While the cardinal rule of business is to not run out of money, some companies have found themselves facing bankruptcy after a record-profit year. How is this possible? One answer might be poor cash-flow management.

Let’s dive into the details of operating cash flow, break down the formula and check out examples so you’ll have the tools to make sure there’s enough money in the bank to sustain your operating costs and grow.

What Is Operating Cash Flow?

First off, let’s review the definition of operating cash flow (OCF). Operating cash flow refers to the amount of cash a business generates from its core operational activities, such as selling and purchasing inventory, paying workers and providing services. It reveals if your company’s operations are enough to sustain and grow your business or if additional investment or financing measures are required.

Unfortunately, poor cash flow is a reason why many small businesses fail. According to a QuickBooks report, 60% of small business owners worldwide report cash flow as a problem for their business.

How to Calculate Operating Cash Flow

There are a number of operating cash-flow equations to consider. Two of the most common ways for how to find operating cash flow include the direct and indirect methods.

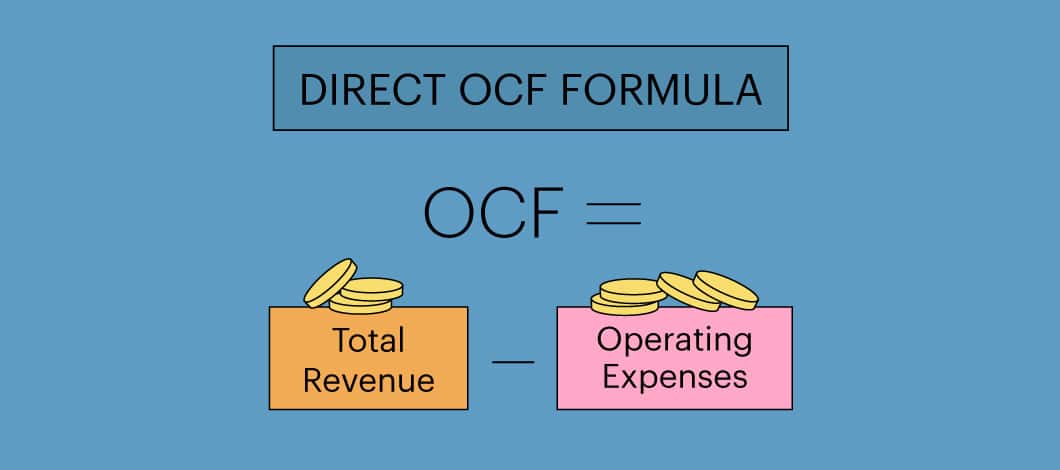

Direct OCF Formula

The direct method of calculating operating cash flow is the simpler of the 2 OCF calculations. However, despite its simplicity, it’s able to offer a glimpse into a company’s profitability. The formula considers total revenue and operating expenses (e.g., production-related expenses, utilities, rent) as follows:

