Did you know 20% of small businesses fail in their first year, roughly 30% close their doors in the second year and about 50% shut down after 5 years in business?

One reason for business failure is due to cash flow. However, there are many ways to prevent cash-flow issues or minimize their impact on your business. In this article, we’ll discuss some of the best ways for solving cash-flow problems in small business and how you can get started.

Why Do Companies Have Cash-Flow Problems?

Cash-flow issues in business can range from overspending to poor financial management, among others. However, an ounce of prevention is worth a pound of cure. As such, understanding the causes of small business cash-flow problems can help a business owner nip them in the bud and prevent them from negatively impacting the company.

Let’s look at some common reasons for cash-flow problems.

Causes of Cash-Flow Problems

- Overestimating future sales volumes: Revenue forecasting is a cash-flow challenge that’s particularly difficult during the first few years of business. That’s because there are no past sales figures or experiences to draw from.

- Spending impulsively during the startup phase: Being distracted by “bright shiny objects” and not spending available capital strategically on tools and services that yield high return on investment are other cash-flow warning signals.

- Not staying on top of past-due receivables: A lack of comprehensive late-payment penalties and collection policies often leads to small businesses not getting paid on time.

- Not tracking day-to-day cash flow: If you don’t regularly keep track of the movement of cash in and out of your business, you may not be able to catch cash-flow problems.

- Not having a cash cushion: It’s not if, but when, a small business runs into cash-flow problems. Without a reserve to draw from, you may not be able to get through the rough patches when sales are unexpectedly slow.

- Low profit margins: Whether it’s because of high overhead, product costs or tax bills, you may find that more money is going out than coming in — even if you’re making a lot of sales. This can be another one of the difficulties in improving cash flow that you could encounter.

- Unnecessary inventory: Misjudgment of market demand often leads to cash being tied up in stock that isn’t selling. Often, you not only lose out on the revenue but you also have to pay for storage.

- Disorganized books: Not having an efficient accounting system could mean you’re not tracking income and bills properly to plan for your expenses and collect payments from customers.

- Bad debts: Without a credit control system, many small businesses find themselves incurring bad debts — money owed by customers that can’t be recovered.

- Out-of-sync credit terms: If you extend a 45-day net term to your customers yet your vendors require you to pay within 30 days, negative cash flow can build up and worsen over time.

- Bad pricing models: Pricing products and services is one of the most challenging components to nail down when running a small business. While it can be relatively easy to determine pricing if you’re selling commodities or consumer goods, it gets fuzzy when you’re selling a unique service or product.

- Poor cash-flow forecasting: This is another common cash-flow problem. If you can’t accurately predict the months during which you may experience a cash deficit, you can’t prepare your business for lean times.

- Poor employee management: Employee salaries and wages are a large part of your outgoing expenses. Poor employee management can, therefore, lead to cash-flow problems — and possibly layoffs.

- Seasonal challenges: Many small businesses are affected by seasonal changes in sales and revenue, which impact cash flow.

