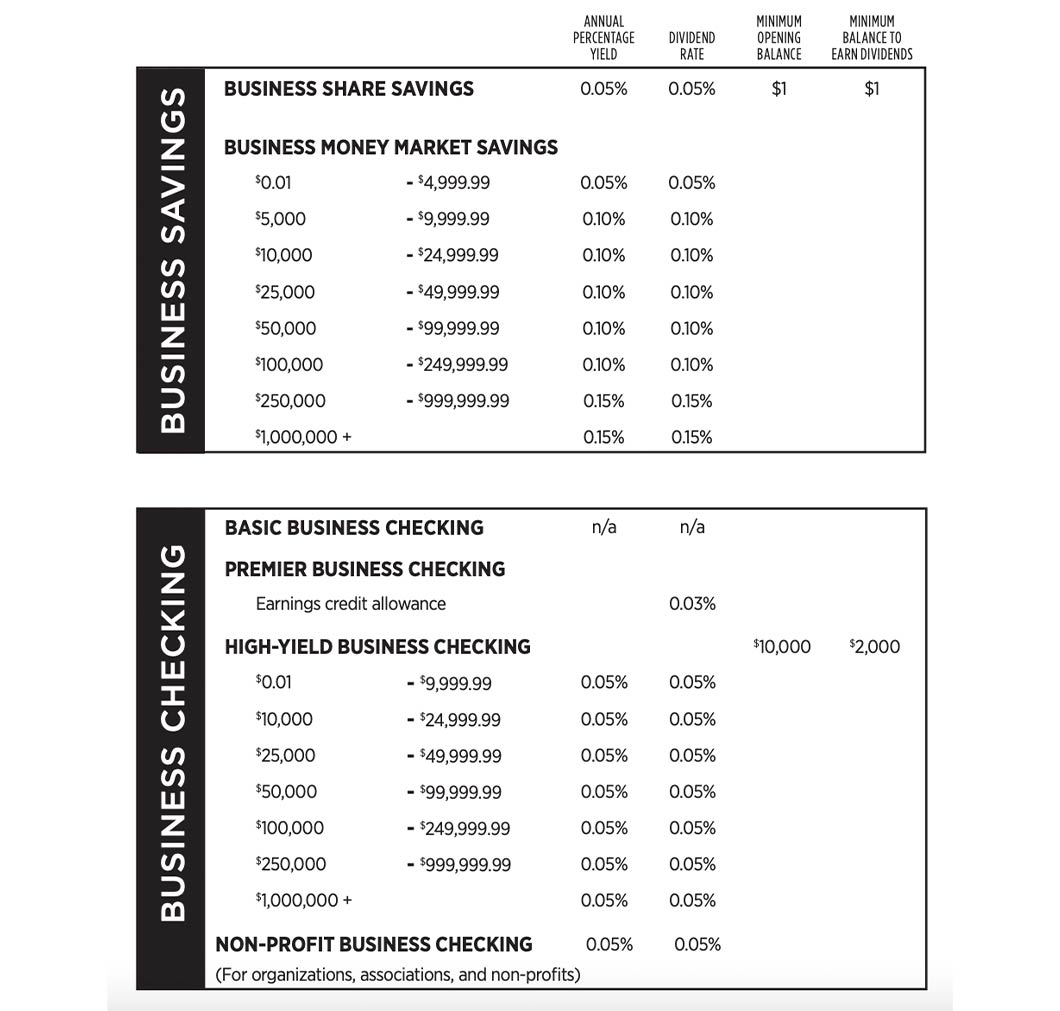

- Premier Business Checking account has a dividend rate of 0.03% and High-Yield Business Checking account has dividend and annual percentage yields of 0.05%

- Business Share Saving account has an annual percentage yield and dividend rate of 0.05% and the Business Money Market Savings account has rates ranging from 0.05%-0.15% depending on the account balance

Based in Ogden, Utah, America First Credit Union (AFCU) has a great selection of business account products.

AFCU has some of the best small business checking accounts credit unions offer. You can sign up for the free basic account, which includes up to 250 free transactions, or pay a monthly fee of $8 or $50, respectively, for AFCU’s Premier and High-Yield Business Checking account options.

Several savings account options include a money market account and dedicated plans that save you money for specific causes.

America First also offers an extensive selection of financing. You can apply for capital to finance equipment, real estate, business acquisitions and more. The various options make AFCU one of the best credit unions for small business loans.

With mobile banking, online bill pay and more than 120 locations, AFCU is one of the more convenient options on the list.

Membership eligibility is the main disadvantage. To become a member, you must work for a select employer, live, volunteer, worship or attend school in certain counties in Arizona, Idaho, Nevada, New Mexico, Oregon and Utah are eligible. Immediate family members of existing members are also eligible for membership.

