A deposit via the Automated Clearing House (ACH) Network is an electronic, automatic transfer of funds between banks. The ACH processed $61.86 trillion in payments in 2020 alone, and it can help your small business make and accept payments.

Let’s go through what you need to know about an ACH deposit, including:

- What is an ACH deposit?

- What is the difference between an ACH deposit and payment?

- How does an ACH transaction work and how long does it take?

ACH Deposits: Where Did They Come From?

The ACH network is a digital system used to process electronic payments for government agencies, businesses and consumers in the U.S.

The network is administered by Nacha, formerly known as the National Automated Clearing House Association, a trade organization representing the financial services industry. It is operated by the Federal Reserve and the Electronic Payments Network (EPN), a digital counterpart to the Federal Reserve owned by the Clearing House Payments Co., a consortium of more than 20 major banks.

Developed in the late 1960s and early 1970s, the federal government initially used the ACH network to help U.S. Air Force personnel receive their paychecks promptly via direct deposit. Clearinghouse associations banded together to expand the concept to process private payroll checks, and the service became more popular as digital technology advanced. Today, businesses prefer the convenience of ACH deposits for both sending and receiving payments because they’re fast, easy to accept and easy to track.

Examples of When to Send ACH Payments

Today, the ACH network is widely used for all kinds of electronic transfers, including:

- Direct deposits of employee paychecks

- Business-to-business payments

- Online payments to credit-card and utility companies

- Consumer and business transfers between bank accounts

- Payments using platforms such as PayPal and Zelle

- Electronic tax refunds

Payment Via ACH vs. Direct Deposit

While direct payment via ACH and ACH deposit share similar names, these terms refer to 2 distinct types of electronic transfers:

- Direct deposits via an ACH transfer transmit funds into an account as a credit.

- In contrast, direct payment via ACH withdrawal takes funds from an account (via either credit or debit) for the purposes of making a payment.

These 2 types of ACH deposit transactions essentially work in the same way, but they have some important distinctions.

What Is an ACH Deposit?

An ACH direct deposit is a type of ACH transfer in which a business, government agency or consumer deposits money from one account into another, crediting the receiving account. Direct deposit paychecks and tax refunds that go directly to your bank account are examples of this type of ACH deposit.

An ACH transfer of funds can include:

- Direct payroll deposits

- Benefit payments

- Employee expense reimbursements

- Tax refunds

- Government benefits

- Interest payments

- Annuities

What Is an ACH Direct Payment?

In contrast to an ACH direct deposit, which transfers money into an account, a direct ACH payment method withdraws money from an account to make a payment.

For instance, if you make automated bill payments from your bank account to your telephone provider every month, this is withdrawing money from your account to pay your phone bill.

Direct ACH payment methods include 2 types of transactions: credit and debit transactions.

ACH Credit Direct Payments

If you want to send an ACH payment, you’d use this type of transaction. Think of this as digitally sending money. A direct payment via ACH that’s processed as a credit transaction “pushes” funds from one account into another, crediting the account receiving the funds.

For example, when you pay a bill online, you authorize a transfer that withdraws money from your account and credits it to your provider’s account.

Ways to use direct payment via ACH credit transactions include:

- Making business payments to contractors or suppliers

- Transferring money between a consumer account

- Transferring money from one consumer to another

- Making an electronic consumer purchase from a business

ACH Debit Direct Payments

In contrast, a debit ACH setup “pulls” funds out of one account to pay another. In other words, it authorizes the recipient of the funds to debit money from the account containing the funds.

For instance, if you set up ACH recurring payments with your credit card provider, you’re authorizing them to automatically debit your account each month.

Ways to use direct payment via ACH debit transactions include:

- Authorizing monthly recurring payments for mortgages

- Setting up automated utility payments

- Automatically paying suppliers and contractors every month

In contrast to the way direct payment via ACH credit transactions “send” money digitally, direct payment via ACH debit arrangements authorize a recipient to digitally “receive” money.

-

ACH vs. Wire Transfer

Although both ACH and a wire transfer send electronic payments from one financial institution to another, there are differences between the methods.

Those differences include ACH time frames for international payments, which are ineligible for same-day processing. In contrast, a wire transfer can deposit international payments to the receiving bank account within a day. International ACH transfers aren’t eligible for same-day processing.

Another difference is ACH has lower fees compared to a wire transfer. A flat, per-transaction ACH fee can run from 20 cents to $1.50. A wire transfer fee ranges from $12 to $50, depending on the destination and financial institution.

