Cash-flow management in the construction industry presents certain problems. In this article, we’ll look at 12 of the more common ones, along with solutions to overcome them.

What Is Cash-Flow Management?

Let’s first clarify what cash flow and cash-flow management are, as many problems stem from misunderstanding these concepts.

Cash flow refers to the net amount of cash and cash equivalents coming into or out of your business over a given time frame.

Cash flow includes all cash gained or lost because of:

- Operations: Sales revenue or payroll expenses

- Investments: Equipment sales or purchases

- Financing: Bank loans or debt payments

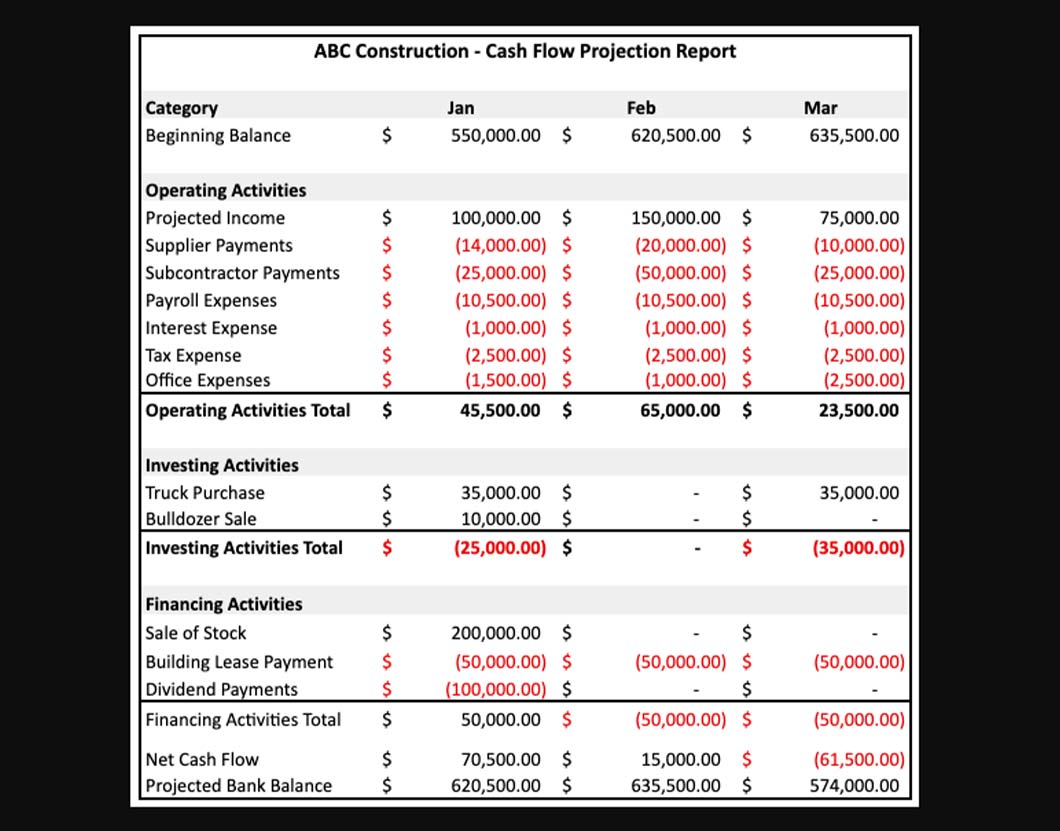

Information about your cash flow is recorded in your books in your cash-flow statement. This is one of the main budgetary statements used by financial institutions and investors to evaluate the health of your business.

To avoid cash-flow problems, it’s important to understand the difference between cash flow versus profit. Your profits, recorded in your profit-and-loss statement, are defined by the difference between your revenue and expenses. Your business is profitable when you’re earning more from revenue than you’re spending on expenses.

However, cash flow involves more than just what you’re earning and spending on business expenses. Cash flow also takes into account money you have coming in from sources such as loans and investments as well as what you’re spending on items such as equipment purchases and debt payments.

You can have strong cash flow without being profitable if you’re getting enough financing to maintain your cash supply. By the same token, you can have cash-flow problems even if you’re profitable if your earnings aren’t enough to offset liabilities, such as debt payment obligations.

To maintain good cash flow, you must monitor your cash-flow statements closely, make accurate cash-flow projections and take proactive steps to avoid letting your inflow of cash get too low. The following tips can help you do this.

