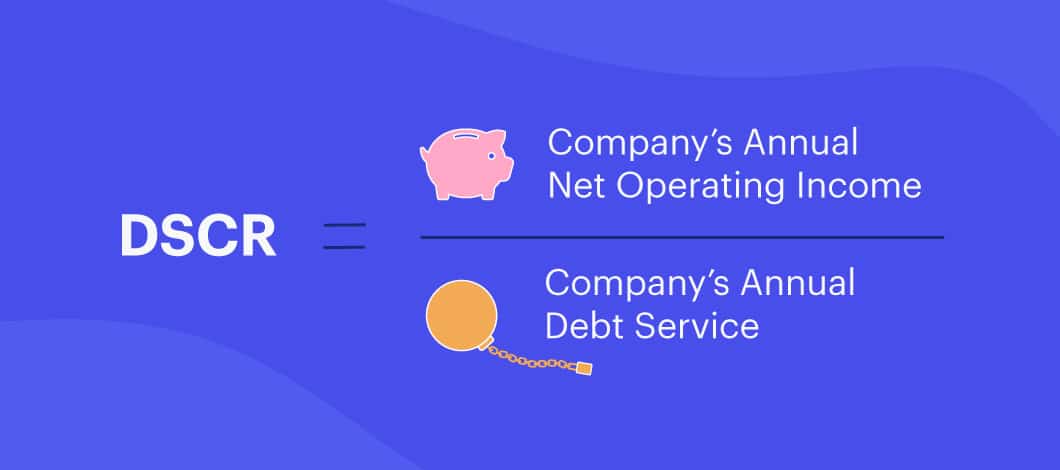

Also referred to as the debt service ratio or debt coverage ratio, debt service coverage ratio (DSCR) is calculated by dividing your business’s net operating income by your annual outgoing debt payments, or debt service, which includes principal and interest.

For example, if your business has a net operating income of $250,000 and a total debt service of $150,000, your DSCR would be 1.67. Find out why DSCR is important, see examples for how to calculate your debt service coverage ratio and discover what a good debt service coverage ratio is (and isn’t).

-

What Is DSCR (and Why Is It Important)?

Your business DSCR is a measure of your company’s cash flow. Calculating the DSCR helps you determine your company’s financial health.

It’s also important to learn how to calculate DSCR for loan purposes. That’s because this ratio is a way lenders evaluate whether your small business can repay financing debt.

The higher your DSCR, the easier it will be to qualify for a small business loan. DSCR also will help determine how much funding you’re approved for as well as the rates and terms that apply.

3 Steps for How to Calculate Debt Service Coverage Ratio

While the debt service coverage ratio formula is straightforward, your DSCR calculation relies on having accurate information about your business finances.

Before using the DSCR formula, you have to determine your annual net operating income and debt payments. Here’s what you need to do when you’re looking for how to figure out your debt service coverage ratio.

1. Determine Your Annual Net Operating Income

Your annual net operating income (NOI) is calculated by subtracting your business expenses from your earnings. You can find this information using your profit and loss statements.

In this situation, your expenses are the cost of goods sold (COGS), including labor, transportation, materials and other operating costs, such as rent.

For instance, if you had $1.2 million in earnings last year and $200,000 in expenses, your net operating income is $1 million.

In this example, $1 million is your annual net operating income, which you’ll need to calculate your debt coverage ratio.

Some lenders will have different methods of determining your company’s cash flow for their debt service coverage ratio formula. Common variations include EBIT and EBITDA as well as capital expenditures (CAPEX).

2. Determine Annual Debt Payments

The next step to calculate the debt service coverage ratio is to determine what your total debt service is. Debt payments include any existing loans you’re repaying. Lenders might also factor in the loan you’re applying for to give themselves an accurate picture of whether you can afford the loan.

Here’s an example of how to determine your annual debt payment. Let’s say you have a $630,000 loan with an interest rate of 6.875% that has to be repaid in 10 months. Using a business loan calculator to determine the amortization schedule, we can see your total debt payment for that loan would be about $650,000, including principal of $630,000 and interest of just over $20,000.