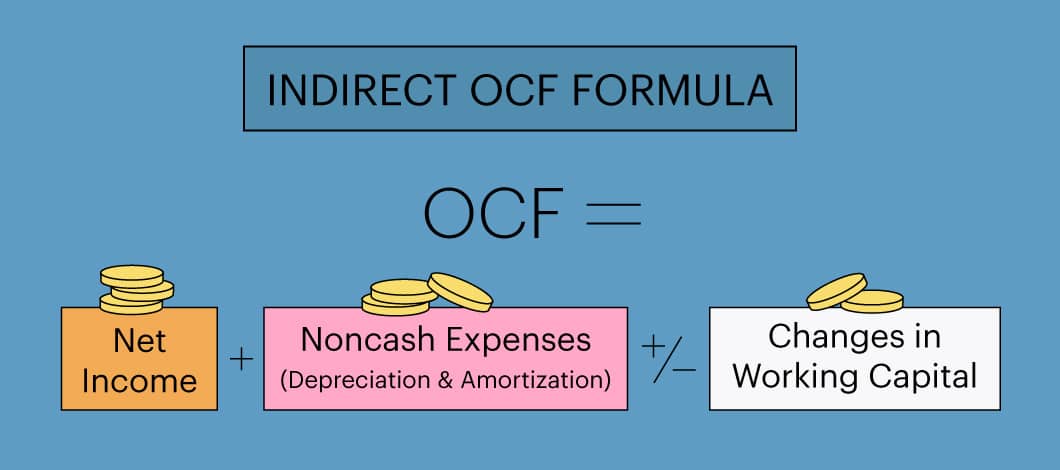

Indirect OCF Formula

With the indirect OCF formula, factors such as depreciation, accounts receivable and accounts payable are considered. The equation is as follows:

-

Operating Cash-Flow Loan Calculators

Most accounting programs have built-in tools to help you create a statement of cash flow. You can also find articles and cash-flow statement templates at SCORE. Additionally, cash-flow calculators are available on websites such as The Hartford and the American Institute of CPAs 360 Degrees of Financial Literacy.

Understanding the Components of the Operating Cash-Flow Formula

It’s important to understand the various factors that come into play when you calculate operating cash flow. Here are explanations of each component:

Net Income

What It Is: Net income represents the amount of money after all expenses have been deducted from a company’s total revenue.

Every operating cash-flow calculation starts with the net income. However, because it includes items that don’t affect cash, such as depreciation and amortization, adjustments must be made.

Noncash Expenses

What It Is: Noncash items are entries on an income statement relating to expenses that are essentially just accounting entries rather than actual movements of cash.

Depreciation and amortization are the most common examples of noncash items. Depreciation is an accounting entry to reflect the reduction in asset value, so you need to add this expense back into net income to calculate operating cash flow.

Changes in Working Capital

What It Is: Working capital is the difference between a company’s current assets, such as accounts receivable and inventory, and its current liabilities, such as accounts payable.

When there are changes in working capital, net income must be adjusted. An increase in accounts receivable, for example, shows that revenue was earned and reported in net income on an accrual basis. To find the real cash impact, the increase in accounts receivable must be subtracted from the net income.

Now that we know how to calculate operating cash flow, let’s look at an example.

Operating Cash-Flow Example

Here is an example of how to calculate operating cash flow using the indirect method.

Jessica Smith is a bridal coordinator.

- She is showing $125,000 in net profit.

- She has $75,000 in uncollected debt from her customers.

- She owes $15,000 to her suppliers.

- In addition, she bought a company vehicle 2 years ago and intends to use it for the next 5 years. So, she has a depreciation expense of $6,000 a year.

Jessica’s operating cash-flow statement looks like this:

| Operating Cash Flow | |

| Net Earnings | $125,000 |

| Non-Cash Expenses: | |

| + Depreciation & Amortization | $6,000 |

| Changes in Working Capital: | |

| – Accounts Receivable | ($75,000) |

| + Accounts Payable | $15,000 |

| Cash Flow from Operations | $71,000 |

As you can see, Jessica was able to generate $71,000 of cash flow from her operations.

It shows Jessica’s core business activities are successful enough to sustain the business with enough left over to invest in initiatives to fuel company growth.

It’s important to note, operating cash flow is just one component of a company’s cash-flow statement. To get a true measure of your available cash flow, you also must factor in costs associated with the investment (purchase or sale of assets not related to day-to-day operations) and financing (owner’s draw/payments against a business loan) activities.

