Current assets are cash or any other asset you can convert to cash, consume or sell within a year or within the operating cycle of a business — whichever term is longer. They’re also known as short-term assets or liquid assets.

Calculating current assets will provide numbers that will demonstrate the stability of your business and its capacity to meet its financial obligations.

We’ll show you what current assets are all about, how to calculate total current assets and how to improve your numbers.

What Are Examples of Current Assets?

An asset is anything owned by a business that has value — including cash and all assets that can or will be converted to cash (or sold or consumed) within a year.

In addition to cash, the following are examples of items that are considered current assets:

- Cash equivalents: These include all bills, currency notes and equivalents, checks not yet deposited and petty cash. Cash equivalents include money stored in the bank or money market accounts.

- Marketable securities: Stocks or bonds with maturities less than a year that are sold through brokers and listed on exchanges fall into this category.

- Short-term investments: Examples of these include U.S. Treasury bills and certificates of deposit.

- Accounts receivable: This refers to the total value of your business’s outstanding invoices, owed by customers for products delivered or services rendered. Ideally, you should collect all accounts receivable within 90 days or less and with a collection rate of 90% or better.

- Advance payments on future purchases and prepaid expenses: Payments you’ve made ahead of time, such as rent or insurance paid in advance, are classified as this.

- Raw materials, finished goods, inventory: These include any raw materials, products in the process of being manufactured, finished goods or other saleable items (not including office supplies) your company can convert to cash. You may count office supplies and other equipment as current assets, but only if you could realistically sell or consume them within a year.

- Office supplies: When purchased in bulk, office supplies are often recorded as assets. They may include ink, toner, cartridges, paper shredding machines, etc.

- Other liquid assets: These include any other assets you plan to convert to cash within a year. These are easy to overlook, so be sure you include them in your total. Examples include long-term investments that will mature within 12 months or property you plan to sell within the year.

When determining whether an asset is current or not, you must consider the amount of time it would take to liquidate that asset while continuing to operate your business. An asset that takes longer than a year to liquidate is not a current asset.

Other types of assets include intangibles such as trademarks, patents and goodwill and non-current assets (also called long-term assets).

Noncurrent assets are things that cannot be liquidated as needed, such as restricted cash (cash that is held and can’t be withdrawn or used for operations), depreciable assets, receivables not due in 12 months or less, land and physical assets such as buildings.

How to Calculate Total Current Assets

If you want to calculate total current assets, add all assets that can be converted to cash, consumed or sold within 1 year of the date of the balance sheet.

Here’s how you can determine if an asset should be included in your current assets formula.

- Does the company own it?

- Does it have tangible value?

- Do you expect to convert it to cash, sell it or consume it within a year?

If you can answer yes to all of these questions, then the asset should be included in your total calculation.

Before you start calculating your current assets, you’ll need to create a list of all of them. The traditional method is to record each item in order from most liquid to least liquid, with cash at the top. Once this is organized, you’re ready to use the current assets formula.

Current Assets Formula

When you’re looking for how to find current assets, use the following total current assets formula:

Calculating Current Assets As a Measure of Financial Health

If your current assets are low — which is known as having a weak asset position — even small revenue fluctuations can cause big problems for your business. By strengthening your asset position, you can deal with unexpected financial challenges and still pay off short-term debts.

On the other hand, if you have too many current assets, you might be missing opportunities to use cash on hand to increase revenue.

Demonstrating you have the right balance is an excellent way to signal to banks, lenders and investors that you are secure, stable and wisely reinvesting your money. Additionally, when applying for a business loan, you can pledge current assets as collateral to help you secure the financing.

Practical Example Using the Current Assets Formula

After you make your balance sheet of short-term assets, add them up. Here’s an example of a current assets balance sheet.

- Cash and cash equivalents: $75,000

- Marketable securities: $50,000

- Short-term investments: $15,000

- Accounts receivable: $20,000

- Prepaid expenses: $12,000

- Inventory, raw materials and finished goods: $45,000

- Office supplies and other equipment: $25,000

- Other liquid assets: $10,000

Using the above numbers, here’s a sample calculation of your total:

$75,000 + $50,000 + $15,000 + $20,000 + $12,000 + $45,000 + $25,000 + $10,000 = $252,000 in Total Current Assets

Other Formulas to Calculate Using Current Assets

Calculating the current assets formula is just the beginning of determining the financial health and liquidity of your business. Once you know how to get current assets, you can use that metric in other formulas to figure out areas for improvement and keep your business running.