1. Problem: You Aren’t Making Accurate Cash-Flow Projections

Good cash-flow management depends on accurate cash-flow projections, but making reliable construction cash-flow forecasts can be particularly challenging. First of all, many businesses don’t pay attention to cash flow in the first place. Even if you do, construction cash-flow forecasting can be clouded by issues such as inaccurate cost estimates, change orders, progress billings, delayed payments and seasonal fluctuations in demand, to name a few.

These and other factors can combine to make estimating cash flow for a construction project in progress tricky.

Solution:

You can take a number of steps to improve the accuracy of your cash-flow projections:

- Hire an accountant experienced with the construction industry to help you develop your cash-flow projections.

- Use an accounting software program with built-in cash-flow projection tools and templates providing cash flow for construction project example scenarios, such as QuickBooks Desktop’s cash-flow forecast and cash-flow projector features.

- Use the cloud to integrate data from all parts of your operation, including your office and field teams.

- Use rolling cash-flow forecasts, which are projections that get updated when significant new data comes in rather than based on a fixed reporting schedule.

- Use timed-phased budgeting, a budgeting strategy that syncs project budgets with expense payment timelines.

Taking these steps can help you make more accurate cash-flow projections, which will help you implement other tips in this article.

2. Problem: You’re Underestimating Costs

Construction cost estimation can be challenging for a number of reasons. Each project is different, and things can change over the course of a project. The price of materials can vary with market conditions, and the time it takes to estimate material costs precisely can be prohibitive.

Unfortunately, inaccurate estimates can leave you without enough cash to complete projects, disrupting your relationships with clients and hurting your ability to land bids.

Solution:

The American Society of Professional Estimators (ASPE) and the Association for the Advancement of Cost Engineering International (AACE) provide professional certifications for construction cost estimators, which require extensive experience, training and testing.

The ASPE has developed a multi-tiered approach to cost estimates, which begins with a general estimate to assess the feasibility of a project and progresses through increasingly more specific and accurate estimates to a detailed bid estimate. Hiring an estimator familiar with this approach and certified in its application can help you make more accurate estimates.

When hiring a construction estimator, look for an estimator who is qualified as a certified professional estimator (CPE). The ASPE maintains a directory of highly experienced estimating consultants and consulting firms.

3. Problem: You Aren’t Processing Change Orders Promptly

Change orders that come in after you’ve begun a project alter cash-flow projections. In some cases they can reduce costs, but in many cases they require additional expenditures. When this happens, procrastinating on billing customers for change orders can leave you without enough cash on hand.

Solution:

To keep change orders from disrupting your cash flow:

- Build changes-to-the-work clauses into your contract language to facilitate cash flow by requiring parties requesting changes to pay in advance.

- Standardize a procedure for processing change orders so they’re handled immediately.

- Use a change order proposal process to make accurate estimates for requested changes before they’re approved.

- Use business process management software to automate timely processing of change orders.

Following these procedures will help minimize the impact of change orders on your cash flow.

4. Problem: You’re Failing to Budget for Contract Retention

Retention, or retainage, refers to the portion of payment that construction clients hold back from paying until a project is completed. This can represent as much as 5%-10% of the contract price.

Failing to factor in the delay for retainage payments can leave you short on cash as the end of a project draws near, potentially jeopardizing completion. If a client elects to withhold retainage longer than expected, it can take you a long time to collect what you owe.

Solution:

If a client fails to pay you for retainage, you can file a mechanics lien, which is a legal claim to security interest in a property preventing the owner from selling it until the lien is paid. However, in most states, the deadline to file mechanics liens typically expires before retainage is due. Filing a mechanics lien before retainage is due can potentially create adversity with clients.

A solution to this is to send clients a document at the beginning of a project called a preliminary notice, also called a prelim or pre-lien notice, to establish your rights to file a mechanics lien in the event the retainage isn’t paid.

Another key to speeding up retention payments is to standardize and automate early transmission of closeout documents, which verify work completion. The faster your closeout process, the faster you’ll receive your retainage payments.

Offering clients a discount for early payment can also help promote prompt retention payments.

5. Problem: You’re Falling Behind on Payroll Expenses

Payroll is a major expense item, and when cash-flow problems hit, it can become one of the first casualties. Payroll is typically the top item affected by cash-flow issues, a survey of construction professionals by payment software provider Levelset and time tracking software provider TSheets by QuickBooks (now QuickBooks Time) found.

Solution:

Contracting employees normally are paid weekly or biweekly, while subcontractors are paid monthly. Subcontractors also may have a pay-when-paid or paid-if-paid clause in their contracts, specifying that they won’t get paid until contractors are paid.

