Learning the ins and outs of how to finance your business’s growth doesn’t have to be challenging or time-consuming. Here’s what you need to know when you’re ready to scale your company and are looking for the right business expansion loan. We’re letting you in on top financing options, where to find them and how to apply.

What Is a Business Expansion Loan?

A business expansion loan is financing designed to help existing companies maintain their growth, scale or develop a stronger presence in the market. Overall, the intent is to increase revenue and profitability.

With business expansion loans, you get upfront access to funds so you can take advantage of an immediate opportunity.

The goal is to invest in your business at a pivotal time to garner continued success and even catapult your company to new heights.

Related: How to Find Funding for Business Growth: Our 10 Top Tactics

What Can Business Expansion Loans Be Used For?

Because the purpose of business expansion loans is to help your company grow, this type of financing can be used for any number of reasons:

- Open a new location

- Buy another business

- Remodel your storefront

- Invest in real estate

- Hire new staff

- Commit to marketing

- Invest in new technology

- Buy a new line of inventory

- Purchase equipment

- Launch a new product

- Expand into new markets

When you’re looking to expand, consider the cost of a business expansion loan and how it compares to the profits you anticipate earning from your expansion efforts, whether you’re investing in more talent, increasing production or buying additional space. For instance, if the use of funds increases efficiency and leads to exponentially more sales, then a business expansion loan could be just the right fit for you.

Whatever your reason for turning to funding for business expansion, there’s likely a financing option available for you.

Related: Easily Calculate Business Loan ROI

Best Business Expansion Loan Options

Apart from getting an investor or winning a small business grant, the best way to finance business expansion is with competitive financing, such as with one of the following loan options:

- Business term loans

- Business lines of credit

- SBA loans

- 7(a) loans

- CDC/504 loans

- Express loans

Let’s take a look at these business expansion loans in more detail, including interest rates, terms and pros and cons.

Business Term Loans

If you’re looking for a business expansion loan, consider a term loan. You could secure funds up to $250,000 and possibly higher. Once your term funding is approved, you’ll get one lump sum.

You can use this money to revamp your building or office or refinance existing debt related to construction or expansion projects you’ve already completed.

While short-term loans are available, renovation and expansion projects typically take time, so you’ll want to look for funding you can pay back in years, not months.

Here’s a rough idea of what you could anticipate spending on the construction component of an office remodel, according to a 2021 article by Shyft Collective, a company providing integrated real estate, construction and design services. Expect to spend $10-$50 per square foot for a light refresh of the space (e.g., paint, carpet, ceiling repair), $60-$110 for a remodel (e.g., limited wall reconfigurations and casework improvements, added lighting) and $100-$200 for a full renovation.

In addition to construction costs, design fees can tack on an additional $4-$15 per square foot. Furniture, fixtures and equipment are other expenses to keep in mind as well, which often run between 30%-60% of the construction costs, according to Shyft Collective.

Interest Rates and Terms

Interest rates on business term loans vary by lender, loan, borrower creditworthiness and whether the loan is secured by collateral or not. Additionally, interest rates for business term loans are usually fixed, though some lenders may opt for variable rates.

Repayment periods often run 1 year to 5 years. However, repayment terms could extend longer depending on the lender, sometimes up to 20 years. Business owners typically make monthly or weekly payments throughout the loan term, though daily payments could be required for short-term loans.

Lines of Credit

Another type of business expansion funding is a line of credit, which is often revolving. This means that a lender approves you for a certain amount and you use however much you need when you need it, like a credit card.

As you pay down your debt, your credit line is replenished up to your original limit. Some lenders also allow you to take a cash advance with no penalty, which might be helpful when you’re working with various vendors and contractors.

Let’s look at common business lines of credit:

Unsecured Line of Credit

If you don’t have specific collateral to offer a lender, you might apply for an unsecured business line of credit. Keep in mind your credit limit likely will be lower and interest rate higher than you’d find with a secured credit line.

Depending on the size and cost of your business expansion project, this kind of funding may be a viable option.

