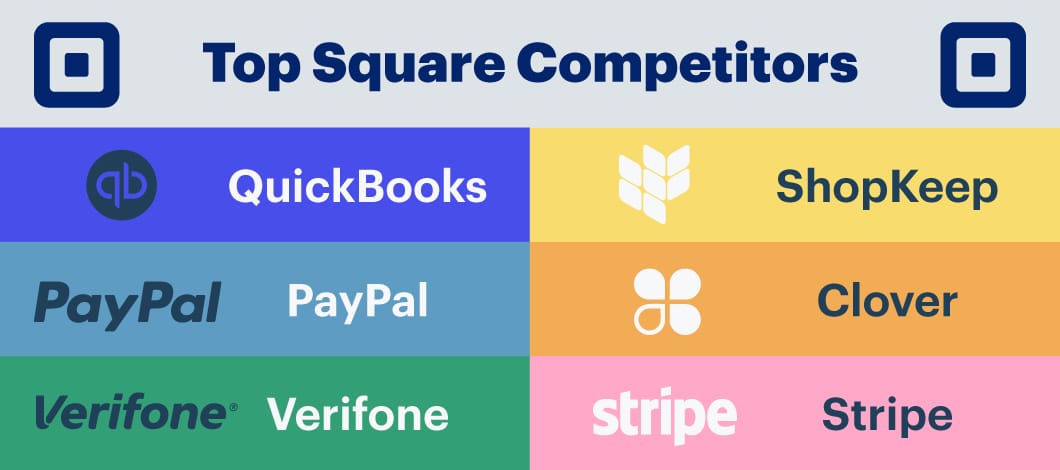

Square dominates the mobile payment-processing industry, handling $22.8 billion in payments for the second quarter in 2020. It’s an industry titan, but there are Square competitors in the point of sale systems (POS) game. Indeed, companies like Square in the mobile POS system sphere are on the rise. Let’s go through 6 Square alternatives and help you decide which point of sale systems are best for your small business.

-

Square’s Competitor Fees

Square’s fees are some of the most competitive on the market. For in-person transactions using the basic Square reader for magstripe, you’ll pay 2.7% plus 10 cents.

If you manually enter a credit card number or use a card that’s already on file for a client for a recurring payment, you’ll pay 3.5% and 15 cents per transaction.

If a customer makes an online purchase or pays their invoice via the web, Square charges 3.5% plus 15 cents for card transactions and charges 1% (with a $1 minimum) for every invoice paid with an ACH bank transfer, according to the Square website.

1. Intuit’s QuickBooks Payments

Intuit’s flagship accounting software QuickBooks has been a major player in the small business finance game. In addition to advanced bookkeeping services, Inuit offers a mobile payment system called QuickBooks Payments.

Users will have to download the app, and they can also obtain a card reader. Intuit offers 2 options:

- A chip and magstripe reader — the first of which is free, with additional units costing $19.

- A chip, magstripe and contactless reader, which costs $49.

QuickBooks Payments can integrate with QuickBooks accounting software, which is ideal for many small business owners. Syncing these programs can give you the ability to do everything from tracking income to paying bills. Note that if you can’t use QuickBooks Payments without being a QuickBooks bookkeeping customer. You’ll have to sign up for an account online or get desktop software to gain access to the mobile POS system.

When you make a Square card reader rates comparison, QuickBooks’ rates are particularly competitive. For online transactions, the fees are:

- QuickBooks Online customers have fees of 2.4% plus 25 cents for swiped transactions and a rate of 3.4% and 25 cents per manually entered transaction; 2.9% plus 25 cents for invoicing; 1% for ACH bank transactions (maximum of $10).

- Or, if you work with QuickBooks Desktop, you can choose a “pay as you go” plan, which doesn’t have a monthly fee, or pay $20 monthly for QuickBooks payments. Note that “pay as you go” has higher transaction fees compared to what the monthly plan’s users are charged.

- For the desktop “pay as you go” plan, users have the following fees: 2.4% and 30 cents for swiped card transactions; 3.5% plus 30 for invoiced transactions; 3.5% plus 30 cents for manually keyed transactions; $3 for ACH bank transfers.

- For the monthly desktop plan, users have the following fees: rates of 1.6% plus 30 cents for swiped card transactions; 3.3% plus 30 cents for invoiced and manually keyed transactions; $3 for ACH bank transactions.

2. PayPal Here

PayPal dominates the online payment realm, so it should come as no surprise the company also launched its own mobile credit-card reader service.

Users can download the PayPal Here app and integrate it with the card reader. PayPal offers 2 different card reader options — a chip-and-swipe reader that can be attached to any mobile device to accept payments anywhere and chip-and-tap card reader and charging stand that’s better if your business frequently handles in-person transactions at a counter. The chip-and-swipe mobile POS system is free with new PayPal Here accounts; otherwise, it costs $24.99. The chip-and-tap card reader and charger cost $79.99.

If your business already relies on PayPal to process online payments, the card reader is easy to integrate. As with QuickBooks, PayPal offers a variety of easy-to-use tools for small business owners.

These are similar to Square’s fees:

- 2.9% plus 30 cents (for transactions with U.S. dollars) for online transactions and 2.7% plus 30 cents for in-store transactions

- QR code transactions for purchases of $10 and less have fees of 2.40% plus 30 cents; transactions of $10.01 or more have fees of 1.90% plus 30 cents

- PayPal Pay Later options — where customers choose to pay either in 4 installments (Pay in 4) or with PayPal Credit — have merchant fees of 2.90% plus 30 cents for online transactions. The same fees are in place for Venmo transactions.

