Are you debating between a business line of credit vs. a business credit card? Or are you looking to get both, but want to know the ins and outs of each? While both financing options are best used for short-term funding needs, what are their pros and cons? Here’s what you need to know before you apply.

Reasons to Use a Business Line of Credit vs. a Credit Card

While both lines of credit and credit cards are flexible funding options for businesses, some expenses are better fitted to one over the other. Additionally, certain items and services simply can’t be paid for with a credit card, in which case a business line of credit would be the best option. Here are a few examples to compare.

Business Line of Credit Use Examples:

- Payroll

- Rent

- Vendor invoices

Business Credit Card Use Examples:

- Employee expensing (e.g., travel, client meals)

- Office technology (e.g., computer, printer)

- Company subscriptions

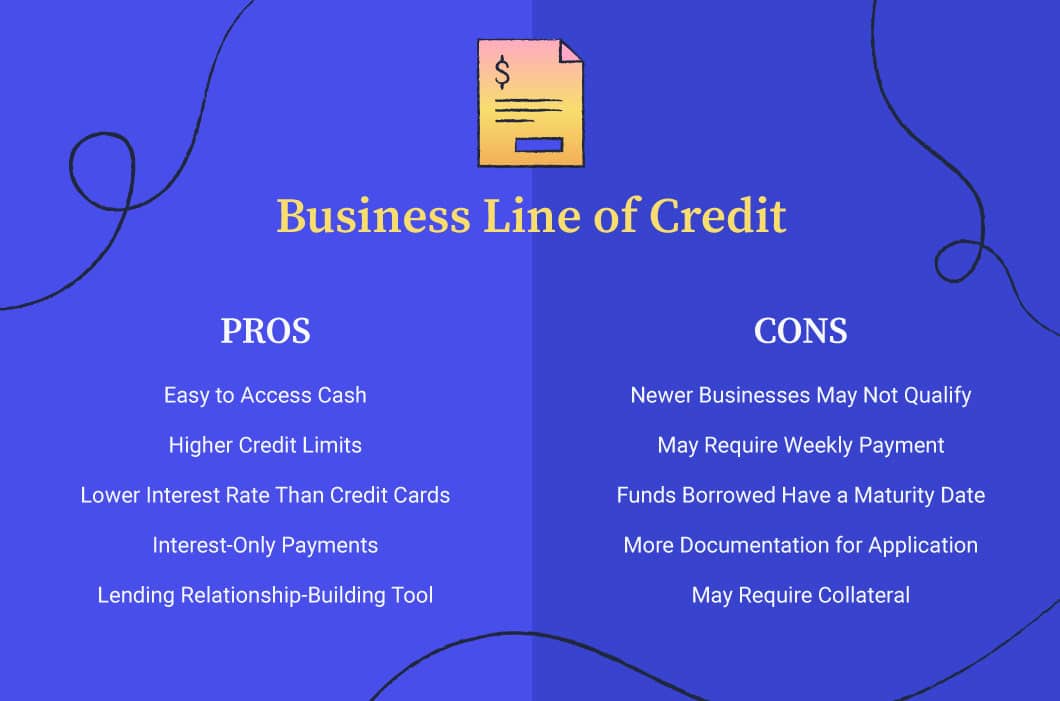

Business Line of Credit: Pros and Cons

Business lines of credit were sought by 30% of small businesses polled in the most recent Small Business Credit Survey conducted by the Federal Reserve Banks. Here are some of the advantages and disadvantages of this type of financing.

Pros

Easy to Access Cash

When you need cold hard cash, a business line of credit is a great choice. This form of funding can be used as cash or to write checks, which is helpful for vendors who do not accept credit as payment. Additionally, it’s easy to access funds through online banking.

Higher Credit Limits

The average small business credit card limit was roughly $56,000 in 2020, while small business lines of credit can have limits up to $100,000, $250,000 or $500,000 depending on lender and borrower qualifications. Needless to say, when it comes to a business line of credit vs. a credit card, the former has greater funding availability.

Lower Interest Rate Than Credit Cards

In addition to having higher limits than business credit cards, credit lines typically have lower interest rates. A lower interest rate means lower payments and a lower cost of financing. Keep in mind that interest rates may be fixed or variable.

Interest-Only Payments

In terms of a small business line of credit vs. a credit card, lines of credit require payments on interest charges only. Pay more toward your balance when you can, but if you can’t, that’s fine. As such, this is an option to consider if your business’s revenue frequently fluctuates.

Lending Relationship-Building Tool

Lenders that offer lines of credit typically offer other types of funding too. Opening a business line of credit could be a great way to establish a payment history with a lender if, down the line, you need a term loan or other kind of financing.

Cons

Newer Businesses May Not Qualify

When it comes to business lines of credit vs. business credit cards, lines of credit are often for more established businesses. At Fast Capital 360, for example, our lending partners require applicants to have at least 1 year in operation for this type of funding.

May Require Weekly Payment

While some lines of credit may have monthly payments, others may have weekly payment structures. This is one way lenders can lower their risks and ensure they receive frequent repayments on borrowed funds.