4. Self-Help Credit Union

-

At a Glance:

- Small business checking account with 0.05% APY

- Free business savings account

- Access to SBA loans

- Focus on underserved communities

The mission of Self-Help Credit Union (SHCU) is to provide economic opportunity for all, focusing on underserved communities and demographics. This includes minorities, women and other socioeconomically disadvantaged groups.

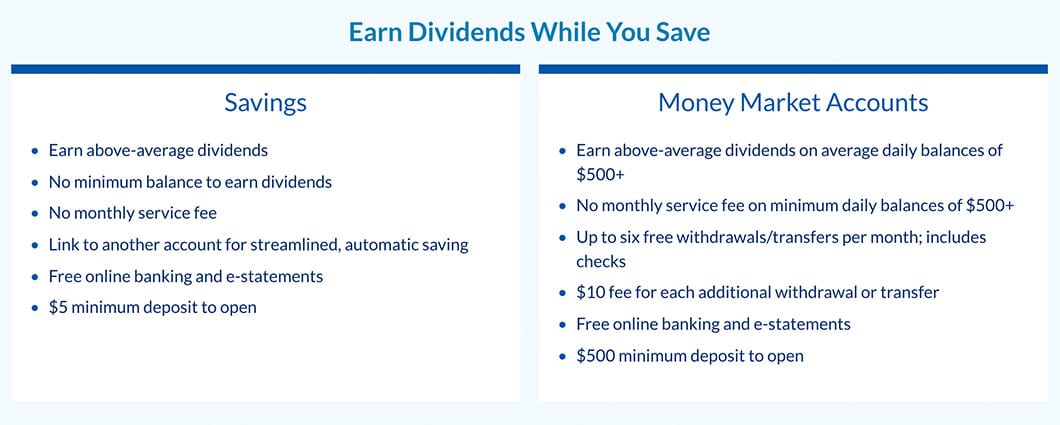

You can open a free business savings account with no minimum balance to earn dividends. Or you can choose a money market option with no monthly service fee on minimum daily balances of $500 or more and up to 6 free withdrawals monthly.

What they lack in account options, they make up for with loan products. As a community development financial institution (CDFI), Self-Help can offer Small Business Administration 504 loans. These government-backed loans feature high funding amounts and low interest rates, allowing SHCU to compete with the best banks for small business loans.

You can apply for other SBA loans, commercial real estate loans and other small business and commercial loans.

Eligible members include residents of specific communities in North Carolina, South Carolina, Virginia and Florida and those who meet their family or employer criteria. If you don’t meet the criteria, you can join by paying a $5 membership fee to the Center for Community Self-Help, which carries on the mission of the credit union. The focus on charity makes it one of the best credit unions anyone can join.

5. First Tech Federal Credit Union

-

At a Glance:

- Business checking and savings accounts available

- Robust online and mobile features

- High commercial real estate loan amounts with no prepayment penalties (no other business loan options)

As the name suggests, First Tech Federal Credit Union is suited for those who prioritize technological features in their business banking partner.