When you’re trying to determine your total debt service, you’ll need to add up all of your debt payments for a year. Keep in mind, your annual debt service will change based on when your loan term begins.

For the most accurate debt service figure, estimate the payments for the loan you’re applying for as well. Consider using a business loan calculator to confirm your debt payments.

For instance, let’s say you’re interested in borrowing another loan of $425,000 and will be repaying the loan in 12 months, starting in January. The interest rate is 8%. Using a business loan calculator you’ll find the total repayment amount that year will be $443,641, including $425,000 in principal and $18,641 in interest.

Combining both loan payments, we’ll round up our repayment amount for the second loan to $444,000 and add that to our first loan repayment amount of $650,000. This will give us a total debt service of $1,094,000.

3. DSCR Calculation

The final step to get the DSCR is to use the debt service coverage ratio formula in which you take the annual net operating income figure you’ve found and divide that by the annual debt payments. The result is your DSCR.

Using our earlier figures, here’s a cash debt coverage ratio example:

This also demonstrates why it’s important to estimate future loan payments when calculating your annual debt service. If you included only your existing loan repayment of $650,000 instead of adding in your prospective loan repayment of $444,000 too, your DSCR would be very different.

-

Debt Service Coverage Ratio Calculators

While it’s important to know the components that go into calculating DSCR, it can be helpful to have a calculator handy. Google “DSCR calculator” and you’ll get several results that could make it easier to calculate your ratio.

Here are a few annual debt service calculators to consider:

What Is a Good DSCR Ratio?

While lenders have different DSCR requirements, a good DSCR is typically between 1.15-1.35, according to financial news website The Street.

This threshold might change based on external factors, such as the overall health of the economy.

In general, the higher your DSCR, the better.

However, a figure below 1 indicates a low debt service coverage ratio. It shows a company is making less money than it needs to pay its debts. In this case, the business is unlikely to have enough income to make payments on any new debt.

A DSCR of 1 means there is exactly enough money to cover debts.

A ratio greater than 1 demonstrates the business has more annual income than necessary to pay debts.

You might need to increase your debt service coverage ratio to boost your chances of getting a small business loan.

Ways to Improve Your Debt Service Ratio

There are a few ways to improve your debt service ratio:

- Decrease your borrowing amount

- Reduce your existing debt

- Increase your net operating income

Let’s look at these in more detail.

Decrease Borrowing Amount

Let’s go back to our earlier debt service coverage ratio example, where we’re looking to borrow $425,000 at 8% interest for a 12-month term starting in January, requiring $425,000 in principal and $18,641 in interest. As mentioned, we’ll round up that sum to $444,000 (Loan B).

Our current annual net operating income is $1 million, and there will be loan payments amounting to $650,000 from an existing loan (Loan A). As previously noted, this would give us an annual debt service of $1,094,000 and a DSCR of 0.91.

A DSCR of 0.91 will make it difficult to qualify for a small business loan of $425,000 plus interest. But what if a loan of $150,000 with those same terms could still help your business?

With an interest rate of 8% and a 12-month term, your total debt payment for the year would be $156,579 — including principal and interest. Let’s round up to $157,000.

Let’s see how this revised debt service figure changes your debt coverage ratio.

A DSCR of 1.24 puts your small business in the range of a good debt service coverage ratio, making it more likely you’ll be approved for that small business loan.

Reduce Existing Debt

Let’s say you implement debt relief strategies and pay off your existing debt of $650,000 before applying for your next loan of $425,000.

Based on the terms previously discussed, this would change your total annual debt service to $444,000, and by extension, your DSCR also would change.

Increase Net Operating Income

You can also turn to creative ways to reduce your expenses, thereby increasing your income. If your net operating income grows, your DSCR will also increase — even if your debt service stays steady.

You’ll want to experiment with all of these strategies if you’re looking to improve your DSCR and qualify for a small business loan. This is a challenging but important part of your company’s financial health.