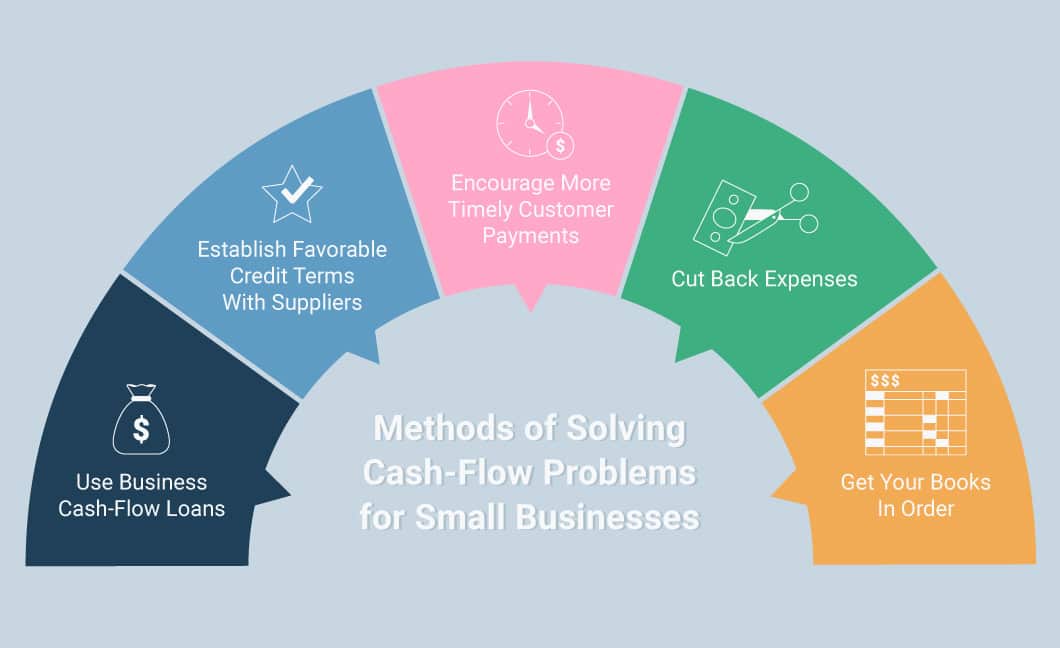

11 Methods of Solving Cash-Flow Problems for Small Businesses

There are plenty of cost-cutting measures you can take to fix cash-flow problems. Sometimes, an adjustment in your business strategy is all you need.

With the right steps, you can get through challenging financial periods and keep your business growing. Here are several cash-flow solutions for small businesses to consider implementing.

1. Cut Back Expenses

It can be difficult to determine which investments are essential to your business. If you don’t plan accordingly, you could over-invest and go over budget.

Your first step should be to establish a budget for spending based on cash flow. This will help you set a baseline for your spending habits. Then, create a plan for your spending. For example, if you intend to invest in new software, map out beforehand how it will drive value and efficiencies.

Also, think about where you can stand to lower your bills. Assess which expenditures are giving you the most bang for your buck (and which ones aren’t).

Here are expenses to consider re-evaluating:

- Marketing

- Business meals

- Subscriptions

- Equipment costs

- Office supplies

- Labor costs

- Location costs

- Business insurance

- Travel and business outings

2. Get a Handle on Sales

If your sales numbers have been on an upward trend for months, it can be tempting to assume they’ll stay that way. Some small businesses run into cash-flow problems because they wager the sales they expect tomorrow to fund the investments they want to make today.

This is a risky strategy. You can’t guarantee future sales, and sometimes a sunny perspective can cloud your judgment.

Because you need a sales forecast to create a business plan, make sure your estimates are based on past data, if you have it. Break your sales down into unit parts and use averages to keep your sales estimates realistic.

3. Set the Right Price

If you price your products and services too high, you could spook buyers. If you price too low, you could miss out on revenue. Both problems will impact your cash flow.

To get the pricing right, pay attention to your competitors and any factors that may affect your market. You don’t necessarily want to undercut your competitors’ prices, especially if your product is superior. But you’ll need to keep your price attainable for your target market if you want to make sales.

4. Improve HR Efficiencies

Establishing better employee management and human resources practices can have a positive effect on your bottom line.

For example, if you rely on shift workers to operate your business, overbooking employee shifts could lead to unnecessary expenses that don’t translate into returns. High rates of employee turnover, job redundancies and a lack of automation also come with avoidable costs.

To resolve these issues, you can cross-train employees to fill more roles as-needed in your business. If you’re losing employees quickly and often, create more favorable working conditions to reduce turnover. Also, introduce new technology to automate repetitive processes and help you manage employees more effectively.

5. Establish Favorable Credit Terms With Suppliers

This is another management strategy used to retain or increase cash flow. This method is particularly helpful if your cash-flow issue is caused by a discrepancy between how soon you have to pay your vendors and the net term you extend to your customers. For example, renegotiating a supplier contract from payments due on receipt to 30 means you can hold onto more cash for a longer time.

If you have a good payment history with vendors, it’s often easy to renegotiate payment terms. Even if you have a supplier that already offers a 30-day net term, you can extend it to a 60- or 90-day payment schedule and get some wiggle room.

6. Encourage More Timely Customer Payments

You can also revisit your invoicing practices and the terms you’re extending to your customers. For example, instead of a 60-day net term, you can bring it down to 30 days to better match your suppliers’ payment terms and minimize negative cash flow. You can also incentivize customers to pay sooner by offering auto-billing, online payment processing and a discount for early payments.

