With ever-changing tax laws and remote work becoming the new norm, it can be difficult to know whether you qualify for a home office tax deduction, and if so, what expenses can be deducted.

So, we’re letting you in on what you need to know when you conduct business from home.

Who Qualifies for an IRS Home Office Deduction?

Generally speaking, homeowners as well as renters able to answer yes to the following questions are eligible for the home office tax deduction.

- Do you have a dedicated area of your home that you regularly and exclusively use to run your business?

- If you meet exclusively and regularly with patients, clients or customers at your home, you can answer yes as well (e.g., dentists, attorneys, doctors with in-home offices). In this case, the part of the home used exclusively and regularly for business doesn’t need to be the principal place of business.

- Is that area in your home your principal place of business?

- Alternatively, you may qualify if you conduct some business outside of your home but also perform administrative or other business functions at the home.

That said, infrequent business meetings and phone calls you take at your home don’t meet the IRS requirements for a residential office and won’t qualify you for the home office deduction.

Note: Employees of a company who are working remotely aren’t eligible for the home office tax deduction. If however, you also run a part-time business out of your home, that business could qualify for the home office tax deduction.

The IRS recently posted a special reminder with rules and resources for the home office deduction.

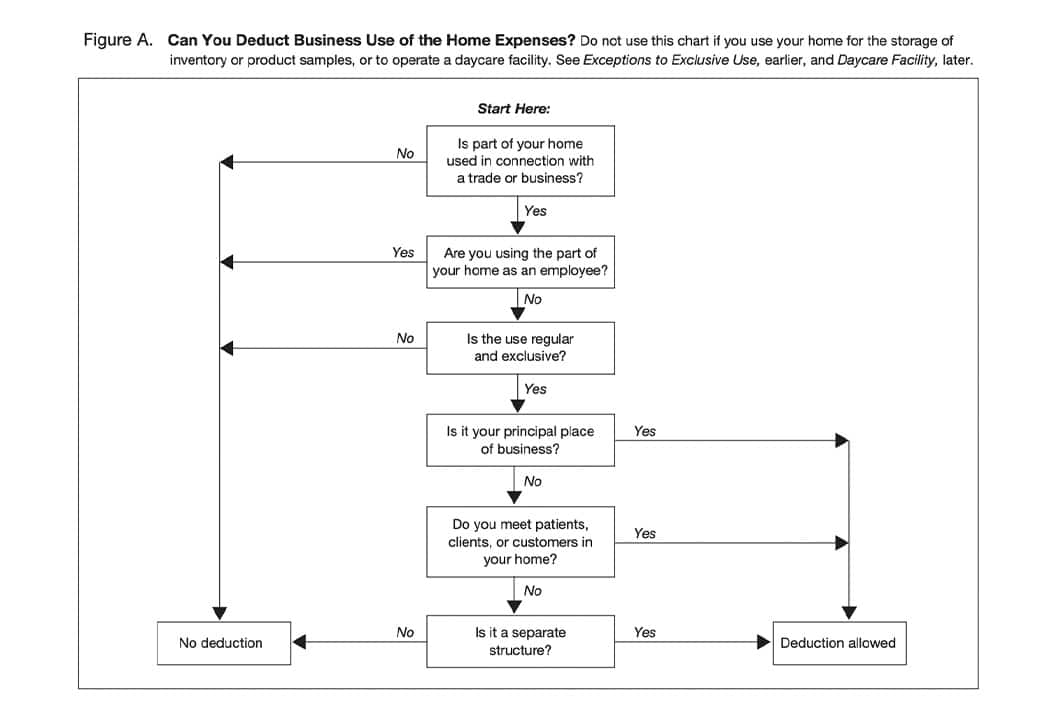

It’s also published this helpful chart to help most individuals determine if they’re eligible for home office write-offs.

Exceptions to the Exclusive Use Requirement

Inventory Storage

Taxpayers who regularly use part of their home for storing inventory or product samples used in a trade or business of selling products at retail or wholesale are eligible for this deduction. To qualify for this exception, your home must be the only fixed location of your trade or business.

Daycare Business

Additionally, individuals who run a daycare out of their home may be able to claim a deduction for part of the home even if it’s the same space for nonbusiness activities.

To qualify the business must:

- Offer daycare services to individuals who aren’t able to care for themselves, including children, those age 65 or older or those with serious physical or mental impairments

- Be recognized as a daycare center or family or group daycare under state law, either having applied for or been granted a license, certification, registration or approval, or exempt from having one

What Is Considered a Qualifying Home Office?

