A Uniform Commercial Code (UCC) filing, also known as a UCC lien, is a common practice for small business lenders. However, if you’re seeking additional funding for your business, an existing UCC filing could cause concern for potential lenders.

We’ll go through the steps you’ll need to take to remove a UCC filing placed against your business.

What Is a UCC Filing?

A UCC-1 filing places a lien on a borrower’s assets. Lenders file a UCC-1 financing statement with the secretary of state as a way to secure the funds they loan.

UCC filings are public records and are noted on your business’s credit report. However, UCC filings alone don’t affect your credit score.

There are 2 types of liens that lenders can file for when they submit a UCC-1:

A blanket lien is essentially an open lien against all of a business’s assets. In contrast, the process for some UCC-1 filings requires listing specific items as collateral, typically the items the business owner will purchase with the funding.

Is a UCC Filing Bad for Your Business?

The UCC process for filing a lien is a common practice in the lending world. However, a UCC filing can limit future financing options.

Why? Liens are collected in the order they were submitted. The first lender to put a lien on your collateral has first dibs on assets, and a subsequent lender will be in a second position to collect on your assets if you default, and so on with additional lenders. There’s also a potential risk that nothing will be left after the first lender has collected what was owed.

For that reason, lenders might consider it risky to lend money to a business with an existing UCC filing. A UCC filing also might prevent you from selling any assets you’ve put up as collateral. These reasons make it vital for business owners to know how to remove a UCC filing from their credit reports when necessary.

How Do I Get Rid of a UCC Filing?

Once you pay your debt in full, you’ll want to make sure the UCC-1 is canceled.

According to the Uniform Commercial Code, Section 9-513, lenders should file a statement of UCC termination within one month after borrowers satisfy their debt.

However, if the lien remains on your business’s credit report despite your full repayment, here’s how to remove a UCC filing.

Contact Your Lender

As UCC filings generally lapse after 5 years, lenders often don’t submit a UCC termination form to remove a filing. Your recourse? Submit a termination demand letter, known as an “authenticated demand.” A UCC termination demand letter is a signed request you send to the lender asking them to cancel the UCC filing.

Be sure to list the name and address of the lender, as noted on your financing statement. After receiving your request, the lender has 20 days to file a termination statement for the UCC state filing. Or instead, they can send you the termination of the UCC filing statement, which you can then file at your secretary of state’s office.

Request Termination of Lien

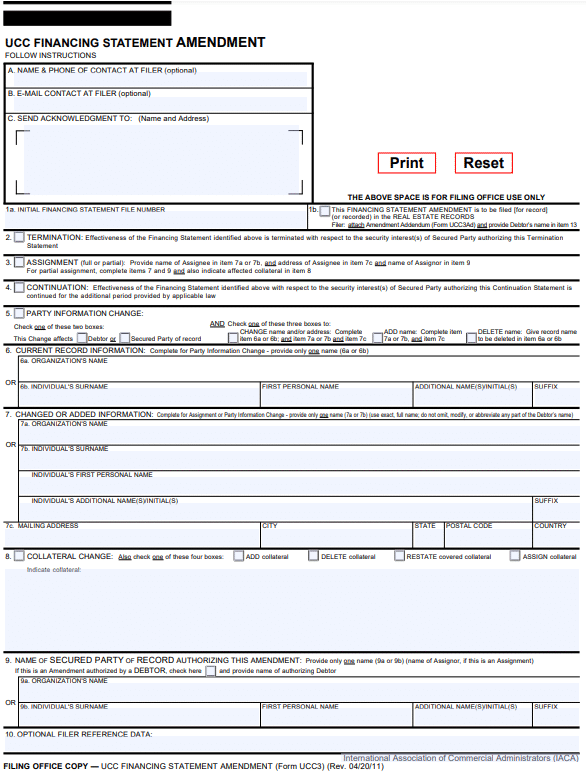

Twenty days after you’ve notified your lender and received no response, you can file a request for termination yourself, referred to as a UCC-3.

On the UCC-3 form to request lien termination, check the box indicating that a debtor authorized the amendment. You would also provide the name of the authorizing debtor, likely you.

When to File a UCC-3

A UCC-3 can be submitted for a few reasons, including UCC filing termination.

Either you or your lender will need to submit a UCC-3 to remove the initial filing record. If after 5 years, the lender wants to keep the lien active because you haven’t repaid your debt, they would request a continuation by filing a UCC-3.

A UCC-3 can also be filed to amend the original filing. Amendments can be made to the following:

- Party information (e.g., address changes, name changes)

- Collateral

- Assignments

Here’s an example of a UCC-3 form:

How to Dispute a UCC Filing on Your Credit Report

If your lender has submitted a UCC-3 to request termination of the UCC-1 filing, credit reporting agencies should remove the lien from your business’s credit report. However, this isn’t always the case.

If your lender has submitted a UCC-3 to terminate your lien and it’s still on your business’s credit report, contact the credit reporting agency and request they remove the filing.

How to Find a UCC Filing

We’ve reviewed how to remove a UCC filing, but what if your business credit report has a filing of which you aren’t aware?

For example, as part of the application process, a lender might complete a UCC-1 on your business in anticipation of offering you funding. However, even if you don’t borrow their funds or your application is denied, the lender might not retract the UCC business filing.

You can find out if there’s a UCC filing in your business’s name by visiting the National Association of Secretaries of State’s website, which provides links to every state office. Some secretary of state websites allow you to complete an online search to access UCC lists, while others might require you to submit a search request in writing.

To complete your search online, you’ll need the debtor’s name, either the name of the business or the individual. You also could search by the UCC filing number, also referred to as the financing statement number. There typically is a charge to request a copy of the filing.