7. Digitize Invoices

If you’re still using paper invoices and accepting checks to receive payments from your customers, it may be time to upgrade how you accept payments. Instead of using a paper invoice, invoice electronically and make it clear that payment is due at a specific time. Keep in mind, paper checks can take as long as a month to fully clear.

You can also improve the billing process by using invoicing software, which allows you to set up automated processes and integrate tools with your accounting software to improve operational cost efficiency. Get invoices to your customers faster, avoid costly delays and errors, collect more from overdue invoices and analyze which customers are paying on time.

Additionally, thanks to the widespread adoption of payment-processing technologies, slow invoice payments are becoming less and less of a problem. Indeed, credit cards, debit cards and other types of electronic fund transfers are much faster and more reliable. They also create a more reliable record of the funds you’ve received.

8. Get Your Books In Order

Along the same lines, another way to solve cash-flow problems and growth concerns is to establish a good accounting system. Having one in place will allow you to track and analyze your finances over time so you can better forecast cash flow and be prepared for slower months. It can also help you minimize bad debts and analyze expenses or tax bills so you can trim the fat and tighten up your budget.

Moreover, getting your books organized helps you gain insights into inventory expenses and the cost of delivering your products. For example, do you have excess inventory you can reduce? Do your products have sufficient gross margins or do you need to raise your price or lower production costs? These insights can inform your product selection and pricing strategy so you can optimize profit margins and minimize cash-flow issues.

9. Beef Up Cash Reserves

Every business should maintain a cash reserve to cover expenses during slow or difficult times. The size of your reserve depends on what makes you comfortable. Many financial experts recommend putting aside emergency funds to cover 3-6 months of expenses.

To create a cash reserve, first determine how much you spend each month. If you operate a seasonal business, calculate your expenses for different times of the year and use the most expensive season as a model. Then, put money aside incrementally until you have a safety net.

10. Prepare for Revenue Fluctuations

Small businesses affected by seasonal changes in sales and revenue can see an impact in cash flow. Businesses that sell consumer goods, for example, can expect increased sales during the holiday season and slower sales during other times of the year.

The best way to avoid seasonal cash-flow problems is to plan your investments accordingly. Use data from past years to plan how you spend and save cash.

11. Leverage Business Cash-Flow Loans

There are many ways to fix cash-flow problems, but some of them may not yield results fast enough to solve pressing issues. Cash-flow loans are quick and often available as collateral-free funding. The approval process can take just a few hours, and the debt financing options are approved based on a company’s past and projected cash flow.

There are different types of cash-flow financing options:

- Business lines of credit: This can be seen as a hybrid between a business credit card and a business loan since you’re approved for funds, though you have no lump-sum disbursement made at account opening. Additionally, you only pay interest on the current outstanding balance, instead of the total credit line that’s been extended. Unsecured business lines of credit don’t require collateral.

- Short-term business loans: This type of business capital loan can provide a company with quick working capital. You’ll receive a lump sum of cash upfront, which is repaid to the lender over a set period of time. Although the interest rate may be higher, over the long run, the total cost of capital for these loans may be less expensive than longer term options that have a lower interest rate.

- Invoice financing: For business-to-business companies, this is a way to borrow money against the amounts due from customers. You can use this method to finance inventory purchases during a busy season or buy inventory to fulfill an order.

- Merchant cash advances: With this type of funding, financing providers will give you a cash advance, which you’ll repay, plus interest, through a portion of your daily credit card sales or a direct draw from your business bank account. This method is most suitable for businesses with solid sales.

Need a cash-flow loan?

Cash-Flow Solutions Can Ensure the Health of Your Small Business

Although no one wants to run into cash-flow issues, it’s not the end of the world if it happens. While small business cash-flow problems are challenging and often unavoidable, there are many ways to navigate through the rough patches.

By implementing a combination of short- and long-term solutions — such as using business cash-flow loans to buffer temporary cash deficits, audit inventory, improve the accounting processes and renegotiate contracts — you can minimize the impact of cash-flow problems and improve your long-term financial health, which is the foundation of a sustainable and profitable business.