In your entrepreneurial journey, you might find that it’s difficult to get approved for a business loan even if you’re showing traction and have a solid business plan.

Getting declined for a business loan is incredibly common, as disruptive as it is to your plans for growth. Here’s how you can take control of the situation if a lender decides not to fund your loan.

1. Find Out Why Your Loan Application Was Declined

When you’re wondering what to do when a lender rejects your loan application, the first thing is to uncover why you weren’t approved.

When a loan is declined, it means some aspect of your application or business background didn’t meet the lender’s requirements for approval.

While you’re unlikely to change the lender’s mind once they reject your loan application, it’s helpful to ask why your application was rejected. An explanation letter can provide you with a thorough road map so you know what needs to be addressed before you try reapplying for a business loan.

Use this information to better prepare for your next loan application, or determine if a loan is even right for your particular business model or purpose. For instance, if you’re missing certain required documentation, make sure you have all your ducks in a row the next time you apply.

2. Check Your Credit Report for Errors

Creditworthiness is a major component in applying for a business loan. Business and personal credit scores are separate concepts, but when it comes to business loans, both will be examined in the loan application process.

Unfortunately, mistakes happen and identity theft is real. If you haven’t already, pull your business and personal credit reports and review for any possible inaccuracies. Also, check to see if items that should have fallen off are still showing as being owed.

3. Improve Your Business Credit Score

If a lender review shows you’re poorly managing your credit, it could lead to your business loan being declined.

Having too much personal debt also can impact your ability to get approved for a business loan. For example, if you are paying off credit cards and are co-signed to your child’s student loans, it will show up on your credit report — even if your child is handling the repayments.

Assess which debts you can prioritize repaying faster, or have your name removed from certain debts. A major life change, such as marriage, divorce, the birth of a child or sending your child to college, also can affect your personal credit.

Even if the explanation letter from the lender didn’t cite credit as a reason for rejecting your loan application, it’s always best to work on improving your credit score. Excellent credit scores help you in the long run as you maintain good standing with lenders.

If you haven’t yet established credit as a business, now is a good time to do so. However, establishing credit as a business can be challenging. This is because timely bill payments made under your business name aren’t usually reported automatically to credit bureaus the way personal accounts are.

To help with that, ask a vendor or commercial landlord to report your timely payments to business credit bureaus such as Experian or Dun & Bradstreet if you have a DUNS number. You also can open a credit card in your company’s name so it will get sent to credit bureaus without having to request it.

4. Apply for Different Types of Financing

After some reassessment, you might realize bank loans aren’t the right type of financing for your particular needs, business goals or business model.

Banks tend to favor capital-intensive businesses with tangible assets, such as vehicles and equipment. If your business model doesn’t require significant assets with a title that can be claimed in the event you default on a loan, you might continue to struggle getting approval for a bank loan. If you don’t want to seek other types of financing, however, you need to drastically improve both revenue and total cash on hand before applying for a loan again.

Today, there are several other types of small business financing, including crowdfunding, factoring, trade credits, incubator programs, grants and business credit cards.

SBA Loans

Another option is to apply for a Small Business Administration (SBA) loan. While the SBA doesn’t actually provide the funding, the agency does partially guarantee these types of loans. This guarantee lowers the risk for lenders in the case of borrower default. Incidentally, if your SBA loan application is denied, there are steps you can take to reapply or appeal the denial.

Credit Lines

You also may consider a credit card or revolving line of credit, which is a better option for your business if you don’t need to borrow a large sum of money and you’re facing a financial shortfall because of an immediate, short-term problem — such as a slow season or losing a major client.

Crowdfunding

Crowdfunding can be a viable route because it’s both a funding and marketing strategy for your business. You can show your business plan to equity-based crowdfunding platforms, such as AngelList and Fundable, if you’re interested in seeking investors. You can also turn to sites such as Kickstarter and Indiegogo for rewards-based crowdfunding.

Accounts Receivable Financing

Factoring services will base your loan amount on your receivables — namely, the payments customers owe your company. This option makes sense if cash collection is slow and the current state of your cash flow would disqualify you for a conventional business loan. Factoring companies buy your receivables, giving you about 70%-90% of their value in 1 or 2 installments.

These different types of financing might be able to serve your needs in the short term if your business loan is declined and you’re now applying to more lenders or waiting to reapply with the same one, or completely replace your need for a loan.

5. Consider Other Lenders

According to the FDIC, large commercial banks (banks with more than $250 million in assets) primarily lend to other large businesses, with 11.6% of loans going to small businesses. Inversely, small business loans comprise 78.7% of smaller banks’ commercial loans. The personal touch that you get with a small bank, and the more dire need for your business, can be all the more reason to seek them out if large bank chains routinely decline to fund your business loan.

Credit Unions and Community Development Financial Institutions

Credit unions and community development financial institutions (CDFIs) are options if you’d like to use a somewhat conventional lender but aren’t having luck with banks. Credit unions are often based on residency or industry, while CDFIs tend to be located in economically devastated regions and provide additional business counseling to borrowers so the loans help revitalize the area. You can research CDFIs by the state as well as the federal directory, Opportunity Finance Network.