Related: Business Lines of Credit – Apply

Secured Line of Credit

Secured lines of credit are another way to obtain capital for business expansion. They’re less risky than unsecured lines of credit for lenders because you’re putting up something of value as collateral. These credit lines generally have lower interest rates and higher credit limits than unsecured lines.

Some lenders also offer equity lines of credit, for which you’d use real estate that you own personally or that belongs to your business to secure your loan.

Interest Rates and Terms

Interest rates for lines of credit are often variable. Some lenders will base your interest rate on the prime rate, which fluctuates. As of Dec. 15, 2022, the prime rate was 7.5%.

SBA Business Expansion Loans

Loans to expand your business are available through funding guaranteed by the Small Business Administration (SBA). SBA loan programs are less risky for lenders because the federal agency guarantees a percentage of the loan, up to 85% in some cases. Lenders partner with the SBA to offer these competitive loans to borrowers who might not have qualified for conventional small business loans.

SBA 7(a)

When you’re in search of how to obtain working capital for expansion or business property renovations, consider an SBA 7(a) loan. This kind of financing allows qualified borrowers to access up to $5 million to fund business needs, including renovations, as well as:

- Expansion

- New construction

- Purchase of land or buildings

- Purchase of equipment and fixtures

- Lease-hold improvements

SBA CDC/504

When you’re wondering how to finance business expansion, also consider a Certified Development Company (CDC)/504 loan, a type of SBA business expansion loan. There isn’t a maximum project size, but the CDC will only service 40% of the loan, up to $5 million.

What about the remaining percentages? The borrower provides a 10% down payment (up to 20% in some cases), and a third-party lender finances a minimum of 50%. It’s important to note that the SBA only guarantees the portion covered by the CDC.

In addition to renovating and constructing facilities, with this type of financing, you could buy:

- Buildings

- Land

- Machinery with 10 or more years of useful life

You also could use funding to make improvements to:

- Gutters

- Parking lots

- Landscaping

- Roofing

- Heating and cooling systems

- Electrical systems

- Plumbing

Funds can be used to refinance debt related to business expansion, and you can pay for professional costs related to your expansion project too. You can even create a reserve fund with up to 10% of the construction costs associated with your project.

SBA Express Loans

If you don’t expect your renovation and expansion project to exceed $500,000, an SBA Express loan may offer a solution for your financing needs. You could get this expansion capital loan in about a month. Compare this to a 7(a) loan, which could take 2-3 months for funding to be released.

Interest Rates and Terms

Interest rates on SBA business expansion loans vary by lender. However, the SBA does set interest rate limits, which a lender can’t exceed.

Rates can be fixed or variable. Maximum variable rates can be tied to 1 of 3 rate types, one of which is the prime rate.

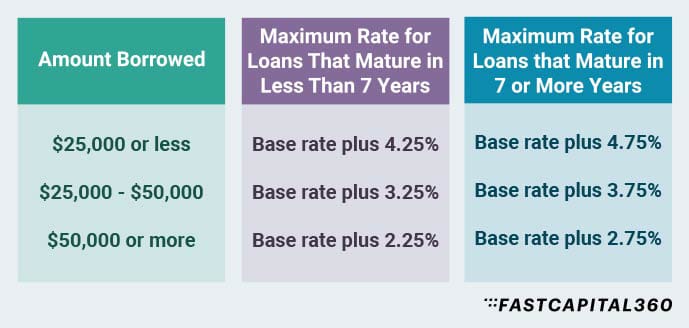

For the 7(a) program, the following maximum interest rates for variable loans apply*:

Repayment terms for the 504 loan vary depending on the use of funds. For instance, if you plan on using the funds to purchase real estate, loan maturity is either 20 years or 25 years. If you’re buying machinery, you’d be expected to repay your loan in 10 years.

The current maximum interest rate that a third-party lender is able to charge for a 504/CDC commercial loan is 6% more than the prime rate (with the exception of maximum interest rates limited by state law), according to the Congressional Research Service.