Net Working Capital Formula

To calculate net working capital, subtract current liabilities from total current assets. Current liabilities are all amounts due to be paid to creditors within the next 12 months. They typically include categories such as accounts payable, accrued expenses, short-term debt and interest payable.

Net working capital is an indication of a company’s liquidity. Having a positive net working capital signals your business is financially healthy and able to meet short-term obligations.

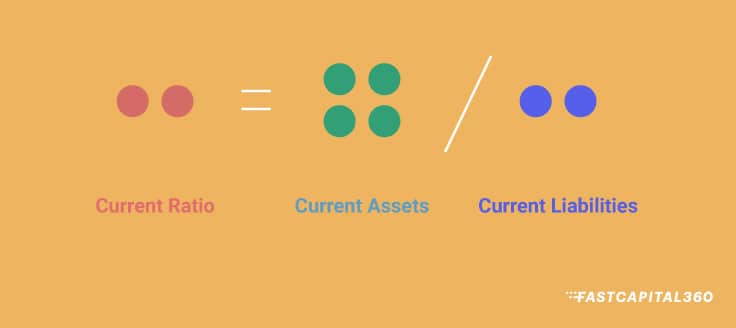

Current Ratio Formula

The current ratio is computed by dividing current assets by current liabilities.

Like net working capital, the current ratio assesses a business’s liquidity. Your business should have a minimum current ratio of 1.0. A current ratio of less than 1.0 indicates low liquidity and poor financial health.

An ideal current ratio is 1.2-2.0. That means your current assets equal 120%-200% of your current liabilities, and you have enough liquidity to operate month to month without falling behind on obligations.

If your current ratio is above 2.0, you might not be putting your cash on hand and other assets to work. If this is the case, you should consider reinvesting revenue at a higher rate to increase future income.

Quick Ratio Formula

The quick ratio is another way to determine liquidity, similar to the current ratio, but it uses a limited number of current asset categories.

Think of the quick ratio as a more conservative, short-term version of the current ratio. Businesses and banks can use the quick ratio as an easy way to determine if a company is able to pay its short-term obligations on time.

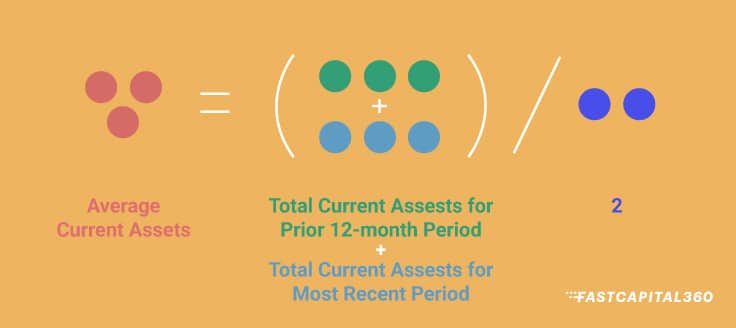

Average Current Assets Formula

Average current assets refers to the mean value of current assets over a period of 2 or more years.

Here is how to calculate it:

Business owners can use average current assets to manage costs, determine monthly budgets and plan for the future. You can also add in multiple years; if you do, remember to divide the total of all assets by the number of years you’re including. For example, if you add 4 years of current assets together, divide by 4 to determine the average over the past 4 years.

Improving Your Current Assets Ratio

If your net working capital is low or negative, or if your ratio isn’t high enough, you should track your total current assets on a monthly basis and recalculate your ratios each month to see if the financial health of your business is improving.

These are the best ways to improve your total current assets and related ratios:

- Promptly collect invoices and other receivables (within 60 days)

- Use caution when borrowing

- Liquidate all unused assets

- Invest carefully

If customers know you promptly collect invoices, they’re more likely to pay on time.

If you need a loan, be sure only to borrow what you need.

If you inventory your assets and find unused items, liquidate them if you don’t plan to use them within a few months or a year at most. You can put the cash to work better by investing it wisely.

When you do have extra cash, invest it carefully to increase your cash pool, but be cautious. Find the right balance of risk and return based on your current assets. As your current assets and current ratio increase, you can pursue investments with higher yields.