3. Verifone

While not as widely known as Square or some of the other competitors, Verifone is indeed a contender. One big thing that sets Verifone apart is its sheer range of products. It does more than equip small business owners with smartphone-enabled point of sale systems: Verifone offers advanced payment processing and personal identification number (PIN) systems.

Some Verifone options include:

- Integrated POS

- Handheld mobile POS systems

- Counter systems and PIN pads

- Portable swipe and PIN pads

- Unattended payment systems

Several Verifone mobile payment services are self-sufficient, meaning that they won’t need to be integrated with smartphones.

Note that Verifone doesn’t publish its fee structure. Instead, it operates on a quote system. Interested businesses can request a custom quote for services.

4. ShopKeep by Lightspeed

Like some other Square reader competitors, Shopkeep by Lightspeed specifically caters to restaurants, retail stores, golf clubs and resorts. ShopKeep by Lightspeed has many of the same standard services you’ll find from another mobile POS system, but it also offers tools you can use for business management and marketing, such as:

- Offer and process gift cards

- Set up a menu and floor plan for restaurants

- Manage online and in-store sales

- Create and manage customer loyalty programs

- Integrate your accounting software

- Review analytics

However, there is a drawback; ShopKeep’s analytics app is only available on iPad.

ShopKeep handles its transaction fees differently than any other option on the market. Rather than charging for each transaction, they charge a monthly rate. You can choose from 6 options, ranging from a basic package to a system with advanced options:

- $69 or $79 per month, based on whether you pay annually or monthly, for the Basic package, which includes retail point of sale systems and payment processing. Note that if you want more than 1 register operating on these systems, you’ll have to pay another $29 per month, regardless of the package you select.

- $99 (per month cost if you pay annually) or $119 per month (if you pay monthly) for the Starter package. This includes point of sale systems, payment processing and the eCommerce option.

- $119 (per month if you pay annually) or $139 (per month if you pay monthly) for the Standard package, which includes all of the options in the Starter package, as well as the ability to connect to your accounting software.

- $169 (per month if you pay annually) or $189 (per month if you pay monthly) for the Advanced package, which includes everything in the Standard package, as well as the option to create and manage customer loyalty programs

- $229 (per month if you pay annually) or $289 (if you pay monthly) for the Pro package, which gives you all of the options in the Advanced package as well as analytics reporting

- If you want the Enterprise POS package, you’ll have to contact the company to request a quote. In addition to point of sale systems, the Enterprise package offers different operations features for your type of business, such as linking to major delivery services and a reservation system for restaurants and managing stock between shops and multi-store reporting for retailers with more than 1 physical location.

If you operate a retail business, restaurant or golf course and do a high volume of transactions, you might want to consider whether Shopkeep, with its flat monthly rates, is preferable to the per-transaction fees from Square and other companies like Square.

5. Clover

If you have employees running your mobile POS system who would have to use their personal devices to make sales, or if you don’t want to use your personal phone for business purposes, you need an alternative. That’s where Clover Flex comes in. Clover Flex is a small, handheld system that can be used with all payment types. Its features include:

- Scanning barcodes

- Printing receipts

- Managing tables and guests at restaurants

- Accepting gift cards

- Promoting deals and discounts

Clover also offers the ability to fully customize its POS system to fit a company’s unique needs. There’s also Clover Go, a Bluetooth card reader for magstripe, chip and contactless pay for small businesses who don’t need these advanced options. Other Clover devices for your point of sales systems include the Station (which is more like a full cash register) for more than $1,000 and the handheld Flex for nearly $500. Clover offers monthly payment options.

Clover’s processing fees are a bit different from Square’s, making them difficult to compare. With Clover, you’ll pay a monthly fee, which is $9.95 per month for the Register Lite plan, with the first 30 days free. A Register Plan is $39.95 per month. If you want to operate Clover on additional devices, it will cost an additional $9.95 per device. After that, you’ll pay:

- 2.7% and 10 cents per in-person transaction with a Clover device for the Register Lite program

- 3.5% and 10 cents per virtual and manually entered transactions for the Register Lite program

- The Register plan charges 2.3% plus 10 cents in fees for in-person transactions and 3.5% plus 10 cents for virtual and manually entered transactions.

6. Stripe

Perhaps out of all of the Square alternatives on this list, Stripe is the only company that’s as well known as Square. Stripe has been used by big corporate names, including:

- Amazon.com

- Shopify

- Instacart

While Stripe’s main industry is online payment processing, it has entered the mobile POS system game with its own card readers. The company offers several mobile card readers and larger, independent systems.

Stripe’s optimized transaction acceptance system means that when a transaction is declined, the system automatically retries the payment through various different connections. Stripe also allows customers to cancel their accounts with no penalties or fees, a plus for small businesses.

However, customers have reported that account freezes or even cancelations are common — and often come with little notice. Stripe doesn’t offer a free card reader; devices start at $59. You can contact their sales team to learn about a Stripe terminal or customized transaction pricing as you set up your point of sale systems.

Stripe’s fees are comparable to Square’s fees, at rates of:

- 2.9% and a 30-cent fee per transaction for online payments or manual entries

- 2.7%, with a 5-cent fee for in-person credit-card processing

Why Switch to One of the Square Alternatives?

Square has been a leader in the mobile point of sale systems game, but companies like Square can offer a competitive service, if not one that would be a better fit for your small business.

When Square changed its fee structure, some criticisms claimed it worked better for businesses that handled high sales volume daily. When reviewing the Square competitors, look at how the fees impact your average customer payments. Depending on what type of industry you’re in and the number of sales transactions you have each day, you might decide a flat monthly charge like Shopkeep by Lightspeed’s is preferable to other companies’ per-transaction fees.

If you’re considering Square reader competitors, be sure to make a Square card reader comparison regarding costs.