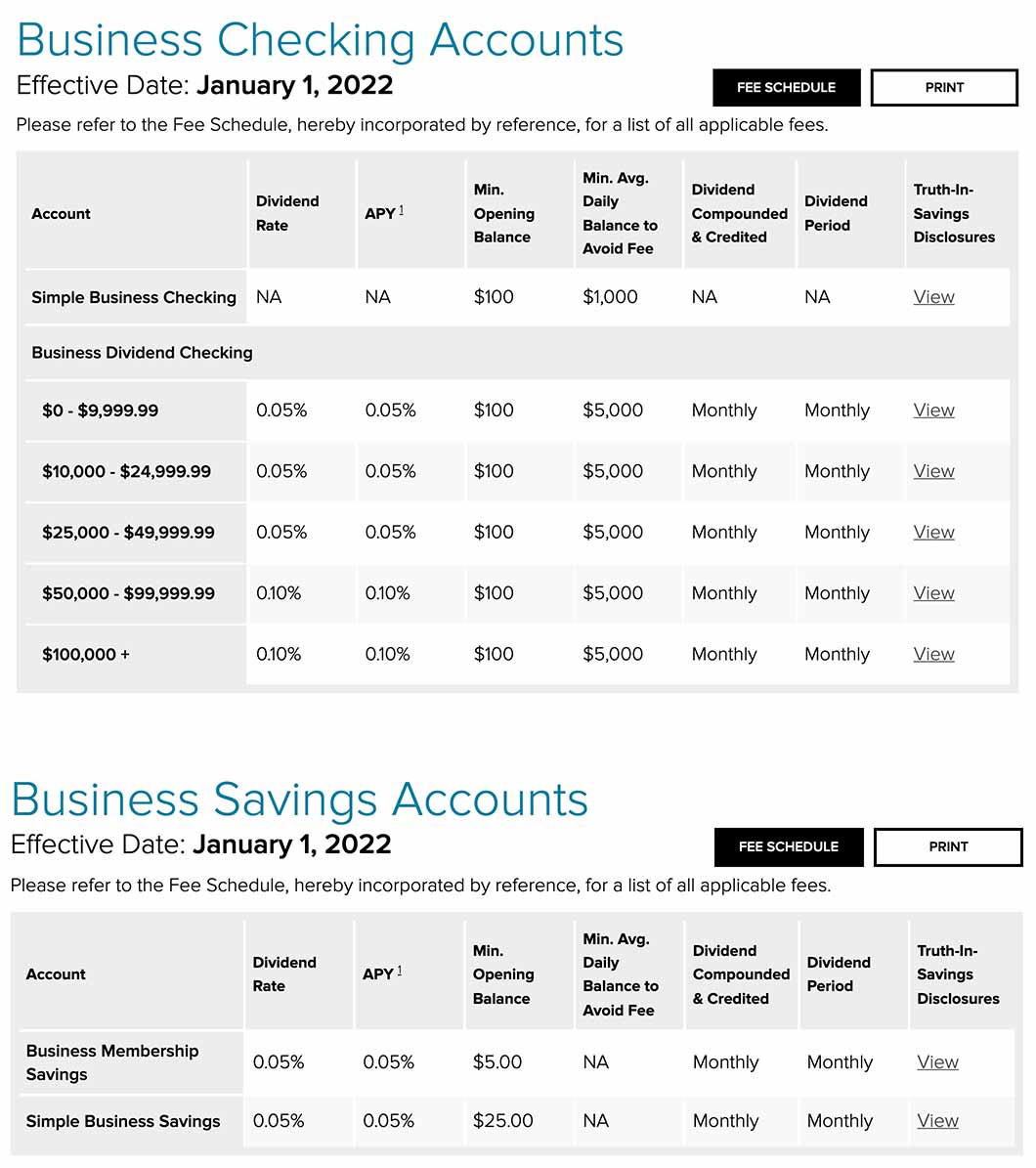

This is one of the best online credit unions for business accounts with multiple options. You can choose between 2 free small business checking accounts. The Business Dividend Checking account offers a 0.10% APY with a daily balance of $5,000 or more, while the Simple Business Checking account is free with a daily balance of $1,000 or more (otherwise $6 monthly).

If your goal is to save for your business, you’ll have a couple of options with savings account interest rates reaching up to 0.05% APY.

Enjoy mobile check deposits and other web and mobile features usually reserved for big banks.

Loan options are limited to commercial real estate, but First Tech does offer higher loan amounts than other credit unions on our list, from $500,000 to more than $10 million.

You can join if you work for an eligible tech company or the state of Oregon, live or work in Lane County, Oregon or join the Computer History Museum or Financial Fitness Association.

Advantages of Credit Unions

The nonprofit structure of credit unions leads to several advantages. Instead of focusing on making more money, credit unions look out for the best interests of their members.

To this end, business credit union savings account interest rates are often higher and financing rates lower than banks. That means that, when joining a credit union, businesses can earn more and spend less.

Because of their community-driven focus, credit unions can offer a more personal touch when it comes to customer service — a big plus for business owners who value working relationships with other companies.

Disadvantages of Credit Unions

The small, community-based, nonprofit status of credit unions can lead to certain disadvantages.

Because credit unions typically serve a specific group, you might not meet the requirements needed to join one.

Some common criteria include:

- Working for a certain employer

- Living in a particular community or region

- Being a union member

- Having a military family history

Even if you don’t meet the requirements, you may still be able to join a credit union. Some may offer you membership if you join an approved group. This often involves paying dues to an organization connected to the credit union.

Most credit unions can’t compete with the technological advantages of big banks. While service and access to a business debit card is a credit union standard, added features such as online bill paying and mobile checking may not be available.

If you’re considering taking out loans in the future, note that due to limited resources, you may not find the same credit card and funding programs at some of the best credit unions as you would banks for small business financing. Highly accessible alternative financing options, such as merchant cash advances, are also not available. Automated teller machines and branch locations also may be more difficult to access.

Make sure to go over exactly what you need, want and expect before joining a credit union.

-

Small Business Tip: Some small business owners are wary of trusting their money with credit unions because the Federal Deposit Insurance Corp. doesn’t insure them, but that shouldn’t be the case.

Most credit unions are backed by the National Credit Union Administration (NCUA). The NCUA insures credit union accounts up to $250,000. Those that aren’t NCUA-backed are likely privately insured. Determine which entity is insuring a credit union when you’re looking to open a business account.

Choosing the Best Credit Union Business Account

Deciding between a bank vs. credit union for a business account? Review your small business needs. If you want to join one of the best credit unions to open a business account, consider the option that will be most convenient for your company and for you as an entrepreneur. Also think about which account features your business will benefit from the most.