When businesses need funds, securing working capital as quickly as possible is crucial. Obtaining a short-term cash flow loan can be key to helping a business through any financial shortfall.

Let’s go through the basics of cash flow lending, how to qualify and which lenders provide cash flow financing.

What Is a Business Cash Flow Loan?

A small business cash flow loan allows you to borrow funds against revenue you expect to earn in the future. This type of financing is quick to fund and provides the working capital needed to fill cash flow gaps.

Related: Bad Credit Business Loans? These Are Your 5 Best Options

How Does a Cash Flow Loan Work?

Cash flow lending doesn’t require collateral like asset-based loans. Instead, the funds are secured against the company’s expected revenue. Often a personal guarantee from the owner and any partners is required. This means if your business can’t pay the loan’s balance, your personal or business assets can be used to cover the outstanding debt.

A cash flow loan is designed to be repaid quickly or refinanced.

Because commercial cash flow lending is an umbrella term for multiple funding programs, the lender requirements to qualify for funding vary. However, businesses with strong sales are likely to qualify for a cash flow loan, even if their credit score is at or below 580.

Business Cash Flow Loans vs. Asset-Based Loans

Regardless of the type of financing you pursue, underwriters consider your cash flow. This isn’t the only way to obtain funds, however. Another common way to secure a loan is by leveraging your assets.

The greatest differentiator between asset-based loans and cash flow loans is the role collateral plays. Asset-based loans are secured by valuables pledged by the business owner. Assets lenders accept as collateral include any income expected from accounts receivable, real estate owned by the company, equipment and inventory.

Another difference between small business cash flow lending and asset-based lending includes processing time. It can take about 30 days for a lender to review an applicant’s asset-based loan request. During this time, the lender evaluates nearly every aspect of the business, including balance sheets and pledged collateral.

In contrast, the underwriting process for cash flow loans helps lenders process applications much faster. Using earnings before interest, taxes, depreciation and amortization (EBITDA) combined with a credit multiplier, lenders can account for any outside uncertainties, along with your own business’s risk.

When to Use a Cash Flow Loan?

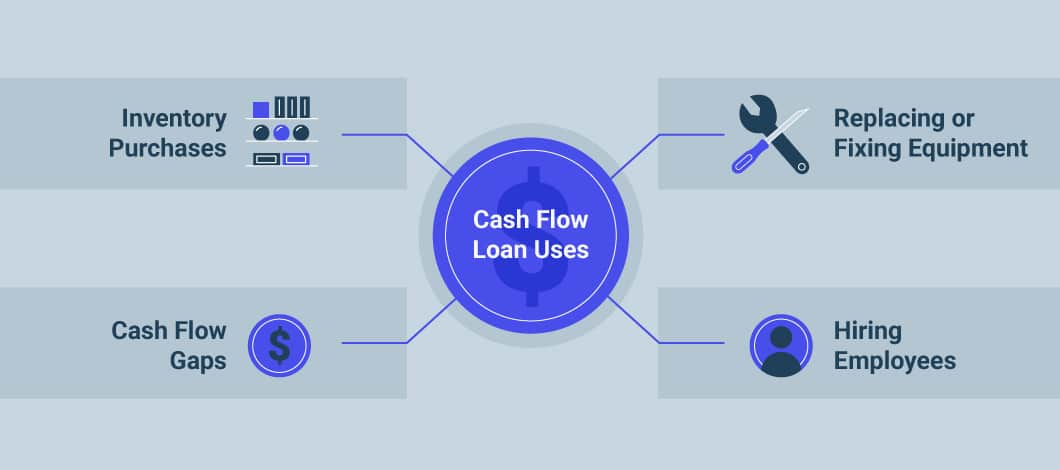

A cash flow loan can help you meet several business needs in the short term, including:

- Inventory purchases: Cash flow loans are often used to address inventory needs. You can replenish your seasonal reserves, purchase in bulk to secure a discount or account for any holes in your product line. A cash flow loan also can aid businesses looking to secure enough product to fulfill a large, unexpected order.

- Replacing or fixing equipment: There’s never a convenient time for an essential piece of equipment to fail. With a cash flow loan, you can gain access to the funds you need to pay for a quick fix or replacement.

- Weathering seasonal downturns: Even when your retail business isn’t busy, bills and other expenses don’t stop. When you need support to get through a slow season, a cash flow loan can sustain your business when sales are down.

- Hiring additional employees: As your business needs grow, so does the size of your workforce. A cash flow loan can help you take on the costs of hiring new employees.

Do you need a cash flow loan for your small business?

