The cash that comes into your business is essential to keep it going, but companies often fall short on funds. Unfortunately, cash-flow problems are the top reason small businesses fail. Indeed, 82% of small businesses don’t succeed because they experience cash-flow issues, according to Visual Capitalist, an investment- and business-focused online publisher.

Don’t become a cash-flow problem statistic. Find out what the most common cash-flow challenges are so you can effectively manage or even avoid them.

Related: Why Small Businesses Fail (and How You Can Succeed)

What Are Cash-Flow Problems?

Cash-flow problems are when there isn’t enough money coming into a business to pay operational expenses or make necessary investments. Too much money is moving out of your business and not enough is moving into it.

What Are the Main Causes of Cash-Flow Problems for Small Businesses?

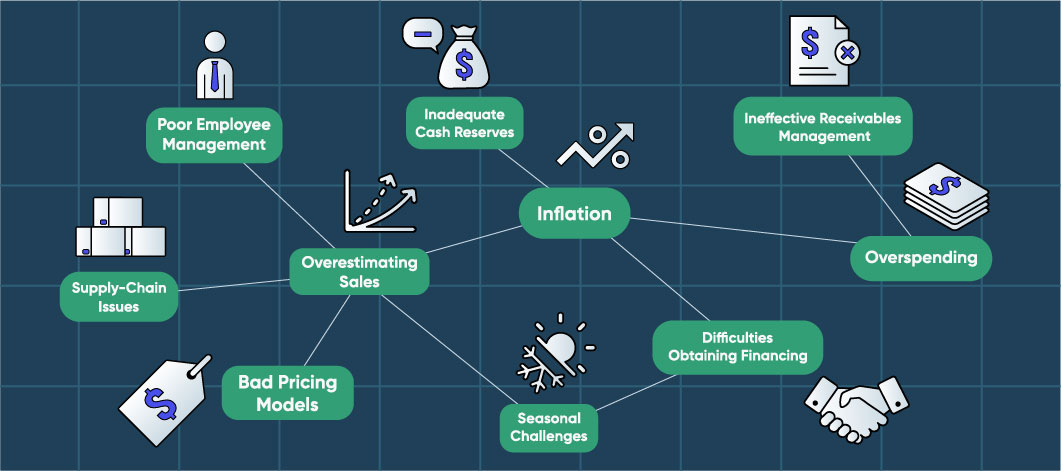

Many factors can cause cash-flow challenges for small businesses, some of which are outside your control, such as slow seasons, rising operational costs or higher priced goods. Cash-flow issues may also arise when a business is looking to expand but lacks enough capital to do so.

Not surprisingly, cash flow is the second most cited challenge small business owners are facing, according to a 2022 SCORE survey, right after getting customers. In fact, more than a third of business owners agree.

That said, cash-flow problems are often the result of common issues you can fix or avoid. Here are some of the most common sources of cash-flow problems for small businesses.

1. Inflation

Inflation has caused prices to go up for nearly everything. Businesses are spending more to maintain inventory and supplies. Utility costs are going up too, as are rent rates.

Additionally, inflation has led to increases in the prime rate, which equates to higher interest rates for credit cards and loans.

Inflation also affects consumer behavior, with many would-be buyers buckling down where they can, translating to fewer sales for businesses.

How to Solve the Problem:

While you can’t single-handedly rectify inflation, you can adjust your behaviors to push back. For example, see where you can reduce your expenses (e.g., subscriptions, office costs, travel).

Also, think about new ways to market yourself to attract buyers. For instance, you might offer special promotions to encourage spending or establish partnerships with other brands to drive more traffic to your business.

Related: 9 Ways Small Business Owners Can Combat Inflation

2. Supply-Chain Issues

Many businesses are experiencing a trickle-down effect of supply-chain issues on their cash flow. Ultimately, the longer it takes for businesses to get inventory or supplies needed to offer their services, the longer it takes to stock items they can sell or to take on new work. With product shipping delays, there’s less potential for cash to come into the business.

How to Solve the Problem:

See how you can improve your inventory forecasts and better time your orders, taking into account longer logistics timelines. Also, consider buying in bulk for items you know you’ll need and use frequently. Additionally, while you want to maintain the quality of your product or service, think about ways to stretch the useful life of equipment and noncritical supplies to reduce ordering needs.

3. Ineffective Receivables Management and Slow Payments

Another common cash-flow problem is inaccurate and inefficient accounting and slow invoice payments. Some small businesses use outdated technologies or even pen and paper to keep track of their books and manage their receivables.

How to Solve the Problem:

If you’re still using paper invoices and accepting checks, which can take some time to clear, it may be time to upgrade. Instead of using a paper invoice, invoice electronically and make it clear that payment is due at a specific time.