The interest rate for the CDC portion of the loan takes into account the current market rate for 5- and 10-year Treasury issues, plus additional fees. As of January 14, 2022, the U.S. Treasury rate for 5-year issues was 1.55 and the rate for 10-year issues was 1.78.

The maximum rate for SBA Express loans is the prime rate plus 4.5% for loans exceeding $50,000. The interest rate limit for SBA Express loans $50,000 or less is prime plus 6.5%.

Lenders for Business Expansion Loans

Not only do you have choices when it comes to your funding, but also how to finance your business expansion.

With so many lenders, how do you decide? Let’s take a look at a couple of main players in the small business lending space.

Conventional Banks

Banks typically have strict lending terms and slow processing times. After a lengthy application process, it could take months to obtain funding. The upside is that rates are lower than you’d find with most online lenders.

However, if you’re a small business owner with poor credit and have been in business less than a year, you might find it challenging to obtain a bank loan to expand your business.

Related: Conventional vs. Alternative Lenders

Alternative Lenders

When you’re seeking capital for business expansion, one of the most significant benefits of online lenders is the ease and speed of which you can apply and be approved for funds.

Depending on the type of financing and lender, you could have access to capital in as little as a day once approved. This benefit often equates to less competitive interest rates, shorter term lengths and more frequent payment installments, however.

Get Your Business Loan Faster

How to Apply for a Loan to Expand Your Business

Once you’re ready to apply for a business expansion loan, be sure you have a good understanding of the loan requirements. Analyze your financing needs and be clear about what aspects of your business you’ll be changing with your renovation and expansion.

Once you’ve created an outline of your project, develop a ballpark budget so you have an idea of how much money you’ll need to borrow. When you have that in place, get ready to meet the following lender requirements for an expansion capital loan.

Business Expansion Loan Application Requirements

When determining how to fund your business’s growth, you need to be prepared for the application process, which could be lengthy depending on the loan and lender.

Also, keep in mind that whatever interest rate you’re approved for, additional fees may apply. These could include origination fees, closing costs, prepayment penalties and late fees.

Application Details

You’ll need to provide lenders with access to your business’s financials. Many alternative lenders advertise a hassle-free application process and are generally less stringent than conventional banks, which might require you to provide:

- Profit-and-loss statements

- Tax returns

- Business plan

Criteria Lenders Consider

Lenders review multiple components when evaluating a business owner for commercial property and business expansion loans. The most common considerations include the following.

Credit Score

Lenders will evaluate your personal and/or business credit score when determining whether to approve you for a renovation loan or business expansion loan. Credit score requirements vary depending on the loan type and lender, with online lenders generally offering more leniency than conventional banks.

If you’re looking to apply for business financing through a conventional bank, you should have a minimum personal credit score of 640 or higher, with approval odds rising for those with scores of 700 or more.

Time in Business

For conventional loans, banks may require you to have been operating your business for at least 2 years. Loans guaranteed by the SBA may require less time in business. In contrast, online lenders may only require you to have 4 months to 1 year in business for other financing options.

Revenue

You need to show that you have income to cover your debt. Lenders will generally require that your business bring in a minimum dollar amount per year. This amount varies depending on the loan type and loan amount.

Some online lenders and loan types may require only $50,000 in annual revenue. However, others may require $200,000 or more.

Cash Flow

Revenue alone is not enough. Lenders need to know you can manage your money. You could make a million dollars a year, but if more money is going out than coming in, high revenue won’t count for much.

Collateral

Collateral reduces risk for lenders. If you aren’t able to repay your debt, they still have something of value they can cash in. In some instances, lenders may prefer, if not require, collateral.

For example, with a commercial real estate mortgage, the property you purchase serves as collateral for your loan. For SBA 7(a) small loans exceeding $25,000 up to $350,000, lenders must, at a minimum, obtain a first lien for assets to be purchased with the funds. SBA lenders must also obtain a lien on a borrower’s fixed assets, to the extent that the full value of the loan is secure.

For 7(a) loans more than $350,000, lenders must secure as much collateral as possible up to the loan amount.