5 Cash Flow Financing Options

The term “cash flow loan” is an umbrella term that can include several types of business financing options:

1. Business Line of Credit

This type of small business cash flow lending is a flexible funding solution, perfect for when your business needs are changing. It allows you to withdraw money whenever you need it, while only paying interest on the funds you borrow.

With a revolving credit line, the money available to you replenishes with every repayment, similar to a credit card. Lines of credit can be secured with collateral or unsecured.

At Fast Capital 360, terms for a business line of credit are as follows:

- Loan Amount: Up to $250,000

- Estimated Repayment Terms: 6 months–3 years

- Interest Rate: Starting at 8%

- Speed of Funding: As fast as 1 day

2. Merchant Cash Advance

Technically, a merchant cash advance (MCA) isn’t a loan, but it can be used as a type of financing to improve short-term business cash flow.

An MCA lender provides you with a set amount of cash upfront based upon future earnings. In exchange, you’re charged a factor rate (instead of an interest rate) and repay the advance with a percentage of your sales along with any funding fees, often with daily automatic withdrawals.

One of the best features of an MCA? In most cases, you can get approved and funded within 24 hours.

Fast Capital 360’s terms for an MCA are the following:

- Financing Amount: Up to $500,000

- Estimated Repayment Terms: 3–24 months

- Factor Rate: Starting at 1.10

- Speed of Funding: As fast as the same day

3. Unsecured Business Term Loan

Unsecured business term loans are a one-time infusion of capital paid back over a given term. These programs have no collateral requirement and are used for larger investments, including equipment purchases and debt restructuring. Term loans often have lower interest rates than other kinds of cash flow financing.

Fast Capital 360’s terms are the following:

- Loan Amount: Up to $250,000

- Estimated Repayment Terms: 1 year–5 years

- Interest Rate: Starting at 7%

- Speed of Funding: As fast as 1 day

4. Short-Term Loans

Short-term business cash flow loans offer a one-time sum of capital like longer term loans, though typically smaller amounts with shorter repayment windows. These programs are usually paid off in 18 months or less, sometimes with daily or weekly payments.

Fast Capital 360 terms:

- Loan Amount: Up to $500,000

- Estimated Repayment Terms: 3–18 months

- Interest Rate: Starting at 10%

- Speed of Funding: As fast as the same day

5. Invoice Financing

Another option when you’re in search of a business loan based on cash flow is invoice financing. If you’re in the business-to-business space and need funds in a pinch, you can leverage your unpaid invoices for fast cash. Invoice financing providers often advance 70%-90% of qualifying accounts receivables.

Fast Capital 360 terms:

- Financing Amount: Up to 80% of receivables

- Estimated Repayment Terms: Until receivables are paid by customer

- Factor Rate: Starting at 1.02

- Speed of Funding: As fast as same day

How to Get a Cash Flow Loan

You’ve decided cash flow financing is the best option for your business, but do you qualify? First, let’s look at what lenders consider when weighing your application, and then examine what type of lender is right for you.

What Factors Do Cash Flow Lenders Evaluate?

Getting approved for small business cash flow lending is often an easier process than acquiring a conventional loan, and it’s a type of financing most businesses can reliably access.

Here are several factors lenders consider for a cash flow loan approval.

Debt-to-Income Ratio

In the underwriting process, lenders consider existing debt and your debt-to-income ratio (DTI).

This ratio gauges your ability to handle additional debt and demonstrates how efficiently you can repay it. The lower your DTI, the easier it will be to receive approval.

Projected Revenue Growth

Underwriting is primarily based on past performance. This information, combined with your intended use of funds, will influence your projected revenue growth. This will give your lender a better idea of how much you may qualify for.

Projecting future revenues becomes a bit trickier for seasonal businesses, however. In this scenario, lenders might request financials from the previous year’s payback months (the period of time when you would be repaying your loan) to ensure a busier season is approaching.

Operating Cash Flow

Operating cash flow is a formula that reveals how much money a company generates — such as what’s earned through manufacturing and the selling of goods or services rendered.

Also known as net cash from operating activities, operating cash flow focuses on recurring business activities. It doesn’t include one-time expenses, such as long-term capital expenses or investment costs.

Your operating cash flow gives lenders a clearer idea of your business’s financial health, how much they can offer your business and how much you can afford to repay. Understanding your average cash flow amounts and any seasonal lulls (e.g., a garden center that doesn’t take in as much cash during the winter) also helps lenders assess your risk as a borrower.

Overall, the stronger your operating cash flow, the more likely you’ll receive a high principal with lower rates.

