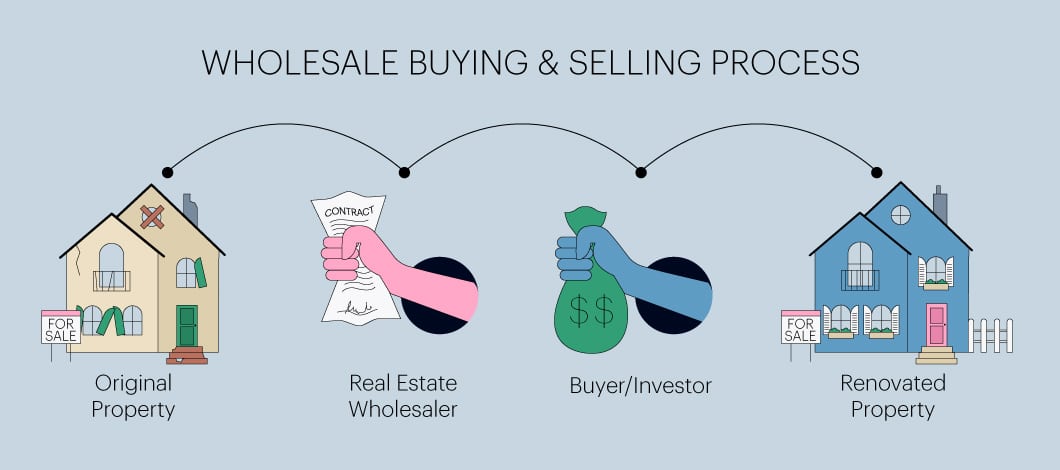

You can think of a real estate wholesaler as a matchmaker of sorts: For a fee, they bring a seller and buyer together.

Let’s get a bit more specific.

According to Merriam-Webster, wholesale refers to the “sale of commodities in quantity usually for resale.” In terms of wholesale real estate, the definition could be thought of in similar terms.

Real estate wholesalers find properties at below-market cost, either because they encounter extremely motivated sellers and/or homes that are very distressed.

In terms of how to write a real estate wholesale contract, real estate wholesalers can negotiate a price and terms with the seller using what’s known as an assignment contract. This is arguably the best way to wholesale real estate because there can be minimal out-of-pocket cost. This method lets the wholesaler transfer the contract to an interested third-party buyer within a specified time frame (e.g., 30-45 days).

Alternatively, in some states, real estate wholesalers can purchase a property from the seller outright and then immediately turn around and sell it to an investor, known as a double close.

After the seller and wholesaler come to a meeting of the minds, the wholesaler works on finding an investor to purchase the property. Buyers are typically investors looking for a flip or those interested in having a long-term rental property.

In wholesale real estate investing, neither the real estate wholesaler nor the investor who buys the property from the wholesaler intends to move into the property.

After the wholesaler makes a deal with an investor, the investor renovates the property. The investor makes a profit by listing the remodeled property for sale at a higher price.

How to Become a Real Estate Wholesaler

Before you jump into becoming a real estate wholesaler, do your research, especially if you aren’t a real estate agent. Consider finding a mentor experienced in the field or attend networking events.

Search for reputable online courses on the topic, such as Udemy’s Wholesaling Real Estate in 30 Days, too. Read books on the topic as well, such as “The Real Estate Wholesaling Bible” by Than Merrill, which has earned a 4.5 out of 5-star rating on Amazon.com. “If You Can’t Wholesale After This … I’ve Got Nothing for You” by Todd M. Fleming is another popular read.

Keep in mind, real estate wholesalers often don’t need to be licensed real estate agents. That said, research the laws in your specific area for more details. For example, Philadelphia requires real estate wholesalers who aren’t licensed real estate agents to obtain a Residential Property Wholesaler License. Along similar lines, Texas and Illinois have legislation in place that requires wholesalers to be licensed agents.

You can find out how to become a licensed real estate agent by visiting the U.S. Bureau of Labor Statistics.

How Do Real Estate Wholesalers Make Money?

In cases where there’s an assignment contract, real estate wholesalers typically make money by charging buyers a finder’s fee, often 5%-10% of the sale price, though this can fluctuate.

In cases where the wholesaler purchases the property and then immediately sells it, the wholesaler makes a profit from any markup on the sales price.

To give you a more concrete figure of what you could expect to earn, according to ZipRecruiter, the national average salary for professionals in wholesale real estate exceeds $78,000.

Learn How to Wholesale Real Estate Step by Step

Real estate wholesalers aren’t offering sellers the best price, but in some cases, they can alleviate the hassle sellers can face when trying to get out from under a property they no longer want, need or can afford. Here are the steps they take to get a deal in place.

1. Get Educated on the Market

Research the most recent sales in the area and comparable properties, if applicable.

Find out about different neighborhoods, what types of housing are popular there, housing demographics and other things that could impact the sale and purchase. Also consider factors such as the number of bedrooms and bathrooms, size of the home and lot size and how that affects the price.

Additionally, be sure to map out your strategy, including timing, before you get started.

