Your Small Business Administration (SBA) loan request can be turned down for any number of reasons. While SBA loans are known for their competitive interest rates and repayment terms, the road to approval can be rocky and sometimes end in disappointment.

Whether you’re in the midst of applying for an SBA loan or were recently declined for one, knowing the reasons why your SBA loan was denied can help you secure funding in the future.

Common Reasons to Be Denied for an SBA Loan

There are several common reasons to be denied for an SBA loan. When lenders evaluate applicants, they consider the 5 C’s of credit – capital, collateral, character, conditions and capacity – which could present specific disqualification factors. Other applicants might not meet the business criteria set forth by the SBA.

SBA Loan Disqualifications

Business owners applying for an SBA loan could be denied for 1 or more of the following reasons.

- Poor credit history or low credit score

- Substantive character issues (e.g., multiple felonies)

- Insufficient collateral

- Lack of capital or cash flow to repay the loan

- Too much outstanding debt

- Default on another government loan

- No true financial need is evident (e.g., applicant has a surplus of assets)

- Active tax lien or judgment

- Ineligible industry (e.g., gambling, lending, investment)

- SBA business size standards not met

- No personal investments made into the business

- Business is located or operating outside the U.S.

If you haven’t applied yet or are looking to reapply, it’s important to keep approval factors in mind so you can avoid being denied for an SBA loan. For example, know what credit score you need, consider saving capital for a down payment and be sure to pay your personal and business bills on time.

COVID-19 SBA Loan Programs

If you’re like many business owners, the coronavirus pandemic has affected your company in one way or another. Furloughs, declining revenue, past-due receivables, evolving customer expectations and more have impacted entrepreneurs throughout the country.

Cue COVID-19 EIDLs (Economic Injury Disaster Loans) and PPPs (Paycheck Protection Program). In response to the changing climate, the SBA began offering these loans in early March and April of 2020, respectively.

Though the programs are no longer accepting applications (as of Jan. 1, 2022 for new COVID EIDL loans or July 31, 2020 for PPP loans), the SBA had received more than 14 million COVID-19 EIDL applications. However, loan requests of more than 10 million applicants weren’t approved.

In addition to some of the reasons for loan denial previously listed, here are some reasons applicants were denied for economic relief.

EIDL: Reasons Loans Were Denied

- Business was too new

- Economic injury not substantiated

- Application expired due to lack of response from applicant

- Missing documents or incomplete application

- Applicant didn’t respond to requests for information within 7 days of being notified

PPP: Reasons Loans Were Denied

- Poor credit history

- Insufficient documentation of payroll expenses

- Lack of Schedule C to prove net income (for sole proprietors)

- Franchise not listed on SBA franchise directory

- Not in operation prior to Feb. 15, 2020

- Business has a 20% owner with prior guilty plea or felony conviction

Additionally, many banks were only taking PPP loan applications from applicants with whom they had an existing relationship, giving many business owners no opening to apply. Other lenders prioritized larger loan requests. Ultimately, loan funds from initial relief packages were exhausted by the time many applications were received.

Your SBA Loan Was Denied: Now What?

Be Clear About Why You Were Denied

First things first. Regardless of the type of SBA loan you applied for, it’s important to have an understanding of why you were denied for an SBA loan.

Once you receive your letter of denial, speak with your SBA lender to see if you can gather more insight into the reasoning for the decision. Denial letters can be vague, but your lender can give you a clearer picture of why you were likely not approved. This will help you know what factors you need to work on going forward.