Cash Flow Lending Sources

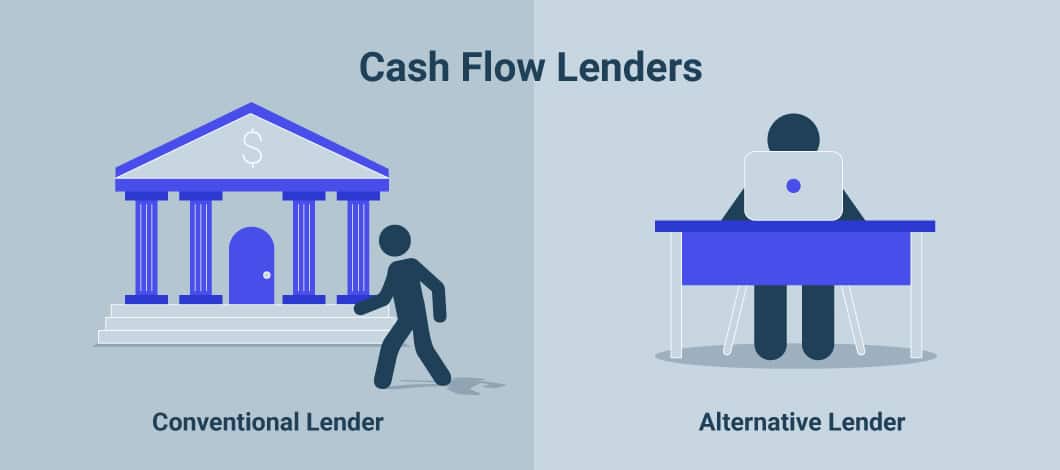

You have 2 major options when looking for short-term cash flow loans and other financing — conventional and alternative, or online lenders.

Conventional Lenders

Banks and credit unions are good options for term loans or business lines of credit. These conventional lenders offer higher funding amounts, lower rates and longer repayment terms. However, with these favorable lending conditions come stricter requirements.

Banks usually want applicants with high revenues, good to excellent credit scores (670 or higher) and lengthy credit histories. They also prefer to work with borrowers who are current or previous customers. It’s difficult for some small businesses to meet these standards, particularly if they don’t generate high revenues or haven’t been in business long enough to build a credit history.

The application process can also be time-consuming, requiring detailed information and documents about your business and personal finances. The time between submitting your application and approval and funding can be several weeks or more than a month.

Alternative Lenders

Alternative online lenders are less risk-averse than conventional funders, offering working capital to more business owners — including those with poor credit. This is done by evaluating the financial health of a business aside from credit score.

In addition to reviewing your current cash flow, these lenders will usually need you to provide the following:

- Details about your business

- Information about the primary business owner(s)

- Your doing-business-as (DBA) name, if applicable

- Several most recent bank statements

When you’ve collected that information, you’ll visit the lender’s website and complete your application entirely online, often in just a few minutes.

Depending on the funder and type of cash flow loan you pursue, your funds can be deposited into your bank account the day you’re approved.

However, the quick turnaround time and easier access to funding mean the lender is taking on a bigger risk. As such, some cash flow financing can require more frequent payment installments and have shorter repayment periods than cash flow loans offered through conventional lenders.

What Are the Downsides to Small Business Cash Flow Loans?

While a commercial cash flow loan can help you meet various business funding needs, there are potential downsides to consider before deciding whether this type of financing is right for you and your business.

Higher Rates and Fees

Because cash flow based lending techniques take a more limited view of your business — namely, your future cash flow — and have shorter terms, they can be bigger risks for lenders. This leads to higher interest rates and fees.

Personal Guarantee

Personal guarantees are a common feature of several business financing options, including cash flow loans. Also, some cash flow lenders may require a lien to secure their investment.

While this is common practice for many lenders, carefully consider whether you and/or your business partner would be able to pay off your cash flow loan’s balance in case of default.

Automatic Payments

Cash flow lenders often require a borrower to agree to automatic payments, which can be challenging if you’re having cash flow issues. However, this helps make lending less risky for financing providers.

Depending on your financing agreement, payments may be withdrawn daily, weekly or monthly. Additionally, payment installments may be fixed or they may fluctuate based on your credit and debit card sales.

Is a Cash Flow Loan Right for Your Business?

In 2021, 62% of small businesses reported seeking financing to cover operating expenses, up from 43% in 2019, according to the Federal Reserve Banks’ Small Business Credit Survey. Needless to say, there is a demand for cash flow loans.

When you’re contemplating whether or not to pursue this type of financing, ask yourself the following:

- Are you entering a slow period?

- Would a short-term cash flow loan facilitate your ability to say yes to more clients and business opportunities?

- Could a business cash flow loan save you money on necessary inventory purchases?

- What would the return on investment be from your cash flow loan?

- What would your business outlook look like if you didn’t seek a cash flow loan?