Thanks to the widespread adoption of payment-processing technologies, slow invoice payments are becoming less and less of a cash-flow management problem. Indeed, credit cards, debit cards and other types of electronic fund transfers are much faster and more reliable. They also create a record of the funds you’ve received.

4. Overspending

It can be difficult to determine which investments are essential to your business. If you don’t plan accordingly, you could over-invest and go over budget. Businesses that overspend on software, office space and perks will often run into cash-flow problems.

The business services landscape is changing all the time. Some solutions may become obsolete, and others may seem like a good idea at first but don’t turn out to provide any value. Unfortunately, it isn’t uncommon for small businesses to get locked into contractual agreements with companies that don’t provide a return on investment.

How to Solve the Problem:

Your first step should be establishing a spending budget based on cash flow. This will help you set a baseline for your spending habits. Then, create a plan for your spending. For example, if you intend to invest in a new software environment, map out beforehand how each piece of software will work together to drive value.

5. Overestimating Future Sales

If your sales numbers have been on an upward trend for months, it can be tempting to assume they’ll stay that way. Some small businesses run into cash-flow problems because they wager the sales they expect tomorrow to fund the investments they want to make today.

This is a risky strategy. You can’t guarantee future sales; sometimes, a sunny perspective can cloud your judgment.

How to Solve the Problem:

Because you need a sales forecast to create a business plan, make sure your estimates are based on past data if you have it. Break down your sales into unit parts, and use averages to keep your sales estimates realistic.

6. Bad Pricing Models

Pricing products and services is one of the most challenging components of running a small business. While it can be relatively easy to determine pricing if you’re selling commodities or consumer goods, it gets fuzzy when you’re selling a unique service or product.

If you price too high, you could spook buyers. If you price too low, you could miss out on revenue. Both problems will impact your cash flow.

How to Solve the Problem:

To get the pricing right, pay attention to your competitors and any factors that may affect your market. You don’t necessarily want to undercut your competitors’ prices, especially if your product is superior. But you’ll need to keep your price attainable for your target market if you want to make sales.

7. Poor Employee Management

Employee salaries and wages are a large part of your outgoing expenses. Therefore, poor employee management can lead to cash-flow problems — and possibly layoffs.

For example, if you rely on shift workers to operate your business, overbooking employee shifts could lead to unnecessary expenses that don’t translate into returns. High rates of employee turnover, job redundancies and a lack of automation also come with avoidable costs.

How to Solve the Problem:

One of the best ways to avoid cash-flow problems like these is to cross-train employees to fill more roles as needed in your business. If you’re losing employees quickly and often, create more favorable working conditions to reduce turnover. Also, introduce new technology to automate repetitive processes and do more with less manpower.

8. Seasonal Challenges

Many small businesses are affected by seasonal changes in sales and revenue, which impact cash flow. Businesses that sell consumer goods, for example, can expect increased sales during the holiday season and slower sales during other times of the year.

How to Solve the Problem:

The best way to avoid cash-flow problems that are seasonal is to plan your investments accordingly. Use data from past years to plan how you spend and save cash.

9. Inadequate Cash Reserves

Every business should maintain a cash reserve to cover expenses during slow or difficult times. Without one, you might need to turn to investors for capital, which might require you to give up equity, or you might apply for debt financing to cover costs.

How to Solve the Problem:

To create a cash reserve, determine how much you spend each month. If you operate a seasonal business, calculate your expenses for different times of the year and use the most expensive season as a model. Then, put money aside incrementally until you have a safety net.

The size of your reserve depends on what makes you comfortable. Many financial experts recommend consumers put aside emergency funds to cover 3-6 months of expenses.

10. Difficulties in Obtaining Financing

Many small businesses depend on financing products, such as business loans and lines of credit, to operate and expand. However, obtaining financing may be difficult for some companies, resulting in a serious cash-flow problem.

A business owner could be denied a business loan for various reasons, including bad credit, no credit or inadequate collateral. Additionally, many banks won’t approve a business loan to be used to address cash-flow problems as the business is showing signs of financial strain.

How to Solve the Problem:

If you’re denied a business loan or a line of credit, your best move is to find out why and work to remedy this issue. It can take time to build credit, but you can also try to cut costs to increase cash flow or make changes to your business plan to make it stronger.

You can also look for alternatives to conventional financing, such as an online marketplace. Some business loans are available even to businesses with bad credit, and some online lenders consider factors other than credit ratings to determine if a company qualifies for financing.

How to Manage Cash-Flow Problems in Your Business

Every business faces difficult financial times at some point. However, you can take plenty of cost-cutting measures to fix cash-flow problems. Sometimes, an adjustment in business strategy is all you need to stay cash- positive. Other times, you might perform a cost/benefit analysis to see if a business loan can help.

At the end of the day, with the right steps, you can get through your cash-flow challenges and keep your business growing.