Alternative Lenders and Lending Marketplaces

There also are numerous alternative lenders and lending marketplaces, most of which operate online, such as Kabbage and Fast Capital 360. Digital payment processors, such as PayPal, offer their own financial products to small business owners based on sales history and do not require a credit check, which can be a viable option if you have poor or no business credit.

Some of these alternative sources like PayPal Working Capital Loans can disburse funds within 24 hours after approval. The financing application and approval process takes place over a sharply smaller window of time.

Reasons for Business Loan Rejection

A lender will typically reject your loan request because your business purpose didn’t satisfy their requirements.

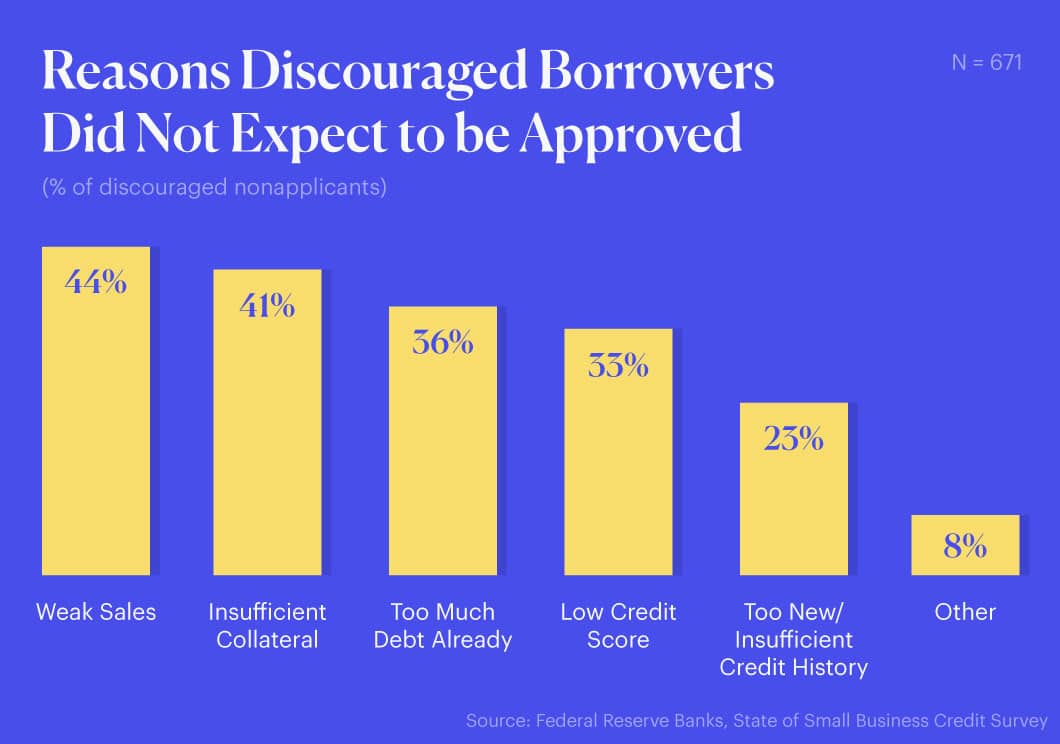

According to the Federal Reserve Banks’ State of Small Business Credit Survey, these were some of the top reasons small firms believed they’d get their request for a business loan declined:

- Weak sales: 44%

- Insufficient collateral: 41%

- Too much debt already: 36%

- Low credit score: 33%

- Too new/insufficient credit history: 23%

Additionally, the Federal Reserve Banks’ report noted that 25% of firms surveyed received none of the funding they sought when applying for a business loan. In contrast, 37% of applicants were approved for all the capital they needed, while 38% received some (23%) or most (15%) of the funds they requested.

Why Was Your Loan Declined After Preapproval?

If you find yourself being denied following a preapproval, there are few reasons why that may have happened:

- Revenue changed

- Additional debt incurred since preapproval

- Cash reserves spent since preapproval

- Insufficient documentation provided for approval

How Does a Declined Loan Affect Credit Score?

According to credit-rating firm Experian, when you apply for a loan, a lender may access your credit report to evaluate the risk involved in offering you funding. This is referred to as a hard inquiry, which is added to your credit report. Hard inquiries have a minimal impact on your credit score and are automatically removed after 2 years.

Keep in mind, a hard inquiry is different from a soft inquiry, which doesn’t impact your credit score and is often seen when a lender you’re already working with checks your credit as part of a routine review of your account, for example.

That said, if you’re declined for a loan, the denial isn’t recorded on your credit report. Additionally, credit reporting agencies aren’t notified if a lender denies your loan request.

What Will You Do If Your Loan Request Is Denied?

Getting rejected for a business loan can be disappointing, but it doesn’t mean an end to your entrepreneurial journey.

Use it as an opportunity to find out where your business can improve so you can apply again with stronger financials and a more well-defined business purpose, or perhaps move on to other types of financing that best serve your company’s immediate and long-term needs.