Jessica:

- Spent $12,000 on equipment

- Paid $25,000 against various business loans

As a result, her complete cash-flow statement looks like this.

| Operating Cash Flow | |

| Net Earnings | $125,000 |

| + Depreciation & Amortization | $6,000 |

| Changes in Working Capital: | |

| – Accounts Receivable | ($75,000) |

| + Accounts Payable | $15,000 |

| Cash Flow from Operations | $71,000 |

| Investing Cash Flow | |

| – Investment in Equipment | ($12,000) |

| Cash Flow from Investing | ($12,000) |

| Financing Cash Flow | |

| – Loan Payment 1 | ($15,000) |

| – Loan Payment 2 | ($10,000) |

| Cash Flow from Financing | ($25,000) |

| Ending Cash | $34,000 |

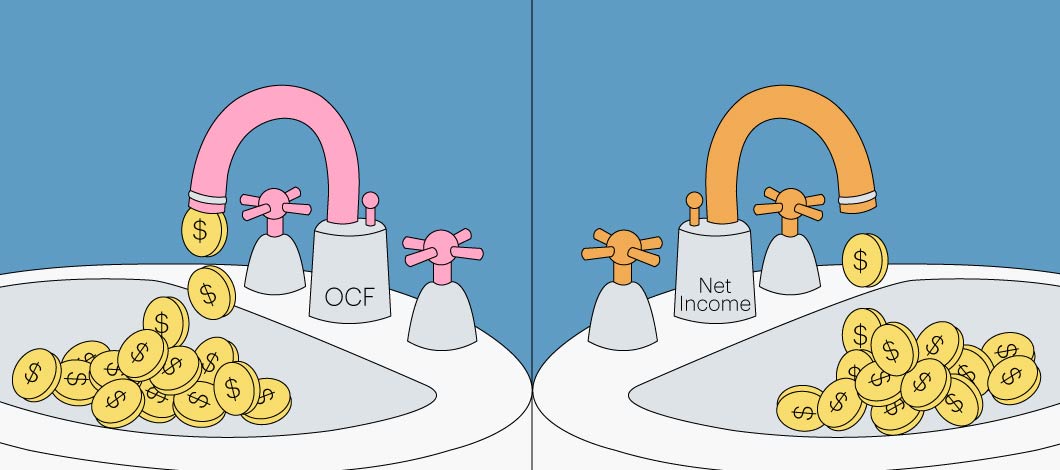

Net Income vs. Operating Cash Flow: Know the Difference

Many new business owners hear the term “operating cash flow” and assume it means the same as “net income” or “net profit.” Although the terms are related, they’re actually quite different.

You can report a net profit without being cash-flow positive. Let’s take a closer look at how this is.

Net income is a big-picture number. It’s calculated by subtracting total expenses from revenue.

In other words, net income is the measure of whether a company made money during a period of time. But what it doesn’t tell you is when those inflows and outflows of cash are happening. Thus, it isn’t a clear indicator of your business’s day-to-day financial well-being.

Consider this example:

Company A and B report the same net profit. However, Company B routinely experienced cash shortfalls and didn’t have enough money to cover rent or make payroll. The reason? Company B collects its accounts receivables at a significantly slower rate than Company A and therefore has lower operating cash flows.

As this scenario shows, the financial trajectory of your business can be strong, but if you struggle with the timing of income relative to expenses, you might find yourself in hot water.

Why It’s Important to Understand the Operating Cash Flow Formula

Understanding the net operating cash flow formula is important because it provides managers, investors and lenders with a clear understanding of the financial condition of a business, including whether it can cover its expenses.

While a few months of negative cash flow from operations isn’t always a big deal for a small business, you’ll want this number to be positive as often as possible for your company to remain solvent. Keep in mind, in order to be profitable, the cash coming into a company must be more than the cash leaving the company.

That said, understanding how to find operating cash flow and OCF finance calculations are only one factor to determine if a company has a sound financial footing. It also is important to know where the cash is originating. For instance, cash from asset liquidations would paint a very different picture than cash coming from sales.

Additionally, by examining your cash-flow statement on a routine basis, you can take swift action to remedy any shortfalls, such as by:

- Buying less inventory if adequately stocked

- Negotiating with vendors to pay later

- Shortening accounts receivable terms

- Raising prices

- Obtaining cash-flow loans to cover temporary shortfalls