Funds Borrowed Have a Maturity Date

Depending on the terms of your financing agreement, funds you draw from a business line of credit may be due in full within several months or several years. Additionally, with many lines of credit, if you borrow multiple times throughout your draw period, the payback term for each draw starts anew for that draw.

More Documentation for Application

In addition to credit score, revenue and time in business will be considered. As a result, line of credit lenders typically require borrowers to submit financial and income statements for approval consideration.

May Require Collateral

Some lines of credit require applicants to offer collateral to secure the financing, particularly to attain low interest rates and high credit limits. That said, there are unsecured credit lines, meaning they don’t require a borrower to pledge collateral.

Want an unsecured business credit line?

Business Credit Card: Pros and Cons

Small business credit card transactions are expected to exceed $700 billion by 2023, according to global payments industry specialist Mercator Advisory Group. What can you expect if you’re one of the entrepreneurs contributing to this market?

Pros

Easy to Qualify

It’s easier for many business owners to qualify for a credit card vs. a line of credit. This is especially the case for those who are newer in business and don’t have an established credit history.

Also, secured credit cards are available that can help borrowers obtain approval despite less-than-stellar credit scores. Applications are also easier than credit lines, with no documentation requirements usually needed.

Rewards Available

Business credit cards often have cash-back rewards or travel rewards, which are atypical of business lines of credit. Whether you’re just starting or are a seasoned business owner, these can be valuable perks.

Added Benefits

In addition to rewards, many business cards offer other benefits:

- Travel insurance

- Trip delay

- Lost luggage

- Cancellation insurance

- Purchase protection benefits

Interest-Free Period

Unlike business lines of credit, some business credit cards offer 0% introductory annual percentage rates, which can last from a few months to over a year. Even if your credit card doesn’t offer a no-interest introductory rate, business credit cards typically offer a grace period where no interest accumulates after a purchase.

No Account Ending Date

When it comes to a line of credit vs. a credit card, if you keep your business credit card payments on time and don’t go over your credit limit, you could likely keep it open indefinitely. Having an established credit card in good standing is a plus for your credit report.

Cons

Could Accidentally Use for Personal Expenses

As a business owner, you likely have multiple credit cards, including personal credit cards, in your possession and in your saved online payments. It could be easy to mistake one form of payment for another and unintentionally run up charges on your business credit card.

Easy to Overextend With Multiple Cards

Along the same lines, if you take out multiple business credit cards, it can be easy to spend and strain your finances. While it can seem helpful to have several credit cards available, it can be too much if your debt-to-credit ratio starts climbing and you can’t afford to keep up with your payments.

Not All Billers Accept Credit Cards

As a small business owner who contracts with other small business owners, you’ve likely encountered cash-only businesses, which can be troublesome when your cash is in flux and you only have credit to rely on.

Cash Advances Can Be Expensive

While credit cards can advance you cash, the cost can be pricey. This is especially true when compared to the costs to access cash from a business line of credit. (Think of double-digit interest rates vs. single-digit rates.)

Higher Interest Rate

Credit cards have higher interest rates when comparing small business lines of credit vs. credit cards. In 2021, the average business credit card APR was 14.16%, according to CreditCards.com, though it’s not uncommon for credit card interest rates alone, without added annual costs, to go up to 30%. Additionally, business credit card interest rates are often variable.

What Are the Similarities Between a Line of Credit and a Credit Card?

Here are a few ways each type of funding is similar:

- Fast, online application: You can apply for both credit cards and lines of credit online with relatively quick application processes. Unlike some business loans, you don’t need to provide a reason you’re seeking the financing, and both have fast funding speeds.

- Flexibility: Both types of financing offer the ultimate in funding flexibility. Borrow funds when you need them for whatever you require.

- Revolving credit: Business credit cards and credit lines are typically set up as revolving credit accounts, meaning you can borrow funds up to your credit limit, pay down your balance and then borrow again up to your credit limit throughout the term of your agreement.

- Fees: Lines of credit often have annual fees as well as draw fees whenever the line is accessed, often 1%-3% of the amount borrowed. Credit cards have high fees if you need a cash advance and some may have annual fees, which can be higher for business credit cards with rewards.

Related: How to Get a Business Line of Credit

What’s the Difference Between a Line of Credit and a Credit Card?

- Application: Credit card approvals are usually based on your personal credit and application information. While line of credit lenders also pull an applicant’s credit score, they also typically require financial statements as a condition of approval.

- Interest: Credit cards are usually interest-free if the balance is paid in full before the due date. However, with a credit line, you begin accruing interest the day of the advance.

- Payments: Payments for credit lines are typically interest only. In contrast, payments for credit cards are a percentage of the outstanding balance, often 2%-4%, or a fixed amount if the balance is low (e.g., $50 if the minimum isn’t met). Additionally, business credit card payments are usually monthly, while line of credit installments can be weekly or monthly.

- Maturity: Credit cards have no maturity date, while lines of credit do.