2. Find Interested Investors

While you could find investors after you sign a contract with a seller, you’ll likely be under time constraints to find a buyer. That said, put yourself in the best position to have a buyer in place. Start creating a list of potential investor contacts. This way you have a pool of possible investors whom you can approach once you have a property to pitch.

- Network: Connect with real estate investment groups, which you can find in your local community, on social media sites or through your local chamber of commerce

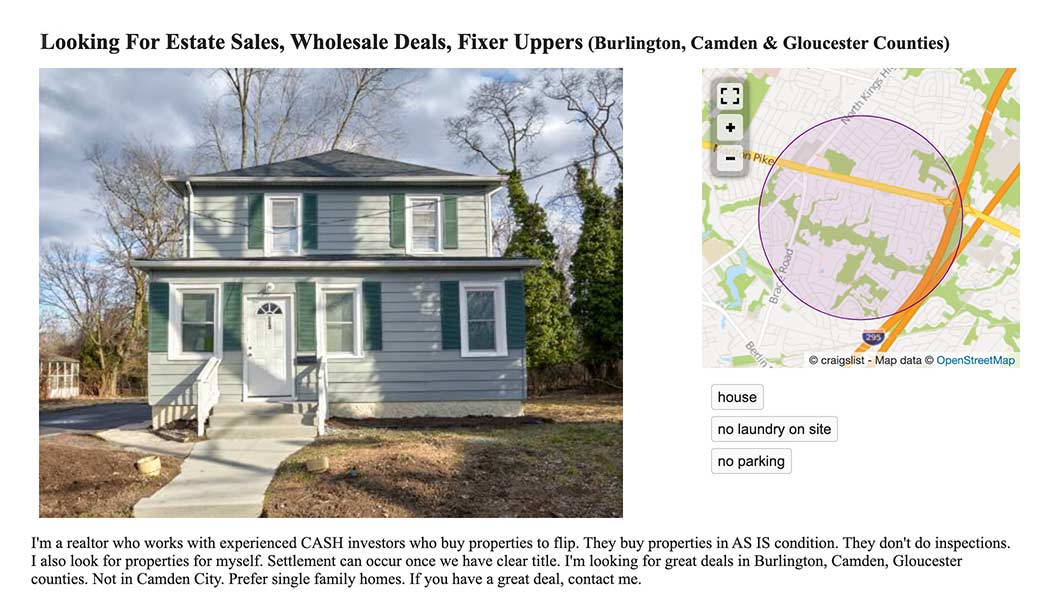

- Advertise: Just as you can use online platforms to search for good wholesale properties, you also can use it to post real estate investment opportunities, as seen in the image below.

3. Locate Viable Properties

Find the right property, one that the owner needs to unload or desperately wants to sell. Because you (and your eventual buyer) are looking to make a profit, you’ll want to be able to find real estate that you can acquire below market value.

Here are a few ways to identify a property that might be worth making an offer on:

- Search websites: Scour sites with real estate listings such as Craigslist, Zillow or For Sale by Owner

- Use relevant keywords: “as is,” “motivated seller,” “investor alert” and similar phrases

- Tap Into the MLS: If you’re a real estate agent or have access to the Multiple Listing Service (MLS), research properties there, too

- Attend auctions: Research auction dates, times and locations

- Review public records: Search probate court documents for property transfers or review property records to get information about real estate you think might be a good buy

- Seek help: If you aren’t a real estate agent, consider enlisting the services of one who specializes in investment properties or hire a part-time worker to help you comb through databases

- Advertise: Some real estate wholesalers advertise online, while others use direct mailers or signs placed strategically throughout a community to generate inbound leads (use caution with phrasing to avoid misleading marketing)

Properties to keep an eye out on include the following:

- Properties with liens or delinquent taxes

- Absentee owner properties

- Inherited properties

- Foreclosures

- Fixer-uppers

- Sheriff sales

4. Prepare to Make a Deal with the Seller

It’s important to do your research so you have a firm idea of what the after-repair value (ARV) of the property will be. This will provide clarity around pricing too.

This is key to attracting investors to the property. Ultimately, investors need to know how much they stand to make after they purchase the property, renovate it and sell it.

Once you come up with a figure, speak with the seller. Explain your role as a real estate wholesaler. Explain the costs an investor will need to put out in order to fix up the property for resell.

If the seller is amenable with your offer, you can draw up a contract. Remember, real estate wholesalers often use assignment contracts. That said, consider using an attorney to ensure the paperwork is done correctly.

5. Tend to the Details

Here are additional steps you’ll need to take:

- Get an appraisal: Make sure you know what the property is valued at. Buyers will want to see a property appraisal report as well.

- Run a title search: You’ll need to work with a title company for this. Provide the buyer with the property’s title report, which shows any liens or issues impacting ownership. Be sure to work with a title company experienced with wholesale real estate transactions.

- Determine the property’s needs: Get a contractor or reliable handyman to look at the property and estimate the costs of repairs that are needed.

6. Go to Settlement

Once you’ve got a buyer in place, it’s time to close the deal. If you are assigning the contract to the buyer, your assignment fee should be listed in the contract.

It’s best to have a legal professional review the details.

Once the closing date is set, the buyer will need to attend to sign the purchase documents and remit payment. At that time, the title company will issue you a check for your fee if applicable.