Submit an SBA Reconsideration Email or Letter

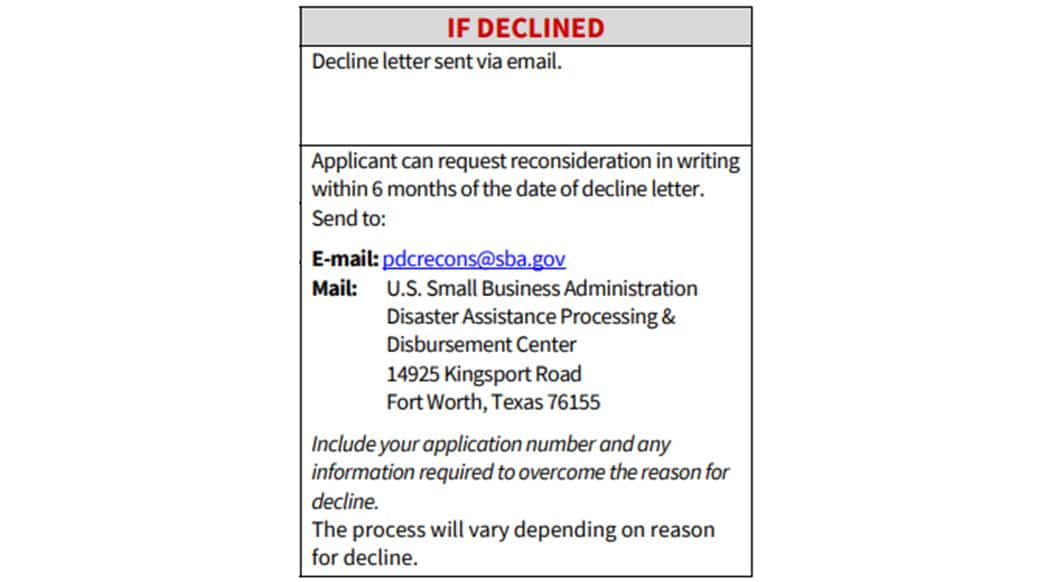

You could petition the SBA to re-review your file and present information to dispute the result and ask for reconsideration.

Keep in mind, in some instances, requesting a reconsideration won’t change the outcome, such as if your business engages in an activity that disqualified you from being approved. But if you’ve found errors on your credit report, for instance, that could be a viable reason to request a reconsideration.

On another note, if you disagreed with the outcome of your COVID-19 SBA disaster loan request you could have formally asked for a reconsideration within 6 months of the date of your decline letter. Applications for COVID EIDL reconsideration or appeal were accepted through Dec. 31, 2021.

Applicants who were interested in submitting a follow-up request should have summarized the cause for denial and included a reason the SBA should have reconsidered the request as well as noted the following:

- Application or loan number

- Business name and address

- Borrower name

- Tax ID or employer identification number or Social Security number

- Copy of more recent business tax returns prior to the pandemic, with schedules included

- Signed and completed IRS form 4506-T

- Copy of voided check from the business bank account

- Up-to-date contact information

Incidentally, for the COVID EIDL program, borrowers may still be eligible to request increases up to their maximum eligible loan amount for up to 2 years after their loan origination date, or until the funds are exhausted, whichever comes first.

Wait It Out and Apply Again

If you’re denied for lack of collateral, credit history or capital and aren’t in a rush for funds, think about giving yourself a bit of time and applying again. While you can reapply after 90 days, you may want to take a few more months to shore up your business finances as well as personal and business credit.

Think about new ways to generate more revenue or reduce expenses. If you have existing debt, work on paying it down. Additionally, if you’re a newer company, waiting several months to a year will give you more time in business. Waiting it out could also mean a better cash-flow scenario, another factor an SBA lender evaluates when determining whether to loan funds.

Seek Other Funding Options

If you’ve been turned down for an SBA loan, there are other options. Here are a few alternatives, including those specifically fitting if your credit score has seen better days.

Small Business Grants

Small business grants are essentially free money because they don’t need to be repaid. What’s more, credit scores typically aren’t a factor considered for awards. That said, grants are highly competitive and difficult to come by.

Alternative Financing

Many online lenders and alternative lending marketplaces offer financing to applicants who may have been denied an SBA loan for not meeting credit requirements. In fact, you might find that you can obtain alternative financing with a credit score of 500.

Types of funding commonly offered by these nonbank lenders include the following:

Investors

Angel investors may pay less importance to a borrower’s credit score than credit history, as the latter can reveal more information, such as a pattern of defaults, for instance. Additionally, if there’s high return-on-investment potential, angel investors may fund startups, which have minimal credit history and, as such, may not fare well with the SBA approval process.

Hard Money Loans

If you’re looking to purchase commercial real estate, you might consider a short-term hard money loan. Because these loans are secured by property, credit score and revenue aren’t strong considerations. Your collateral’s value is the primary consideration for lenders.

Moving On After Your SBA Loan Is Declined

You’re a business owner, so you know the importance of perseverance and resilience. While you might be denied for an SBA loan, that doesn’t mean you’ll hear a “no” every time. Find out what you can do to improve your standing in the eyes of lenders and try again.

Also, keep in mind SBA loans aren’t for everyone. Sometimes, other funding options, whether grants or alternative financing, could be a better fit depending on your circumstances. Stay open to the possibilities and keep persevering.