If you qualify for the home office deduction, any of the following as well as similar property are deemed a “home” for tax purposes if used regularly, exclusively and principally for your business:

- House

- Apartment

- Condominium

- Mobile home

Separate free-standing structures, such as the following, also can qualify if they are exclusively and regularly used for business, though not the principal place of business.

- Unattached garage

- Studio

- Barn

- Workshop

- Greenhouse

The home office deduction does not include any part of a property used exclusively as an inn, motel, hotel or similar business.

Simplified Home Office Deduction vs. Regular Method

When it’s time to file your business taxes, there are 2 ways to calculate the home office deduction. Additionally, you can choose which one you’d like to file for any tax year. That said, once you have chosen a method for the year in which you’re filing, you can’t change it.

Additionally, according to the IRS, if you use the simplified method once and then switch to the regular method for a later year, you’ll need to calculate the depreciation deduction for the subsequent year using the correct optional depreciation table.

In both cases, the small business home office tax deduction can’t exceed the gross income from the business use of the home after expenses. However, in the regular method, the amount over the gross income limitation can be carried over, where in the simplified method, it cannot. Here are some other differences between the two methods.

Simplified Method

With the home office deduction simplified method, qualifying taxpayers have a home office expense rate of $5 per square foot for the business portion of the home, up to a maximum of 300 square feet of used business space. This is the standard home office deduction. Using this method, the max deduction for a home office is $1,500.

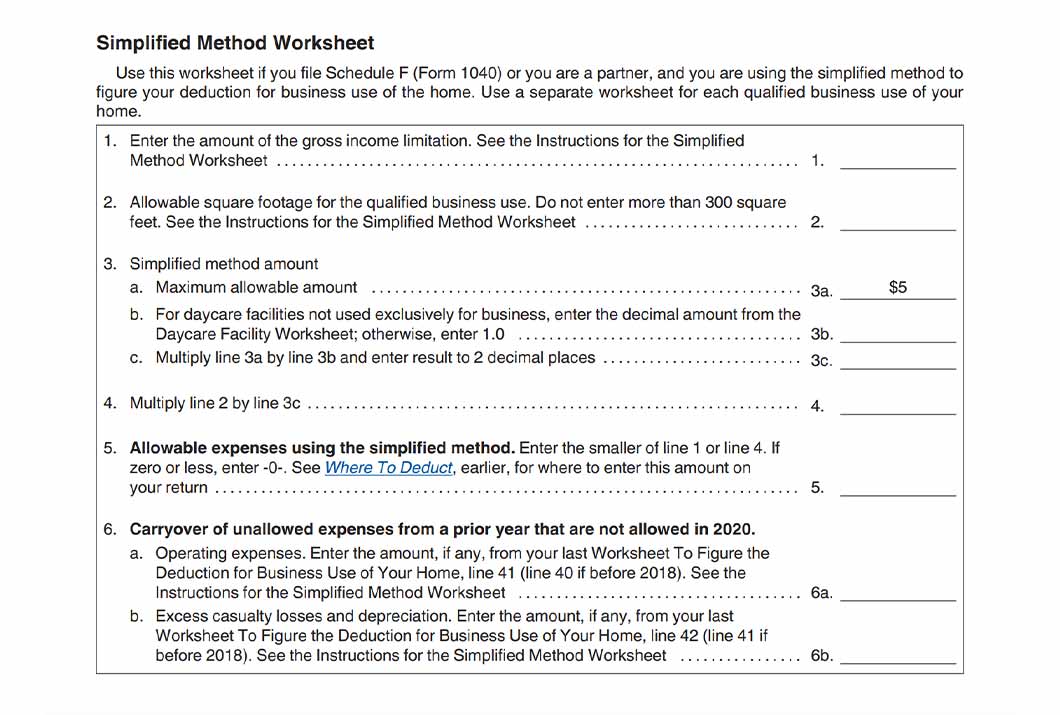

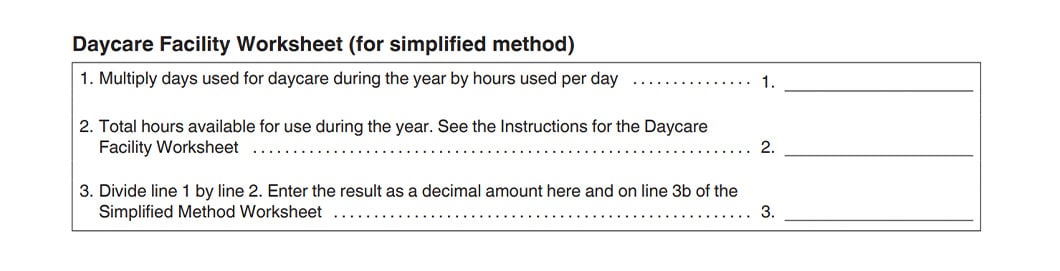

To use the simplified method, daycare providers must complete a worksheet, found in Publication 587. Self-employed individuals use Form 1040, Schedule C, Line 30 to claim deduction, and farmers claim the deduction on Schedule F, Line 32.