Consider using subcontractors to reduce the velocity of payroll expenses. Implementing the other steps in this guide will also help free up funds for covering payroll.

6. Problem: You’re Paying Too Much for Materials

Materials are another major expense that can drain your cash flow. For example, as the end of a project approaches, paying for finishes can increase your cash-flow burdens.

Solution:

The following are a few ways for how to improve cash flow in construction in regards to material costs:

- Buy in bulk

- Shop multiple suppliers

- Negotiate with suppliers for better deals

- Ask suppliers for financing arrangements, such as lines of credit or loans

- Ask for payment terms equal to or longer than those you will need to get paid by clients

- Ask property owners or general contractors to buy materials directly from suppliers rather than having you pay for them

7. Problem: You’re Paying Cash for Assets

Assets such as equipment and vehicles are necessary expenses, but paying for them with cash can become a drain on your cash flow. These types of long-term investments can cost considerably more than short-term expense items.

Solution:

Use financing to spread out the cost of asset payments. For instance, specialized heavy equipment financing and loans and other types of construction loans can help make these purchases affordable without putting too much of a strain on your outflows.

Need a construction business loan?

8. Problem: You’re Paying Bills Faster Than Cash Is Coming In

Paying bills as soon as they come in may seem intuitive. However, if you’re paying bills before they’re due, you may be cutting into your cash flow.

Solution:

Use your cash-flow projections to determine how to schedule bill payments so you don’t get ahead of your cash inflow. Delay payments until the end of payment cycles when strategic, while still taking care to avoid late payments.

9. Problem: Your Suppliers Aren’t Giving You Enough Time to Pay

Keeping up with supplier payments can be another drain on cash flow in construction management. If your supplier contracts require you to pay ahead of delivery or upon receipt of goods, or if you have credit terms that only give you a short time to pay, you may find yourself struggling to keep up with payments.

Solution:

Negotiating more favorable invoice payment terms with your supplier might alleviate your cash-flow burden. Common credit arrangements allow payment 30 days after receipt of invoices (net 30), 60 days after invoicing (net 60) or 90 days after invoicing (net 90).

Suppliers may be more open to extending you credit if you’re a loyal customer, if you have a good business credit score or if you can put up some type of collateral, such as equipment or a percentage of future payments.

10. Problem: You’re Invoicing Customers Too Slowly

A sluggish invoicing process will slow down your cash-flow management in a construction project timeline. If your invoicing cycle is falling behind your expense and debt obligations, you may be heading for a cash-flow crunch.

Solution:

Keep your invoices and pay applications flowing in sync with your cash needs by creating standardized invoicing procedures. Use software such as QuickBooks Online Advanced to generate automated billing statements and send them out on time.

Implement procedures for confirming invoices have been received. Then follow up a week later to verify there are no issues that need resolution.

11. Problem: Your Customers Are Paying Late

Late payments from clients can hold up your cash flow. This can hurt your ability to complete current projects as well as deprive you of cash needed for future projects.

Solution:

In addition to using good invoicing procedures, you can take several other steps to promote on-time payments:

- Screen clients by checking their income, business credit score and payment history

- Lay out payment terms in contracts

- Offer multiple payment methods

- Offer incentives for early payments

- Create flexible payment options for delinquent clients

- Exercise mechanics lien and bond claims when necessary

12. Problem: You Don’t Have Financing Resources to Offset Cash-Flow Crunches

When your cash flow slows down, having financing available can help your business persevere until cash starts coming in again. If you don’t have financing resources to fall back on, a cash-flow crunch can become a real emergency.

Solution:

Develop a good financing strategy to sustain your cash flow:

- Position yourself to qualify for financing by building a strong personal and business credit score

- Establish relationships with financial providers

- Apply for a business line of credit

- Use equipment financing to cover asset purchases

- Set aside a portion of your profits to build enough emergency cash reserves to sustain your business for at least several months

Establish a sound financing strategy to help you access extra cash when you need it.

Avoid Construction Cash-Flow Problems to Keep Your Finances Healthy

Cash-flow problems don’t have to cripple your construction business if you know what to watch out for. The problems discussed here represent some of the most common cash-flow issues you’re likely to encounter in the construction industry. You can avoid these issues by applying the strategies suggested above to keep your cash-flow under control.

One pillar of good cash-flow management is having a sound financial planning strategy, which should include a financing strategy. Fill out our free online application to find out which types of equipment financing and other financing options you may qualify for.