How Does an ACH Deposit Work?

No matter what type of ACH transfer is involved, the transaction unfolds through a series of 7 steps. Ultimately, the money starts out in one account and ends with the money arriving in another account.

1. ACH Transfer Initiation

An ACH transfer begins when the originator of the transaction initiates the process by requesting the transaction. The originator can be a business, a government agency or a consumer. The transaction can be a deposit or a credit or debit payment.

2. Originating Financial Institution Submits Entry

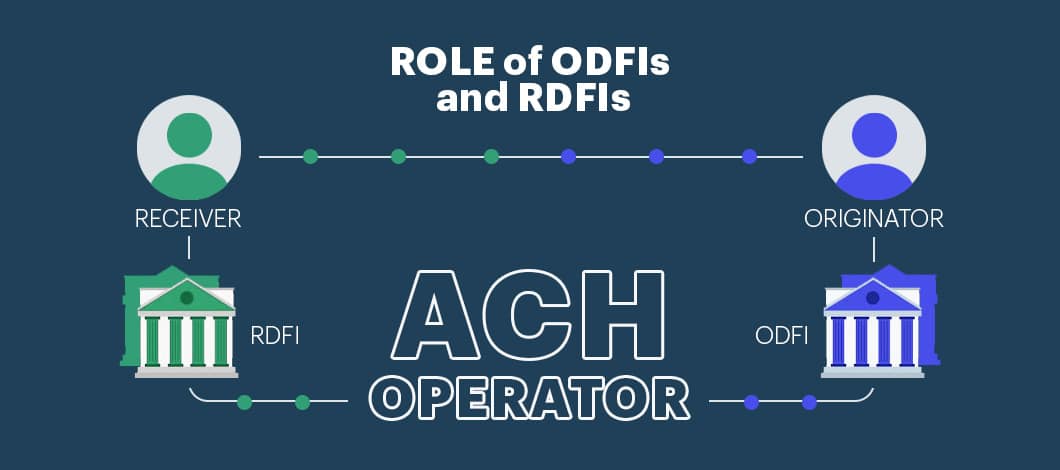

Once a transaction is initiated, an entry is submitted by the bank or payment processor handling the first phase of the ACH transaction. The bank or payment processor is known as the Originating Depository Financial Institution (ODFI).

3. Originating Financial Institution Sends ACH Entry Batch

For efficiency, financial institutions often send ACH entries in batches, typically 4 times a day during regular business hours. Batches are sent on a predetermined schedule to an ACH operator, an institution within the ACH network authorized to handle switching funds between originating and receiving accounts. Federal Reserve banks and the EPN are national ACH operators.

4. ACH Operator Sorts Entries

An ACH operator sorts through a batch of entries once they’re received. Entries get sorted into deposits and payments, and payments get sorted into ACH credit and debit payments. This ensures that money gets transferred in the right direction.

5. ACH Operator Sends Entries

After sorting entries, the ACH operator sends them to their destined financial institutions. The receiving financial institution is known as a Receiving Depository Financial Institution (RDFI).

6. Receiving Financial Institution Verifies Sufficient Funds

If the ACH transaction involves moving funds out of an ODFI’s account, the RDFI must first check to verify that sufficient funds are in the ODFI account to cover the transaction.

7. Receiving Financial Institution Debits or Credits Originating Institution

Finally, the receiving financial institution either credits or debits the receiving account, depending on the nature of the transaction.

-

More on ODFIs and RDFIs

Both of these institutions are usually banks that are members of the Federal Reserve System and have been certified by Nacha. They are responsible for making sure the information needed for the transfer is correct and must adhere to financial control and security measures. Most financial institutions are approved to be both ODFIs and RDFIs.

ODFIs initiate ACH requests within the network on behalf of an originator. RDFIs receive the requests and execute the payment to the party receiving the ACH transfer. The RDFI is responsible for reporting any return codes to the ODFI, such as a return code due to insufficient funds in the account to be debited.

If the sender and receiver do not have accounts at the same bank, an ACH operator is needed to facilitate the transfer (e.g., The Clearing House, FedNow).

What Is the ACH Deposit Time Frame?

Most ACH debit and credit transactions can be settled the same day. As of March 18, 2022, the per-payment maximum for same-day ACH transactions for eligible business and consumer credits and debits will increase to $1 million from $100,000, according to Nacha. The exceptions to same-day processing are international payments.