Additionally, according to the IRS, “If you itemize deductions and use the simplified method for a taxable year, you can deduct expenses for the home that are otherwise deductible (for example, mortgage interest and property taxes) as itemized deductions on Form 1040 or 1040-SR, Schedule A, without reducing these expenses by the amounts allocable to the portion of the home used in a qualified business use. You do not deduct any portion of these expenses from the gross income derived from the qualified business use of the home.”

While the simplified method is the easier of the 2 methods, your business may have less of a tax break.

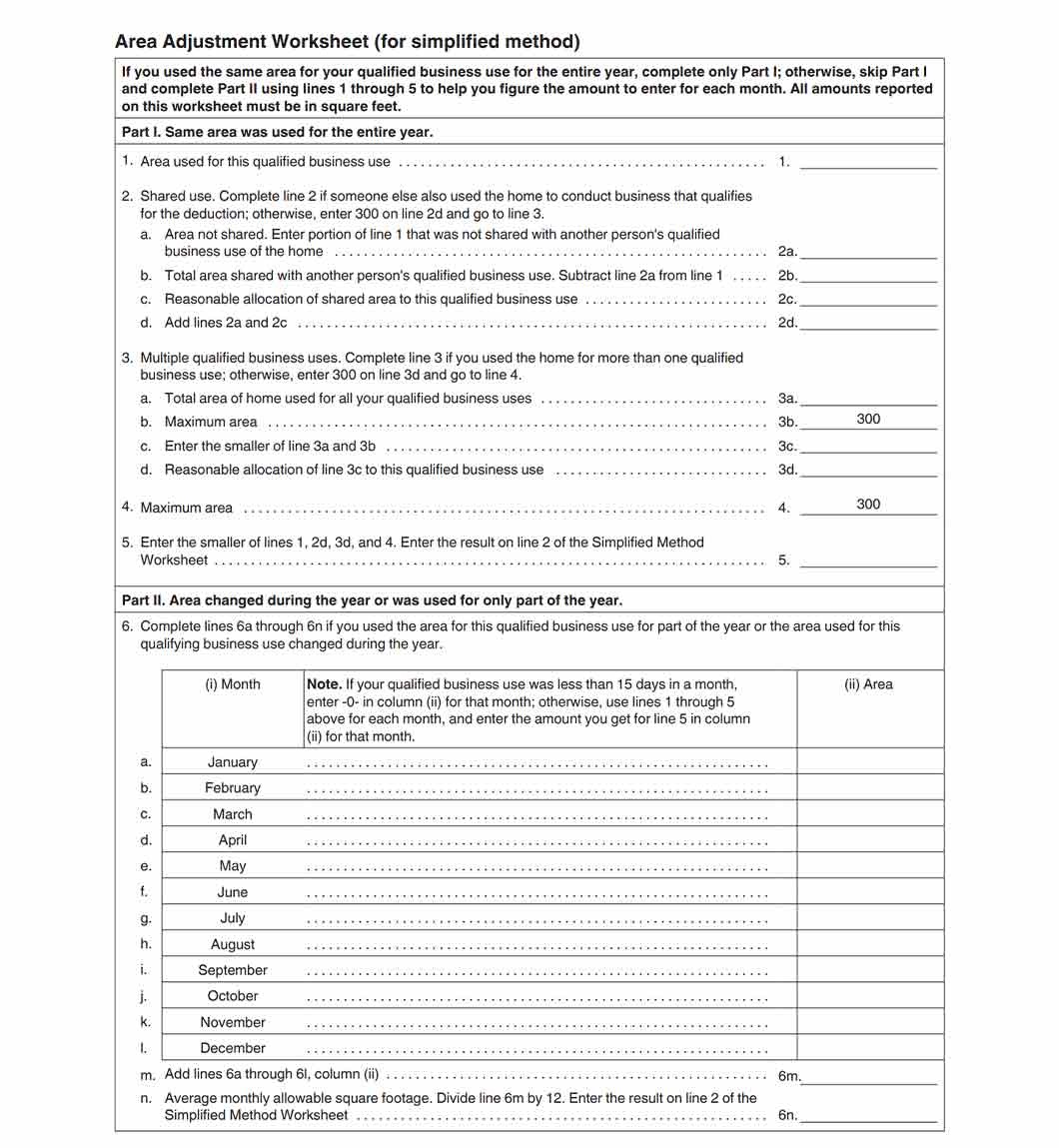

The IRS offers taxpayers these simplified method worksheets.

