EBIT or EBITDA: Scratching your head right about now?

Of the many acronyms small business owners have to keep in mind, these two rank high on the list and there are some important distinctions between them.

Find out the meaning of these terms and when to use EBIT vs. EBITDA. Also review practical EBIT vs. EBITDA examples and learn how to calculate each.

Once you’re familiar with the basics of EBIT vs. EBITDA, you’ll be able to use them to gain insight into a company’s profitability, whether your own or one you’re considering investing in.

What Does EBIT Mean vs. EBITDA?

EBIT stands for earnings before interest and taxes, also sometimes referred to as operating income.

EBITDA stands for earnings before interest, taxes, depreciation and amortization.

The main difference between EBIT and EBITDA is if EBIT represents operating income, EBITDA takes that one step further and represents cash flow generated by business operations.

Let’s take a closer look at EBIT vs. EBITDA’s meaning, so you can better understand when to use each for your business.

Earnings

Earnings refer to net income or the bottom line.

Interest

Interest includes any interest payments you make on credit or loans.

Taxes

The tax part of EBIT and EBITDA comprises whatever dollar value your company must pay in federal and state taxes as stated by the law.

Depreciation

Depreciation refers to the reduction in value of fixed assets over time. Only tangible assets (e.g., inventory, vehicles, buildings) depreciate.

Amortization

Amortization also refers to the reduction in value of fixed assets over time. Unlike depreciation, though, amortization is used for intangible assets (e.g., software, licenses, patents).

What Does EBIT Show?

EBIT is used as a profitability measurement. Calculating earnings before interest and taxes is a preferable metric for companies with high capital expenditure. By removing interest and taxes, a clearer picture emerges regarding the profit a company makes solely based on its operations.

If you’re wondering, “Does EBIT include depreciation?” The answer is no.

Why Use EBIT?

EBIT allows investors a different perspective on a company’s finances and revenue-generating potential.

Tax obligations vary, which makes it difficult to gauge whether a company has more potential than another. EBIT allows us to compare similar companies that have different tax obligations in any given industry.

It does this by stripping variables like debt, equity and taxes, revealing whether or not the core operations of a company are able to generate earnings. This can provide insight into whether a business can pay its debts, fund day-to-day operations and make a profit.

EBIT can also help shed light on innovative business ideas that are actually making money.

Formulas to Calculate EBIT

The formula to calculate EBIT requires you to subtract the cost of goods sold and operating expenses from total revenues.

The formula for earnings before interest and taxes is as follows:

EBIT = Revenue – Cost of Goods Sold – Operating Expenses

We also can calculate EBIT using this formula:

EBIT = Net Income + Interest + Taxes

What Does EBITDA Show?

EBITDA is an indicator of financial performance and can tell us how profitable a company is based solely on its fundamental operations. It’s also a good representation of cash flow in companies that have more or less low capital expenditures needed to fund their operations.

Why Use EBITDA?

A metric of profitability, EBITDA excludes nonoperating expenses and certain noncash expenses, such as debt financing and intangible assets. This provides insight into how actual operating decisions affect a company’s finances.

EBITDA has become commonplace among owners, buyers and investors as a metric for comparing business valuations. EBITDA also is used when investors need to assess a company for acquisition purposes.

As long as your financial information is accurate, calculating EBITDA is straightforward.

Formulas to Calculate EBITDA

As with EBIT, there are two formulas to calculate EBITDA. While they are different, each will give you the same result. The formulas for calculating earnings before interest, taxes, depreciation and amortization include:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Or

EBITDA = Operating Profit + Depreciation + Amortization

To correctly calculate EBITDA, it’s essential to have the full depreciation and amortization number. All of the information you need to complete either formula should be available on your financial statements.

Keep in mind, sometimes depreciation and amortization may be listed on the income statement or the cash flow statement, or they may be included as part of the operating expenses.

EBIT vs. EBITDA Example Calculations

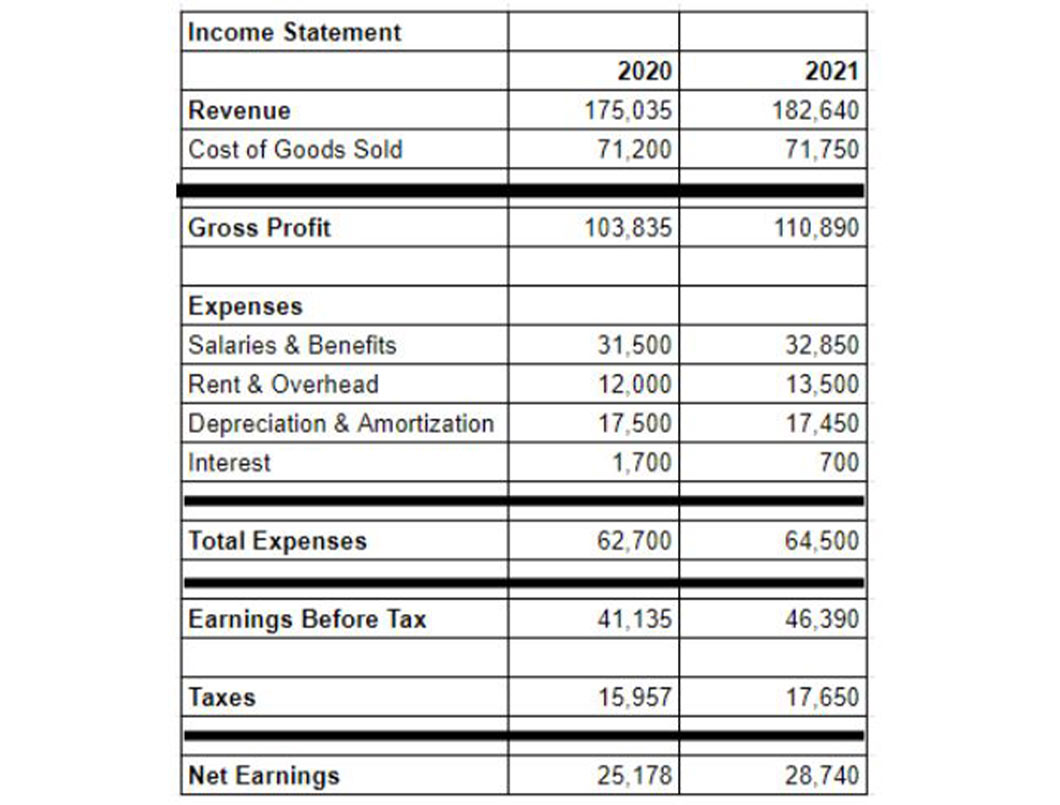

Using this sample income statement, here’s how to find EBIT for 2021:

EBIT = Net Income + Interest + Taxes

EBIT = $28,740 + $700 + $17,650

EBIT = $47,090

Now, we’ll use the same sample year’s figures to calculate EBITDA:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

EBITDA = $28,740 + $700 + $17,650 + $17,450

EBITDA = $64,540

Difference Between EBIT vs. EBITDA: When to Use and Limitations

While EBIT and EBITDA are considered reliable by many investors, they’re not deemed standard measures for financial reporting according to the Generally Accepted Accounting Principles (GAAP). This is because these formulas don’t always give us the full picture. Indeed, by ignoring certain expenditures, companies can hide problem areas in their finances.

Interestingly, billionaire investor Warren Buffett is an outspoken critic of EBITDA. He’s said people use it to dress up their financial statements. He’s also indicated he wouldn’t buy companies that use the formula in their annual reports.

At the end of the day, when comparing EBIT vs. EBITDA and which is better, consider that for businesses with high capital expenditures, such as oil, gas and mining companies, EBITDA fails to consider the capital expenditure necessary to sustain a business.

The amount of capital spending these businesses need puts EBITDA and actual cash flow very far apart. Consequently, EBIT may be a better metric for high capital expenditure companies.

Calculating EBIT and EBITDA for Your Business

Despite their limitations, EBIT and EBITDA can be useful tools for analyzing profitability and cash flow. They can help you plan for your company’s future or assist in the evaluation of businesses you’re considering as investments.

If you’re not already, consider using accounting software to track your company’s EBIT vs. EBITDA performance metrics on an annual basis.