If you run a daycare out of your home and don’t have a dedicated space for exclusive use of the daycare, then use the below worksheet. If at least 300 square feet of your home was used regularly and exclusively as a daycare throughout the year, then you don’t need to complete the worksheet.

Regular Method

With this method, deductions are tied to the percentage of the home used exclusively for the business. A taxpayer will need to determine this percentage in order to deduct indirect expenses, or those expenses for maintaining your entire home.

Direct expenses, which are those specific to the business part of your home (e.g., repair in business space), can be deducted in full, subject to the deduction limit. Unrelated expenses for parts of the home not used for business (e.g., landscaping) are not deductible.

While tax return preparation software may have a home office deduction calculator, let’s work it out by hand. Here’s how you’d determine the percentage of your home used for business. Let’s say you use a room measuring 10 feet by 12 feet (or 120 square feet) exclusively and regularly for your business, and the entire square footage of your home is 1,000 square feet, your dedicated home office makes up 12% of your home.

Self-employed taxpayers using the regular method file Form 1040, Schedule C, and compute their home office deduction on Form 8829.

Work-From-Home Tax Deductions

In Publication 587, the IRS offers a worksheet taxpayers can use to help them determine their deduction for the business use of their home if they’re using actual expenses instead of the simplified approach.

The worksheet is divided into 4 parts:

1. Part of home used for business

2. Allowable deduction calculation, factoring the following:

- Gross income from business

- Casualty losses

- Deductible mortgage interest

- Real estate taxes

- Business expenses not from business use of home

- Deduction limit

- Excess mortgage interest

- Excess real estate taxes

- Insurance

- Rent

- Repairs and maintenance

- Utilities

- Other expenses

- Allowable operating expenses

- Limit on excess casualty losses

- Excess casualty losses

- Depreciation of home

- Carryover of excess casualty losses and depreciation from prior year

- Allowable excess casualty losses and depreciation

- Allowable expenses from business use of home

3. Depreciation of home

4. Carryover of unallowed expenses to the next year

Instructions for how to complete the worksheets are found in Publication 587.

Using the regular method, if your gross income from the business use of your home is greater than or equal to your total business expenses (including depreciation), you can deduct all business expenses related to the use of your home. If your business income is less than your total business expenses, your deduction for certain expenses for the business use of your home is limited.

The IRS also states the following:

“Your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with depreciation of your home taken last), that are allocable to the business, is limited to the gross income from the business use of your home minus the sum of the following.”

“1. The business part of expenses you could deduct even if you did not use your home for business (such as mortgage interest, mortgage insurance premiums, real estate taxes, and casualty losses attributable to a federally declared disaster if you itemize deductions on Schedule A (Form 1040) or net qualified disaster losses if you claim the standard deduction)”

“2. The business expenses that relate to the business activity in the home (for example, business phone, supplies, and depreciation.”

Additional Things to Know When Determining Tax Benefits for a Home Office

When using actual expenses, keep the following in mind:

- Save receipts for business expenses, such as equipment purchases, repairs, client meals and work-related travel.

- You’re unable to deduct expenses for the business use of your home incurred during any part of the year you did not use your home for business purposes.

- You can’t deduct expenses related to tax-exempt income (e.g., veteran benefits, gifts, welfare benefits) unless you receive a tax-exempt parsonage allowance or a tax-exempt military allowance. Then mortgage interest, mortgage insurance premiums and real estate taxes are deductible under the normal rules.

Additionally, if you have a rental property for which you have income and expenses, refer to Publication 527 for information about case-specific deductions.

Maximizing Your IRS Home Office Deduction

The ins and outs of business taxes can be difficult to understand. If you haven’t already, consider enlisting the help of a reputable accountant or tax advisor to maximize your home office tax deduction. The IRS offers certain tips for choosing a tax professional.

If your business is small and has an uncomplicated setup, popular tax software programs, such as TurboTax, may be another option.

If after filing your business tax return, you find you owe the IRS money and don’t have the capital to make your payment, consider if a small business loan can help.